Always review the Lecture Notes for each part PRIOR to starting that

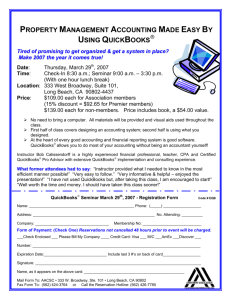

advertisement

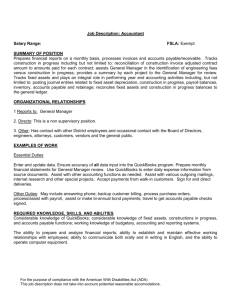

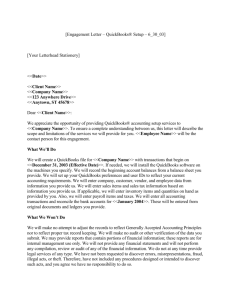

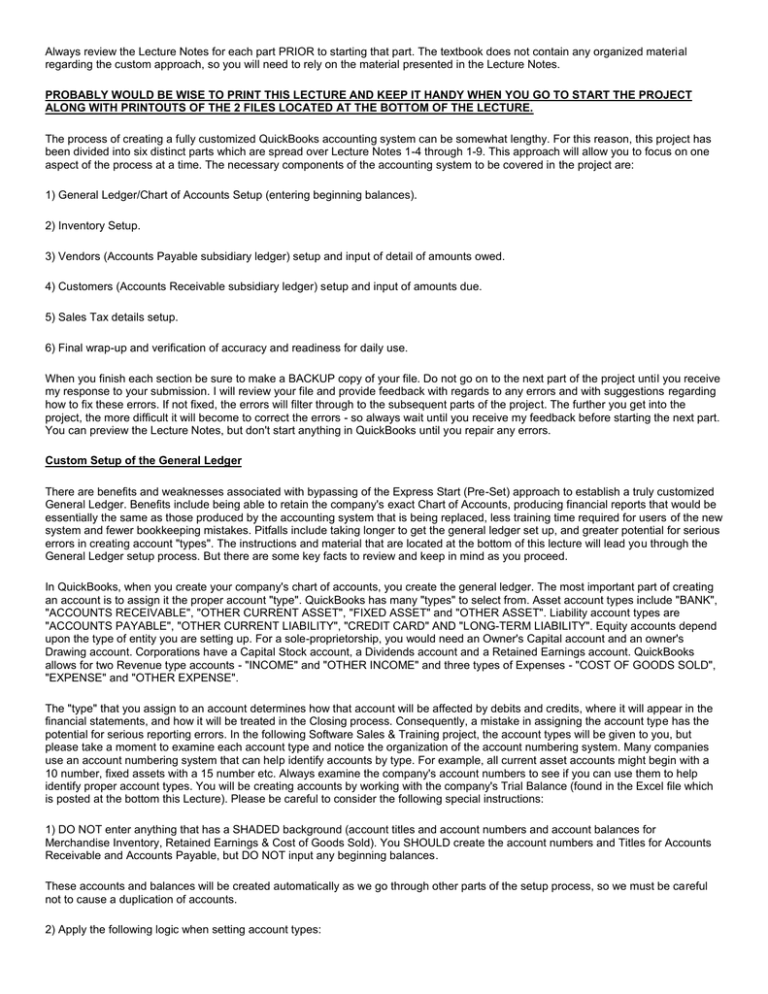

Always review the Lecture Notes for each part PRIOR to starting that part. The textbook does not contain any organized material regarding the custom approach, so you will need to rely on the material presented in the Lecture Notes. PROBABLY WOULD BE WISE TO PRINT THIS LECTURE AND KEEP IT HANDY WHEN YOU GO TO START THE PROJECT ALONG WITH PRINTOUTS OF THE 2 FILES LOCATED AT THE BOTTOM OF THE LECTURE. The process of creating a fully customized QuickBooks accounting system can be somewhat lengthy. For this reason, this project has been divided into six distinct parts which are spread over Lecture Notes 1-4 through 1-9. This approach will allow you to focus on one aspect of the process at a time. The necessary components of the accounting system to be covered in the project are: 1) General Ledger/Chart of Accounts Setup (entering beginning balances). 2) Inventory Setup. 3) Vendors (Accounts Payable subsidiary ledger) setup and input of detail of amounts owed. 4) Customers (Accounts Receivable subsidiary ledger) setup and input of amounts due. 5) Sales Tax details setup. 6) Final wrap-up and verification of accuracy and readiness for daily use. When you finish each section be sure to make a BACKUP copy of your file. Do not go on to the next part of the project until you receive my response to your submission. I will review your file and provide feedback with regards to any errors and with suggestions regarding how to fix these errors. If not fixed, the errors will filter through to the subsequent parts of the project. The further you get into the project, the more difficult it will become to correct the errors - so always wait until you receive my feedback before starting the next part. You can preview the Lecture Notes, but don't start anything in QuickBooks until you repair any errors. Custom Setup of the General Ledger There are benefits and weaknesses associated with bypassing of the Express Start (Pre-Set) approach to establish a truly customized General Ledger. Benefits include being able to retain the company's exact Chart of Accounts, producing financial reports that would be essentially the same as those produced by the accounting system that is being replaced, less training time required for users of the new system and fewer bookkeeping mistakes. Pitfalls include taking longer to get the general ledger set up, and greater potential for serious errors in creating account "types". The instructions and material that are located at the bottom of this lecture will lead you through the General Ledger setup process. But there are some key facts to review and keep in mind as you proceed. In QuickBooks, when you create your company's chart of accounts, you create the general ledger. The most important part of creating an account is to assign it the proper account "type". QuickBooks has many "types" to select from. Asset account types include "BANK", "ACCOUNTS RECEIVABLE", "OTHER CURRENT ASSET", "FIXED ASSET" and "OTHER ASSET". Liability account types are "ACCOUNTS PAYABLE", "OTHER CURRENT LIABILITY", "CREDIT CARD" AND "LONG-TERM LIABILITY". Equity accounts depend upon the type of entity you are setting up. For a sole-proprietorship, you would need an Owner's Capital account and an owner's Drawing account. Corporations have a Capital Stock account, a Dividends account and a Retained Earnings