The Effective Use of Capital

advertisement

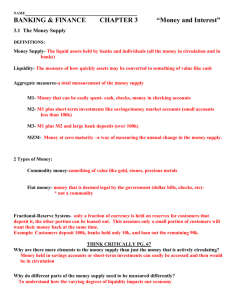

Bank Management, 5th edition. Timothy W. Koch and S. Scott MacDonald Copyright © 2003 by South-Western, a division of Thomson Learning THE EFFECTIVE USE OF CAPITAL Chapter 13 Why worry about bank capital? …capital reduces the risk of failure by acting as a cushion against losses and by providing access to financial markets to meet liquidity needs. While bank capital-to-asset ratios averaged near 20% at the turn of the century, comparable ratios today are closer to 8 percent. 15.00% Historical Trends in Bank Capital 13.00% 11.00% 9.00% 7.00% 5.00% 3.00% 1.00% -1.00% Total Capital to Total Assets Growth Rate in Total Capital Risk-based capital standards During the last half of the 1980s, for example, all U.S. banks were required to meet a 5.5% minimum primary capital requirement and a 6 percent minimum total capital requirement. Primary capital consisted of stockholders equity, perpetual preferred stock, mandatory convertible debt, and loan loss reserves. The Basle agreement In 1986, U.S. bank regulators proposed that U.S. banks be required to maintain capital that reflects the riskiness of bank assets. By 1988, the proposal had grown to include risk-based capital standards for banks in 12 industrialized nations according to the terms of the Basle Agreement. Regulations were fully in place by the end of 1992. Terms of the Basle Agreement varied, primarily in terms of what constitutes capital, but there are common elements. Minimum capital requirement is linked to its credit risk as determined by the composition of assets. Stockholders' equity is deemed to be the most critical type of capital. Minimum capital requirement increased to 8% for total capital. Capital requirements were approximately standardized between countries to 'Level the playing field.' Risk-based elements of the plan To determine minimum capital requirements, bank managers follow a four-step process: 1. 2. 3. 4. Classify assets into one of four risk categories; Classify off-balance sheet commitments and guarantees into the appropriate risk categories; Multiply the dollar amount of assets in each risk category by the appropriate risk weight; this equals risk-weighted assets; and Multiply risk-weighted assets by the minimum capital percentages, currently either 4 percent or 8 percent. Regional National Bank (RNB), risk-based capital Regional National Bank (RNB) Assets $ 1,000 Category 1: Zero Percent Cash & reserve Trading Account U.S. Treasury & agency secs. Federal Reserve stock Total category 1 Category 2: 20 percent Due form banks / in process Int. bearing Dep./F.F.S. Domestic dep. institutions Repurchase agrements (U.S. Treas & agency) U.S. Agencies (gov. sponsored) State & Muni's secured tax auth C.M.O. backed by agency secs. SBAs (govt. guaranteed portion) Other category 2 assets Total category 2 Category 3: 50 percent C.M.O. backed by mtge loans State & Muni's / all other Real estate: 1-4 family Other category 3 assets Total category 3 Risk Weight Risk Weighted Assets 104,525 830 45,882 5,916 157,153 0.00% 0.00% 0.00% 0.00% 0 0 0 0 0 303,610 497,623 38,171 329,309 412,100 87,515 90,020 29,266 0 1,787,614 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 60,722 99,525 7,634 65,862 82,420 17,503 18,004 5,853 0 357,523 10,000 68,514 324,422 0 402,936 50.00% 50.00% 50.00% 50.00% 5,000 34,257 162,211 0 201,468 Regional National Bank (RNB) Risk-based capital Regional National Bank (RNB), Risk-Based Capital Assets $ 1,000 Category 4: 100 percent Loans: comm/ag/inst/leases Real estate, all other Allowance for loan and lease losses Other investments Premises, eq. other assets Other category 4 assets Total category 4 Total Assets before Off-Balance Sheet Off-Balance Sheet Contingencies 0% collateral category 20% collateral category 50% collateral category 100% collateral category Total Contingencies Total Assets and Contingencies before allowance for Less: Excess allowance for loan and lease losses (amount that exceeds 1.25% of gross RAA) Total Assets and Contingencies 1,966,276 388,456 (70,505) 168,519 194,400 0 2,647,146 Risk Weight 100.00% 100.00% 0.00% 100.00% 100.00% 100.00% 4,994,849 0 0 364,920 290,905 655,825 5,650,674 Risk Weighted 1,966,276 388,456 0 168,519 194,400 0 2,717,651 3,276,642 0.00% 20.00% 50.00% 100.00% 0 0 182,460 290,905 473,365 3,750,007 (2,152) 5,650,674 3,747,855 Regional National Bank (RNB) Risk-based capital (continued) Regional National Bank (RNB) Off Balance Sheet Conversions Contingencies 100% conversion factor Direct Credit substitues Acquisition of participations in BA, direct Assets sold w/ recourse