Chapter_10.1

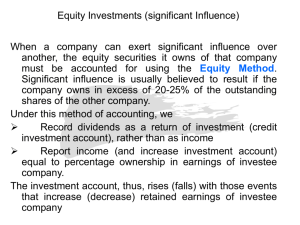

advertisement

BSAD 221 Introductory Financial Accounting Donna Gunn, CA Why do we make investments? Why do we have financial statements? Financial statements are the primary means of communicating financial information to parties outside the business organization. Balance Sheet Income Statement Stakeholders Investments Strategic Investments Passive Investments Investment made with a long-term strategy in mind for the betterment of the Company Primarily made for financial gain directly from the investment. Google CEO Larry Page: “Our acquisition of Motorola will increase competition by strengthening Google’s patent portfolio, which will enable us to better protect Android from anticompetitive threats from Microsoft, Apple and other companies.” Equity Investments: Common Shares Percentage Ownership 0% 20% 50% 100% Level of Influence Little or None Significant Control Type of Investment No Significant Influence Significant Influence Subsidiary Accounting Method Fair Value (AFS) Equity Method Consolidation; Use the fair value method for investments. Accounting for Available-for-Sale Investments (Passive Investment) The investor usually holds less than 20% of the voting shares and would normally play no important role in the investee’s operations. Available-for-sale investments are accounted for using the cost method. Accounting for Available-forSale Investments Suppose ATCO Ltd. purchases 1,000 Agrium Inc. common shares at the market price of $50.00. ATCO intends to hold these shares for longer than one year. Accounting for Available-forSale Investments Long-term Investment Cash 50,000 50,000 Purchased investment (1,000 × $50.00) Accounting for Available-forSale Investments Assume that ATCO receives a $0.14 per share cash dividend on this investment. Remember they purchased 1,000 shares Accounting for Available-forSale Investments Assume that ATCO receives a $0.14 per share cash dividend on this investment. Cash 140 Dividend Revenue 140 Received cash dividend (1,000 × $0.14) Value of an Investment Assume that the market value of the Agrium common Shares is $53,000 on December 31, 2010. Remember, currently recorded at a cost of $50,000 Value of an Investment Assume that the market value of the Agrium common Shares is $53,000 on December 31, 2010. Long-Term Investment Unrealized Gain on Investment 3,000 3,000 Adjusted investment to market value ($53K - $50K) Selling an Available-for-Sale Investment Suppose ATCO sells its investment in Agrium Inc. shares for $57,000 during 2011. Remember: Purchased for $50K and FMV at last balance sheet date was $53K. 10 - Selling an Available-for-Sale Investment Suppose ATCO sells its investment in Agrium Inc. shares for $57,000 during 2011. Remember: Purchased for $50K and FMV at last balance sheet date was $53K. Cash 57,000 Long-Term Investment Gain on Sale of Investment 53,000 4,000 10 - Use the equity method for investments. Accounting for Equity Method Investments The equity method is used to account for investments in which the investor owns 20 to 50% of the investee’s voting shares and can significantly influence the decisions of the investee. Equity Method 1. Includes investment as an asset account 1. Recognizes proportionate share of the investee’s operating income as their own income Increases investment account 1. Recognizes proportionate share of dividends paid Decreases investment account Accounting for Equity Method Investments NPC Corporation paid $611 million for 32% of the common shares of Bruce Power in Ontario Accounting for Equity Method Investments NPC Corporation paid $611 million for 32% of the common shares of Bruce Power in Ontario Long-Term Investment Cash 611 611 Investor’s Percentage of Investee Income Bruce Power reports net income of $100 million for the year. Remember, NPC owns 32% and has significant influence in Bruce power. Investor’s Percentage of Investee Income Bruce Power reports net income of $100 million for the year. Remember, NPC owns 32% and has significant influence in Bruce power. Long-term Investment 32,000,000 Equity Investment Revenue 32,000,000 To record investment revenue ($100 × 0.32=$32) Receiving Dividends Under the Equity Method Bruce Power declares and pays a cash dividend of $10 million. NPC receives 32% of this amount. Receiving Dividends Under the Equity Method Bruce Power declares and pays a cash dividend of $10 million. NPC receives 32% of this amount. Cash Long-Term Investment 3,200,000 To receive cash dividend on equity-method investment ($10 × 0.32) 3,200,000 Investment Account After the preceding entries are posted, NPC’s Investment account reflects its equity in the net assets of Bruce Power (in millions): Long-Term Investment Jan. 2 Purchase Dec. 31 Net income Dec. 31 Balance 611 Dec. 31 Dividends 32 640 3 Understand consolidated financial statements. Consolidated Subsidiaries Parent Company 100% ownership 85% ownership Subsidiary A Subsidiary B Consolidated Subsidiaries Parent Financial Statements _____ _____ _____ _____ _____ _____ _____ _____ Subsidiary Financial Statements _____ _____ _____ _____ _____ _____ Consolidated Financial Statements _____ _____ _____ _____ _____ _____ Income of a Consolidated Entity Parent Company Subsidiary S-1 Subsidiary S-2 Net Income Parent’s (Net loss) Ownership of Each of Each Company Company $330,000 100% $150,000 100% $(100,000) 60% Income of a Consolidated Entity Parent Company Subsidiary S-1 Subsidiary S-2 Consolidated net income Parent’s Net Income Parent’s Consolidate (Net loss) Ownership d of Each of Each Net Income Company Company (Net Loss) $330,000 x 100%= $330,000 $150,000 x 100%= $150,000 $(100,000) x 60%= $(60,000) $420,000 Account for long-term investments in bonds. Account for international operations. Foreign Currencies and Exchange Rates The measure of one currency against another is called the foreign-currency exchange rate. Using an exchange rate to convert the cost of an item given in one currency to its cost in a second currency is called a translation. £ $ € ¥ Foreign Currencies and Exchange Rates Country Hong Kong France Germany Italy Japan Mexico United Kingdom United States Monetary Unit Dollar Euro (€) Euro (€) Euro (€) Yen (¥) Peso (P) Pound (£) Dollar ($) Canadian Dollar Value $0.129 1.35 1.35 1.35 0.010 0.823 1.544 1.00 Managing Cash in International Transactions Hedging means to protect oneself from losing money in one transaction by engaging in counterbalancing transactions. Losses on the receipt of one currency may be offset by gains of the payment on another currency.