Guidelines:

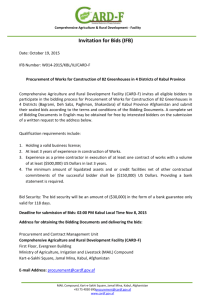

advertisement