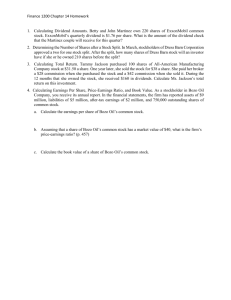

Earnings Per Share & Retained Earnings

advertisement

Chapter17 Earnings Per Share and Retained Earnings Intermediate Accounting 10th edition Nikolai Bazley Jones An electronic presentation by Norman Sunderman Angelo State University COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 2 Objectives Compute basic earnings per share (EPS). 2. Understand how to compute the weighted average common shares for EPS. 3. Identify the potential common shares included in diluted EPS. 4. Apply the treasury stock method for including stock options and warrants in diluted EPS. 1. 3 Objectives 5. 6. 7. 8. 9. Calculate the impact of a convertible security on EPS. Compute diluted EPS. Record the declaration and payment of cash dividends. Account for a property dividend. Explain the difference in accounting for small and large dividends. 4 Objectives 10. Understand how to report accumulated other comprehensive income. 11. Prepare a statement of changes in stockholders’ equity. 5 Basic Earnings Per Share Net Income - Preferred Dividends Weighted Average Number of Common Shares Outstanding 6 Weighted Average Shares Since a corporation earns its net income over the entire year, the earnings are related to the common shares outstanding during the year. 7 Weighted Average Shares McTeal Corporation had 12,000 shares of common stock outstanding at the beginning of the year. On March 2, it issued 2,700 shares; on July 3, it issued another 3,300 shares, and on December 1, it reacquired 480 shares as treasury stock. The nearest whole month is used Months Shares Are Outstanding Shares Outstanding Fraction of Year Equivalent Outstanding Whole Units January-February 12,000 x 2/12 = 2,000 March-June 14,700 x 4/12 = 4,900 July-November 18,000 x 5/12 = 7,500 December 17,520 x 1/12 = 1,460 Total weighted average common shares 15,860 8 Weighted Average Shares Wallers corporation begins operations in January 2007, and issues 5,000 shares of common stock that are outstanding all during 2007. On December 31, 2007, it issues a 2-for-1 stock split. Months Shares Are Outstanding Shares Outstanding Fraction of Year Equivalent Outstanding Whole Units January-December 5,000 x 12/12 = The two-for-one split is retroactive to January 1 Total weighted average common shares Continued 5,000 + 5,000 10,000 9 Weighted Average Shares On May 29, 2008, R Corporation issues 5,000 shares of common stock; on August 3, it issues a 20% stock dividend; and on October 5, it issues 2,000 shares of stock. 2007 Data on 2008 Statement Months Shares Are Outstanding Shares Outstanding January-December 5,000 x Fraction of Year Equivalent Outstanding Whole Units 12/12 = 5,000 5,000 x 200% x 120% = 12,000 equivalent whole units Continued 10 Weighted Average Shares 2008 Data on 2008 Statement Months Shares Are Outstanding Shares Outstanding January-May 10,000 June-July 15,000 August-September 18,000 Fraction of Year Equivalent Outstanding Whole Units Issued 5,000 shares Issued 20% stock dividend 11 Weighted Average Shares 2008 Data on 2008 Statement Months Shares Are Outstanding January-May June-July August-September October-December Shares Outstanding 12,000 10,000 15,000 18,000 18,000 20,000 Fraction of Year Equivalent Outstanding Whole Units Increases 20% Increases 20% 12 Weighted Average Shares 2008 Data on 2008 Statement Months Shares Are Outstanding Shares Outstanding January-May June-July August-September October-December 12,000 18,000 18,000 20,000 x x x x Fraction of Year Equivalent Outstanding Whole Units 5/12 2/12 2/12 3/12 = = = = 5,000 3,000 3,000 5,000 16,000 13 Simple Capital Structure For purposes of computing earnings per share, there are two types of capital structure -simple and complex. A simple capital structure is one that consists of 1. Only common stock, or 2. Common stock and nonconvertible preferred stock. 3. Requires only Basic Earnings Per Share 14 Complex Capital Structure Many corporations have a more complex capital structure that includes outstanding convertible securities or contingent shares that could have a dilutive effect on earnings per share. These securities are referred to as potential common shares. 15 Diluted Earnings Per Share A corporation with a complex capital structure is required to report two amounts on the face of its income statement. Yes… basic earnings per share and diluted earnings per share. 16 Diluted Earnings Per Share The amount for diluted earnings per share shows the earnings per share after including all potential common shares that would reduce earnings per share. 