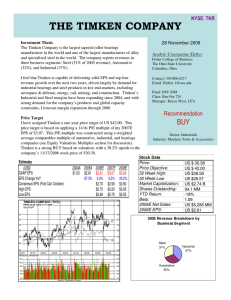

The Timken Company

advertisement

The Timken Company (TKR) Presented by, Han Yang Nurul Alam Rafi Kannu Priya Presented on April 24, 2012 Agenda • • • • • • • • Introduction Macro-economy Industry Timken’s Business Financial analysis Multiple valuation DCF valuation Recommendation Introduction • Company: The Timken Company • Reg. in NYSE Ticker: TKR • Current market price : $ 49.57 (Previous close price on 4/23/2012) • PEG = 0.84 • Industry : Industrial Machinery GICS Map place: 20106020 • Founded in 1899 by Henry Timken with two patents on the design of tapered roller bearings. • TKR develops, manufactures, markets and sells products for friction management and mechanical power transmission, alloy steels and steel components. • 1 yr implied growth in EPS = 28% Graham g = 1.25% • Greenblatt profitability ratios: EBIT/TA = 32% EBIT/EV=14.7% Sum= 47% Relationship to economy • The Bearing industry is correlated to Macroeconomic activities US GDP vs TKN's revenue 40.00% 30.00% 20.00% Changes 10.00% 0.00% -10.00% -20.00% -30.00% -40.00% -50.00% US GDP TKN sales 2008 2.15% -3.73% Source: World Bank; Timken 09’, 10’ 10-K 2009 -1.73% -37.68% 2010 3.84% 29.09% Industry overview • Bearing industry in the US generated $7.9 billion revenue in 2011. • The industry is at mature stage • The annual growth rate from 2006 to 2011 is 1.4% • The forecasted annual growth for next 5 years is 2.3% Up and down stream • The up stream of bearing industry is steel industry. • The customers of bearing products include Transportation industry Defense industry Clean energy (wind turbine) Major players in the US Market share 12% 26% 21% 41% Source: IBIS World NSK Aktlebolaget SKF Timken Ohters Business Overview • Started with two patents on the design of tapered roller bearing, Timken grew to become the world’s largest manufacturer of tapered roller bearing. • 10 technology and engineering centers • 14 distribution centers and warehouses and • nearly 21,000 employees. • operates in 30 countries and territories. • Have many customers in many industries and no single customer generates 10% or more of total sales or segment sales • Around 66% sales comes from the US market. Product lines Anti-Friction Bearings and Adjacent Transmission Mobile Industry Process Industry Steel Aerospace and Defense Bearings & Power Transmission • Bearings can be of different shapes and sizes. • Have 4 components: 1) the cone or inner race 2)the cup or outer race 3)the rollers in between cup and cone 4)the cage between the rollers Usage: • To reduce friction where shafts, gears or wheels are used. • To provide high load tolerance Applications: • Transportation including cars, trucks, heavy trucks, helicopters, airplanes and trains. • Industries including mills, mining, oil and gas extraction and production, gear drives, health and positioning control, wind mills and food processing. Tapered Roller Bearing Ball Bearings Spherical Plain Bearings High Performance Bearings Precision Bearings Integrated Bearing Assemblies Aerospace Bearings Precision Bearing Assemblies Picture source: www.timken.com Steel • produces more than 450 grades of carbon, micro-alloy and alloy steel, which are sold as ingots, bars and tubes in a variety of chemistries, lengths and finishes and custom made precision steel products for many industries. Applications: a wide variety of end products including oil country drill pipe, bits and collars, gears, hubs, axles, crankshafts and connecting rods, bearing