Production and Costs

advertisement

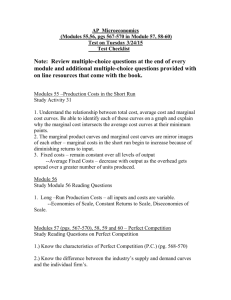

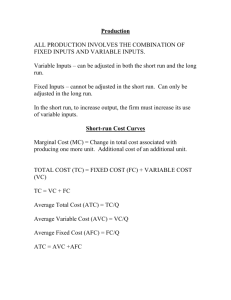

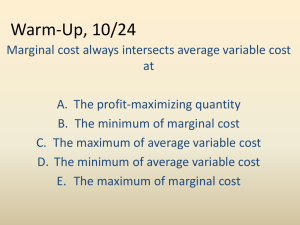

Production and Costs The How Question? • From the circular flow diagram, resource markets determine input or resource prices. • Profit-maximizing firms select the production technology, given the input prices, to select the combination of input that minimize the cost of producing any given output level. • This helps answer the second condition for economic efficiency. • Economic efficiency – maximum satisfaction from scarce resources: The two conditions are: – Produce the combination of goods and services that consumers most highly value – Produce the combination of goods and services at least possible cost. Economic versus Accounting Costs • Understanding costs will help to understand efficiency as well as behavior. • Economic costs are theoretical constructs which are intended to aid in rational decision-making. • Accounting costs are legal constructs intended to provide uniformity in measurement. • Profit = Total Revenue – Total Costs • Total Net Benefits = Total Benefits minus Total Costs • Costs as Opportunity Costs – Explicit Costs – Implicit Costs • Opportunity cost of entrepreneur’s invested capital • Opportunity cost of entrepreneur’s time • Economic versus Accounting Profit • Normal Profits: the accounting profits that just covers implicit or opportunity costs Figure 1 Economic versus Accountants How an Economist Views a Firm How an Accountant Views a Firm Economic profit Accounting profit Revenue Implicit costs Revenue Total opportunity costs Explicit costs Explicit costs Copyright © 2004 South-Western Production and Costs • Intuitively, costs of production depend on two things: – Production technology – Input Price • Technology is the state of knowledge about how to combine inputs to produce output. • Production Function describes the relationship between inputs and outputs – Q = F ( K, L , NR, E) • Short-run versus Long-run – SR - at least one input is fixed – limits to adjustment – diminishing returns – LR – all inputs are variable – complete flexibility – returns to scale • Remember the widget example! • Applying more labor resulting in a diminishing marginal product of labor and increasing marginal costs. • Let’s see this at work again in a more detailed way. A Short-Run Production Function and Costs • Assume two inputs, capital (say a factory) and labor, and that capital is fixed in the short-run. • Marginal Product of Labor – change in total output from added one more laborer. • MPL = change in Q / change in L • Preview of Costs: Production + input prices – With only one variable input, say labor, – MC= wage/MPL=(wage x change L)/change Q – Table and exercise Figure 2 Hungry Helen’s Production Function Quantity of Output (cookies per hour) Production function 150 140 130 120 110 100 90 80 70 60 50 40 30 20 10 0 1 2 3 4 5Number of Workers Hired Copyright © 2004 South-Western Table 1 A Production Function and Total Cost: Hungry Helen’s Cookie Factory Copyright©2004 South-Western Different Measures of Cost • Total Cost (TC) = FC+VC – Fixed Cost (FC) – are costs that do not vary with output. FC only are present in the short-run are the result of fixed factors. – Variable Cost (VC) – are costs that vary with output. VC result from different levels of fixed factors. All costs are VC in the long-run. • Marginal Cost (MC) = change in TC/ change in Q and measures the cost of producing another unit. (general formula) • Average Cost (AC) = TC/Q and measures the cost of a typical unit of output. Cost Formulas • TC = FC +VC • Dividing both sides of the total cost formula by Q, we get the average cost formula: – TC/Q = FC/Q + VC/Q – ATC = AFC +AVC – Average Total Cost = Average Fixed Cost + Average Variable Cost Marginal and Average Costs Revisited • As Q increases if – MC<AC AC