Financial planning

advertisement

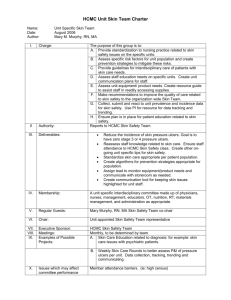

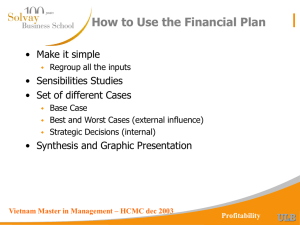

Business Plan The Techniques • Our Case : The Red Line Saigon Hotel • Mission and Vision • SWOT Analysis • The Financial Plan Step by Step Initial Balance Sheet Year 1 • • • • Profit and Loss Balance Sheet Calculation of financial debt and interest Cash Flow Statement Year 2 Etc. Vietnam Master in Management – HCMC dec 2003 BP Techniques Hanoi Hotel : Mission and Vision • What we are A medium size high level hotel in the centre of HCMC • 130 rooms • Average income per night/room in 2003 : 80 US$ • Mission We want to deliver excellent service to our business (40%) and leisure (60%) customers and want them to come back • What we want to become Possibility to add 60 additional rooms • Vision We want to become immediately after the Rex the reference hotel for people who want a unique experience and not the standard (high level) service provided by international chains Vietnam Master in Management – HCMC dec 2003 BP Techniques SWOT Analysis STRENGTHS Good image Excellent location (centre) Experienced management and personnel WEAKNESSES Not a member of an international chain Quite old building (we should renovate all rooms for a total capex of 3Mio US$) OPPORTUNITIES New building with 60 rooms (total capex of 4Mio US$) Become member of international network (license of 1 MioUS$) THREATS A lot of new hotels are coming on the market Competition try to hire our personnel Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 1 : Initial Balance Sheet • last available figures for existing company • opening Balance Sheet for new venture Liabilities = only equity Assets = only cash BPcons.xls - STEP1!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 1bis : Simplified Balance Sheet • Calculation of Working Capital R + S - DSTop • Calculation of Capital Employed FIX + WC + CASH BPcons.xls - STEP1bis!B1 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 2 : Profit & Loss Year 1 based on • P&L of last year • Operational assumptions for year 1 Turnover Margins (Cost of sales) Costs of goods and services Salaries and productivity of labor • Fixed assets table depreciation • Balance Sheet of last year calculation of interests on debt BPcons.xls - STEP2!A48 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 2bis : Fixed assets & depreciation based on • Fixed assets at the end of last year • Depreciation rules • Capex of the year Tangible Intangible BPcons.xls - STEP2bis!A111 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 3 : Balance Sheet Year 1 based on • Balance Sheet of Year 0 • P&L of Year 1 EAT & DIV for EQ Depreciation for FIX • Operational assumptions Change in Working Capital • Duration of inventories • Duration of collection • Etc. • Capex for FIX Financial assumptions New LT debt Capital increase for EQ Reimbursed LT debt • Short term fin debt to balance BPcons.xls - STEP3!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques How to do to finance the company ? • Cash Flow from financing activities • First : use the existing cash or credit lines • Second : seek additional debt provided by banks Duration should depend on needs but … • Always seek long term to reduce the risks Limits for the bankers • Future Cash flows • Cover of interest ratio must be respected • Cover of debt must be respected • Finally : seek new capital provided by shareholders Is it an interesting investment for them ? Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 4 : Cash flow statement Year 1 based on • Cash Flow from operations P&L of the year Operational assumptions • EAT • Depreciation • Changes in components of WC • CF from investing activities Fixed assets assumptions • Capital expenditures • Assets sales • CF from financing activities Financial assumptions • New and reimbursment LT • Calculation short term debt • Sanity check : the cash BPcons.xls - STEP4!A173 Vietnam Master in Management – HCMC dec 2003 BP Techniques Step 5 : Profit & Loss Year 2 based on • P&L of Year 1 • Operational assumptions for Year 2 Turnover Margins (Cost of sales) Costs of goods and services Salaries and productivity of labor • Fixed assets table depreciation • Balance Sheet of Year 1 & 2 calculation of interests on debt BPcons.xls - STEP5!A48 Vietnam Master in Management – HCMC dec 2003 BP Techniques Iterative Process • Step 5 : • Step 6 : • P&L for year 3 Steps 9 • • Cash flow statement for year 2 Step 8 • Balance Sheet for year 2 Step 7 : • P&L for year 2 Balance Sheet for year 3 Step 10 …… Vietnam Master in Management – HCMC dec 2003 BP Techniques How to build the Financial Plan Balance Sheet t BPcons.xls - STEPfoll!A48 BPcons.xls - STEPfoll!A1 Profit & Loss t+1 Balance Sheet t+1 Cash Flow Statement t+1 BPcons.xls - STEPfoll!A160 Vietnam Master in Management – HCMC dec 2003 BP Techniques Sensibility studies • We can see immediately all the consequences of changing one assumption occupancy rate or load factor unit price additional capital expenditures • more rooms, more planes, more shops • fixed and variable costs interest rate exchange rate etc. BPcons.xls - SENSIB!A1 Vietnam Master in Management – HCMC dec 2003 BP Techniques