races and rolling elements, bushings, fuel injectors, wind energy shafts and other demanding applications, where mechanical power transmission is critical to the end customer. Distribution and Services • Mostly use their own efficient distributors to sell products in Mobile industries, Process Industries and Aerospace and Defense segments. • Has a joint venture named CoLinx, LLC in North America to support sales in Process segment. • Timken provides expert services for bearing maintenance and repair. Total services accounted for less than 5% of the sales last year. Risks • Pricing pressure resulted from high competition in bearing and steel industry and potential overcapacity in Steel industry. • Cyclical nature of many customers and sustained uncertainty in financial market. • Substantial costs and limitations on operation imposed by environmental laws and regulations. Recent Acquisitions and new products • Acquired Drives LLC in 2011. - Manufactures highly engineered products like precision roller chain, pintle chain, agricultural conveyor chain, engineering class chain, oil filled roller chain and augur products. • Acquired Philadelphia Gear Corp. in 2011. - provides aftermarket gear box repair services and gear-drive systems for the industrial, energy and military marine sectors, including refining and pipeline systems, mining, cement, pulp and paper making and water management systems Financial analysis – revenue 6,000.00 Steel 5,000.00 4,000.00 Aerospace and Defense 3,000.00 Process Industries 2,000.00 Mobile Industries 1,000.00 0.00 2007 Timken 08’,09’,10’,11’ 10-Ks 2008 2009 2010 2011 Financial analysis – EBIT margin 25.00% 20.00% 15.00% Mobile Industries 10.00% Process Industries 5.00% Aerospace and Defense 0.00% -5.00% 2007 -10.00% Timken 08’,09’,10’,11’ 10-Ks 2008 2009 2010 2011 Steel Financial analysis – Dep & Capex Depreciation VS Capital Expenditure 350 In millions 300 250 200 150 100 50 0 Capex Depreciation Timken 08’,09’,10’,11’ 10-Ks 2007 289.8 187.9 2008 258.1 200.8 2009 114.1 201.5 2010 115.8 189.7 2011 205.3 192.5 Financial analysis - ROE 2007 2008 2009 2010 2011 Profit margin 4.9% 5.4% -4.3% 6.8% 8.8% Assets turnover 1.03 1.11 0.78 0.97 1.19 Leverage (A/E) 2.23 2.73 2.51 2.15 2.13 11.41% 16.31% -8.40% 14.15% 22.24% ROE Comparable Companies Anti Friction Bearing and Power Transmission Steel SKF AB Tenaris SA NSK Ltd. Gerdau SA Nucor Corp. Steel Dynamics Inc. Multiples Timken (TKR) SKF NSK (SKFRY.PK) (NPSKY.PK) Price per share $ 50.51 25.09 13.64 D/A 9% 14% 35% P/E 11 13.25 21.72 P/S .95 1.13 .83 EV/Revenue .96 1.27 1.08 EV/EBITDA 5.36 7.77 2.29 Revenue $ EBITDA $ EPS $ Anti Friction Bearings 3334 678 3.04 Steel 1836.7 316.5 1.55 Total 5170 924.2 4.59 Data source for multiples: Yahoo Finance Contd. Tenaris (TS) Gerdau (GGB) Nucor (NUE) Steel Dynamics (STLD) Price per share $ 34.92 9.55 39.67 12.89 D/A 4% 31% 25% 0% P/E 15.48 14.62 16.54 13.46 P/S 2.08 .85 .63 .36 EV/Revenue 2.03 1.12 .72 .6 EV/EBITDA 8.41 8.61 7.32 6.6 Data source for multiples: Yahoo Finance Valuation Anti-friction Bearings & Power Transmission Steel Enterprise Equity Value Enterprise Equity Value Value $ per Share $ Value $ Per Share $ P/E 53.20 23.25 Value per Share $ Weight 76.45 0.25 EV/EBITDA 3,408.33 2,448.13 59.73 0.25 EV/Revenue 3,916.86 2,052.51 60.89 0.25 51.84 0.25 P/S Final Value $ 33.42 18.42 62.23 Recommendation • Multiple valuation: $ 62.23 • DCF valuation: $63.67 • Current price: $49.57 Recommendation: buy 200 share at market price – approximately 3% of total portfolio