Futures & forward contracts Interest rate swaps Other 100% collateral category Total 100% collateral category Contingencies 50% conversion factor Transaction-related contingencies Unused commitments > 1 year Revolving underwriting facilities (RUFs) Other 50% collateral category Total 50% collateral category Contingencies 20% conversion factor Short-term trade-related contingencies Other 20% collateral category Total 20% collateral category Contingencies 0% conversion factor Loan commitments < 1 year Other 0% collateral category Total 0% collateral category 1999 Assets $ 1,000 $ Amt. Risk Weight Risk Weighted Assets Credit Credit 165,905 0 0 50,000 75,000 0 290,905 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 165,905 0 0 50,000 75,000 0 290,905 0 364,920 0 0 364,920 50.00% 50.00% 50.00% 50.00% 0 182,460 0 0 182,460 0 0 0 20.00% 20.00% 0 0 0 0 0 0 0.00% 100.00% 0 0 0 General descriptions of the four risk categories Asset Category Risk Weight Effective Total Capital Requirement 1 0% 0% 2 20% 1.6% 3 50% 4% 4 100% 8% Obligor, Collateral, or Guarantor of the Asset Generally, direct obligations of the federal government; e.g., currency and coin, government securities, and unconditional government guaranteed claims. Also balances due or guaranteed by depository institutions. Generally, indirect obligations of the federal government; e.g.; most federal agency securities, full faith and credit municipal securities, and domestic depository institutions. Also assets collaterlized by federal government obligations are generally included in this category; e.g., repurchase agreements (when Treasuries serve as collateral) and CMOs backed by government agency securities. Generally, loans secured by one to four family properties and municipal bonds secured by revenues of a specific project (revenue bonds). All other claims on private borrowers. What constitutes bank capital? …according to accounting definition, capital or net worth equals the cumulative value of assets minus the cumulative value of liabilities, and represents ownership interest in a firm. Total equity capital equals the sum of: common stock, surplus, undivided profits and capital reserves, and net unrealized holding gains (losses) on available-for-sale securities and cumulative foreign currency translation adjustments, and perpetual preferred stock Risk-based capital standards …two measures of qualifying bank capital 1. Tier 1 or core capital consists of (4%): common equity, qualifying perpetual preferred stock, and minority interest in consolidated subsidiaries, less intangible assets such as goodwill. 2. Tier 2 capital or supplementary capital: allowance for loan loss reserves up to 1.25 percent of risk-weighted assets, preferred stock, and mandatory convertible debt. Leverage capital ratios Regulators are also concerned that a bank could acquire so many low-risk assets that risk-based capital requirements would be negligible hence, regulators have also imposed a 3 percent leverage capital ratio, defined as: Tier 1 capital divided by total assets net of goodwill and disallowed intangible assets and deferred tax assets. This capital requirement was implemented to prevent banks from operating with little or no capital, even though risk-based standards might allow it. Risk-based capital ratios for differentsized U.S. Commercial banks Asset Size Number of Institutions Reporting Equity capital ratio (%) Return on equity (%) Core capital (leverage) ratio (%) Tier 1 risk-based capital ratio (%) Total risk-based capital ratio (%) Year 2001 2000 1999 1997 1995 2001 2000 1999 1997 1995 2001 2001 2001 2001 $100 Million to $1 < $100 Million Billion 4,486 3,194 4,842 3,078 5,156 3,030 5,853 2,922 6,658 2,861 10.9 9.68 11.08 9.6 10.68 9.24 10.81 9.62 10.42 9.39 8.07 12.24 10.63 9.17 15.87 12.88 16.96 14.06 $1 to $10 Billion 320 313 318 301 346 9.76 8.99 9.09 9.16 8.57 13.77 8.74 11.83 13.77 > $10 Billion 80 82 76 66 75 8.77 8.05 7.87 7.58 7.19 13.43 7.23 8.86 12.16 All Commercial Banks 8,080 8,315 8,580 9,142 9,940 9.09 8.49 8.37 8.33 8.11 13.1 7.79 9.9 12.72 FDICIA and bank capital standards Effective December 1991, Congress passed the Federal Deposit Insurance Improvement Act (FDICIA) with the intent of revising bank capital requirements to: emphasize the importance of capital and authorize early regulatory intervention in problem institutions, and authorized regulators to measure interest rate risk at banks and require additional capital when it is deemed excessive. A focal point of the Act was the system of prompt regulatory action, which divides banks into categories or zones according to their capital positions and mandates action when capital minimums are not met. Five capital categories of FDICIA. Not subject to regulatory directives regarding capital: 1. 