17 Diluted Earnings Per Share To be included in the diluted earnings per share calculation, any potential common share must have a dilutive effect on earnings per share. 18 Diluted Earnings Per Share Step 1: Compute the basic earnings per share. Step 2: Include dilutive stock options and warrants and compute a tentative diluted earnings per share (DEPS). Step 3: Develop a ranking of the impact of each convertible preferred stock and convertible bond on DEPS. Step 4: Include each dilutive convertible security in DEPS in a sequential order based on the ranking and compute a new tentative DEPS. Step 5: Select the lowest computed DEPS as the diluted earnings per share . 19 20 Stock Options and Warrants Assumed Shares Issued + Change (Incremental) in Shares Proceeds ($) Assumed Shares Reacquired (at average market price) - 21 Treasury Stock Method 1. Determine the average market price of common shares during the period. 2. Compute the shares assumed issued from the assumed exercise of all options and warrants. 3. Compute the proceeds received from the assumed exercise by multiplying the shares issued by the option price [plus any unrecognized compensation cost (net of tax) per share]. 4. Compute the assumed shares reacquired by dividing the proceeds by the average market price. 5. Compute the incremental common shares. 22 Treasury Stock Method To illustrate Step 3 further, assume Plummer Corporation has compensatory stock options to purchase 1,000 common shares at $18 per share outstanding the entire year, the average market price for the common stock was $25 per share, and the unrecognized compensation cost (net of tax) was $2 per share. Page 834. Shares assumed issued from assumed exercise: 1,000 1,000Proceeds x ($18 + $2) $20,000 = = (800) Average Market Price Per Share $25 $25 Assumed increment in common shares for computing diluted earnings per share 200 23 Convertible Securities Convertible bonds and convertible preferred stock are considered in DEPS after stock options and warrants. Page 834. 24 Convertible Securities If convertible bonds were assumed converted, the numerator increases net-of-tax because interest expense would not exist, but income taxes would increase. 25 Convertible Securities Numerical Value Impact on Diluted Earnings Per Share $5,400 Increase in Earnings Per Share Numerator Security A = $1.80 3,000 Increase in Earnings Per Share Denominator 9% convertible preferred stock dividends of $5,400 were declared during the year. The preferred shares are convertible into 3,000 shares of common stock. Continued 26 Convertible Securities Numerical Value Impact on Diluted Earnings Per Share Security B $4,800 = $2.50 1,920 10% convertible bonds. Interest expense (net of income taxes) of $4,800 was recorded during the year. The bonds are convertible into 1,920 shares of common stock. Continued 27 Convertible securities Numerical Value Impact on Diluted Earnings Per Share Security C $8,000 = $1.60 5,000 8% convertible preferred stock. Dividends of $8,000 were declared during the year. The preferred shares are convertible into 5,000 shares of common stock. Continued 28 Convertible Securities Numerical Value Impact on Diluted Earnings Per Share Security D $6,300 = $2.00 3,150 7% convertible bonds. Interest expense (net of income taxes) of $6,300 was recorded during the year. The bonds are convertible into 3,150 shares of common stock. Continued 29 Convertible Securities Security Impact Order in Ranking A $1.80 2 B $2.50 4 C $1.60 1 D $2.00 3 Security C has the lowest impact on DEPS and is the most dilutive. It is the first convertible security (after options and warrants) to be included in DEPS (if dilutive). 30 Testing to Determine Whether a Convertible Security is Dilutive If the EPS of the first ranked convertible security is less than the tentative EPS, add the potential income to the numerator and the potential shares to the denominator and continue until the impact of the next convertible security is more than the previously computed tentative diluted earnings per share. 