100 Muslim Commercial Bank Limited Ratio analysis

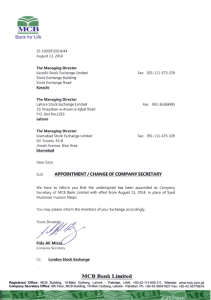

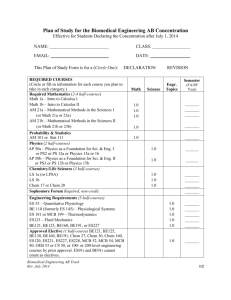

advertisement

In the name of Allah the most beneficent ,the most merciful Muhammad Khalid Mc100203060 MBA Finance Introduction to MCB Bank Ltd. A bank is a financial institute which deal in money And credit. It receive the deposit and make the loans History of MCB bank Muslim commercial bank limited. MCB bank is the one of the leading bank of the Pakistan MCB have the experience over 50 year in Pakistan and the hard work which make it leading organization in the present scenario .MCB is not make the overnight success story but behind the success of the MCB is the hardworking and the full dedication MCB incorporated by the Adamjee group, during in 1960s the bank grew rapidly with the concentration on trade finance products. In 1947, MCB was nationalized along with the private bank and then MCB privatized in 1991 during the Nawaz Sharif‘s government financial sector deregulation policies Product and Services of MCB Al-Makhraj saving account IANAT account Al-Makhraj TDR Saving 365 gold Saving extra Smart dollar account Saving account Current account Current life account Foreign currency account Auto loan Credit Cards Visa Debit card MCB visa platinum MCB visa MCB visa Prepaid Competitor of MCB United Bank Limited Allied Bank Limited Habib Bank Limited Askari Bank Limited Alfalah Bank Limited Business volume of MCB Details 2008 2009 2010 Total Assets 443,615,904 509,223,727 567,552,613 Deposits 330,181,624 367,604,711 431,371,937 Advances-net 262,135,470 253,249,407 254,551,589 Investments-net 96,631,874 167,134,465 213,060,882 Shareholder’s Equity 52,244,865 61,075,932 488,348,404 Profit before Taxation 21,867,566 23,154,945 26,253,075 Profit after Taxation 15,374,600 15,495,297 16,873,175 Earning per Share(Rs.) 22.25 20.38 22.20 Organizational Hierarchy Chart President Chairman Vice president Senior Vice President Chief Financial Advisor Audit Committee Regional Manager Branch Manager Training Program Starting Date 10 November 2011 Ending Date 24 December 2011 My Working Departments 2 Weeks Account opening 3rd Week Cash 4th Week Credit 5th Week Clearing 6th Week Remittances Ratio Analysis Ratio analysis Muslim Commercial Bank Limited (Net profit after taxation / net sale) * 100 Net profit margin Year 2008 Year 2009 Year 2010 15374600/40043824 *100 = 38.39 % 15495297/51616007 *100 = 30.02% 16873175/54821296 *100 = 30.78 % Net Prof it Margin 40 30 20 Net Prof it Margin 10 0 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Net interest margin / mark-up earned Gross spread ratio Year 2008 Year 2009 Year 2010 28,483,084 / 40,043,824 =0.71 times 35,774,544/ 51,616,007 =0.69 times 36,833,529/ 54,821,296 =0.67 times Gross Spread Ratio 0.71 0.7 0.69 Gross Spread Ratio 0.68 0.67 0.66 0.65 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Non interest income / total income Non Interest income to total income ratio Year 2008 Year 2009 Year 2010 30255403 / 70299277 =0.43 times 34095108 / 85711115 =0.39 times 39501718/94323014 =0.41 times Non Interest Income to Total Income Ratio 0.43 0.42 0.41 Non Interest Income to Total Income Ratio 0.4 0.39 0.38 0.37 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Interest earned / interest expenses Spread ratio Year 2008 Year 2009 Year 2010 40,043,824/11,560,74 0 =3.46 times 51,616,007/15,841,46 54,821,296/17,987,7 3 67 =3.258 times =3.047 times Spread Ratio 3.5 3.4 3.3 3.2 Spread Ratio 3.1 3 2.9 2.8 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited (Earning before income tax / total assets) * 100 Return on Assets Year 2008 Year 2009 Year 2010 21867566/443615904 *100 =4.93 % 23154945/509223727 26253075/56755261 *100 3 *100 =4.55 % =4.63 % Return on As s ets (ROA) 5 4.8 Return on As s ets (ROA) 4.6 4.4 4.2 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited (Net income / sale) * (sale / total assets) * 100 DuPont Return on Assets Year 2008 Year 2009 Year 2010 (0.3839*0.090267) * 100 =3.47 % (0.3002*0.101362) * 100 =3.04 % (0.3077*0.096592) * 100 =2.97 % DuPont Return on A ssets 3.6 3.4 3.2 DuPont Return on A ssets 3 2.8 2.6 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited (Net income / total equity) * 100 Return on total Equity Year 2008 Year 2009 Year 2010 15,374,600/ 52,244,865 * 100 = 29.43 % 15,495,297/ 61,075,932*100 =25.37% 16,873,175/ 69180,011*100 =24.39 % Return on Total Equity 30 25 20 Return on Total Equity 15 10 5 0 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Total Liabilities / Total Assets Debt Ratios Year 2008 Year 2009 Year 2010 385,179,850 / 443,615,904 = 0.87 Times 439,483,714 / 509,223,727 = 0.86 Times 488,348,404 / 567,552,613 = 0.86 Times Debt Ratio 0.87 0.868 0.866 0.864 0.862 Debt Ratio 0.86 0.858 0.856 0.854 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Total liabilities / total share holder Equity Debt / Equity Ratio Year 2008 Year 2009 Year 2010 385,179,850 / 525,244,865 =7.37 Times 439,483,714 / 61,075,932 =7.19 times 488,348,404 / 69,180,011 =7.06 times Debt to Equity Ratio 7.4 7.3 7.2 Debt to Equity Ratio 7.1 7 6.9 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Earning before Income Tax (EBIT) / Interest Expenses Times Interest Earned Year 2008 Year 2009 Year 2010 33,428,306 / 11,560,740 =2.89 times 38,996,408 / 15,841,463 =2.46 times 44,240,842 / 17,987,767 =2.46 times Times Interest Earned 2.9 2.8 2.7 2.6 Times Interest Earned 2.5 2.4 2.3 2.2 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Advance / deposit Advance / deposit ratio Year 2008 Year 2009 Year 2010 262,135,470/330,181, 624 =0.79 times 253,294,407/367,604, 254,551,589/431,37 711 1,937 =0.69 times =0.59 times Advance to Deposit Ratio 0.8 0.7 0.6 0.5 Advance to Deposit Ratio 0.4 0.3 0.2 0.1 0 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Operating cash flow / current liabilities Operating cash flow ratio Year 2008 Year 2009 Year 2010 20,315,38/384742713 =0.0052 times 78,148,082/43628697 58,701,161/4834143 1 86 =0.179 times =0.121 times Operating Cash Flow Ratio 0.18 0.16 0.14 0.12 0.1 Operating Cash Flow Ratio 0.08 0.06 0.04 0.02 0 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Total dividend / no. of outstanding shares Dividend per share Year 2008 Year 2009 Year 2010 98,341,75/628276.8 =15.65 Rs. 67 355,10 / 691104.5 =9.75 Rs. 85,675,47 / 760215 =11.27 Rs. Dividend per Share 16 14 12 10 8 Dividend per Share 6 4 2 0 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Earning per share Year 2008 Net income / number of outstanding Year 2009 Year 2010 15,374,600 / 628276.8 15,495,297/691104.5 =24.47 Rs. =22.42 Rs. 16,873,175 / 760215 =22.19 Rs. Earning per Share 24.5 24 23.5 23 Earning per Share 22.5 22 21.5 21 2008 2009 2010 Ratio analysis Muslim Commercial Bank Limited Market value per share / earning per share Price / earning ratio Year 2008 Year 2009 Year 2010 125.81 / 24.471061 =5.14 Rs. 219.68 / 22.421062 =9.79 Rs. 228.54 /22.195267 =10.29 Rs. Price / Earning Ratio 12 10 8 6 Price / Earning Ratio 4 2 0 2008 2009 2010 Conclusion During my internship in MCB bank I conclude that the organization doing overall good business and also have a good culture. MCB provide different type of products and account to the customer. MCB’s most of branches have online system and ATM machines which is good for the customer. MCB has also the largest branch setup all over the Pakistan. Net profit of the organization is decreases and it is need to be improve for the portability. Also the Debt ratio of the organization is decreasing over the time so it is good sign for the organization. Return on assets of the organization is very good so the bank is utilize there sources very well and gain profit. So there is also some week point of the organization as there is some strict rule regarding the account opening so customer face some difficulty. Finely the organization doing a very good business. Recommendation The MCB bank (Ltd) doing good gob over the years that way the deposit of the organization increase and the profitability also increase. The recommendation for the improvement is as follow training of the employees according to the new technology and also hire the young talent and fresh blood in the organization Make all the banks online and minimum charges of the usage of ATM cars and also make the mobile transaction free of cost. Bank also take the step to increase in profit. There is need to improve the security of the organization as improve security cameras and other devices for safety. Also make the documentation awareness Investment in assets should be appropriate. Return on assets is improving over the year and make sure this is continued.