Short-Term Financial Management

advertisement

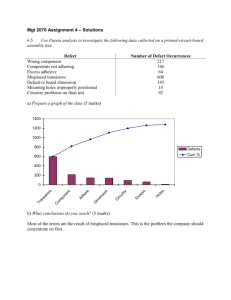

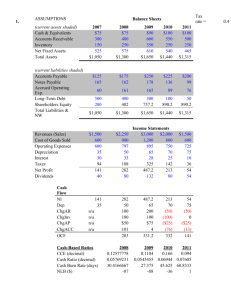

SHORT-TERM FINANCIAL MANAGEMENT Chapter 3 – Cash Holdings Prepared by Patricia R. Robertson Kennesaw State University 2 Chapter 3 Agenda CASH HOLDINGS Identify the benefits and costs associated with corporate cash holdings, discuss motives for holding cash, assess corporate liquidity using financial ratios, and explain and use cash management models. Cash Flow Timeline 3 The cash conversion period is the time between when cash is received versus paid. The shorter the cash conversion period, the more efficient the firm’s working capital and more cash is generated. The firm is a system of cash flows. These cash flows are unsynchronized and uncertain. Cash Holdings 4 The CCP is the length of time to convert cash disbursements into cash receipts. It is useful in assessing firm liquidity during ordinary operations. It is not a good indicator of a firm’s ability to withstand cash flow shocks from unexpected events (e.g.: losing a major customer, litigation, etc.). This chapter focuses on the role of cash. Cash Holdings 5 Cash is viewed as an idle corporate resource since it is a very low yielding asset. It can include cash in bank accounts and low-risk, short-term marketable securities. The latter has transaction costs. Firm’s establish a policy on it’s target cash position given: The current economic environment. Other liquidity sources. Upcoming obligations. Liquidity Strategies 6 To determine the target cash position ($ or % of assets): Low-Liquidity Strategy Minimal cash level (higher risk; higher return). Appropriate for firms with predictable cash flows and spare debt capacity. Moderate-Liquidity Strategy More cash (less risk; less return). Strategy matches cash needs to upcoming obligations. High-Liquidity Large Strategy cash-to-asset ratio (low risk; low return). Appropriate for firms with high business risk. Costs and Benefits of Holding Cash 7 The cost of holding cash is the firm’s opportunity cost. Managers hold cash for the following 3 reasons: Transaction Cash is available to run the business without having to liquidate investments and pay transaction costs. Precautionary Cash is available for uncertainties and cash flow shortfalls. Speculative Cash is available to capture unexpected opportunities (e.g.: acquisitions). Cash-Based Liquidity Measures 8 Liquidity includes both flow and stock. If cash from operations (flow) is insufficient to cover maturing obligations, the firm needs access to other resources (stock). Financial measures to gauge firm liquidity from a cash perspective are: Cash Conversion Efficiency Cash Ratio Cash Burn Rate Net Liquid Balance (NLB) Current Liquidity Index Lambda Cash Conversion Efficiency (CCE) 9 CCE measures the firm’s ability to convert revenues into operating cash flows. The CCE should be positive indicating the firm is successfully converting revenues (sales) to cash flows. Cash Ratio 10 The cash ratio is the proportion of total assets held on the balance sheet in cash. Cash Burn Rate 11 The cash burn rate is the number of days a firm’s existing cash will last to cover ongoing expenses without any new cash inflows or external financing. The denominator is dependent on the industry; a service firm might use operating expenses instead. WCR & NLB (from Chapter 2) 12 Working Capital Requirements (WCR) Net Working Capital Current Assets Minus Current Liabilities Current Assets Minus Current Liabilities Cash Accounts Payable Cash Accounts Payable Marketable Securities Notes Payable Marketable Securities Notes Payable Accounts Receivable CMLTD Accounts Receivable CMLTD Inventory Accruals and Other Inventory Accruals and Other Prepaids and Other Prepaids and Other Net Liquid Balance (NLB) Current Assets NWC = WCR + NLB Minus Current Liabilities Cash Accounts Payable Marketable Securities Notes Payable Accounts Receivable CMLTD Inventory Accruals and Other Prepaids and Other Net Liquid Balance (NLB) 13 Net Working Capital = WCR + NLB NLB = Financial CA – Financial CL It shows ability of stock resources to pay ‘arranged’ maturing debt which is unaffected by the operating cycle. A negative NLB indicates dependence on outside financing. Continued sales growth and the permanent increase in WCR should be financed with a permanent source of financing. Seasonal sales growth results in temporary increases in WCR (A/R and Inventory), which can be financed by drawing down NLB. Current Liquidity Index & Lambda 