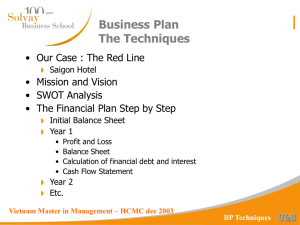

Vietnam Master in Management – HCMC dec 2003 Profitability

advertisement

How to Use the Financial Plan • Make it simple Regroup all the inputs • Sensibilities Studies • Set of different Cases Base Case Best and Worst Cases (external influence) Strategic Decisions (internal) • Synthesis and Graphic Presentation Vietnam Master in Management – HCMC dec 2003 Profitability Input Data Improvement • It is useful to bring all the input data together Easier to make sensibilities studies BPcons.xls - SENSIB!A182 Vietnam Master in Management – HCMC dec 2003 Profitability Sensibilities studies • Goals To cover a broad scope of possible futures To identify the business drivers • Most important factors to determine the future To measure the risks • Usually a few major scenarios Base Case (or Management Case) Best and Worst Case Influence of major capex decisions Vietnam Master in Management – HCMC dec 2003 Profitability Saigon Hotel Sensibilities Unit rate Occupancy Capex new rooms Base Dip in 03-04 Dip in 03-06 (60-65 US$) (50%-65%) Best Lower dip (65-70 US$) Reduced dip (70%-75%) Worst Longer dip (till 2005) Longer dip (till 2006) Extension As in Base As in Base 4 MioUS$ Slower recov (2003-04) Chain Better than Base Better than Base Vietnam Master in Management – HCMC dec 2003 Capex chain license 1 MioUS$ (2003) Profitability How to analyze sensibilities studies • Analyze most important indicators Profit and loss • Revenues • EBITDA • EAT Balance Sheet • Equity • Debt Ratios • ROCE • ROE • Debt/equity ratio • Use graphs Vietnam Master in Management – HCMC dec 2003 Profitability Saigon Hotel Revenues REVENUES 4.000 3.500 3.000 2.500 2.000 1.500 1.000 500 0 2002 base 2005 2004 2003 best worst Vietnam Master in Management – HCMC dec 2003 2006 extension 2007 chain Profitability Saigon Hotel EBITDA 2.500 2.000 1.500 1.000 500 0 2002 base 2005 2004 2003 best worst Vietnam Master in Management – HCMC dec 2003 2006 extension 2007 chain Profitability Saigon Hotel EAT 800 600 400 200 0 -2002002 2005 2004 2003 2006 2007 -400 -600 -800 -1.000 -1.200 -1.400 base best worst Vietnam Master in Management – HCMC dec 2003 extension chain Profitability Saigon Hotel Cash Flow CASH FLOW FROM OPERATIONS 2.500 2.000 1.500 1.000 500 0 2002 base 2005 2004 2003 best worst Vietnam Master in Management – HCMC dec 2003 2006 extension 2007 chain Profitability Saigon Hotel Equity EQUITY 7.000 6.000 5.000 4.000 3.000 2.000 1.000 0 2002 base 2005 2004 2003 best worst Vietnam Master in Management – HCMC dec 2003 2006 extension 2007 chain Profitability Saigon Hotel Financial Debt FINANCIAL DEBT 9.000 8.000 7.000 6.000 5.000 4.000 3.000 2.000 1.000 0 2002 base 2005 2004 2003 best worst Vietnam Master in Management – HCMC dec 2003 2006 extension 2007 chain Profitability Saigon Hotel : ROCE ROCE 15% 10% 5% 0% 2002 2005 2004 2003 2006 2007 -5% -10% base best worst Vietnam Master in Management – HCMC dec 2003 extension chain Profitability Saigon Hotel ROE ROE 15% 10% 5% 0% 2002 -5% 2003 2004 2005 2006 2007 -10% -15% -20% -25% -30% -35% base best worst Vietnam Master in Management – HCMC dec 2003 extension chain Profitability Financial analysis and leverage • Necessity to have a quick vision of the financial situation of a company common language comparability • Profitability ratios to measure the efficiency and the profitability • Leverage ratios to measure the indebtness Vietnam Master in Management – HCMC dec 2003 Profitability Financial analysis and leverage • Coverage ratios how are the debt and the interests covered by the cash-flow ? • Liquidity ratios how liquid is the company ? • Distribution ratio what does the company distribute to the shareholders ? Vietnam Master in Management – HCMC dec 2003 Profitability Necessity of the Financial Analysis • Who needs the financial analysis ? the banker • to assess a new loan or to maintain a credit line the supplier • to be sure to be paid by his customers the customer • to be sure that his supplier will stay in the business the market (stock exchange) • to assess companies • to valuate companies Vietnam Master in Management – HCMC dec 2003 Profitability What is important for the analysis ? • To be able to compare ... different companies • with the same activity (hotels, airlines, etc.) • with different activities one company across the time • . . . everyone must use the same indicators necessity of a common language • no discussion on the facts • but discussion on the interpretation of the facts Vietnam Master in Management – HCMC dec 2003 Profitability What is important for the analysis ? • Limits to the comparability differences in accounting rules and practices • in different countries (laws, fiscal