785

advertisement

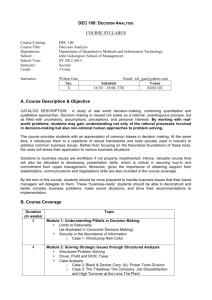

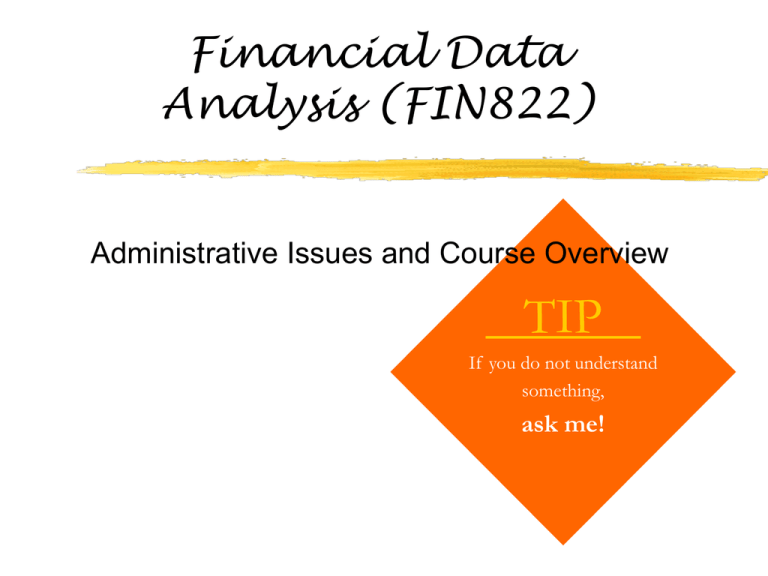

Financial Data Analysis (FIN822) Administrative Issues and Course Overview TIP If you do not understand something, ask me! The instructor My name is Donglin Li. Email: donglinli2006@yahoo.com Office hours: M 15:00-17:00(DTC580), Tu 12:00-14:00, BUS315 http://online.sfsu.edu/~donglin/courses.html I will put lecture slides, in-class-work, and project assignments on my web. Research interest: Corporate finance: Agency cost, overinvestment Accounting: Financial Statement Analysis, Market Anomalies Credit Risk Analysis 2 My expectation in this course I want everyone to be able to understand fundamental financial statements carry out basic valuation analysis and credit analysis master a set of statistical tools that will help you identify the relation between some accounting variables/ratios and stock returns. 3 This course has not been offered for the past 4 years Please do not expect too high from this course. 4 Reference Books: you may use any statistics/econometrics textbook that you are familiar with. The textbook should cover regression analysis. or, “Introductory Econometrics with Applications” By Ramanathan, 5e, South-Western. “Analysis of Financial Data”, By Gary Koop, John Wiley 5 Prerequisite FIN 819 with a grade of B- or better; FIN 825 and 828 recommended. This course is about numbers, so you should have a good knowledge of financial accounting and statistics. 6 Add, drop and withdrawal policy The business school has the policy for add, drop and withdrawal In the first four weeks, you have to get enrolled in the class, if you want. Students can withdraw at most once. 7 Projects You will be given 3 projects. You need to have access to a PC. 8 In-Class-Work There will be 4 in-class work assignments. The schedule of these in-class projects will not be announced in advance, so just come to the lectures. 9 Three quizzes and final exam The quizzes are closed-book and closed notes. There are no make-ups. The tests are based on material covered in lectures, in-class-work, homework, and projects. The in-class-work will be relevant for the quizzes; The quizzes will be relevant for the final! 10 Class performance Any attempt to seek undue favor from the instructor will negatively affect your class performance. The instructor cannot assign extra work to any individual to improve her/his grade. 11 Grading Class performance Quiz of lowest score The other two quizzes Final exam Projects Total 5 points 10 40 35 30 120points 12 Curve grade A range Top 30% B range Top 80% The instructor reserves the right to make minor adjustment if necessary. The cure might be shifted upward if the whole class is doing well on average. 13 Academic integrity The instructor has zero tolerance for cheating or looking at each other during the exams. In the exams, please sit as far as possible from each other. In doing the in-class-work, feel free to discuss with your classmates. 14 Communicate with the instructor Teaching Style: Lectures, problem solving and computer projects. Please pay attention to what is covered in class. I appreciate any constructive suggestions (in person or through email) that would improve the course. 15 Course organization This course is broken-down into two parts: 1: Techniques. 2: Applications of these techniques on data analysis (often analyzing a lot of firm’s financials at the same time.) 16 You also need to understand financial statements well Financial analysts use financial statements to rate and value companies. External investors read financial statements to select stocks and decide when to buy or sell. Bankers use them in deciding whether to extend loans and determine loan terms. 17 Financial statements may be cooked; we will introduce some models that unravel earnings management. Earnings manipulation GAAP Earnings management Real earnings management No earnings management 18 Equity Valuation Analysis Discounted cashflow models Residual income model 19 Credit Analysis Z-scores Z=1.2 Net Working Capital/Total assets+1.4 Retained Earnings/Total assets+3.3 EBIT/Total assets +0.6 Market Value of Equity/Book Value of Liability+1.0 Sales/Total assets Credit rating methods by S&P and Moody’s Logit/Probit models My own model 20 Why is Data Analysis useful? Because you do not believe in semi-strong form of market efficiency. Because you can identify variables/ratios that might be relied upon to predict future stock returns. Earn huge bucks! (in theory) Another eye-catching item on your resume. 21 In Data Analysis, We will focus on regression techniques. Example, is there a significant relation between firm investment and future stock returns? We will discuss several market anomalies. 22 One-year-ahead hedge returns based on capital investment levels. ©Donglin Li 2004 1 year ahead hedge returns between lowest and highest deciles of investment (d_PPE) firms Go long the lowest investment stocks. 0.35 Go short the highest investment stocks. 0.3 0.25 12 month size adjusted buy and hold hedge returns after May each year. Hedge Portfolio Return 0.2 0.15 Positive in 36 out of 39 years, average 12.6% 0.1 0.05 0 1962 1964 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 -0.05 -0.1 Pattern is consistent with market mispricing and inconsistent with semistrong efficiency. Year 23