31 Diluted Earnings Per Share Format Explanation Earnings Shares Earnings = Adjustments Adjustments Per Share Basic EPS $x,xxx Incremental shares (options) Tentative EPS 1 $xxxx Savings in interest expense xxx Incremental shares (bonds) Tentative EPS 2 $x,xxx Savings in preferred dividends xxx Incremental shares from Pref. St. xxx Diluted earnings & shares $x,xxx / xxx xx / xxx = $xxx Basic xxx / xxx = = $xxx Ten. / xxx = $xxx Ten. = $xxx Diluted = $xxx Ten. 32 Example 17-5 33 Diluted Earnings Per Share Page 838 Explanation Earnings Adjustments / Shares Earnings = Per Share (Adjustments) Basic EPS $2,000 / 900 Incremental shares (options) 85 Tentative EPS 1 $2,000 / 985 Savings in interest expense 224 Incremental shares (bonds) 160 Diluted earnings & shares $2,224 / 1,145 = $2.22 Basic = $2.03 Ten. = = $1.94 Diluted 34 Additional Disclosures Identifies the amount of preferred dividends deducted to determine the income available to When a corporation reports its basic common stockholders. and diluted earnings per share on its 2. Describes the potential common shares that income statement, it also required to per were not included in theisdiluted earnings make share additional disclosures inthey the were notes computation because to its financial statements. antidilutive. 3. Describe any material impact on the common shares outstanding of subsequent transactions after the close of the accounting period but before the issuance of the financial report. 1. 35 Types of Dividends Cash Property Stock Liquidating Scrip 36 Dividend Considerations Declared Not larger than unrestricted retained earnings Not paid on treasury stock Other restrictions Scrip 37 Cash Dividend There are four significant dates for a cash dividend. The date of declaration The ex-dividend date The date of record The date of payment 38 Cash Dividend Date Accounting Procedures Reduce Retained Earnings Date of Declaration Increase Liabilities Date of Record Memorandum Entry Reduce Assets Date of Payment Reduce Liabilities 39 Cash Dividend On November 3, 2007, the board of directors of Bay Corporation declares preferred dividends totaling $10,000 and common dividends totaling $20,000. These dividends are payable on December 15, 2007, to stockholders of record on November 24, 2007. November 3, 2007 Retained Earnings 30,000 Dividends Payable: Preferred Stock 10,000 Dividends Payable: Common Stock 20,000 40 Cash Dividend On November 3, 2007, the board of directors of Bay Corporation declares preferred dividends totaling $10,000 and common dividends totaling $20,000. These dividends are payable on December 15, 2007, to stockholders of record on November 24, 2007. November 24, 2007 Memorandum entry: The company will pay dividends on December 15, 2007, to preferred and common stockholders of record as of today, the date of record. 41 Cash Dividend On November 3, 2007, the board of directors of Bay Corporation declares preferred dividends totaling $10,000 and common dividends totaling $20,000. These dividends are payable on December 15, 2007, to stockholders of record on November 24, 2007. December 15, 2007 Dividends Payable: Preferred Stock 10,000 Dividends Payable: Common Stock 20,000 Cash 30,000 42 Fully Participating Dividend Everett Corporation has issued 10%, participating, cumulative preferred stock with a total par value of $20,000 and common stock with a total par value of $30,000. The preferred stock is two years in arrears. Everett Corporation declares a $9,000 dividend. 43 Fully Participating Preferred Stock Preferred Common Current dividend (10% x $20,000) 2,000 Common dividend (10% x $30,000) Total to allocate $9,000 Allocated ( 5,000) Remainder $ 4,000 $20,000/$50,000 to preferred and $30,000/$50,000 to common 1,600 Dividend to each class of stock $3,600 $3,000 2,400 $5,400 44 Partially Participating Preferred Stock (up to 12%) Again assume a $30,000 dividend. Preferred Common Current dividend (10% x $20,000) 2,000 Common dividend (10% x $30,000) 2% dividend on par 400 Remainder to common ($9,000 – $6,000) Dividend to each class of stock $2,400 $3,000 600 3,000 $6,600 45 Property Dividend Occasionally, a corporation will declare a property dividend that is payable in assets other than cash. 46 Property Dividend The corporation typically uses marketable securities of other companies that it owns for the property dividend. 47 Property Dividend The corporation records a property dividend at the fair value of the asset transferred, and recognizes a gain or loss. 48 Property Dividend Asel Corporation declares a property dividend payable in held-to-maturity bonds of Bard Company. The bonds are carried on Asel’s books at a book value of $40,000, but their current fair value is $48,000. Continued 49 Property Dividend Date of Declaration Investment in Bard Co. Bonds 8,000 Gain on Disposal of Investments Retained Earnings Property Dividends Payable 8,000 48,000 48,000 Date of Payment Property Dividends Payable Investment in Bard Co. Bonds Continued 48,000 48,000 50 Stock Dividends They receive no corporate Stockholders often view stock dividends favorably even though- assets. Their percentage ownership does not change. Theoretically the total market value of their investment will remain the same. Future cash dividends may be limited because retained earnings is decreased by the amount of the stock dividend. 