regulations, accounting rules) • inside the countries (internal practices of the companies) • depreciation period • research & development • brands leads to a growing standardization of the rules • BUT … the practices remain different Vietnam Master in Management – HCMC dec 2003 Profitability What is important for the analysis ? • Trust in the figures published by the companies themselves the Board of Directors is responsible • Risks “window dressing” “cover-up” • Remedies external auditors market authorities stock price complains by shareholders • the “Swissair Case : Accounts of 2000” • the “Enron Case” Vietnam Master in Management – HCMC dec 2003 Profitability The Swissair Case Accounts 2000 • Underestimation of the losses of subsidiaries Sabena, AOM-Air Liberté • Underestimation of committed reinvestments Sabena, AOM-Air Liberté, LTU • Hidden commitments put options given to other shareholders in joint-ventures Vietnam Master in Management – HCMC dec 2003 Profitability The Enron Case • Underestimation of “off-balance” items Additional investments committed • False profits on asset sales Assets were sold by Enron to Enron funded companies • Over-estimation of turn-over / activities Enron controlled only fees on turn-over and NOT turn-over • Finally … destruction of documents and files by the company … … and its external auditors Vietnam Master in Management – HCMC dec 2003 Profitability Profitability Ratios : the ROE • The key concept : Return on equity ROE Rfin EAT/EQ • Key concept for the shareholder profitability of their investment in shares of this company compared to alternate financial assets other shares fixed rates bonds (of companies or government) • How to measure the equity ? book-value or... ...market price the difference can be huge for listed companies Vietnam Master in Management – HCMC dec 2003 Profitability Drivers of the ROE • What are the drivers of the ROE ? • The profit margin on Sales • The productvity of capital employed all the assets used by the company fixed assets working capital cash • The financial structure of the company level of debt vs. equity Vietnam Master in Management – HCMC dec 2003 Profitability Profitability Ratios : ROCE • The Return On Capital Employed (ROCE) measures what the company earns (before interest and tax) per unit of capital employed ROA ROCE EBIT/Assets ROCE = EBIT/(FIX+WC+CASH) in the practice the total Assets of the Balance Sheet are often used this ratio is not influenced by the financial structure of the company • because we use the EBIT is also called Return On Investment (ROI) or Return On Assets (ROA) Vietnam Master in Management – HCMC dec 2003 Profitability ROCE after taxes • It can be useful to calculate the ROCE after taxes ROCE* = ROCE.(1-Tc) where Tc is the average tax rate Vietnam Master in Management – HCMC dec 2003 Profitability Relation between ROE and ROA • If the company has no financial debt ROE = ROCE* = ROCE.(1-Tc) for the demonstration please see in a finance reference book this is logical because in this case the total of assets is equal to the equity and no interest is paid • The higher the ROCE the higher the ROE • The lower the tax rate the higher the ROE Vietnam Master in Management – HCMC dec 2003 Profitability Relation between ROE and ROA • If the company has financial debt ROE = ROCE.(1-Tc) + (ROCE-id).(1-Tc).Dfin/EQ where id is the average rate of interest on the debt for the demonstration see in the book • The ROCE should be higher than the interest rate if ROCE > id then ROE > ROCE* if the ROCE is higher than the interest rate on the debt then the ROE is higher than the ROA after taxes if ROCE < id then ROE < ROCE* Vietnam Master in Management – HCMC dec 2003 Profitability Leverage Effect • This equation is very important in finance ROE = ROCE.(1-Tc) + (ROCE-id).(1-Tc).Dfin/EQ • The higher the ROCE the higher the ROE • The lower the tax rate the higher the ROE • The higher the debt (Dfin) vs. equity (EQ) the higher the ROE if the ROCE is higher than the interest rate • This is called the Leverage Effect Vietnam Master in Management – HCMC dec 2003 Profitability Leverage Effect • It means that the ROE can be improved by increasing the debt level if and only if the ROCE is higher than the interest rate • How far can the Equity be reduced and the financial debt increased ? the company must find a bank to bring the debt the bank will look at the risks not to be repaid - higher risks will be compensated by higher interest rates - higher interest rates will reduce the Leverage effect Vietnam Master in Management – HCMC dec 2003 Profitability Risks of the Leverage Effect • The company can be in a bad situation if the interest rate increases if the future Free Cash flows are lower