IRR - DramatisPersonae.org Dramatis Personae Bruce Firestone

advertisement

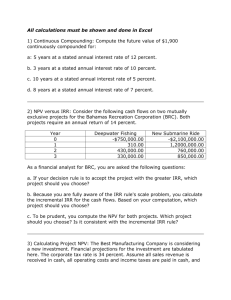

LBD3300 Advanced Real Estate 003 Real Estate Cost Benefit Analysis Prepared for: LearnByDoing.ca By: @ProfBruce Date: September 2012 Create the Future Professor Bruce Murray Firestone B. Eng. (Civil), M. Eng.-Sci., Ph.D. Founder Ottawa Senators, Ottawa Senators Foundation and Scotiabank Place Entrepreneurship Ambassador, Telfer School of Management, University of Ottawa Executive Director, Exploriem.org Novelist, Quantum Entity Trilogy Writer, Entrepreneurs Handbook II Columnist, Ottawa Business Journal Broker, Century 21 Explorer Realty •Follow him on Twitter at @ProfBruce •Read his blogs at www.EQJournal.org and www.DramatisPersonae.org •Current motto: “Making Each Day Count” Lecture 3— Cost/Benefit Analysis: Internal Rate of Return Cap Rates Business Models for Real Estate Differentiated Value Highest and Best Use How to Buy—you make money in r.e. when you buy not when you sell When to Sell Why Vacant Land is Worth More than Land with a Building IRR— Probably truest measure of project’s rate of return IRR = interest rate that exactly balances discounted value of future net cashflows with investment required to develop project or enterprise higher interest rate (discount rate) needs to be in order that future net cashflows exactly offset upfront investment, higher IRR is/ better project is, at least in terms of return on investment IRR— IRR found by solving following equation by trial and error Computers do it using iterative process IRR— In simplest model, if student loans Professor $1,000 and Professor pays it back in three years with interest of, say, $150 per year, we have: Year Investment/Cashflow (from the Student’s POV) 0 -$1,000 1 $150 2 $150 3 $1,150 IRR— IRR can be found by solving the following equation by trial and error (not much trial or error here): $1,000 – $150/(1+irr)^1 – $150/(1+irr)^2 – $1,150/(1+irr)^3 = 0 or IRR = 15% p.a. IRR— Survey after survey (not scientifically) of students No students willing to lend (poor) Professor $1,000 in return for $150 per year of interest Usually aren’t interested until money gets to be around $200/year and most of them looking for $300 or $400 in interest per year Implies Internal Rates of Return in 20 to 40% p.a. range IRR— Rates of return for students pursuing architecture degree suggest IRRs are in range of just 14% http://www.eqjournal.org/?p=1061 Possibly architects somewhat ‘other directed’ IRR is not whole story Ignores alternative investment returns on equity invested elsewhere IRR— Personal discount rates tend to fall as people age because: a. Usually have more CASH as they get older and greater supply of money implies price will fall b. their willingness to take risks drops so that would rather have it in T-bills than startups by time most people are in 60s, 70s or 80s IRR— IRR— Mega corporations have minimum expectations for IRRs (on equity) around 20 to 22% p.a. Entrepreneurs and startups require much higher IRRs because so many things can go wrong Land dev target rate for IRR = 100% p.a.! IRR— IRR IRR On Equity Investors Principal 0 ($81,500) ($75,000) ($6,500) 1 $7,458.29 $5,593.72 $3,520.57 2 $7,458.29 $5,593.72 $3,520.57 3 $7,458.29 $5,593.72 $3,520.57 4 $7,458.29 $5,593.72 $3,520.57 5 $164,030.72 $123,023.04 $42,663.68 abd% p.a. mno% p.a. xyz% Incl Mgt Fee p.a. IRR— Solve: -81,500 + 7,458/(1+r)^1 + 7,458/(1+r)^2 + 7,458/(1+r)^3 + 7,458/(1+r)^4 + 164,030/(1+r)^5 = 0 IRR— Solve: -75,000 + 5,594/(1+r)^1 + 5,594/(1+r)^2 + 5,594/(1+r)^3 + 5,594/(1+r)^4 + 123,023/(1+r)^5 = 0 IRR— Solve: -6,500 + 3,521/(1+r)^1 + 3,521/(1+r)^2 + 3,521/(1+r)^3 + 3,521/(1+r)^4 + 42,664/(1+r)^5 = 0 IRR— IRR IRR On Equity Investors Principal 0 ($81,500) ($75,000) ($6,500) 1 $7,458.29 $5,593.72 $3,520.57 2 $7,458.29 $5,593.72 $3,520.57 3 $7,458.29 $5,593.72 $3,520.57 4 $7,458.29 $5,593.72 $3,520.57 5 $164,030.72 $123,023.04 $42,663.68 21.2% p.a. 15.7% p.a. 78% Incl Mgt Fee p.a. IRR— Mega corporations have minimum expectations for IRRs (on equity) around 20 to 22% p.a. Entrepreneurs and startups require much higher IRRs because so many things can go wrong Land dev target rate for IRR = 100% p.a.! IRR— Banks lend money at 3% but mega corps want minimum IRRs of 20 to 22% p.a.? How much interest on savings