14 These two measures have a coverage component similar to the Current Ratio, but they also have a time (or flow) dimension as a result of including a measure of cash flow. Current Liquidity Index (CLI) 15 CLI combines beginning cash & cash equivalents (‘stock’) plus expected OCF (‘flow’) in the numerator and liabilities due in the upcoming year (N/P and CMLTD) in the denominator. It indicates if internal liquidity is sufficient to cover maturing obligations and/or if external financing will be required. The variability of operating cash flow affects the target cash level and the need for access to bank credit lines. Lambda (λ) 16 Lambda accounts for the uncertainty of future cash inflows along with access to bank lines of credit. Lambda measures the probability of illiquidity. The numerator represents overall liquidity, including cash, unused credit lines, and next period’s expected OCF. The denominator is cash flow uncertainty, measured as the standard deviation of operating cash flow. Lambda includes information about the volatility of expected cash flows. Historical data is used to calculate the denominator, using the standard deviation of the distribution of the firm’s expected net cash flow from operations. λ And Related Values 17 For example, a Lambda of 1.645 signals a 5% chance of running out of cash. The approach is useful in differentiat ing liquidity risk for firms with identical cash levels. How Much Liquidity Is Enough? 18 Using Lambda, and based on a firm’s unique circumstances, a firm need only maintain liquid reserves to meet unforeseen circumstances arising from a high degree of uncertainly regarding future cash flows. If the future is stable, there is a lesser need for liquid resources. Financial Flexibility 19 Financial Flexibility is related to a firm’s overall financial structure and if its financial policies allow it flexibility to take advantage of unforeseen opportunities. A flexible short-term financial policy would maintain a high level of current assets relative to sales, such as: Maintaining large cash balances. Maintaining large inventory levels. Offering liberal credit terms, leading to more sales and a higher receivable book. Cash Management Models 20 Firm liquidity includes cash and near-cash investments (marketable securities). Holding cash has an opportunity cost; converting securities to cash involves transaction costs. Transaction costs include brokerage commissions, funds transfer fees, costs of communicating instructions and record keeping, etc.) Firms want to maximize investment returns by minimizing idle cash while minimizing transactions costs. Cash management (optimization) models help the firm determine the optimal number of liquidations per period (and the amount per liquidation) to minimize total costs. Cash Management Models 21 We’ll look at three models, each which include different assumptions: Baumol Miller-Orr Stone Baumol Model 22 The goal of the Baumol model is to choose the Z* that results in the optimal trade-off between the cost of transferring funds out of securities (transaction costs) and foregone interest from holding cash (opportunity cost). Baumol Model Illustrated 23 Baumol Model 24 The Baumol Model assumes: The firm has forecasted cash needs over the planning period (total cash need - TCN). Cash is replenished by liquidating investments. The firm liquidates investments periodically, but must disburse funds at a continuous, steady rate. The firm is able to forecast cash disbursements with certainty. Z Z/2 The model assumes net cash flow is negative. When cash reaches zero (or a minimum “safety” amount), cash is replenished in consistent increments by selling securities. THE “OPTIMAL RETURN POINT” TO REPLENISH CASH IS DENOTED Z* IN THE MODEL. Baumol Model 25 The Total Cost of the cash position is given by the following formula: Transaction Costs + Opportunity Cost Cost/Transaction х Number of Transactions Period Interest Rate х Average Cash Balance = Total Cost Where: Z* = Cash transfer amount (cash starting and return point) F = Fixed transaction cost per sale of security TCN = Total cash needed during planning period # Transactions Avg. Cash Balance i = Interest rate, per period (opportunity cost of holding cash) Baumol Model 26 There exists some Z* that minimizes the total costs. The first expression includes Z in the denominator; with larger (but fewer) transactions, Transaction Costs are lower. The second expression includes Z in the numerator; with larger (less frequent) transactions, Opportunity