than expected • less business • additional unexpected investments to do • change in economic conditions – tax rate – exchange rate if the shareholders want more dividends if the bankers become nervous Vietnam Master in Management – HCMC dec 2003 Profitability Leverage effect : example No debt 50% debt 75% debt Assets EBIT Taxation rate Interest rate 100 $ 20 $ 50% 10% 100 $ 20 $ 50% 10% 100 20 $ 50% 10% Equity debt 100 $ 0$ 50 $ 50 $ 25 $ 75 $ RES ROA ROE 10 $ 20% 10% Vietnam Master in Management – HCMC dec 2003 Profitability Saigon Hotel – Leverage Effect • Case 1 : Extension with initial capital structure 4 Mio US$ capex and 4 Mio US$ debt • Case 2 : Extension with more equity 2 Mio US$ equity and 2 Mio US$ debt • Case 3 : As Case 1 but continued adverse circumstances Unit rate and occupancy • Case 4 : As Case 2 but continued adverse circumstances Vietnam Master in Management – HCMC dec 2003 Profitability Saigon Hotel leverage : ROCE 10% 8% 6% 4% 2% 0% 2002 -2% 2003 2004 2005 2006 2007 -4% -6% -8% -10% base extension equity Vietnam Master in Management – HCMC dec 2003 worst equity worst Profitability Reference levels for ROCE and ROE • What is a sound level for the ROCE ? higher than the interest rate in the range 10%-18% in western economies the level is a reference for expected profitability of new capital expenditures • What is a sound level for the ROE ? in the range 12%-25% depends on the risk of the business • activity related risks (high tech vs. low tech) • maturity of the business (start up vs. mature) • financial structure (highly leveraged vs. standard) Vietnam Master in Management – HCMC dec 2003 Profitability Saigon Hotel leverage : ROE 15% 10% 5% 0% 2002 -5% 2003 2005 2004 2007 2006 -10% -15% -20% -25% -30% -35% extension worst Vietnam Master in Management – HCMC dec 2003 equity worst Profitability Saigon Hotel leverage : D/E ratio 3,0 2,5 2,0 1,5 1,0 0,5 0,0 2002 2003 extension 2004 2005 worst Vietnam Master in Management – HCMC dec 2003 2006 2007 equity worst Profitability Leverage ratios • The indebtness of a company can be measured by the debt-equity ratio () debt-equity ratio Dfin/EQ be sure the leases are included in the debt • Alternate : the debt ratio debt ratio Dfin/(Dfin+EQ) • Some authors use only the medium and long term financial debt (DMLT) we prefer all the financial debts (possibility of switch between DMLT and DSTfin) Vietnam Master in Management – HCMC dec 2003 Profitability Reference level for the debt-equity ratio • It must be sustainable for the company payment of interests reimbursement of the debt • Consequently it will be different from company to company depending on : the projected Cash flows and Free Cash flows the sensibility to outside factors - general economic situation - influence of new competitors - etc. Vietnam Master in Management – HCMC dec 2003 Profitability Liquidity ratios • These ratios measure how liquid is the company • Current ratio current ratio currents assets / current liabilities current ratio (S+R+CASH) / (Dop+Dfin,short term) • Acid test (Quick test) this ratio reflects the fact that some current assets are less liquid (inventories) acid test (R+CASH) / (Dop+Dfin,short term) Vietnam Master in Management – HCMC dec 2003 Profitability Reference levels for liquidity ratios • All these ratios depend on the industry • Current ratio if possible, higher than 1 • Acid test if possible, higher than 0.7 / 0.8 Vietnam Master in Management – HCMC dec 2003 Profitability Distribution ratio • The pay-out ratio measures the share of the net result distributed to the shareholders pay-out DIV / EAT • Reference level depends on the financial needs of the company for listed companies : expectations of the markets standard for mature companies : 40% to 60% Vietnam Master in Management – HCMC dec 2003 Profitability General remark on the calculations of ratios • For the P&L no doubt : use the year figures • For the Balance Sheet which figures ? at the end of the year ? at the end of last year ? another figure ? • Correct calculation : daily average • Use the average (end of the year/end of last year) best estimate of the reality • Be always coherent Vietnam Master in Management – HCMC dec 2003 Profitability Conclusions of the lesson • The Sensibilities studies are useful To look at the different possible futures To identify the business drivers To identify the risks • The financial ratios are quick tools to analyze the financial situation of companies • By using the financial ratios one can compare different companies across the time • Limits of the financial ratios can we trust the Balance Sheet & Profit &Loss ? reference levels depend of the industry Vietnam Master in Management – HCMC dec 2003 Profitability