Chapter 12 - TeacherWeb

advertisement

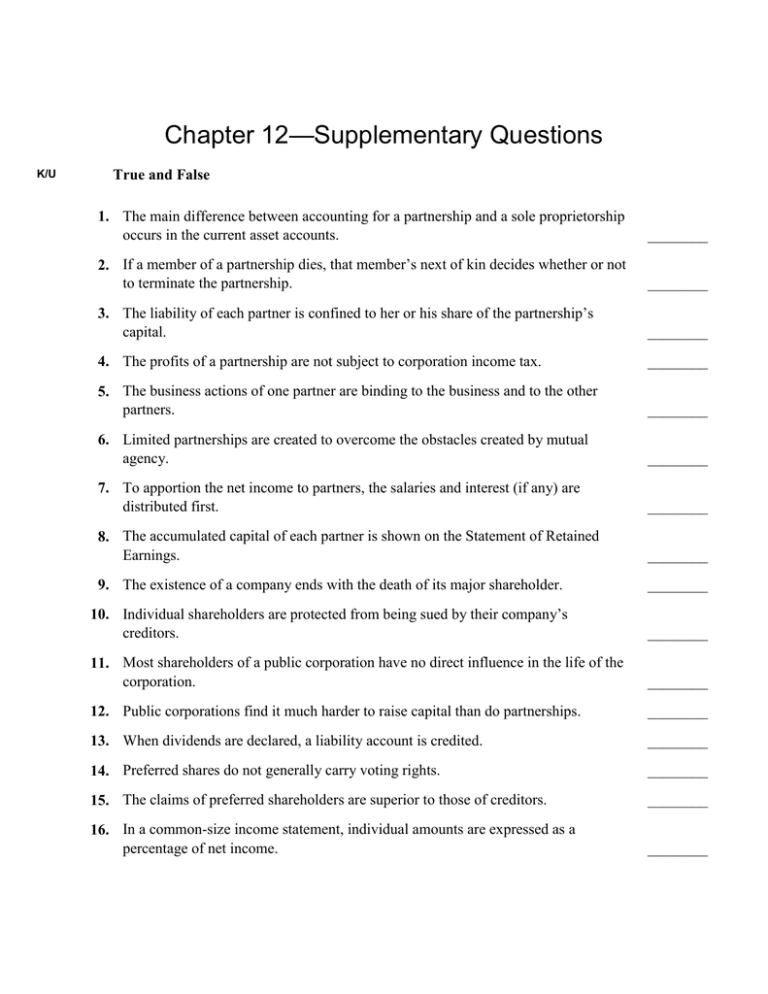

Chapter 12—Supplementary Questions K/U True and False 1. The main difference between accounting for a partnership and a sole proprietorship occurs in the current asset accounts. ________ 2. If a member of a partnership dies, that member’s next of kin decides whether or not to terminate the partnership. ________ 3. The liability of each partner is confined to her or his share of the partnership’s capital. ________ 4. The profits of a partnership are not subject to corporation income tax. ________ 5. The business actions of one partner are binding to the business and to the other partners. ________ 6. Limited partnerships are created to overcome the obstacles created by mutual agency. ________ 7. To apportion the net income to partners, the salaries and interest (if any) are distributed first. ________ 8. The accumulated capital of each partner is shown on the Statement of Retained Earnings. ________ 9. The existence of a company ends with the death of its major shareholder. ________ 10. Individual shareholders are protected from being sued by their company’s creditors. ________ 11. Most shareholders of a public corporation have no direct influence in the life of the corporation. ________ 12. Public corporations find it much harder to raise capital than do partnerships. ________ 13. When dividends are declared, a liability account is credited. ________ 14. Preferred shares do not generally carry voting rights. ________ 15. The claims of preferred shareholders are superior to those of creditors. ________ 16. In a common-size income statement, individual amounts are expressed as a percentage of net income. ________ K/U 17. On common-size balance sheets, individual items are expressed as a percentage of total assets. ________ 18. The current ratio measures the ability of a business to pay its debts. ________ 19. A current ratio of 1.5 is considered very good. ________ 20. A quick ratio of less than 1 is desirable. ________ 21. The quick ratio and current ratio must together total 100%. ________ 22. The rate of return on net sales represents the number of cents of profit from every dollar of sales. ________ 23. The rate of return on owner’s equity may be compared to the acid test ratio to determine the true profitability of a firm. ________ 24. The shorter the collection period for Accounts Receivable, the better. ________ 25. The inventory turnover ratio is found by dividing the cost of goods sold by the average merchandise inventory. ________ 26. An inventory turnover figure of 4.0 is considered good for a grocery store. ________ 27. Since the potential for fraud is so great, public companies are prohibited from publishing their financial statements on the internet. ________ Multiple Choice 28. The actions of one partner may force an obligation on the other partner(s). This is called A. joint liability. B. limited liability. C. unlimited liability. D. mutual agency. 29. The main difference between a sole proprietorship and a partnership accounting is found in A. current asset and current liability accounts. B. fixed asset and long-term liability accounts. C. capital and drawings accounts. D. None of the above. 30. The taxation of a partnership is treated like that of a A. sole proprietorship. C. not-for-profit organization. B. corporation. D. limited company. 31. Which class of owner does not benefit from limited liability? A. a limited partner C. a common shareholder B. a general partner D. a preferred shareholder 32. If there is no partnership agreement, A. the partnership continues after the death of one the partners. B. the senior partner receives 51% of the profits and losses. C. profits and losses are divided equally. D. the partners have limited liability. 33. If Jones, Smith, and Green have invested in a partnership at $28 000, $35 000, and $7000 respectively, the ratio of their capital accounts is A. 2:3:1. C. 4:3:2. B. 4:5:1. D. 5:4:1 34. When apportioning net income, the income-sharing ratio is applied after A. interest. C. the provincial act rules are applied. B. salaries. D. A and B. 35. You can usually tell if a business is a partnership from its A. name. B. long-term liability accounts. C. amount of capital. D. current asset accounts. E. current liability accounts. 