2. well-capitalized and adequately capitalized banks Subject to regulatory restrictions: 3. Undercapitalized, 4. significantly undercapitalized and 5. critically undercapitalized Capital categories under FDICA Total RiskBased Ratio Tier 1 RiskBased Ratio Well capitalized 10% & 6% & Adequately capitalized 8% & 4% & Undercapitalized < 8% or < 4% or Significantly undercapitalized < 6% or < 3% or Critically undercapitalized Tier 1 Capital Directive / Requirement Leverage Ratio Not subject to a capital directive to meet a specific level 5% for any capital measure Does not meet the definition of 4% well capitalized < 4% < 3% Ratio of tangible equity to total assets is 2% Prompt regulatory action under FDICIA B. Provisions for Prompt Corrective Action Category Well capitalized Adequately capitalized Undercapitalized Significantly undercapitalized Critically undercapitalized Mandatory Provisions Discretionary Provisions None None 1. No brokered deposits, except with FDIC approval 1. Suspend dividends and management fees 2 Require capital restoration plan 3. Restrict asset growth 4. Approval required for acquisitions, branching, and new activities 5. No brokered deposits 1. Same as for Category 3 2. Order recapitalization 3. Restrict interaffiliate transaction 4. Restrict deposit interest rates 5. Pay of officers restricted None 1. Same as for Category 4 2. Receiver/conservator within 90 daysd 3. Receiver if still in Category 5 four quarters after becoming critically undercapitalized 4. Suspend payments on subordinated debtd 5. Restrict certain other activities Order recapitalization 2. Restrict interaffiliate transactions 3. Restrict deposit interest rates 4. Restrict certain other activities 5. Any other action that would better carry out prompt corrective action 1. Any Zone 3 discretionary actions 2. Conservatorship or receivership if fails to submit or implement plan or recapitalize pursuant to order 3. Any other Zone 5 provision, if such action is necessary to carry out prompt corrective action Tier 3 capital requirements for market risk …many large banks have dramatically increased the size and activity of their trading accounts, resulting in greater exposure to market risk. Market risk is the risk of loss to the bank from fluctuations in interest rates, equity prices, foreign exchange rates, commodity prices, and exposure to specific risk associated with debt and equity positions in the bank’s trading portfolio. Market risk exposure is, therefore, a function of the volatility of these rates and prices and the corresponding sensitivity of the bank’s trading assets and liabilities. Tier 3 capital requirements for market risk …In response to the FDICIA stipulation that regulators systematically measure and monitor a bank’s market risk position, risk-based capital standards require all banks with significant market risk to measure their market risk exposure and hold sufficient capital to mitigate this exposure. A bank is subject to the market risk capital guidelines …if its consolidated trading activity, defined as the sum of trading assets and liabilities for the previous quarter, equals 10 percent or more of the bank’s total assets for the previous quarter, or $1 billion or more in total dollar value. Banks subject to the market risk capital guidelines must maintain an overall minimum 8 percent ratio of total qualifying capital to risk-weighted assets and market risk equivalent assets. Tier 3 capital allocated for market risk plus Tier 2 capital allocated for market risk are limited to 71.4 percent of a bank’s measure for market risk. Value-at-risk Market risk exposure is a function of the volatility of rates and prices and the corresponding sensitivity of the bank's trading assets and liabilities. The largest banks use a value-at-risk (VAR) based capital charge, estimated by using an internally generated risk measurement model. The original Basel Accord’s approach to capital requirements was primarily based on credit risk. Although it set appropriate protections from a market- and credit-risk perspective, it did not address operational or other types of risk. Operational risk itself is not new to financial institutions. It’s the first risk a bank must manage, even before making its first loan or executing its first trade. What is new is that by 2005, a bank’s regulatory capital needs could increase significantly—up to 20 percent of total risk-based capital—as a result of its exposure to operational risk. The new BASEL capital accord (BASEL II) and