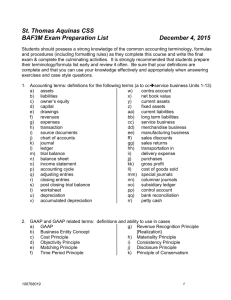

EXAM Review Terms final

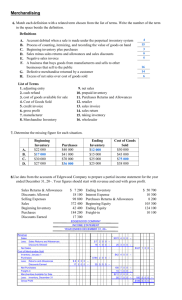

advertisement

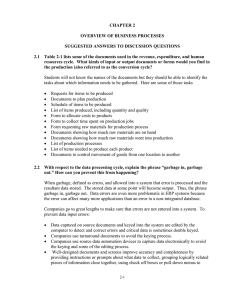

Exam Review Chapter 1: Accounting and Business accounting types of business (service, merchandising, manufacturing, non-profit) forms of business ownership (sole proprietorship, partnership, corporation) CA, CMA, CGA auditing Canadian Institute of Chartered Accountants CICA Handbook Chapter 2: The Balance Sheet asset liability owner’s equity (capital, net worth) balance sheet accounts receivable debtor accounts payable creditor liquidity accounting principles (GAAP) o business entity concept o continuing concern concept o principle of conservatism Chapter 3: Analyzing Changes in Financial Position business transaction source document accounting principle GAAP - objectivity principle Chapter 4: The Simple Ledger account ledger t-accounts debit/credit accounting entry double entry system of accounting account balance exceptional account balance trial balance Chapters 5 and 6: Expanded Ledger/The Journal and Source Documents equity accounts - capital, drawings, revenue, expense income statement fiscal period chart of accounts trial balance Source Documents: o cash sales slip o sales invoice o purchase invoice o cheque copy o cash receipts daily summary o bank debit advice o bank credit advice o others…bank statement, credit card statement, memorandum… serially prenumbered documents accounting principle - cost principle Sales Tax: o goods and services tax (GST) o harmonized sales tax (HST) o remitting GST to the government o input tax credit o contra account buying and selling on credit/on account generally accepted principles o time period concept o revenue recognition principle o matching principle journal (book of original entry) two-column general journal journal entry journalizing Chapter 7 posting cross-referencing accounting cycle trial balance out of balance o shortcuts in detecting a single error transposition error Chapter 8 work sheet accounts receivable control account accounts payable control account income statement balance sheet formats o account form balance sheet o report form balance sheet classified balance sheet - current assets, fixed assets (or plant and equipment), current liabilities, long-term liabilities, owner’s equity accountability o users of financial statements o audit accounting principles o full disclosure principle o consistency principle o materiality principle comparing financial data o trend analysis o common size statements Chapter 9: Completing the Accounting Cycle Adjusting Entries Types of adjustments o late purchase invoices o supplies o prepaid expense o depreciation straight line method declining balance method accumulated depreciation net book value contra account Closing entries o real accounts/permanent accounts o nominal accounts/temporary accounts o closing an account o income summary account Accounting cycle GAAP o matching principle o materiality principle o consistency principle o full disclosure principle Audit Chapter 10: Cash Control and Banking internal control bank reconciliation statement Chapter 11: Accounting for a Merchandising Business merchandise inventory inventory methods o periodic inventory method o perpetual inventory method physical inventory purchases account freight-in account calculating cost of goods sold gross profit closing entries credit invoice sales returns and allowances purchases returns and allowances discounts for early payment – discounts allowed and discounts earned, terms of sale inventory shrinkage Chapter 12: Modifying Accounting Systems subsidiary ledger Chapter 13: Business Organization and Decision-Making partnerships advantages and disadvantages of partnerships partnership agreement corporation share certificate / stock certificate shareholder common shareholders limited liability board of directors advantages and disadvantages of corporations public corporations private corporations capital stock retained earnings dividends apportionment of net income or net loss for a partnership o salaries o interest o income or loss sharing ratio common stock preferred stock statement of distribution of net income statement of partners’ capital ratio and percentage analysis o current ratio o quick ratio o accounts receivable collection period o inventory turnover o debt ratio o equity ratio o rate of return on sales o rate of return on shareholders’ equity o times interests earned ratio o earnings per share o price earnings ratio