comprehensive examination b

B - II

B - III

B - IV

B - V

B - VI

B - VII

B - VIII

COMPREHENSIVE EXAMINATION B

(Chapters 6 – 9)

Approximate

Problem Topic Points Minutes

B - I Multiple Choice ............................................ 20 15

Estimating Inventory ...................................

Special Journals ..........................................

Bank Reconciliation ....................................

Periodic Inventories .....................................

Journal Entries .............................................

Correcting Entries ........................................

Notes Receivable .........................................

Checking Work ...........................................

15

9

12

100

10

12

13

9

12

10

13

90

5

95

10

10

10

10

Problem B - I — Multiple Choice (20 points)

Circle the one best answer.

1. The composite balance of individual accounts in the accounts receivable subsidiary ledger must a. equal the composite balance of the individual accounts in the accounts payable subsidiary ledger. b. always be zero. c. equal the balance of the accounts receivable account in the general ledger. d. agree with the total of the Accounts Receivable column in the cash receipts journal.

2. The one characteristic that all entries recorded in a cash payments journal have in common is a. that they all represent purchases of merchandise. b. a debit to the cash account. c. that they are all posted to the accounts payable subsidiary ledger. d. a credit to the cash account.

3. A cheque correctly written and paid by the bank for $381 is incorrectly recorded on the company's books for $318. The appropriate adjustment on a bank reconciliation would be to a. deduct $381 from the book's balance. b. deduct $63 from the book's balance. c. deduct $63 from the bank's balance. d. add $63 to the bank's balance.

4. The Petty Cash account should be debited a. whenever an expense is paid from the fund. b. when the fund is established. c. whenever the fund is replenished. d. when the fund is liquidated.

5. A dishonoured note receivable is usually a. written off as soon as possible. b. transferred to an accounts receivable. c. reduced to net realizable value by use of an allowance account. d. none of these.

6. The basis of estimating expected uncollectible accounts that emphasizes the matching of expenses with revenues is the a. percentage of receivables basis. b. percentage of sales basis. c. lower of cost and market basis. d. direct write-off method.

7. A company just starting business purchased three merchandise inventory items at the following prices: first purchase $870; second purchase $840; third purchase $810. If two items were sold during the period and the company used the LIFO costing method, the gross profit for the period would be how much greater or less than if the FIFO costing method had been used? The company uses the periodic inventory system. a. Gross profit would be $60 greater. b. Gross profit would be $60 less. c. Gross profit would be the same. d. Gross profit would be $30 greater.

8. A company uses the periodic inventory system. An error in the physical count of goods on hand at the end of the current period resulted in a $3,000 understatement of the ending inventory. The effect of this error in the current period is to a. overstate cost of goods sold. b. understate cost of goods available for sale. c. overstate gross profit. d. overstate net income.

9. In a period of rising prices, the inventory method that will show the highest net income is a. Average Cost. b. FIFO. c. LIFO. d. Lower of cost and market.

10. Granting of credit to a customer for a sales return is recorded in the a. cash payments journal. b. cash receipts journal. c. general journal. d. sales journal.

*Problem B - II — Estimating Inventory (10 points)

Instructions

Complete the requirements specified for each of the following independent situations.

1. A major portion of Mohamud Company’s inventory was destroyed by a flood. Accounting records provide the following information:

Sales

Sales Returns and Allowances

Beginning Inventory

$180,000

30,000

25,000

Purchases

Purchases Returns and Allowances

Freight In

$142,000

15,000

8,000

Assuming a gross profit rate of 30% on net sales and that undamaged inventory is appropriately valued at $10,000, calculate the cost of the merchandise destroyed in the flood.

2. Hudler Company uses the retail inventory method. Given the following information, calculate the ending inventory at cost.

Beginning Inventory

Purchases

Sales

Sales Returns and Allowances

*Problem B - III — Special Journals (12 points)

Cost

$ 15,000

125,000

Retail

$ 20,000

180,000

150,000

10,000

José Company incurs the following transactions in January. For each of the transactions listed below, record the transaction in the appropriate journal. GST is 7% and PST is 8%. The company uses a perpetual inventory system.

Jan. 3 Sell merchandise on credit to B. Chu for $1,000, invoice No. 510, plus GST and PST.

Cost $700.

Jan. 5 Purchase merchandise from S. Singh for $2,000 plus GST, terms n/30.

Jan. 13 Receive $500 in part payment from B. Chu.

Jan. 14 Summary daily cash sales total $10,000 plus GST and PST. Cost $7,000.

Jan. 15 Pay $400 cash, using cheque #1, for office supplies from Grand Company plus GST and PST.

Jan. 17 Return $1,000, plus $70 GST, of merchandise to S. Singh and receive credit.

Date

Date

Date

Date

Date

Account

Debited

Account

Debited

Cheque

No.

Account

Credited

Ref.

Terms

Payee

Invoice

No.

Cash Dr.

Terms

Cash Cr.

SALES JOURNAL

Ref.

CASH RECEIPTS JOURNAL

Accounts

Receivable

Cr.

Acc. Rec.

Dr.

Sales

Cr.

Sales Cr.

GST

Payable

Cr.

PURCHASES JOURNAL

Ref.

Merchandise Inventory

Dr.

CASH PAYMENTS JOURNAL

Merchandise

Inventory

Dr.

