0176530835_383399

advertisement

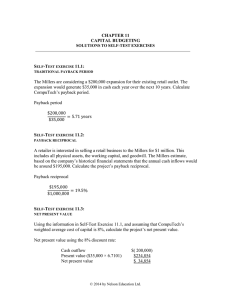

CHAPTER 10 TIME-VALUE-OF-MONEY CONCEPT SOLUTIONS TO SELF-TEST EXERCISES SELF-TEST EXERCISE 10.1: CASH FLOW FORECAST OF A PHOTO CENTRE CompuTech’s five-year cash flow forecast is as follows: Years Revenue (20%) Operating expenses - Salaries (8%) - Materials (15%) - Depreciation Total expenses Profit before taxes Income tax expense (35%) 1 2 3 4 5___ $125,000 $150,000 $180,000 $216,000 $259,200 (25,000) (50,000) (15,000) (90,000) 35,000 (12,250) (27,000) (29,160) (31,493) (34,012) (57,500) (66,125) (76,044) (87,451) (15,000) (15,000) (15,000) (15,000) (99,500) (110,285) (122,537) (136,463) 50,500 69,715 93,463 122,737 (17,675) (24,400) (32,712) (42,958) Profit for the year 22,750 32,825 45,315 60,751 79,779 Add back depreciation 15,000 15,000 15,000 15,000 15,000 $ 37,750 $47,825 $60,315 $75,751 $94,779 Cash flow SELF-TEST EXERCISE 10.2: FUTURE VALUE OF A SINGLE SUM Joan Miller has just inherited $30,000 wants to invest it. She is trying to choose between GICs, safe mutual funds, or in stock options that are more risky. Based on her analysis, the historical performance for each type of investment is 5%, 9%, and 12%, respectively. If there are no withdrawals, how much would Joan have at the end of 20 years for each choice? By using Table A in Appendix B at the end of the book, and using the 5%, 9% and 12% column and 20-year row, and multiplying the appropriate factors by the $30,000 amount, we get the following: GIC (5%) Mutual funds (9%) Stock market (12%) $ 30,000 × 2.653 = $ 30,000 × 5.604 = $ 30,000 × 9.646 = © 2014 by Nelson Education Ltd. $ 79,590 $ 168,120 $ 289,380 10-2 Chapter 10 Time-Value-of-Money Concepts SELF-TEST EXERCISE 10.3: FUTURE VALUE OF AN ANNUITY Joan Miller was given a choice on her $30,000 inheritance between receiving (1) the full payment today or (2) a $3,000 annuity for the next 20 years and a lump sum of $10,000 at the end of the 20th year. If Joan can earn 9%, which option is the most attractive? The first option is the most attractive because Joan would earn $168,120 instead of $163,480. Option 1 By going to Table A in Appendix B at the end of the book at the 9% and 20-year row, you will find factor 5.604. The future value of the lump-sum amount is $168,120 calculated in the following way: This future value is worth $168,120 ($30,000 × 5.604). Option 2 By going to Table C in Appendix B at the end of the book at the 9% and 20-year row, you find factor 51.160. The future value of the $3,000.00 annuity is $153,480 ($3,000 × 51.160). By adding this amount to $10,000, the future value of the second option will be $163,480. SELF-TEST EXERCISE 10.4: PRESENT VALUE OF A SINGLE SUM The Millers would like to have a $30,000 education fund for their son Vincent, who is now three years old, and the same amount for their daughter, Takara, who has just turned one. The Millers expect that their children will start university when they are 20 years of age. How much will the Millers have to invest today (in one lump sum) if the registered education savings plan guarantees a 7% annual interest rate free from any income tax? This problem can be solved by finding the present value of each of the two investments separately and then by adding them up. By going to Table B in Appendix B at the end of the book, at the 7% column, you will have the following: Number of Years 17 19 Future Value $30,000 $30,000 $60,000 Total payment to be made today PV Value 0.31657 0.27651 Lump Sum Payment $ 9,497.10 $ 8,295.30 $17,792.40 © 2014 by Nelson Education Ltd. Vincent Takara Chapter 10 Time-Value-of-Money Concepts 10-3 The Millers will have to pay $17,792.40 now to have $30,000 for each child by the time they reach the age of 20 if they expect to earn 7% annually on the RESP. SELF-TEST EXERCISE 10.5: PRESENT AND FUTURE VALUES OF AN ANNUITY Len has just won $100,000 at a casino. If money is worth 10%, would it be better for Len to receive the full amount now or $15,000 each year for the next 10 years? Questions 1. What is the value of each amount 10 years from now? The lump sum option is more attractive: $259,400 versus $239,055. Lump sum option By going to Table A in Appendix B at the end of the book at the 10% and 10-year row, you find factor 2.594. The future value of the $100,000 lump sum amount is $259,400 ($100,000 × 2.594). Annuity option By going to Table C in Appendix B at the end of the book at the 10% and 10-year row, you find factor 15.937. The future value of the $15,000 annuity is $239,055 ($15,000 × 15.937). 