Chapter 8

advertisement

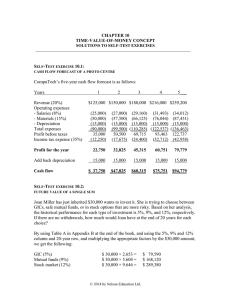

CHAPTER 11 CAPITAL BUDGETING SOLUTIONS TO SELF-TEST EXERCISES SELF-TEST EXERCISE 11.1: TRADITIONAL PAYBACK PERIOD The Millers are considering a $200,000 expansion for their existing retail outlet. The expansion would generate $35,000 in cash each year over the next 10 years. Calculate CompuTech’s payback period. Payback period $200,000 = 5.71 years $35,000 SELF-TEST EXERCISE 11.2: PAYBACK RECIPROCAL A retailer is interested in selling a retail business to the Millers for $1 million. This includes all physical assets, the working capital, and goodwill. The Millers estimate, based on the company’s historical financial statements that the annual cash inflows would be around $195,000. Calculate the project’s payback reciprocal. Payback reciprocal $195,000 = 19.5% $1,000,000 SELF-TEST EXERCISE 11.3: NET PRESENT VALUE Using the information in Self-Test Exercise 11.1, and assuming that CompuTech’s weighted average cost of capital is 8%, calculate the project’s net present value. Net present value using the 8% discount rate: Cash outflow Present value ($35,000 × 6.7101) Net present value $( 200,000) $234,854 $ 34,854 © 2014 by Nelson Education Ltd. 11-2 Chapter 11 Capital Budgeting SELF-TEST EXERCISE 11.4: NET PRESENT VALUE: PURCHASE OF EXISTING BUSINESS Use the information in Self-Test Exercise 11.2, and assume that the Millers want to make 20% on their investment and would like to sell the retail store for $4 million in the 20th year. Calculate the company’s net present value, and calculate the net present values by using the following discount rates: 18%, 19%, 20%, 21%, and 22%. Net present value using the 20% discount rate: Cash outflow $(1,000,000) Present value $(195,000 × 4.8696) 949,572 Sale of store $(4,000,000 × 0.02608) 104,320 Total present value 1,053,892 Net present value $ 53,892 For each incremental percentage, the net present value is as follows: NPV @ 18% = $189,808 NPV @ 19% = $118,012 NPV @ 20% = $53,892 NPV @ 21% = $( 3,565) NPV @ 22% = $( 55,282) SELF-TEST EXERCISE 11.5: INTERNAL RATE OF RETURN Use the information in Self-Test Exercise 11.1 to calculate the project’s internal rate of return. Use the payback period as a factor (see answer to Self-Test Exercise 11.1) and go to Table D in row 10. By crossing the discount columns, reach the factor that is closest to 5.71 which is at 12% (5.6502). Cash outflow Cash inflow ($35,000 × 5.6502) Net present value $ (200,000) $197,757 $ ( 2,243) To calculate the IRR, you have to multiply the $35,000 amount by a factor using a discount rate that is slightly less than 12%; to be exact, the rate is 11.73%. © 2014 by Nelson Education Ltd. Chapter 11 Capital Budgeting 11-3 SELF-TEST EXERCISE 11.6: INTERNAL RATE OF RETURN Use the information in Self-Test Exercises 11.2 and 11.4 to calculate the project’s internal rate of return. As shown in Self-Test Exercise 11.4, the rate that makes the inflows equal to the outflow is between 20% and 21%, closer to 21%. By interpolation, or using a financial calculator, the internal rate of return gives exactly 20.93%. SELF-TEST EXERCISE 11.7: PROFITABILITY INDEX Use the information in Self-Test Exercises 11.1 and 11.3 to calculate the profitability index. By using the information obtained in the NPV calculation in Self-Test Exercise 11.3 divide the discounted cash inflows (8%) by the cash outflows. $234,854 = 1.17 $200,000 SELF-TEST EXERCISE 11.8: PROFITABILITY INDEX Use the information in Self-Test Exercises 11.2 and 11.4 to calculate the profitability index. By using the information obtained in the NPV calculation in Self-Text Exercise 11.4, divide the discounted cash inflows (20%) by the cash outflows. $1,053,892 = 1.05 $1,000,000 © 2014 by Nelson Education Ltd. 11-4 Chapter 11 Capital Budgeting SELF-TEST EXERCISE 11.9: BUY VERSUS LEASE OPTION Questions If the Millers want to make 30%, should they buy or lease the retail store? To answer this question, calculate the following: 1. Net present value 2. Internal rate of return Option A: Purchase 1. Net present value: At 30%, the net present value is $104,033. 2. Internal rate of return: The internal rate of return is 33.84%. Option B: Leasing 1. Present value: At 30%, the present value is $170,492 ($70,000 × 2.4356). 2. The IRR cannot be calculated since there is no cash outflow. Since the leasing option offers a greater NPV, it would be more economically advantageous to lease. Also, leasing is considered less risky than buying and there is no cash outflow and no financing would be required. SELF-TEST EXERCISE 11.10: PROJECT ANALYSIS These are the numbers that were presented in the opening case on page 463. Years Calculations Factors Factors @ 11% PV @ 20% PV 0 (350) 1 (25) 2 5 3 100 4 125 5 140 6 150 7 150 8 150 9 150 10 150 10 900 Net present value -(350) 0.9009 (23) 0.8116 4 0.7312 73 0.6587 83 0.5934 83 0.5346 80 0.4817 72 0.4339 65 0.3909 59 0.3522 53 0.3522 317 516 -- (350) 0.8333 (21) 0.6944 3 0.5787 58 0.4822 60 0.4019 56 0.3349 51 0.2791 42 0.2326 35 0.1938 29 0.1615 24 0.1615 146 133 © 2014 by Nelson Education Ltd. Factors @ 25% -0.8000 0.6400 0.5120 0.4096 0.3278 0.2621 0.2097 0.1678 0.1342 0.1074 0.1074 P.V. (350) (20) 3 51 51 46 40 31 25 20 16 97 10 Chapter 11 Capital Budgeting Questions 1. What is CompuTech’s NPV using 11% and 20% weighted average cost of capital? At 11% is At 20% is At 25% is $ 516,046 $ 132,688 $ 10,295 2. What is the retail store’s payback period? Payback is 5.03 years 3. What is CompuTech’s IRR? The internal rate of return is 25.52%. 4. What is the PI? Using the 11% cost of capital ($516,000 + $350,000 = $866,000) $866,000 = 2.47 $350,000 5. Should the Millers go ahead with the opening? Yes. The Millers should go ahead with the decision because the cost of capital is 11% and the hurdle rate is 20% while the project gives a 25.5% IRR. © 2014 by Nelson Education Ltd. 11-5