36. Which of the following would not appear in the expense section of a partnership’s income statement? A. a partner’s salary B. interest on a partner’s investment C. income tax expense D. A. and C. E. A, B, and C. 37. Which of the following is not a financial statement for a partnership? A. Statement of Retained Earnings B. Statement of Distribution of Net Income C. Statement of Partners’ Capital D. Balance Sheet 38. Which of the following statements would be prepared first for a partnership? A. Statement of Retained Earnings B. Statement of Distribution of Net Income C. Statement of Partners’ Capital D. Income Statement 39. Which of the following financial statements eliminates detail from the balance sheet of a partnership? A. Statement of Retained Earnings B. Statement of Distribution of Net Income C. Statement of Partners’ Capital D. Income Statement. 40. A partnership A. can generally raise more capital than a corporation. B. is simpler to organize than is a corporation. C. has fewer capital accounts than a corporation. D. reports to more people than does a corporation. 41. In terms of dollars, most business in Canada is done by A. corporations. B. not-for-profit organizations. C. partnerships. D. sole proprietorships. 42. Which of the following is likely to be found in a corporation’s name? A. Incorporated B. Inc. C. Limited D. Ltd. E. Any one of the above. 43. An owner of a corporation is called a A. limited partner. B. shareholder. C. manager. D. director. 44. A corporation is treated as a separate, legal person by the law. This feature gives rise to the concepts of A. mutual agency and the shotgun clause. B. double taxation and continuity. C. limited liability and mutual agency. D. continuity and limited liability. 45. To gain approval for a bank loan, a shareholder signs a personal guarantee on behalf of the company. The shareholder has forfeited his or her rights to A. limited liability. B. ownership transfer. C. privacy. D. continuity. 46. The daily operation of a company is controlled by the A. board of directors. B. managers. C. shareholders. D. president. 47. The policies of a company are set by the A. board of directors. B. managers. C. shareholders. D. president. 48. In theory, to control a corporation, a person must own A. 51% of the common shares. B. 50% plus one share of the preferred shares. C. 51% of the preferred shares. D. 50% plus one share of the common shares. 49. When a small corporation is taxed in Canada, the tax A. is passed along to the shareholders. B. is only about 23%. C. is two times the rate of a partnership (double taxation). D. is the burden of the preferred shareholders. 50. The Toronto Stock Exchange lists A. public corporations. B. private corporations. C. limited partnerships. D. not-for-profit organizations. E. all Canadian companies. 51. The number of shareholders in a private corporation cannot be more than A. 25. B. 10. C. 50. D. 100. 52. When shareholders invest in a company, their claim on assets is shown in A. the long-term liability section of the balance sheet. B. a capital stock account on the balance sheet. C. the retained earnings account on the income statement. D. the expenses section on the income statement. 53. A dividend must be paid A. once per fiscal period. B. when there is a profit. C. when stock prices increase. D. when the board of directors declare one. 54. A dividend must be paid on the A. date of record. B. date of declaration. C. year-end date. D. date of payment. 55. When a dividend is declared, A. a liability increases. B. an asset decreases. C. retained earnings increases. D. there is no change in the balance sheet accounts. 56. Preferred shareholders have a superior claim over common shareholders on A. assets and liabilities. B. dividends and revenue. C. revenue and assets. D. assets and dividends. 57. Working capital is found by subtracting current liabilities from A. capital. B. total assets. C. current assets. D. total liabilities. 58. The debt ratio shows A. the total amount of debt. B. the portion of assets bought with borrowed money. C. total debt as a percentage of profit. D. debt divided by equity. 59. Which ratio measures the performance of a business compared to other investments? A. rate of return on net sales B. rate of return on shareholders’ equity C. quick ratio D. times interest earned ratio 60. A firm has a current ratio of 3:1. Which of the following transactions will increase this ratio? A. borrowing cash from the bank B. collection of an Account Receivable C. a reduction in several Accounts Payable D. obtaining a mortgage loan 61. Which ratio is understated when inflation raises the market value of assets above the original cost? A. times interest earned ratio B. return on sales ratio C. equity ratio D. debt ratio 62. Which ratio indicates how effectively the owner’s investment is being used? A. current ratio B. acid test ratio C. rate of return on shareholders' equity D. inventory turnover 63. Ratios are more effective as tools of analysis than simply reading the financial statements because A. financial statement balances are usually too large to understand. B. financial statements cannot be used for analysis. C. ratios show relationships between related accounts. D. ratios are more accurate than financial statement figures. 