operational risk The events of September 11, 2001 tragically demonstrated the need for banks to protect themselves against operational risk to their systems and people. Starting in 2005, regulators will begin calculating bank capital according to the recently adopted Basel II Accord for capital adequacy. The new focus of Basel II is operational risk. The focus is on the optimum use of capital in the technology and business process operations areas of a financial institution. The Basel Committee defines operational risk as “the risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events.” Functions of bank capital Provides a cushion for firms to absorb losses and remain solvent. Provides ready access to financial markets, guards against liquidity problems. Constrains growth and limits risk-taking: TA / TA = EQ / EQ ROA (1 DR) EC / TA TA / TA EQ / TA ROA (1 DR) Example: TA / TA = EQ / EQ Assume ROA=1.1%, 7% equity, DR=40%: 0.11 (1 0.4) 0 %TA 0.07 0.11 (1 0.4) 10.41% Weakness of the risk-based capital standards The current formal standards do not account for any risks other than credit risk, except for market risk at large banks with extensive trading operations. Although the new Basel II does account for operational risk. Book value of capital is not the most meaningful measure of soundness. It ignores changes in the market value of assets, the value of unrealized gains or losses on held-to-maturity bank investments, the value of a bank charter, and the value of federal deposit insurance. Trading account securities must be marked-to-market and unrealized gains and losses reported on the income statement but other bank assets and liabilities are generally listed at book value The contra asset account, Loan Loss Allowance, is a crude measure of anticipated default losses but does not generally take into account the change in value of the loans from changes in interest rates. The effect of capital requirements on bank operating policies: limiting growth Ratio Asset growth rate (percent) Asset size (millions of $) ROA (percent)a Dividend payout rate (percent) Undivided Profits (millions of $) Total capital less undivide profits (millions of $) Total capital / total assets (percent) Case 1 Intitial Initial 8% Position Asset Growth 8.00% 100.00 108.00 4.00 4.00 8.00% Case 2 12% Growth: ROA 12.00% 112.00 Case 3 Case 4 12% 12% Growth: Growth: External ROA Capital 12.00% 12.00% 112.00 112.00 0.99% 1.43% 0.99% 40.00% 40.00% 13.42% 4.64 4.96 4.96 4.00 4.00 4.00 8.00% 8.00% 8.00% 0.99% 40.00% 4.665 4.295 8.00% Application of Equation 13.2 Case 1: 8% asset growth, dividend payout = 40%, and capital ratio = 8%. What is ROA? ROA(1 0.40) 0 0.08 0.08 ROA(1 0.40) Solve for ROA 0.99% Case 2: 12% asset growth, dividend payout = 40%, and capital ratio = 8%. What is required ROA to support the 12% asset growth? ROA(1 0.40) 0 0.12 0.08 ROA(1 0.40) Solve for ROA 1.43% Case 3: ROA = 0.99%, 12% asset growth, and capital ratio = 8%. What is the required dividend payout to support the 12% asset growth? 0.99(1 DR) 0 0.12 0.08 0.99(1 DR) Solve for DR 13.42% Case 4: ROA = 0.99%, 12% asset growth, capital ratio = 8%, and dividend payout = 40%. What is the required external capital to support the 12% asset growth? 0.99(1 0.40) ΔEC/TA 0.12 0.08 0.99(1 0.40) Solve for EC/TA 0.29% ΔEC $294,720 External capital sources Banks that choose to expand more rapidly must obtain additional capital from external sources, a capability determined by asset size. Large banks tap the capital markets regularly, but small banks must pay a stiff premium to obtain capital, if it is available at all. Capital sources can be grouped into one of four categories: 1. 2. 3. 4. subordinated debt, common stock, preferred stock, or trust preferred stock and leases. Each carries advantages and disadvantages. Subordinated debt Does not qualify as Tier 1 or core capital Imposes an interest expense burden on the bank when earnings are low. Subordinated debt offers several advantages to banks. interest payments are tax-deductible, generates additional profits for shareholders as long as earnings before interest and taxes exceed interest payments. Subordinated debt also has shortcomings. interest and principal payments are mandatory, default if not paid many issues require sinking funds Common stock Common stock is preferred by regulators as a source of external capital. It has no fixed maturity and thus represents a permanent source of funds. Dividend payments are discretionary, Losses can be charged against equity, not debt, so common stock better protects the FDIC. Common stock is not as attractive from the bank's perspective due to its high cost