Chapter 3 - Cengage Learning

advertisement

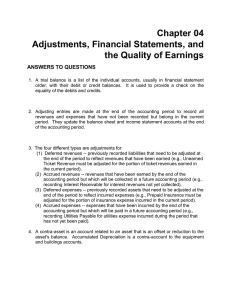

7/e Processing Accounting Information 3 PowerPoint Author: Catherine Lumbattis COPYRIGHT © 2011 South-Western/Cengage Learning External and Internal Events External events: interaction between entity and outside environment Internal events: Event occurs entirely within the entity LO1 Source Documents Purchase Invoice Cash Register Tape Payroll Records Evidence needed in an accounting system to record transactions Shipping Document Sales Invoice Checks Receiving Document LO2 Issue Capital Stock for Cash 1/2010 Transactions for Glengarry Health Club The accounting equation must always remain in balance LO3 Purchase of Property in Exchange for Note Payable Increase on left has corresponding increase on right Cost Principle requires assets such as equipment be recorded at cost to acquire and continue to report this amount until asset is sold these assets are not carried at market value (only few exceptions) Effect of Revenue and Expenses on Retained Earnings Income Statement Revenue – Expenses = Net Income or (Net Loss) Statement of Retained Earnings Beg. R/E + Net Income OR ( – Net Loss) – Dividends = End. R/E Identify and Analyze What type of activity? operating, financing or investing What accounts are affected and are the accounts increased or decreased? at least two accounts are always affected Which financial statements are affected? just the balance sheet or balance sheet and income statement Sell Monthly Memberships on Account Payment of Wages and Salaries Payment of Wages and Salaries: Operating activity Two accounts are affected: Cash is decreased and Wage and Salary Expense is increased This transaction affects both the Balance Sheet and the Income Statement Payment of Wages and Salaries Appendix: The T Account Account Name Debits are entered on left Credits are entered on right Representation of one account in the general ledger LO5 The T Account Account Name 400 dr. Debits and credits are netted to obtain balance in account 900 cr. 500 cr. Debits/Credits and the Accounting Equation STOCKHOLDERS’ = LIABILITIES + EQUITY ASSETS Dr. Cr. Dr. Cr. Dr. + – – + – Cr. + Opposite sides of the accounting equation are increased/decreased in an opposite way Link Between Revenues and Retained Earnings RETAINED EARNINGS Dr. – + Cr. REVENUES Dr. – Cr. + Both accounts are increased with credits Revenues increase retained earnings (part of owners’ equity) Link Between Expenses and Dividends and Retained Earnings RETAINED EARNINGS Retained earnings is decreased with debits DR. – Expenses and dividends decrease retained earnings Use debits to record(increase) expenses and dividends CR. + EXPENSES AND DIVIDENDS DR. CR. + – Normal Account Balances Debit Assets Expenses Dividends all increased with debits Credit Liabilities Stockholders’ Equity Revenues all increased with credits Determine the Balance of the T Accounts Cash (1) 100,000 (5) 5,000 (8) 4,000 94,000 10,000 (6) 3,000 (7) 2,000 (9) Accounts Receivable (4) 15,000 4,000 (8) 11,000 The Journal: Chronological Record of Transactions Book of Original Entry Transactions recorded in the journal first and then posted to the ledger LO6 Posting from Journal Transactions are entered in: And then posted to: Journal (via journal entries): Cash Capital Stock Dr. 100,000 Cr. 100,000 To record the issuance of 10,000 shares Ledger Accounts • Cash • Capital Stock Glengarry Health Club Trial Balance January 31, 2010 Cash Accounts Receivable Equipment Building Land Accounts Payable Notes Payable Capital Stock Membership Revenue Court Fee Revenue Wage Expense Utility Expense Dividends Totals Debits Credits $ 94,000 11,000 20,000 150,000 50,000 $ 20,000 200,000 100,000 15,000 5,000 10,000 3,000 2,000 $340,000 $340,000 LO7 End of Chapter 3