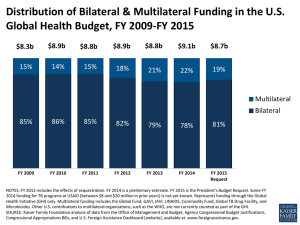

Trade Good/Bad – General

advertisement