because: dividends are not tax-deductible, transactions costs on new issues exceed comparable costs on debt, and shareholders are sensitive to earnings dilution and possible loss of control in ownership. Preferred stock Preferred stock is a form of equity in which investors' claims are senior to those of common stockholders. As with common stock, preferred stock pays nondeductible dividends One significant difference is that corporate investors in preferred stock pay taxes on only 20 percent of dividends. For this reason, institutional investors dominate the market. Most issues take the form of adjustable-rate perpetual stock. Trust preferred stock Trust preferred stock is a hybrid form of equity capital at banks. It is attractive because it effectively pays dividends that are tax deductible. To issue the security, a bank establishes a trust company. The trust company sells preferred stock to investors and loans the proceeds of the issue to the bank. Interest on the loan equals dividends paid on preferred stock. The loan is tax deductible such that the bank deducts dividend payments. As a bonus, the preferred stock counts as Tier 1 capital!! Capital planning Capital planning is part of the overall asset and liability management process. Bank management makes decisions regarding the amount of risk assumed in operations and potential returns. The amount and type of capital required is determined simultaneously with the expected composition of assets and liabilities and forecasts of income and expenses. The greater is assumed risk and asset growth, the greater is required capital. Capital planning: forecast performance measures for a bank with deficient capital ratios 2001 2002 2003 2004 Historical 10% Growth in Assets: $250,000 In Dividends Total assets $ 80.00 $ 88.00 $ 96.80 $ 106.48 Net interest margin 4.40% 4.40% 4.50% 4.60% ROA 0.45% 0.45% 0.60% 0.65% Total capital $ 5.60 $ 5.75 $ 6.08 $ 6.52 Capital ratio 7.00% 6.53% 6.28% 6.12% 2005 $ 117.13 4.70% 0.75% $ 7.15 6.10% Shrink the Bank, reduce assets by $1 million a year: $250,000 In Dividends Total assets $ 80.00 $ 79.00 $ 78.00 $ 77.00 $ 76.00 Net interest margin 4.40% 4.40% 4.50% 4.60% 4.70% ROA 0.45% 0.45% 0.60% 0.65% 0.75% Total capital $ 5.60 $ 5.71 $ 5.92 $ 6.17 $ 6.49 Capital ratio 7.00% 7.22% 7.59% 8.02% 8.54% Slow Growth, $2 million increase in assets each year: No Dividends Total assets $ 80.00 $ 82.00 $ 84.00 $ 86.00 $ 88.00 Net interest margin 4.40% 4.40% 4.50% 4.60% 4.70% ROA 0.45% 0.45% 0.60% 0.65% 0.75% Total capital $ 5.60 $ 5.97 $ 6.47 $ 7.03 $ 7.69 Capital ratio 7.00% 7.28% 7.71% 8.18% 8.74% Slow Growth, $2 million increase in assets each year: $250,000 In Dividends, $800,000 External Capital Injection In 2004 Total assets $ 80.00 $ 82.00 $ 84.00 $ 86.00 Net interest margin 4.40% 4.40% 4.50% 4.60% ROA 0.45% 0.45% 0.60% 0.65% Total capital $ 5.60 $ 5.72 $ 5.97 $ 7.08 Capital ratio 7.00% 6.97% 7.11% 8.23% $ 88.00 4.70% 0.75% $ 7.49 8.51% Federal deposit insurance The Banking Act of 1933 established the FDIC and authorized federal insurance for bank deposits up to $2,500, today coverage stands at $100,000 per account. The initial objectives of deposit insurance were to prevent liquidity crises caused by largescale deposit withdrawals and to protect depositors of modes means against a bank failure. The large number of failures in the late 1980s and early 1990s put pressure on the FDIC by slowly depleting the reserve fund. By the late 1990’s, the FDIC was well funded Financial Institution Reform, Recovery, and Enforcement Act of 1989 (FIRREA) authorized the issuance of bonds to finance the bailout of the FSLIC and provide resources to close problem thrifts. The Deposit Insurance Funds Act of 1996 (DIFA) was enacted on September 30, 1996 1. 2. 3. Included both a one-time assessment on SAIF deposits to capitalize the SAIF fund Required the repayment of the Financing Corporation (FICO) bonds Mandated the ultimate elimination of the BIF and SAIF funds by merging them into a new Deposit Insurance Fund Risk-based deposit insurance FDIC insurance premiums are assessed based on a Risk-Based Deposit Insurance system required by the FDIC Improvement Act of 1991 and adopted in September 1992. These premiums are reviewed semiannually by the FDIC to ensure that: premiums appropriately reflect the risks posed to the insurance funds and that fund reserve ratios are maintained at or above the target Designated Reserve Ratio (DRR) of 1.25 percent of insured deposits Deposit insurance premiums are assessed as basis points per one hundred dollars of insured deposits. FDIC reserve ratios, fund balance, and insured deposits Insurance Fund