is falling – MC>AC AC is rising – So, when MC=AC AC is at its minimum • The above also applies to MC and AVC • The height example The Cost Curves • Short-run Cost Curves – at least one fixed factor, so fixed costs exist. Economist like to use the example of the factory or plant size being fixed and labor being the variable input. – Law of Diminishing Marginal Returns implies that the MC will eventually increase. – Increasing MC results in U-shaped ATC curves. – If MC initially falls and then begins to rise, both the ATC and AVC curves will be U-shaped. – Since capital is often assumed to be fixed, the short-run cost curves describe costs associated with the utilization of existing plant capacity. Fixed Quantity Cost 0 1 2 3 4 5 6 7 8 9 10 $ $ $ $ $ $ $ $ $ $ $ 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 3.00 Variable Total Costs Costs $ $ $ $ $ $ $ $ $ $ 0.30 0.80 1.50 2.40 3.50 4.80 6.30 8.00 9.90 12.0 $ 3.30 $ 3.80 $ 4.50 $ 5.40 $ 6.50 $ 7.80 $ 9.30 $ 11.00 $ 12.90 $ 15.00 Marginal Costs $ $ $ $ $ $ $ $ $ $ 0.30 0.50 0.70 0.90 1.10 1.30 1.50 1.70 1.90 2.10 Quantity AFC 0 1 2 3 4 5 6 7 8 9 10 $ $ $ $ $ $ $ $ $ $ 3.00 1.50 1.00 0.75 0.60 0.50 0.43 0.38 0.33 0.30 AVC $ $ $ $ $ $ $ $ $ $ 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 ATC $ $ $ $ $ $ $ $ $ $ MC 3.30 1.90 1.50 1.35 1.30 1.30 1.33 1.38 1.43 1.50 $ $ $ $ $ $ $ $ $ $ 0.30 0.50 0.70 0.90 1.10 1.30 1.50 1.70 1.90 2.10 Figure 5 Thirsty Thelma’s Average-Cost and MarginalCost Curves Costs $3.50 3.25 3.00 2.75 2.50 2.25 MC 2.00 1.75 1.50 ATC 1.25 AVC 1.00 0.75 0.50 AFC 0.25 0 1 2 3 4 5 6 7 8 Quantity of Output (glasses of lemonade per hour) 9 10 Copyright © 2004 South-Western Excel Cost Curves • Changes in input prices or productivity change the cost curves – Change in fixed costs do not affect MC – Increases in prices or or decreases in productivity of variable inputs cause VC, TC, AVC, ATC, and MC to increase – Decreases in prices or increases in productivity of variable inputs causes VC, TC, AVC, ATC, and MC to decrease Long-run Cost Curves • Long-run cost curves – all factors are variable, so there are no fixed costs and all costs are variable. – Economies and diseconomies of scale • benefits to a larger scale of operations – specialization, purchasing volume, efficient use of capital, design and development costs • costs of a larger scale of operation – coordination problems – LR cost curves are U-shaped if a production process is characterized by first by economies of scale, and then diseconomies of scale. – Since capital can be varied, the long-run cost curves describe the costs with changing the scale of operations (reducing or increasing plant size). • The long-run cost curve is constructed from various short-run cost curves. – Remember increasing capital makes labor more productive, so increase plant size makes labor more productive and decreases marginal costs – Even though marginal costs decline, average costs may go up or down because of the cost of capital and labor are added together to calculate average costs. Figure 7 Average Total Cost in the Short and Long Run Average Total Cost ATC in short run with small factory ATC in short ATC in short run with run with medium factory large factory $12,000 ATC in long run 0 1,200 Quantity of Cars per Day Copyright © 2004 South-Western Figure 7 Average Total Cost in the Short and Long Run Average Total Cost ATC in short run with small factory ATC in short ATC in short run with run with medium factory large factory ATC in long run $12,000 10,000 Economies of scale 0 Constant returns to scale 1,000 1,200 Diseconomies of scale Quantity of Cars per Day Copyright © 2004 South-Western Summary • Short-run – at least one input is fixed so the primary decision is how best to use existing plant capacity • Long-run – all inputs are variable so the primary decision is what overall scale of operations or plant size should be chosen.