account. QuickBooks allows for two Revenue type accounts - "INCOME" and "OTHER INCOME" and three types of Expenses - "COST OF GOODS SOLD", "EXPENSE" and "OTHER EXPENSE". The "type" that you assign to an account determines how that account will be affected by debits and credits, where it will appear in the financial statements, and how it will be treated in the Closing process. Consequently, a mistake in assigning the account type has the potential for serious reporting errors. In the following Software Sales & Training project, the account types will be given to you, but please take a moment to examine each account type and notice the organization of the account numbering system. Many companies use an account numbering system that can help identify accounts by type. For example, all current asset accounts might begin with a 10 number, fixed assets with a 15 number etc. Always examine the company's account numbers to see if you can use them to help identify proper account types. You will be creating accounts by working with the company's Trial Balance (found in the Excel file which is posted at the bottom this Lecture). Please be careful to consider the following special instructions: 1) DO NOT enter anything that has a SHADED background (account titles and account numbers and account balances for Merchandise Inventory, Retained Earnings & Cost of Goods Sold). You SHOULD create the account numbers and Titles for Accounts Receivable and Accounts Payable, but DO NOT input any beginning balances. These accounts and balances will be created automatically as we go through other parts of the setup process, so we must be careful not to cause a duplication of accounts. 2) Apply the following logic when setting account types: Accounts starting with a 10 number sequence are BANK type accounts. Accounts Receivable should be set as Accounts Receivable type account (only one set this way). All other accounts starting with a 11 number sequence are Other Current Asset types. All Accounts starting with a 15 number sequence should be set as Fixed Asset types. All Accounts starting with a 17 number sequence should be set as Other Asset types. Accounts Payable account should be set as Accounts Payable type account (only one set this way). All other accounts starting with a 20 number sequence are Other Current Liability types. All accounts starting with a 30 or 32 number sequence are Equity type accounts. All accounts starting with a 40 number sequence are Income types. All accounts starting with a 50 number sequence are Cost of Goods Sold types. All accounts starting with the number 6 are Expense type accounts (see instruction #3 below regarding Parent/Sub-Account relationships). All accounts starting with a 70 number sequence are Other Income types. All accounts starting with a 80 number sequence are Other Expense types. 3) QuickBooks allows for the use of PARENT & SUB-ACCOUNT relationships. For example, in Software Sales & Training, you will set up an account called SELLING EXPENSES (This will be a PARENT account) - nothing special has to be done directly to this account while creating it. SUB-ACCOUNTS are related to the PARENT and the PARENT MUST be identified when you create the SUBACCOUNT. When you eventually get to record transactions, you should never use the PARENT account in an entry, but instead use the most appropriate SUB-ACCOUNT related to that PARENT. This treatment mostly affects the appearance of information in the financial statements. Given the example above, on the income statement of Software Sales & Training, you would see a heading SELLING EXPENSES and all of the related SUB-ACCOUNTS would be shown with their balances below this heading - then they would be added together to get the total Selling Expenses. 