Balance as a Percent of Total Insured Deposits 1.75% BIF SAIF 1.50% 1.25% Target Ratio 1.00% 0.75% 0.50% 0.25% 0.00% 1991 -0.25% -0.50% 1992 1993 1994 1995 1996 Year 1997 1998 1999 2000 2001 At the beginning of 2002, over 93% of banks are listed in the lowest category and pay no FDIC insurance premiums. Capital Group Well capitalized Adequately capitalized Undercapitalized Supervisory Subgroups A B C 0 bp 3 bp 17 bp 3 bp 10 bp 24 bp 10 bp 24 bp 27 bp Problems with deposit insurance Government backed deposit insurance provides for stability of the financial system by reducing or preventing banking panics and protecting the less sophisticated depositor — but this come at a price. Problems with deposit insurance …First, deposit insurance acts similarly to bank capital and is a substitute for some functions of bank capital. In noninsured industries, investors or depositors look to the company’s capital as a safety net in the event of failure. All else equal, lower capital levels mean that the company must pay a risk premium to attract funds or they will find it very difficult if not impossible to borrow money. In banking, a large portion of borrowed funds come from insured depositors who do not look to the bank’s capital position in the event of default A large number of depositors, therefore, do not require a risk premium to be paid by the bank. Normal market discipline in which higher risk requires the bank to pay a risk premium does not apply to all providers of funds. In addition to insured depositors, many large banks are considered to be “too-big-to-fail” (TBTF). As such, any creditor of a large bank would receive de facto 100 percent insurance coverage regardless of the size or type of liability. Problems with deposit insurance …Second, deposit insurance has historically ignored the riskiness of a bank’s operations, which represents the critical factor that leads to failure. Thus, two banks with equal amounts of domestic deposits paid the same insurance premium, even though one invested heavily in risky loans and had no uninsured deposits while the other owned only U.S. government securities and just 50 percent of its deposits were fully insured. This creates a moral hazard problem whereby bank managers had an incentive to increase risk. For example, suppose that a bank had a large portfolio of problem assets that was generating little revenue. Managers could use deposit insurance to access funds via brokered CDs in $100,000 blocks. Problems with deposit insurance … Third, deposit insurance funds were always viewed as providing basic insurance coverage. Historicall, there were three fundamental problems with the pricing of deposit insurance. Premium levels were not sufficient to cover potential payouts. Regardless, deposit insurance coverage slowly increased from $15,000 per account per institution in 1966 to $20,000 in 1969, $40,000 in 1974, and $100,000 in 1980. The FDIC and FSLIC were initially expected to establish reserves amounting to 5 percent of covered deposits funded by premiums. Unfortunately, actual reserves never exceeded two percent of insured deposits as Congress kept increasing coverage while insurance premiums remained constant. Even then, customers could obtain multiple account coverage at any single institution by carefully structuring ownership of each account. The high rate of failures during the 1980s and the insurance funds demonstrate that premiums were inadequate. Problems with deposit insurance … The final historical problem with deposit insurance is that premiums were not assessed against all of a bank’s insured liabilities. There were many liabilities that the federal government effectively guaranteed or where the holders had a prior claim on bank assets, that should have required insurance premiums. For example, insured deposits consisted only of domestic deposits while foreign deposits were exempt. The argument for not charging premiums against foreign deposits is that U.S. banks would be less competitive with foreign bank competitors. Too-big-to-fail doctrine toward large banks means that large banks would have coverage on 100 percent of their deposits but pay for the same coverage as if they only had $100,000 coverage as smaller banks do. This means that regulators were much more willing to fail smaller banks and force uninsured depositors and other creditors to take losses. If a bank’s liabilities were covered by federal insurance, the firm should have paid insurance premiums. Bank Management, 5th edition. Timothy W. Koch and S. Scott MacDonald Copyright © 2003 by South-Western, a division of Thomson Learning THE EFFECTIVE USE OF CAPITAL Chapter 13