Cost is higher. Where: Z* = Cash transfer amount (cash starting and return point) F = Fixed transaction cost per sale of security TCN = Total cash needed during planning period i = Interest rate, per period (opportunity cost of holding cash) Baumol Model 27 The goal is to choose the Z* (the Optimal Return Point) that results in the optimal trade-off between Transaction and Opportunity Costs. Z* is the amount of securities that should be sold to replenish cash when the disbursements account has been drawn down. Take the derivative of the total cost equation and set equal to zero. Where: Z* = Cash transfer amount (cash starting and return point) F = Fixed transaction cost per sale of security TCN = Total cash needed during planning period i = Interest rate, per period (opportunity cost of holding cash) Minimize Total Cost Function 28 1 TCCash F (TCN ) Z 1 i Z 2 dTC 1 F (TCN ) Z 2 i 0 dZ 2 F (TCN ) Z Z 2 2 1 i 2 1 i 2 F (TCN ) Z2 2 F (TCN ) i Baumol Model Example 29 Using Baumol, determine Z* given: Transaction costs (F) are $65/each. Annual cash disbursements (TCN) are $1 million. Target cash position is $0 (no safety cash). Short-term securities (i) are paying 3%/yr. Where: Z* = Cash transfer amount (cash starting and return point) F = Fixed transaction cost per sale of security TCN = Total cash needed during planning period i = Interest rate, per period (opportunity cost of holding cash) Baumol Model Example 30 When investments are liquidated, it is done in $65,828 increments. $65,828 $32,914 If disbursements are made at “a continuous and steady rate,” the average cash position is half of $65,828, or $32,914. # of Annual Transactions (TCN/Z) $1M / $65,828 = 15.19 X or about every 24 days Miller-Orr Model 31 Like Baumol, Miller-Orr minimizes total costs (transaction and opportunity). Baumol assumed net cash flows are steady and predictable; Miller-Orr assumes net cash flows are random and unpredictable. The model includes two ‘trigger’ points: Miller-Orr allows for imperfections in daily cash balance forecasts. Upper Control Limit (UCL) – Triggers a purchase to return cash balance to the “return point.” Lower Control Limit (LCL) – Triggers a sale to return cash balance to the “return point”. No transactions are made so long as the cash balance remains within the control limits (ranges). Miller-Orr Model Illustrative 32 The model allows for an increase in the daily cash position, in addition to a decreases. No action occurs so long as the daily cash balance remains within the range set by the control limits. UCL - Purchase Return Point If the cash balance reaches the UCL, cash is invested to bring cash levels back to the Return Point (Z* + LCL). If the cash balance reaches the LCL, investments are sold to bring cash levels back to the Return Point. LCL - Sell Miller-Orr Model Illustrative So long as the cash balance remains within the range, no action is taken. 33 UCL – If there is too much cash, securities are bought returning the cash balance to the Return Point (Z* + LCL). Return Point LCL – If there is too little cash, securities are sold returning the cash balance to the Return Point. Miller-Orr Model Illustrative 34 Three values must be set: 1) UCL 2) LCL 3) Return Point (Z* + LCL) Return Point Miller-Orr Model Formula 35 Miller-Orr Model Example 36 A firm is considering cash variability in its planning based on the following assumptions: Variance of daily cash flows = $1.0M LCL = $0 (could be > $0) Transaction Fee = $65/ea. Investment Rate = 3% Calculate Z*: Miller-Orr Model Example 37 When cash is outside of the control limits, the firm takes action to return the cash balance to the Return Point, investing only when cash reaches the UCL and liquidating investments at the LCL. WE NOW HAVE TO ESTABLISH THE RETURN POINT, UCL AND LCL. Miller-Orr Model Example 38 If the LCL is $0 and Z* is $8,402: Return Point = Z* + LCL $25,206 = $8,402 + $0 = $8,402 UCL = 3Z* + LCL Return Point $8,402 = (3 x $8,402) + $0 = $25,206 Average Cash Balance = (4/3)(Z*) + LCL = (4/3)($8,402) + $0 = $11,203 $0 Miller-Orr Model Example 39 The firm starts with $8,402 in cash. If UCL is reached, the firm invests $16,804. If the LCL is reached, the firm sells $8,402 in investments. In either case, the firm returns to the Return Point (Z* + LCL). $25,206 INVEST $25,206 - $8,402 = $16,804 Return Point $8,402 SELL $8,402 $0 Miller-Orr Model Example 40 If the LCL is $5,000 and Z* is $8,402: Return Point = Z* + LCL $30,206 = $8,402 + $5,000 = $13,402 UCL Return Point = 3Z* + LCL $13,402 = (3 x $8,402) + $5,000 = $30,206 Average Cash Balance = (4/3)(Z*) + LCL = (4/3)($8,402) + $5,000 = $16,203 $5,000 Miller-Orr Model Example 41 The firm starts with $13,402 in cash. If UCL is reached, the firm STILL invests $16,804. If the LCL is reached, the firm sells $8,402 in investments. In either case, the firm returns to the Return Point (Z* + LCL). $30,206 INVEST $30,206 - $13,402 = $16,804 Return Point $13,402 SELL $8,402 $5,000 Stone Model Example 42 A firm is planning its cash management activities using Stone; it begins with the rules for Miller-Orr: Assume LCL set at $50,000 (cash buffer) Assume Z* is calculated at $25,000 Return Point Therefore, the control limits are: $125,000 $75,000 LCL = $50,000 UCL = 3Z* + LCL = (3 x $25,000) + $50,000 = $125,000 Return Point = Z* + LCL = $25,000 + $50,000 = $75,000 $50,000 Stone Model Example 43 A firm is planning its cash management activities using Stone; it begins with the rules for Miller-Orr: INVEST The firm starts with $125,000 - $75,000 = $50,000 $75,000 in cash. Return Point If UCL is reached, the firm invests $50,000. If the LCL is reached, the SELL firm sells $25,000 in $25,000 investments. In either case, the firm returns to the Return Point. $125,000 $75,000 $50,000 Stone Model Example 44 Now, the Stone model attributes are added: The firm selects a ‘lookahead’ period between 3 and 12 days to project the cash balances; say 7 days. It estimates daily, net cash flows for the look-ahead period. It assigns a forecasting error for the cash flow estimates; say 3%. Cash Flow Projections: Stone Model Example 45 To account for the firm’s estimated forecasting error, the Miller-Orr control limits are adjusted by 3%, shrinking the range. $125,000 Modified UCL Return Point $121,250 $75,000 Modified Control Limits (3% Adjustment) UCL ($125,000 x 97% = $121,250) LCL ($50,000 x 103% = $51,500) Modified LCL $51,500 $50,000 Stone Model Example 46 All Stone Model assumptions are assembled: Control Limits UCL ($125,000) Modified UCL ($121,250) LCL ($50,000) Modified LCL ($51,500) Return Point ($75,000) Look-Ahead Forecast (7 days) k (3 days) Cash Flow Projections Forecasting Error (3%) Cash Flow Projections: Stone Model Example 47 A chart is built for the length of the look-ahead period, including Day 0. The daily, net cash flow projections are added. With the beginning cash balance (say, $105,000), the estimated daily “Cash Balance” is calculated AND the estimated “Cash Balance in 3 Days” (k) is calculated, all for the 7 day look-ahead period. Cash Flow Projections: Stone Model Example 48 Each day (for the entire look-ahead) period, the “Cash Balance” is compared to original control limits AND the “Cash Balance in 3 (k) Days” is compared to the modified control limits. Decision-making is based on both. Cash Flow Projections: Stone Model Example 49 Day 0 - The $105,000 Cash Balance is below the $125,000 UCL, so no further analysis is needed and no action is taken. Cash Flow Projections: Control Limits UCL ($125,000); Mod. UCL ($121,250) LCL ($50,000); Mod. LCL ($51,500) Stone Model Example 50 Day 1 - The $150,000 projected Cash Balance is more than the UCL and it remains that way for at least 3 days since, $160,000, the projected Cash Balance in 3 Days, is also more than the Modified UCL Plan to buy $85,000 in securities on Day 1 bringing cash to “return point” of $75,000 in 3 days. • $160,000 - $85,000 = $75,000 Cash Flow Projections: Control Limits UCL ($125,000); Mod. UCL ($121,250) LCL ($50,000); Mod. LCL ($51,500) Stone Model Example 51 Day 1 - The $150,000 projected Cash Balance is more than the UCL and it remains that way for at least 3 days since, $160,000, the projected Cash Balance in 3 Days, is also more than the Modified UCL Plan to buy $85,000 in securities on Day 1 bringing cash to “return point” of $75,000 in 3 days. • $160,000 - $85,000 = $75,000 Cash Flow Projections: Note: If, on Day 1 the Cash Balance changes… since the ACTUAL Day 1 cash flows were different than projected...no action has to be taken. It is a planning tool and the decision rules are flexible. Stone Model Illustrative 52 Return Point Stone Model Options 53 A more complex version of Stone calls for the use of two look-ahead periods. For example, a firm could use both a 2-day lookahead and a 3-day look-ahead. Transfers between cash and securities only take place if the cash position gets very high or low and is expected to stay that way for another 2 days (in the first analysis) and 3 days (in the second analysis). Cash Trends 54