4) When you enter OPENING BALANCES, you do not have to indicate if the account has a debit or credit balance. QuickBooks makes the decision based on the type of account for which you are entering the balance. Asset = Debit Balance, Liability = Credit Balance etc. You must be careful when you enter balances in CONTRA accounts like Allowance for Bad Debts and all Accumulated Depreciation accounts. QuickBooks does not give the user an option for a "CONTRA" type of account. So these accounts have to be set up as "OTHER CURRENT ASSET" type for the Allowance for Bad Debts account or as "FIXED ASSET" type for the Accumulated Depreciation accounts. Contra accounts have balances that are opposite of the accounts that they are related to. The purpose of the Allowance account is to offset or reduce the Debit balance in the Accounts Receivable account and the purpose of the Accumulated Depreciation accounts is to offset the Debit Balance in the Fixed Asset account that it is related to. SO - when you enter the balance of a Contra account, YOU MUST ENTER IT AS A NEGATIVE NUMBER by using a leading MINUS sign before the account balance amount. This will cause QuickBooks to recognize the balance as an abnormal balance for that account type. You do not have to use a minus sign for any other account types. 5) The setup date is also an important consideration (you will be using 12/31/11 in our project) - this will enable us to use Jan.1, 2012 as our start date. The best time to start using QuickBooks would be at the start of a new year. At this point in time, there would be no balances in any Income or Expense type accounts. If any other time of year is chosen for a start date, then transactions from prior months must be entered to create the proper balances in the income and expense accounts. Most accounts will have to be setup from scratch by the user, but QuickBooks does create some accounts automatically as you will see when you go through this project - be on the lookout for them, because we will have to do some account "editing" later in the project. Be especially careful to NOT enter any information (account title, account #, balance etc.) that is shown in a SHADED CELL IN THE EXCEL data worksheet Trial Balance. These items are setup through special procedures which we will get to in subsequent parts of the project. PLEASE NOTE - THE FIRST EXAM WILL INCLUDE A PROBLEM WHICH WILL BE SIMILAR TO THIS PROJECT. When you have completed this part of the project, you will have MOST, but not all of your accounts established. Be sure to make a BACKUP copy of your file when you get to the end of this part. Click on the link to the Software Sales & Training company EXCEL file to obtain the data for this project - be sure to print it out and keep it for ALL parts of the project. Also, be sure to print each page of the file - you will see "TABS" at the bottom the file - clicking a tab will change the page. Then return to this lecture and click on the link to the Instructions Word file below - print out that file and carefully follow and complete all steps. If you have questions or comments, click on the Discussion/Questions link at the very bottom of this page. TAKE YOUR TIME AND PAY ATTENTION TO WHAT YOU ARE DOING - READ AND FOLLOW INSTRUCTIONS CAREFULLY - WHEN THIS PART OF THE PROJECT HAS BEEN COMPLETED, MAKE A BACKUP COPY OF THE FILE (PLEASE INCLUDE YOUR LAST NAME IN THE FILENAME).