account Less than 1% (in fact, after all the fees, probably negative) Banks use OPM (Other People’s Money) mixed in with a little of own capital so their IRRs on equity among best on planet IRR— Reverse IRR Model Establish monthly goals for new enterprise http://www.old.dramatispersonae.org/IRR/R everseIRRAcmePromotions.xls Ski racers want to race > when they know other times Set goal, break it down into intervals and WIN IRR— Same thing for any business No good to say, ‘I want $150k in revenues first year’ Need $12,500/month or $625 /day, every day for 20 working days in each month Visualization is key Put up sign “N = ?” and drive N up N can be leasing, sales, number of clients… IRR— Don’t think that, ‘oh well, I didn’t make $625 in sales today, I’ll make it up at month’s end’ Doesn’t work Miss today’s target, means sell $1,300 tomorrow or $1,925 day after Pretty soon, you and your business toast IRR— Reverse IRR Model based on assumption that, going in, you are likely to know costs more accurately that what revenues likely to be Revenue estimates, whether based on marketing surveys are guesstimates/can be highly unreliable Goal setting based on expected costs plus allowance for profitability probably reasonable mechanism to establish future revenue streams IRR— Using OPM (Other People’s Money) or leverage (aka debt) Normally increases IRR on your equity Can cause risk to go down not up! E.g., use your equity to build five units instead of one One tenant leaves, have 20% vacancy rate instead of 100% Free cashflow from other four (still occupied) units helps biz stay afloat IRR— If average vacancy rate for each unit over a ten year period, say, 10%, Probability all five units vacant at same time low 0.1 to power of five or just .001% Entrepreneurs can argue with Bank for more leverage not less IRR— Bank will say: 1. Put down more equity, better debt to equity ratio/means if asset values tumble, their loans protected by your equity since in Bankruptcy, Foreclosure or Power of Sale proceeding, secured creditor (the Bank) gets paid first 2. If only had one unit instead of five and becomes vacant, your income from other sources may be enough to cover loan payments but if coping with all five units becoming vacant, under water IRR— Known as cashflow coverage for loan Your free cashflow as calculated by Lender must be significantly greater than monthly mortgage obligations or won’t make the loan Lenders usually only include half rental income and will deduct from your employment and other income, other monthly obligations like home mortgage, car payments and student loans Cap Rate— Most real estate professionals do not use IRR however Use Cap Rates to compare one project with another Cap Rate (‘Capitalization Rate’) approximate measure, as all financial measures are Cap rate, r = (NOI + Mortgage PMT)/S.P. Cap Rate— One way to look at inverse of Cap Rate, approximation for number of years it takes to earn back your capital Widely used in commercial real estate sector Higher Cap Rate, better for Buyer and worse for Seller Cap Rate— Total ROE = ROE (Cash-on-Cash Portion) + ROE (General Real Property Inflation) + ROE (Average Principal Repaid) + ROE (Tax Advantage on Unearned Rents) Cap Rates only measure first variable IRR first three Maple Leaf Design and Construction (An Example of Bootstrapping) Bootstrapped their way to success Source of capital (essentially supplier credit) Friendly landowner provides options on land, basically at no cost Owner gets paid by home buyer not Maple Leaf Self Capitalize -why? -VC-funding is hard to get and takes a lot of time -also, you may end up losing control of your business -VC funded biz are just large biz w/ 0 revenues -power comes from having real clients/real cashflow -if you do go for financing and you do it at the mezzanine stage, you’ll have more leverage -Maple Leaf Design and Construction Brain Saumure, B. Arch (CU and SOA) Fred Carmosino, B. Com (Sprott) -No serfdom for Brian: wanted to be his own boss because he could create more interesting work for himself than others could create for him -Started with $0 Maple Leaf Design and Construction Option on lots Sweat equity: summer in a trailer with plans, signs and Agreements of Purchase and Sale Pre-sell Collected deposits Now have $$$ in their bank account– impressed