Ch 12 Economies of Scale

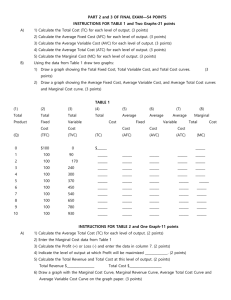

advertisement

Economies of Scale Introduction We have learned: Economic principles relating to (primarily) households and society at large; now we will turn our attention to the economics of the firm You will now learn: Revenues, costs, and profits are the fundamental concerns of firms The importance of the production function The difference between fixed and variable costs The importance of cost curves Short-run versus long-run costs Adam Smith’s Pin Factory Stylized Facts Introduction cont. One of the greatest technological innovations in human history is the assembly line. “Many hands make light work” Imagine the cost of a Mercedes if it were assembled by one man instead of twenty men and forty robots. o If I order a Mercedes auto tomorrow, that unit can be delivered to me anywhere in the United States within 13 days. How long would it take without the benefit of assembly line technology? Imagine the cost of an appendectomy if all of the functions were performed by a single actor instead of a long chain of specialized experts. o If doctors conclude that my appendix is about to burst, they can remove it within an hour. How long would it take without the benefit of assembly line technology? Consider the employment of assembly line technology at the university. Total Revenue, Total Cost, and Profit o The goal of a firm is to maximize profit. o total revenue: the amount a firm receives for the sale of its output. Total Revenue = Price Quantity o total cost: the market value of the inputs a firm uses in production. o profit: total revenue minus total cost. Profit = Total Revenue Total Cost Costs as Opportunity Costs o The costs of producing an item must include all of the opportunity costs of inputs used in production. o Total opportunity costs include both implicit and explicit costs. explicit costs: input costs that require an outlay of money by the firm. implicit costs: input costs that do not require an outlay of money by the firm. The total cost of a business is the sum of explicit costs and implicit costs. This is the major way in which accountants and economists differ in analyzing the performance of a business. Accountants focus on explicit costs, while economists examine both explicit and implicit costs. The Cost of Capital as an Opportunity Cost o The opportunity cost of financial capital is an important cost to include in any analysis of firm performance. o Example: Garret uses $300,000 of his savings to start his firm. It was in a savings account paying 5% interest. o Because Garret could have earned $15,000 per year on this savings, we must include this opportunity cost. (Note that an accountant would not count this $15,000 as part of the firm's costs.) o If Garret had instead borrowed $200,000 from a bank and used $100,000 from his savings, the opportunity cost would not change if the interest rate stayed the same (according to the economist). But the accountant would now count the $10,000 in interest paid for the bank loan. Economic Profit versus Accounting Profit o economic profit: total revenue minus total cost, including both explicit and implicit costs. Economic profit is what motivates firms to supply goods and services. To understand how industries evolve, we need to examine economic profit. o accounting profit: total revenue minus total explicit cost. The Production Function o production function: the relationship between quantity of inputs used to make a good and the quantity of output of that good. o Example: Garret cookie factory. The size of the factory is assumed to be fixed; Garret can vary his output (cookies) only by varying the labor used. Number of Workers 0 1 2 3 4 5 6 Outp ut 0 50 90 120 140 150 155 Marginal Product of Labor --50 40 30 20 10 5 Cost of Factor y $30 30 30 30 30 30 30 Cost of Worke rs $0 10 20 30 40 50 60 Total Cost of Inputs $30 40 50 60 70 80 90 o marginal product: the increase in output that arises from an additional unit of input. Marginal Product of Labor = change in output change in labor As the amount of labor used increases, the marginal product of labor falls. diminishing marginal product: the property whereby the marginal product of an input declines as the quantity of the input increases. o Diminishing marginal product can be seen from the fact that the slope falls as the amount of labor used increases. From the Production Function to the Total-Cost Curve We can draw a graph of the firm's total cost curve by plotting the level of output (x-axis) against the total cost of producing that output (y-axis). o The total cost curve gets steeper and steeper as output rises. o This increase in the slope of the total cost curve is also due to diminishing marginal product: As Garret increases the production of cookies, his kitchen becomes overcrowded, and he needs a lot more labor. The Various Measures of Cost Example: Garret’s Coffee Shop Fixed and Variable Costs o Definition of fixed costs: costs that do not vary with the quantity of output produced. o Definition of variable costs: costs that do vary with the quantity of output produced. o Total cost is equal to fixed cost plus variable cost. TC FC VC Coffee beans? Labor? Coffee Boiler? Building? Average and Marginal Cost o average total cost: total cost divided by the quantity of output. o average fixed cost: fixed costs divided by the quantity of output. o average variable cost: variable costs divided by the quantity of output. ATC marginal cost: the increase in total cost that arises from an extra unit of production. MC TC VC FC ; AVC ; AFC Q Q Q change in total cost change in output Average total cost tells us the cost of a typical unit of output and marginal cost tells us the cost of an additional unit of output. Cost Curves and Their Shapes Rising Marginal Cost o This occurs because of diminishing marginal product. o At a low level of output, there are few workers and a lot of idle equipment. But