ROI

advertisement

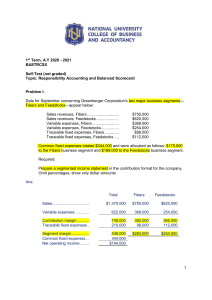

Chapter 12 Decentralization and Performance Evaluation 1 Introduction The dilemma for companies is to find tools that allow the evaluation of managers at all levels in the organization. How would the evaluation be different for each of these? •A plant manager in a factory •The manager of a retail store •The regional sales manager •The CEO 2 Management of Decentralized Organizations Centralized: a few individuals at the top of an organization retain decision-making authority. Decentralized: managers at various levels throughout the organization make key decisions about operations relating to their specific area of responsibility. 3 Management of Decentralized Organizations •Advantages of Decentralization •Those closest to the problem are more familiar with the problem •Higher job satisfaction of managers •Managers receive on-the-job training, making them better managers •Decisions are often made in a more timely fashion 4 Management of Decentralized Organizations •Disadvantages of Decentralization •Decision making spread among too many managers, causing a lack of company focus •Managers make decisions benefiting their own segment, not always in the best interests of the company •Managers not adequately trained in decision making at early stages of their careers •Lack of coordination and communication between segments •May result in duplicative costs/efforts 5 Responsibility Accounting and Segment Reporting The key to effective decision making in a decentralized organization is responsibility accounting—holding managers responsible for only those things under their control. 6 Cost, Revenue, Profit, and Investment Centers •Cost Center •The manager has control over costs but not over revenue or capital investment decisions. •Example: Human Resources Manager 7 Cost, Revenue, Profit, and Investment Centers •Revenue Center •The manager has control over the generation of revenue but not costs. •Example: Sales Manager of a retail store 8 Cost, Revenue, Profit, and Investment Centers •Profit Center •The manager has control over both cost and revenue but not capital investment decisions. •Example: Manager of a particular location of a hotel chain 9 Cost, Revenue, Profit, and Investment Centers •Investment Center •The manager is responsible for the amount of capital invested in generating income. It is, in essence, a separate business with its own value chain. •Investment centers are often called strategic business units (SBUs) 10 Profit Center Performance and Segmented Income Statements Segmented Income Statements calculate income for each major segment of an organization in addition to the company as a whole. 11 Investment Centers and Measures of Performance Evaluating investment centers requires focusing on the level of investment required in generating a segment’s profit. 12 Return on Investment (ROI) ROI measures the rate of return generated by an investment center’s assets. ROI = Margin X Turnover Margin = Net Operating Income /Sales Turnover = Sales/Average Operating Assets ROI = Net Operating Income Sales X Sales Average Operating Assets 13 Return on Investment (ROI) •Increase sales revenue What do I need to do to increase my ROI? •Reduce operating costs •Reduce investment in operating assets 14 Residual Income Residual Income The amount of income earned in excess of a predetermined minimum rate of return on assets. All things equal, the higher the residual income of an investment center, the better. 15 Residual Income Residual Income = Net Operating Income - ( Average Operating Assets X Minimum Required Rate of Return) If net income is $60,500, average operating assets are $100,000, and the required ROI is 20%, what is the RI? RI = $60,500 - ($100,000 X .20) RI = $40,500 16 Economic Value Added (EVA) •EVA tells management whether shareholder wealth is being created by focusing on whether after-tax profits are greater than the cost of capital. •Economic value added = After-tax operating profit – [(Total assets - Current liabilities) x Weighted average cost of capital)] 17 Performance and Management Compensation Decisions In order to motivate managers and ensure goal congruence, the compensation of managers should be linked to performance and based on a combination of short-term and long-term goals. 18 Segment Performance and Transfer Pricing • Transfer pricing is needed when segments within the same company sell products or services to one another. • The three approaches to establishing transfer prices are: 1. Use the market price if it is available. 2. Base the transfer price on the cost of the product transferred. 3. Let the buyer and seller negotiate the price. 19 A General Model for Computing Transfer Prices Minimum Transfer Price = Variable Costs of Producing and Selling + Contribution Margin Lost on Outside Sales 20 A General Model for Computing Transfer Prices The transfer price that provides the most benefit to the company as a whole is the one that should be chosen. 21