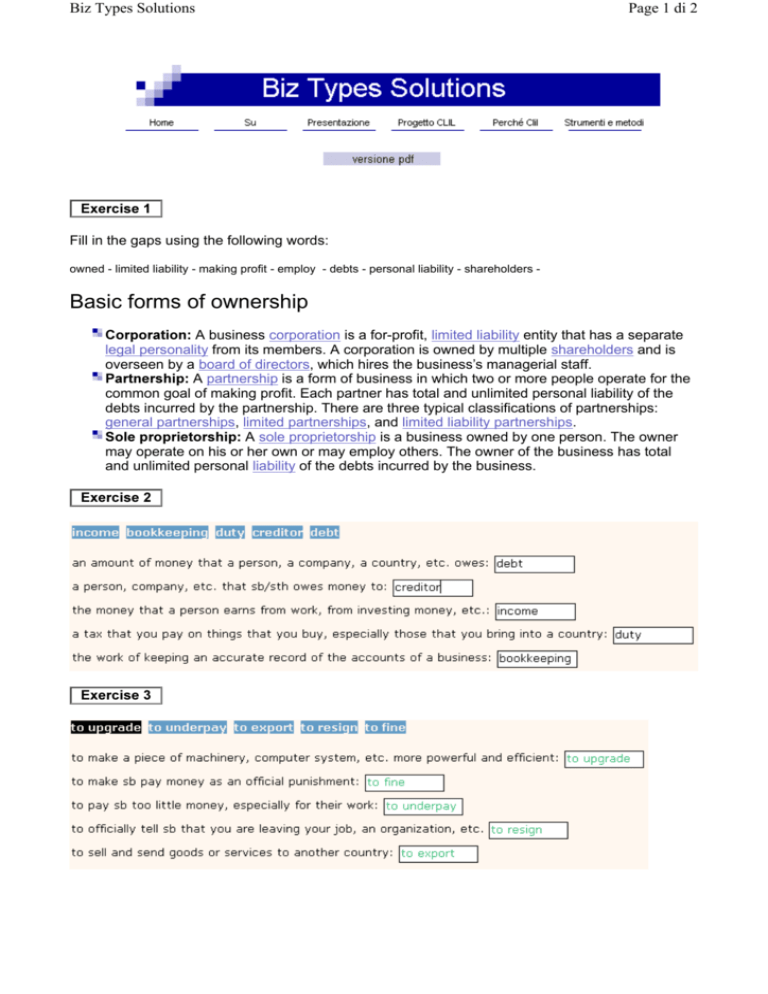

Basic forms of ownership

advertisement

Biz Types Solutions Page 1 di 2 ([HUFLVH Fill in the gaps using the following words: owned - limited liability - making profit - employ - debts - personal liability - shareholders - Basic forms of ownership &RUSRUDWLRQ A business corporation is a for-profit, limited liability entity that has a separate legal personality from its members. A corporation is owned by multiple shareholders and is overseen by a board of directors, which hires the business’s managerial staff. 3DUWQHUVKLS A partnership is a form of business in which two or more people operate for the common goal of making profit. Each partner has total and unlimited personal liability of the debts incurred by the partnership. There are three typical classifications of partnerships: general partnerships, limited partnerships, and limited liability partnerships. 6ROHSURSULHWRUVKLS A sole proprietorship is a business owned by one person. The owner may operate on his or her own or may employ others. The owner of the business has total and unlimited personal liability of the debts incurred by the business. ([HUFLVH ([HUFLVH Biz Types Solutions Page 2 di 2 ([HUFLVH &KRRVH$6WUXFWXUH Many factors must be considered when choosing the best form of business ownership or structure. The choice you make can have an impact on multiple aspects of your business, including taxes, liability, ownership succession, and others $GYDQWDJHVRID6ROH3URSULHWRUVKLS Easiest and least expensive form of ownership to organize. Profits from the business flow directly to the owner’s personal tax return. The business is easy to dissolve, if desired. 'LVDGYDQWDJHVRID6ROH3URSULHWRUVKLS May be at a disadvantage in raising funds and are often limited to using funds from personal savings or consumer loans. May have a hard time attracting high-caliber employees or those that are motivated by the opportunity to own a part of the business. $GYDQWDJHVRID3DUWQHUVKLS Is relatively easy to establish; however time should be invested in developing the partnership agreement. With more than one owner, the ability to raise funds may be increased. Prospective employees may be attracted to the business if given the incentive to become part of the business 'LVDGYDQWDJHVRID3DUWQHUVKLS Profits must be shared with others. Since decisions are shared, disagreements can occur. The partnership may have a limited life; it may end upon the withdrawal or death of a partner. &RUSRUDWLRQV&RPSDQ\ $GYDQWDJHVRID&RUSRUDWLRQ Investors have limited liability for the corporation’s debts or judgments against the corporations. Generally, shareholders can only be held accountable for their investment in stock of the company. (Note however, that officers can be held personally liable for their actions, such as the failure to withhold and pay employment taxes.) Corporations can raise additional funds through the sale of stock. 'LVDGYDQWDJHVRID&RUSRUDWLRQ The process of incorporation requires more time and money than other forms of organization. Corporations are monitored by federal, state and some local agencies, and as a result may have more paperwork to comply with regulations.