Accounts

Payable Dr.

GENERAL JOURNAL

Account Title and Explanation

GST

Payable

Cr.

PST

Payable

Cr.

GST

Recoverable

Dr.

Ref.

PST

Payable

Cr.

GST Recoverable

Dr.

C. of G.S. Dr.

Merch. Inv. Cr.

Account

Debited

Debit

Other

Accounts

Cr.

Accounts Payable.

Cr.

Ref.

S1

C. of G.S. Dr.

Merch. Inv. Cr.

CR1

P1

CP1

Other

Accounts

Dr.

J1

Credit

Problem B - IV — Bank Reconciliation (13 points)

Roberts Company received a bank statement for the month of October 2001, which showed a balance per bank of $3,600. The company's Cash account in the general ledger showed a balance of $1,206 at October 31. Other information that may be relevant in preparing a bank reconciliation for October follows:

1. The bank returned an NSF cheque from a customer for $480.

2. The company recorded cash receipts of $340 on October 31 but this amount does not appear on the bank statement.

3. A cheque correctly written and paid by the bank for $1,640 was incorrectly recorded in the cash payments journal for $1,460. The cheque was a payment on account.

4. Cheques that were written in September but still had not been presented to the bank for payment at October 31 amounted to $760.

5. The bank included a credit memorandum for $1,454 which represents a collection of a customer's note by the bank for the company; principal amount of the note was $1,330 and the remainder was interest.

6. The bank included a $20 debit memorandum for service charges for the month of October.

7. Cheques written in October which have not been paid by the bank at October 31 amounted to $1,200.

Instructions

1. Prepare a bank reconciliation for Roberts Company for October which reconciles the balance per books and the balance per bank to their adjusted correct balances.

2. Prepare the necessary adjusting entries for the Roberts Company at October 31, 2001.

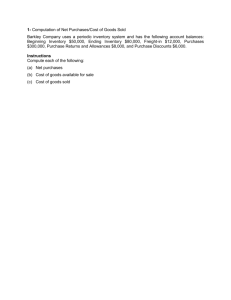

Problem B - V — Periodic Inventories (9 points)

Singh Company uses the periodic inventory method and had the following inventory information available for the month of November.

Date

11/1

11/5

11/12

11/18

11/25

11/30

Transaction

Beginning inventory

Purchase No. 1

Sale No. 1

Purchase No. 2

Sale No. 2

Purchase No. 3

Units

400

500

400

500

700

600

Unit Cost

$3

$5

$6

$7

A physical count of units on November 30 revealed that 900 units were on hand.

Answer the following independent questions and show calculations supporting your answers.

1. Assume that the company uses the average cost method. What is the dollar value of the ending inventory on November 30?

2. Assume that the company uses the FIFO inventory method. The dollar value of the ending inventory on November 30 is:

2. Assume that the company uses the LIFO inventory method. What is the dollar value of the cost of goods sold during November?

Problem B - VI — Journal Entries (15 points)

Antonio Company uses the allowance method to account for uncollectible accounts and the perpetual inventory method to account for inventories. Prepare the appropriate journal entries to record the following transactions during 2001. You may omit journal entry explanations.

Jan. 3 Paid freight on goods purchased on December 30, $500,

Jan. 5 Sold merchandise, which cost $11,000, to Bob Taborio for $19,000 on account.

Credit terms: n/30.

Jan. 14 Received balance due from Bob Taborio.

June 20 The account of Jeff Short for $1,500 was deemed to be uncollectible and is written off as a bad debt.

Dec. 31 Use the following information for year-end adjusting entries:

The balance of Accounts Receivable and Allowance for Doubtful Accounts at year end are $131,000 and $3,900, respectively. It is estimated that bad debts will be 5% of accounts receivable.

Problem B - VII — Correcting Entries (9 points)

An inexperienced accountant for Brennen Company made the following incorrect entries.

1. Notes Receivable .......................................................................... 10,800

Accounts Receivable ............................................................

Interest Revenue ..................................................................

10,000

800

Facts: Accepted a $10,000, 1 year, 8% note from John Tan Company for balance due.

2. Accounts Receivable —American Express ..................................... 35,000

Sales .................................................................................... 35,000

Facts: Accepted American Express credit card for $35,000; the service fee is 4%.

3. Allowance for Doubtful Accounts ................................................... 18,450

Notes Receivable .................................................................

Interest Revenue ..................................................................

18,000

450

Facts: M. Bailey dishonoured an $18,000, 10%, 3-month note because of bankruptcy.

Bailey is expected to pay. No interest had been accrued on the note.

Instructions

Prepare entries to correct Brennen Company's books based on the facts given. Do not reverse out incorrect entries that were recorded above, but rather correct the account balances so that they reflect the proper amounts.

Problem B - VIII — Notes Receivable (12 points)

Instructions

Prepare journal entries to record the following events:

Jul. 1 Kiner Company accepted a 12%, 3-month, $4,000 note dated July 1 from Fox

Company for balance due.

Jul. 31 Kiner accrued interest on the above note for the month of July.

Oct. 1 Collected Fox Company note in full. Assume interest was correctly accrued on

August 31 and September 30.

Oct. 1 Assume instead that the note is dishonoured and that no interest has been accrued.

Fox Company is expected to eventually pay the amount owed.