with a trust Used homeowners credit scores to get construction financing What is cheaper? Debt or Equity? Debt. What is cheaper than debt? Bootstrap Capital (e.g.: Trade Credit, Deposits,…) They’re FREE! Reverse out the work -the Internet is the most important new invention of the last 50 years -it is where electrification was at same stage, 20 yrs in -create custom outputs from standard inputs (e.g. new age virtual home builder) -reverse out the work to customers and suppliers -match making -mass communicate at ~ no cost (Twitter, FB, blog, Skype, email, IM, messaging,…) -Crowd sourcing (voting on designs) -user generated content by customers (and suppliers) e.g.: YouTube, Twitter, FB, Reddit, Digg & Threadless (suppliers: artist community submit t-shirt designs voted on by customers) Virtual home builder: -tried in 2000 to get home builders to do this -very conservative industry -put lots available and designs online in a physics engine together w/ all options/finishes -allow everyone to use physics engine -go online: choose lot, design, fit-up, finishes (carpet, tile, kitchen cabinets, lighting package, plumbing fixtures, etc.) -put cash register online too -consumer can see what granite or concrete counter tops add to cost -can fool around for 30+ hours -then hit “submit” button Homebuilders fear putting prices online – their competitors might find out! Ever heard of “Secret Shoppers?” -Put CPM (schedules) online: let customers see where their home is at and let suppliers see too when they’re needed for Footing and Foundation, framing, roofing, windows, electrical, plumbing, insulation, dry wall, paint, carpet, cabinets,… -As more options are available, more users will visit the site, as more users visit the site, more suppliers come onboard and you have a virtuous cycle -Now “Best Homes 4 U” is enjoying network effects -Suddenly, the flow of cash could reverse direction w/ suppliers becoming advertisers and sponsors More about Best Homes 4 U: -Allow lawyers access for e-closings -Allow lenders access for e-funding -Now if your WS attracts 10,000s of visitors, you can get your suppliers and your suppliers’ suppliers to pay for ads so more people will buy higher-end products (chandeliers, beveled mirrors, granite, counter tops, home theatre,…) -more options => more people => more options => more people… -In a virtuous, self-reinforcing cycle (Google is also an example of Network Effects) -30+ hours in Design Centre with clients can become just 60 minutes -Imagine the productivity increase for homebuilder sales staff, lawyers, mortgage lenders, the GC, the foreman (Worst problem? Homebuyer questions about when this or that happens..), suppliers, trades, subs, … Also, customer satisfaction increases since: a) b) they get EXACTLY what they want, they feel they had a hand-in its creation (like Aunt Jemima Pancake Mix: just add eggs and milk). The folks who bring you this pancake mix famously had an erroneous insight years ago—they thought that by adding powdered eggs and milk to their mix and eliminating the instructions “Just add eggs and milk”, they could save the busy consumer time and sell more product It turned out that homemakers liked adding ‘real’ eggs and milk: first, they thought it was healthier that powdered eggs and milk and, second, they wanted to be involved in ‘making’ their kids’ breakfasts For most kids, you are what you do for them By taking this away, sales went down not up Best Homes 4 U, by involving the consumer in the design of their own home are catering to a deep seated need in humans to ‘buy-in’ This is a powerful lesson for tech—giving consumers the power to customize products and services is big business. For example, Dell is currently using Threadless.com’s platform to allow artists to submit and prospective customers to select winning designs for laptop covers Highest and Best Use— Many models developed as organizing principles for villages, towns and cities First villages probably founded by handful of families joining together for mutual protection Division of labour increases well being of village Those better skilled at farming, hunting, gathering, flint knife carving or producing textiles would specialize in those tasks Highest and Best Use— Improvement in wealth of village from intravillage trading Over time, surplus develops