51 Stock Dividends Stock Dividend What factors might enhance the perceived attractiveness of stock dividends? 52 Stock Dividends The stockholders may see the stock dividend as evidence of corporate growth. The stockholders may see the stock dividend as evidence of sound financial policy. Other investors may see the stock dividend in a similar light, and increased trading in the stock may cause the market price not to decrease proportionally. 53 Stock Dividends The corporation may state that it will pay the same fixed cash dividend per share. The stockholders may see the market price decreasing to a lower trading range, making the stock more attractive to additional investors so that the market price may eventually rise. 54 Stock Dividends Retained Earnings Small <25% Large 25% or more Fair Value Par Value Capital Stock Additional Paid-In Capital Retained Earnings Capital Stock 55 Stock Dividends Stockholders’ Equity Prior to Stock Dividend Common stock, $10 par (20,000 shares issued and outstanding) $200,000 Additional paid-in capital 180,000 Retained earnings 320,000 Total stockholders’ equity $700,000 56 Small Stock Dividend Ringdahl Corporation declares and issues a 10% stock dividend. On the date of declaration, the stock sells for $23 per share. Date of Declaration 20,000 shares x 0.10 x $23 Retained Earnings 46,000 Common Stock To Be Distributed Additional Paid-in Capital From Stock Dividend Continued 20,000 26,000 Par 57 Small Stock Dividend Ringdahl Corporation declares and issues a 10% stock dividend. On the date of declaration, the stock sells for $23 per share. Date of Issuance Common Stock To Be Distributed Common Stock, $10 par 20,000 20,000 Par 58 Small Stock Dividend Stockholders’ Equity After Stock Dividend Common stock, $10 par (22,000 shares issued and outstanding) $220,000 Additional paid-in capital 206,000 Retained earnings 274,000 Total stockholders’ equity $700,000 Note: Total remained the same 59 Large Stock Dividend Ringdahl Corporation declares and issues a 40% stock dividend. On the date of declaration, the stock sells for $23 per share. 20,000 shares x 0.40 x $10 Date of Declaration Retained Earnings 80,000 Common Stock To Be Distributed Date of Issuance Common Stock To Be Distributed 80,000 Common Stock, $10 par Continued 80,000 80,000 60 Large Stock Dividend Stockholders’ Equity After Stock Dividend Common stock, $10 par (28,000 shares issued and outstanding) $280,000 Additional paid-in capital 180,000 Retained earnings 240,000 Total stockholders’ equity $700,000 Note: Same total as small stock dividend 61 Statement of Retained Earnings Although not a required separate financial statement, some corporations include a statement of retained earnings in their financial statements. 62 Statement of Retained Earnings Retained earnings, as previously reported, Jan. 1, 2007, -Plus (minus) Prior period adjustments (net of income tax effect) Adjusted retained earnings, January 1, 2007 -Plus (minus): Net income (loss) Minus: -Dividends (specifically identified, including per share amounts) -Reductions due to retirement or reacquisition of capital stock -Reductions due to conversion of bonds or preferred stock Retained earnings, December 31, 2007 63 Accumulated Other Comprehensive Income Other comprehensive income might include- Unrealized increases (gains) or decreases (losses) in the market value of investments in available-for-sale securities. Translation adjustments from converting the financial statements of a company’s foreign operation into U.S. dollars. Certain gains and losses on “derivative” financial instruments. Certain pension liability adjustments. 64 Accumulated Other Comprehensive Income A corporation may report its comprehensive income (net of income taxes)- On the face of its income statement. In a separate statement of comprehensive income. In its statement of changes in stockholders’ equity. 65 Statement of Changes in Stockholders’ Equity APB Opinion No. 12 states: “…disclosures of changes in the separate accounts comprising stockholders’ equity (in addition to retained earnings) and of the changes in the number of shares of equity securities during at least the most recent annual fiscal period…is required to make the financial statements sufficiently informative.” 66 Statement of Changes in Stockholders’ Equity 67 Chapter 17 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.