as output increases, the coffee shop gets crowded and the cost of producing another unit of output becomes high. U-Shaped Average Total Cost o Average total cost is the sum of average fixed cost and average variable cost. ATC AFC AVC AFC declines as output expands and AVC typically increases as output expands. AFC is high when output levels are low. As output expands, AFC declines pulling ATC down. As fixed costs get spread over a large number of units, the effect of AFC on ATC falls and ATC begins to rise because of diminishing marginal product. efficient scale: the quantity of output that minimizes average total cost. The Relationship between Marginal Cost and Average Total Cost Whenever marginal cost is less than average total cost, average total cost is falling. Whenever marginal cost is greater than average total cost, average total cost is rising. The marginal-cost curve crosses the average-total-cost curve at minimum average total cost (the efficient scale). SO? So what? Really…irrelevant. This is the real reason why people call economics the dismal science; because we try to teach them bits of irrelevant knowledge. We should try to teach them the economic mindset, not where two lines intersect. Typical Cost Curves Marginal cost eventually rises with output. The average-total-cost curve is U-shaped. Marginal cost crosses average total cost at the minimum of average total cost. o And this is important...WHY? Costs in the Short Run and in the Long Run The division of total costs into fixed and variable costs will vary from firm to firm. Some costs are fixed in the short run, but all are variable in the long run. o For example, in the long run a firm could choose the size of its factory. o Once a factory is chosen, the firm must deal with the short-run costs associated with that plant size. The long-run average-total-cost curve lies along the lowest points of the shortrun average-total-cost curves because the firm has more flexibility in the long run to deal with changes in production. The long-run average-total-cost curve is typically U-shaped, but is much flatter than a typical short-run average-total-cost curve. The length of time for a firm to get to the long run will depend on the firm involved. Economies and Diseconomies of Scale economies of scale: the property whereby long-run average total cost falls as the quantity of output increases. diseconomies of scale: the property whereby long-run average total cost rises as the quantity of output increases. constant returns to scale: the property whereby long-run average total cost stays the same as the quantity of output changes. Lessons from a Pin Factory o In The Wealth of Nations, Adam Smith described how specialization in a pin factory allowed output to be greater than it would have been if each worker attempted to perform many different tasks. o The use of specialization allows firms to achieve economies of scale. o McDonalds example: specialization o McDonalds example: logistics company and beef/potato grower…restaurant? What? Economies of scale is one of our species’ greatest innovations…EVERYTHING is produced on production lines- undoubtedly production lines are one of humanity’s greatest inventions. The benefits of employing assembly line technology for the production of goods far exceed the benefits from employing assembly line technology to service production and delivery. o I’m not sure; I think that it depends on how we define the value chain. Economies of Scope: similar to economies of scale; but, whereas scaling is concerned with the optimal quantity to produce of a single product, economies of scope is concerned with the optimal number of different products that the firm should make…to achieve the lowest possible, cost of course Read about Ford’s assembly line here. Largest companies if the world. Rank Company Revenues ($ millions) Profits ($ millions) 1 Wal-Mart Stores Logistics, scale, scope 421,849 16,389 2 Royal Dutch Shell Scale 378,152 20,127 3 Exxon Mobil Scale 354,674 30,460 4 BP Scale, Scope 308,928 -3,719 5 Sinopec Group Scale 273,422 7,629 6 China National Petroleum Scale 240,192 14,367 7 State Grid Ch. nrg; Scale, Scope 226,294 4,556 8 Toyota Motor Scale, Scope 221,760 4,766 9 Japan Post Holdings Private p.o; scope 203,958 4,891 10 Chevron Scale 196,337 19,024 11 Total Fr. Nrg; Scale, Scope 186,055 14,001 12 ConocoPhillips Scale 184,966 11,358 13 Volkswagen Scale, Scope 168,041 9,053 14 AXA Fr. Insur; Scale, Scope 162,236 3,641 15 Fannie Mae Scale, Scope 153,825 -14,014 16 General Electric Scale, Scope 151,628 11,644 17 ING Group Scale, Scope 147,052 3,678 18 Glencore International Commodities; SS 144,978 1,291 19 Berkshire Hathaway Genius, Patience 136,185 12,967 20 General Motors Scale, Scope 135,592 6,172 Wal-Mart CEO Michael Duke (60) earned $1.2 million in salary and $18.7 million total compensation in 2011? Is he overpaid? It is much more likely that he is underpaid. Why would I say this? If Wal-Mart were a country, it would be the 25th largest in the world (Rev=GDP). Owners of the firm are more than happy to hire very smart, capable and experienced people to watch over the management of such incredibly complex and competitive operation. $19 million is just .000045 of the $424 billion in revenue that he manages. Think about it: if you had a business that earned $100 per hour, you’d pay someone to manage that business at least $1 per hour, right? Now that’s 1%. Duke is one of the smartest leaders in the world. He works 16 hours per day, 7 days per week (on average). He doesn’t see his family much. He doesn’t get anywhere near 1% of the firm’s revenue. He is probably underpaid. Two more things about executive compensation: o Executive market is a competitive one; people earn what the market will bear. And if you think that executives make too much money, then why don’t you get into the marketplace and get rich yourself? o Athletes, Actresses and Actors, People who win lottery,…