in one village led to trade with other nearby villages which had own specializations As cities, towns and villages grew, problem of how to efficiently organize became more pronounced Highest and Best Use— Spatial organization of city, at various times, been based on: a) religious or other forms of hierarchical systems, b) defense principles, c) royal edict, d) class or race based systems, e) guild based separation, f) fiat based systems (a master planned community with its zoning codes is an example of this), g) FOB (Friends of the Boss – Mayor, Fire Chief, Chief of Police and so forth), or combinations of above Highest and Best Use— Structuring cities based on principle that each individual parcel should be put to highest and best use prominence over the last century highest and best use is use or combination of uses that produces highest land rents Comparative analysis of costs and benefits of alternative projects; project that produces highest IRR (Internal Rate of Return) is arguably right use for subject property presumably also produces highest land rents Highest and Best Use— Rule is also ‘DAD rule’– Dollars are Democrats rule DAD rule, persons or organizations that have the where-with-all to develop parcel to highest and best use will also be those willing to pay highest price for lands or highest land rent Implies: a) land supply rationed using price mechanism, b) anyone can participate irrespective of race, creed, gender or religion and c) lands used efficiently at greatest intensity and density Highest and Best Use— Land limited resource and should be used efficiently Seems self-evident Remarkable how often neo-urbanists run into the NIMBY mentality, not-in-my-backyard syndrome Highest and Best Use— Dunrobin Village Plaza OMB Hearing (I am opposed because I don’t want it) Robertson Mews OMB Hearing (walking the dog, golf playing) Dunrobin Lake (You got any evidence?) Palladium OMB Hearing (10th anniversary, I was never an opponent) Highest and Best Use— Modern’ alternative seems to be to place all our faith in all-seeing, all-knowing master planners and zoners to dictate how cities grow, change and develop This is just another form of FOB, Friends of the Boss Zoning actually keeps entrepreneurs out Best friend of large developers Same as Rent Control (Minto experience) Highest and Best Use— Nimbys are Wrong to Oppose Mixed Use and Higher Densities Nimbys fear growth and sprawl Also oppose densification and intensification Highest and best use rules imply an increase in city density over time as urbanization increases and population grows Rent curves, measured cross-sectionally at any point in time, tend to peak in the city centre and fall towards the urban/rural boundary, all else being equal As city expands outward over time, overall demand for all types of land uses and demands on the public room, increase Rent curves tend to secularly increase as demand for land, apartments, commercial and institutional space increases Highest and Best Use— If this were not true, the rent curve (and density gradient) of a place like Manhattan would not look significantly different from, say, a town like Ottawa To meet such demand, landowners are inclined to increase the density of built form Rents for existing housing stock and commercial property are secularly increased from this combination of greater demand, intensification and densification Creeping commercialization of residential areas, the addition of commercial uses to homes and more mixing together of various uses will, prima facie, also contribute to rising rents Highest and Best Use— As long as public order and safety are maintained, home owners should not fear densification or mixed use coming to their neighborhood Land rents will go up and property values will go up not down If a new office tower is constructed nearby, more would-be potential homeowners or renters have just moved into your community Demand for housing in the area goes up and so do prices Highest and Best Use— Densification and increased mixing together of different land uses (aka, intensification) make for more interesting communities; ones that better support public transportation and can be safer too It makes no sense to construct single purpose suburbs made up exclusively of single family homes where no employment uses are permitted