64. Which transaction has no effect on working capital? A. collected Accounts Receivable B. paid Mortgage Payable C. sold merchandise inventory at a profit D. purchased machinery for cash 65. Creditors like to see a high proportion of shareholders’ equity compared to liabilities because A. companies with this ratio tend to be larger. B. the risk to creditors is reduced. C. company profits tend to be higher. D. owners have demonstrated good planning. 66. Dunlop’s Trailer Manufacturing has an inventory turnover of 8. It would not be useful to compare this figure to the inventory turnover of A. previous years. B. competitors. C. the trailer manufacturing industry. D. companies in the same town. 67. Which calculation shows how investors feel about a company listed on the stock exchange? A. collection period B. rate of return on net sales C. price earnings ratio D. earnings per share 68. A financial plan that involves a forecast of financial figures is called a A. planned forecast. B. budget. C. financial forecast. D. budgeted financial statement. 69. The most familiar type of budgeted financial statement is the A. income statement. B. cash flow statement. C. balance sheet. D. statement of retained earnings. 70. To design a flexible spreadsheet model, you should use A. exact amounts. B. formulas, functions, and cell references. C. colour and formatting. D. precise labels. 71. The following figures are found on an income statement. Sales $300 Total Expenses $240 Net Income $ 60 After the income statement has been converted to common-size, which of the following statements would be correct? A. Sales is 50% B. Net Income is 100% C. Total Expenses is 80% D. Net Income is 60% 72. Which of the following statements concerning the common-size balance sheet is false? A. It enables comparison between companies of unequal size. B. It presents the trends of each item on the balance sheet. C. Total assets is used as the base figure. D. Total Liabilities and Shareholders' Equity is always 100% of the base figure. 73. The total assets figure on a balance sheet is $375 000. The Accounts Payable figure is $56 250. On a common-size balance sheet, Accounts Payable would be A. 67%. B. 15%. C. 28%. D. 13%. K/U Fill in the Blanks 74. A _______________________ exists when one or more persons join together in a business and share in its profits or losses. 75. A(n) ______________________ is a legal contract that sets forth the specific terms and conditions of the partnership. 76. One major disadvantage of a partnership is that each partner has ______________________ liability. 77. A partnership is terminated by the ____________________ , ______________________ , or _______________________ of any partner. 78. The principle of ______________________ means that the partners are legally bound by the actions of any one of them. 79. Corporation policy is decided by a committee of ______________________ called the board of directors. 80. The two principal accounts of the shareholders’ equity section are ______________________ and _______________________. 81. An amount of earnings that a corporation distributes to a shareholder is called a(n) _______________________ . 82. A share that usually carries one vote in company matters is called a(n) ______________________ share. 83. A share that has superior claim on assets is called a(n) _______________________. 84. Working capital is found by subtracting ______________________ from _______________________ . 85. The acid-test ratio measures the ability of a business to ______________________ in a short time period. 86. Once ratios have been calculated, you can compare them to ratios from ______________________ years and _________________________ companies. 87. The debt ratio may be calculated by deducting the ______________________ from 100%. 88. A current ratio of 2:1 may still be inadequate when _________________________ and _______________________ are too high. 89. On a common-size balance sheet, individual items are expressed as a percentage of _______________________. 90. Common-size balance sheets can be useful to accountants because they can compare the financial position of companies of _______________ sizes.