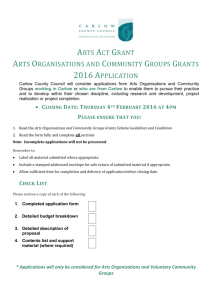

Unit - Carlow County Council

advertisement

Carlow County Council Development Contribution Scheme 2010 (Planning & Development Act 2000 – Section 48) Scheme of Contributions in respect of the Administrative Area of Carlow County ________________________________________________________________________ Carlow County Council has made, on Monday, 13th September, 2010, a Development Contribution Scheme, 2010 – 2014. The nature of the decision was to implement the Scheme as advertised and as revised by particular recommendations of Carlow County Council as Planning Authority for the area, as follows: Exemption for Voluntary/Community Groups receiving funding of less than 80% from the state, with no commercial element in the development, Social Housing attained in conjunction with Part V, Planning And Development Act 2000, Residential Development by a Voluntary Housing Body and Development at which a planning application fee is not payable in accordance with Section 157 of the Planning & Development Regulations, 2001. Commercial education facilities will be charged at €12.50 per sq. m. Educational facilities provided by voluntary non-profit making organisations will continue to be exempt. 50% reduction for works at Registered Derelict Sites and at Protected Structures. At developments which include upgrading, rebuilding or change of use of premises, the charge will be the net difference between the rate for current and proposed uses, if any, related to floor area of current development. Planning approvals for temporary periods will be subject to 10% of the appropriate rate of contribution, per annum. In the case of single house developments on zoned lands, the levy per hectare shall be based on effective site area, subject to maximum levy relating to 0.1ha. Extensions to dwellings on zoned lands shall be subject to charge only in respect of additional gross floor area. The Council may agree for a developer to undertake works and/or provide lands in respect of which the contribution(s) were levied in lieu of payment thereof. In all such cases the prior written agreement of the Council will be required and any works carried out shall be to the standards and specifications of Council. "Any other development", will be charged at €25 per sq. m. Contributions will be adjusted on date of payment to correspond with changes in the House Building Cost Index. Details of the Contribution Scheme are available for inspection from 9.30am to 3.30pm at the offices of Carlow County Council, Athy Road, Carlow, Monday to Friday, (excluding public holidays). The scheme will apply to planning applications received after 23rd July, 2010 and granted after 01/07/2015. (The terms of the above scheme is updated in accordance with House Building Cost Index available at 01/07/2015). Roads Residential/ Unit €612.31 Industrial Per m2 Commercial Per m2 Agri Business Hort & Forestry Per m2 Domestic Extension €4.44 Community/ Recreational/ Parks/Leisure €572.81 to 126sq m €25.66 per sq m thereafter €8.88 Ancillary €7.41 €12.34 €4.44 €3.95 €1.87 €1.87 €1.28 per m2 €3.46 €4.57 per m2 for floor area in excess of 40m2.) €4.93 Recreational Facilities Per m2 €2.97 Educational Per m2 €2.47 €11.35 €1.97 Any Other Development Per m2 Carparking, glasshouses, horticultural/mushroom tunnels – nil contribution. Agri buildings above 500m2 - €3.95 per m2. Extraction/Landfill - €10,853.62 per hectare Golf Courses (non-member owner) - €394.84 per hectare with a three-year derogation from date of permission Telecommunication Masts - €9,871.12 per mast Windfarm - €3,259.05 per turbine payable on connection to the national grid Levies (at zoned lands and in addition to standard charges Carlow Town Environs applied throughout the County) – Residential - €4,935.57 per unit (not applicable to extensions) for social amenities, recreation and community aid. – Mixed Use Zone/Industrial, Community Education/Community Service and Neighbourhood Centre €58,737.98 per hectare – Enterprise & Development €104,645.17 per hectare Palatine, Tinryland and Ballinabrannagh/Raheendoran Residential €58,737.98 per hectare for social amenities, recreation and community aid. Borris, Grange, Leighlinbridge, Muinebheag, Rathoe, Rathvilly, Tinnahinch, Tullow, Ballon, Hacketstown, Carrigduff, Kildavin, Clonegal, Myshall, Newtown, Fenagh. Residential €22,509.18 per hectare for social amenities, recreation and community aid. Carparking – per shortfall space - Carlow Environs €6,913.13 / Tullow / Muinebheag €5,421.89 / Elsewhere €2,715.87 Note: In accordance with the Water Services (No. 2) Act 2013 a charge in respect of water services infrastructure provision in respect of developments granted planning permission after 1st January 2014 will be levied by Irish Water. Development Contribution Scheme 2010 (Planning & Development Act 2000 – Section 48) Scheme of Contributions in respect of the Administrative Area of Carlow Town ________________________________________________________________________ Carlow Town Council has made on Thursday, 2nd September, 2010, a Development Contribution Scheme, 2010 – 2014. The nature of the decision was to implement the Scheme as advertised and as revised by particular recommendations of Carlow Town Council as Planning Authority for the area, as follows: Exemption for Voluntary/Community Groups receiving funding of less than 80% from the state, with no commercial element in the development, Social Housing attained in conjunction with Part V, Planning And Development Act 2000, Residential Development by a Voluntary Housing Body and Development at which a planning application fee is not payable in accordance with Section 157 of the Planning & Development Regulations, 2001. Commercial education facilities will be charged at €12.50 per sq. m. Educational facilities provided by voluntary non-profit making organisations will continue to be exempt. 50% reduction for works at Registered Derelict Sites and Protected Structures and 25% for outdoor storage proposals. At developments which include upgrading, rebuilding or change of use of premises, the charge will be the net difference between the rate for current and proposed uses, if any, related to floor area of current development. Planning approvals for temporary periods will be subject to 10% of the appropriate rate of contribution, per annum. The Council may agree for a developer to undertake works and/or provide lands in respect of which the contribution(s) were levied in lieu of payment thereof. In all such cases the prior written agreement of the Council will be required and any works carried out shall be to the standards and specifications of Council. " Any other development", will be charged at €25 per sq. m. Contributions will be adjusted on date of payment to correspond with changes in the House Building Cost Index. A levy for Community, Recreational & Amenity, only, at extensions to residential units, will apply. This levy to be pro-rata as for residential units up to 126m2. Details of the Contribution Scheme are available for inspection from 9.30am to 3.30pm, at the offices of Carlow County Council, Athy Road, Carlow, Monday to Friday, (excluding public holidays). The scheme will apply to planning applications received after 9th July, 2010 and granted after 01/07/2015. (The terms of the above scheme is updated in accordance with House Building Cost Index available at 01/07/2015). ROADS Residential €1,975.20 COMMUNITY RECREATIONAL AMENITY Up to 126m²€2,123.32 €24.69/m² thereafter €17.27 ANCILLARY €1.48 per m² Unit €2.87 €2.47 Industrial M² €22.61 €6.84 €28.13 €1.97 Commercial M² €36.94 €3.46 Commercial Education per m2 €2.47 €11.35 €1.97 Any Other Development Per m2 Construction of Carparking - €17.76 per m² Recreational facilities €3.95 per m² road road imp. imp. Carlow Town Environs: Land Use Levy (at - Residential - €147,259.73 per hectare zoned lands of - Community, Recreation, Parks & Leisure - €790.07 per unit Carlow Local Area - Enterprise and Development - €130,806.48 per hectare Plan only in addition to standard charges applied throughout the Town Area) Surface Carparking shortfall - €7,900.72 per space Note: In accordance with the Water Services (No. 2) Act 2013 a charge in respect of water services infrastructure provision in respect of developments granted planning permission after 1st January 2014 will be levied by Irish Water.