2. What is today’s present value of each amount? Just like in question one, the lump sum option is better: $100,000 versus $92,169. Lump sum option The $100,000 amount received today is worth $100,000. Annuity option By going to Table D in Appendix B at the end of the book at the 10% and 10-year row, you find factor 6.1446. The present value of the $15,000 annuity is $92,169 ($15,000 × 6.1446). 3. How much would Len have to receive each year to be equivalent to receiving $100,000 today? The yearly amount is approximately $16,275. This answer can be obtained in two ways. a) By going to Table C in Appendix B at the end of the book at the 10% and 10-year row, you find factor 15.937. By dividing this factor into the future value of the annuity $259,400 (see question 1), you get $16,277. © 2014 by Nelson Education Ltd. 10-4 Chapter 10 Time-Value-of-Money Concepts b) By going to Table D in Appendix B at the end of the book at the 10% and 10-year row, you find factor 6.1446. By dividing this factor in the $100,000 amount, you get $16,274. 4. If Len received $15,000 each year instead of the $100,000 amount, what would the effective interest rate or the internal rate of return (IRR) be? Without a financial calculator or a spreadsheet, you can only find the answer by trial-anderror. By going to Table D at the 9% and 10-year row, you find factor 6.4176. By multiplying this factor by $15,000, you get $96,264. With a $3,736 negative net present value, it means that the effective interest rate or the internal rate of return is less than 9.0%. By using 8% instead, the present value is $100,652 ($15,000 × 6.7101) and gives a positive $652 net present value, which means that the effective interest rate or the internal rate of return is slightly more than 8%. By using a financial calculator, you get exactly 8.14%. SELF-TEST EXERCISE 10.6: PRESENT VALUE OF UNEVEN SUMS Use the cash flow forecast from Self-Test Exercise 10.1 to calculate the photo centre’s present value. Assume that the company’s cost of capital is 10%. The present value is $229,747. Years Cash Flow 1 $ 37,750 2 47,825 3 60,315 4 75,751 5 94,779 Total net present value (NPV) Discount Factor 0.90909 0.82645 0.75131 0.68301 0.62092 Present Values $ 34,318 39,525 45,315 51,739 58,850 $229,747 © 2014 by Nelson Education Ltd. Chapter 10 Time-Value-of-Money Concepts 10-5 SELF-TEST EXERCISE 10.7: NET PRESENT VALUE AND NET FUTURE VALUE Use the cash flow forecast from Self-Test Exercise 10.1 to calculate the photo centre’s NPV and NFV. Assume that the company’s cost of capital is 10%.The net present value is $79,947. The net future value is $128,357. Net Present Value (NPV) By using the present value amount calculated is the Self-Test Exercise 10.6, the net present value is calculated as follows: Cash outflow (year 0) Present value Net present value (NPV) $ 150,000 229,747 $ 79,947 Net future value (NFV) Years 0 Cash Flow Compound Factor Future Values $150,000 1.611 $ 241,650 1 37,750 2 47,825 3 60,315 4 75,751 5 94,779 Future value (FV) 1.464 1.331 1.210 1.100 1.000 55,266 63,655 72,981 83,326 94,779 $ 370,007 Total net future value (NFV) © 2014 by Nelson Education Ltd. $ 128,357 10-6 Chapter 10 Time-Value-of-Money Concepts SELF-TEST EXERCISE 10.8: INTERNAL RATE OF RETURN Use the cash flow forecast from Self-Test Exercise 10.1 to calculate the photo centre’s IRR. Using a discount rate of 26%, the net present value is +$134. By using a financial calculator, the project gives an internal rate of return of 26.04%. Present value using a 26% discount rate Years Cash Flow 1 $ 37,750 2 47,825 3 60,315 4 75,751 5 94,779 Total present value (PV) Discount Factor Present Values 0.79365 0.62988 0.49991 0.39675 0.31488 $ 29,960 30,124 30,152 30,054 29,844 $150,134 Net present value (NPV) Present value of the cash inflows Cash outflow $150,134 150,000 Net present value (NPV) $ © 2014 by Nelson Education Ltd. 134