Document

advertisement

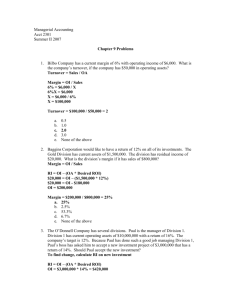

Chapter 11 Other Cost Tools for Cost Control and Performance Evaluations Topics to be Discussed Introduction Management of Decentralized Organizations Accounting Information Systems and Decentralized Organizations Responsibility Accounting and Segment Reporting Cost, Profit and Investment Centers Introduction The dilemma for companies is to find tools that allow the evaluation of managers at all levels in the organization. How would the evaluation be different for each of these? A plant manager in a factory The manager of a retail store The regional sales manager The CEO Management of Decentralized Organizations Centralized: a few individuals at the top of an organization retain decisionmaking authority. Decentralized: managers at various levels throughout the organization make key decisions about operations relating to their specific area of responsibility. Management of Decentralized Organizations Segment: any activity or part of the business for which a manager needs cost, revenue or profit data. Management of Decentralized Organizations Advantages of Decentralization Those closest to the problem are more familiar with the problem Key in improving customer service Higher job satisfaction of managers Managers receive on-the-job training, making them better managers Management of Decentralized Organizations Disadvantages of Decentralization Decision making spread among too many managers, causing a lack of company focus Managers concerned with their own area and lose sight of big picture Managers make decision benefiting their own segment, not always in the best interest of the company Managers not adequately trained in decision making at early states of their careers Accounting Information Systems and Decentralized Organizations Key Concept Decentralized organizations require very well-integrated information systems. The flow of information and open communication between divisions and upper and lower management is critical. Responsibility Accounting and Segment Reporting Responsibility Accounting: Holding managers responsible for ONLY those things under their control. Responsibility Accounting and Segment Reporting Key Concept The key to effective decision making in a decentralized organization is responsibility accounting - holding managers responsible for only those things under their control. Should a manager on an engine assembly line be held responsible for a production problem dealing the the vehicle body? Cost, Profit and Investment Centers Cost Center The manager has control over costs but not over revenue or capital investment decisions. Example: Human Resources Manager Cost, Profit and Investment Centers Revenue Center Manager has control over the generation of revenue but not costs. Example: Reservation Department of an airline Cost, Profit and Investment Centers Profit Center Manager has control over both cost and revenue but not capital investment decisions. Example: Manager of a specific hotel chain Cost, Profit and Investment Centers Investment Center Manager is responsible for the amount of capital invested in generating its income. They are in essence separate businesses with their own value chains. Example: Owner of own independent store Topics to Measure Performance Profit Center Performance and Segmented Income Statements Investment Centers and Measure of Performance Return on Investment Residual Income Profit Center Performance and Segmented Income Statements Segmented Income Statements calculate income for each major segment of an organization in additon to the company as a whole. Profit Center Performance and Segmented Income Statements J. C. Penney Co. allocates the corporate costs of auditing, legal, and personnel services to its subsidiaries based on the time spent providing the services to each subsidiary. In the past, the allocation was made based on the revenue earned by each subsidiary. (“Teamwork Pays Off at Penney’s,” Business Week, no. 2734, pp. 107-108) Profit Center Performance and Segmented Income Statements Pause and Reflect Do you think the new allocation bases are appropriate or should Penney’s treat the auditing, legal, and personnel costs as common costs? The Segmented Income Statement Consulting Audit Dept. Dept. Total Firm Tax Dept. $1,000,000 $500,000 $400,000 $100,000 400,000 200,000 160,000 40,000 Contribution margin $600,000 $300,000 $240,000 $60,000 Less:Traceable fixed 200,000 100,000 75,000 25,000 $400,000 $200,000 $165,000 $35,000 Client billings Less: Variable expense Segment margin Less: Common fixed Net income 200,000 $200,000 The Segmented Income Statement Individual Tax Business Tax Tax Dept. Division Division Client billings Less: Variable expense Contribution margin Less:Traceable fixed Divisional Segment margin $500,000 $100,000 $400,000 200,000 80,000 120,000 $300,000 $20,000 $280,000 80,000 30,000 50,000 $220,000 $(10,000) $230,000 Departmental Segment margin $200,000 The Segmented Income Statement Contribution Margin: primarily a measure of short-run profitability. Segment Margin: a measure of longterm profitability and is more appropriate in addressing long-term decisions such as whether to drop product lines. The Segmented Income Statement Pause and Reflect Garcia and Buffet have considered allocating the advertising costs to each division based on the revenue generated in each division. Comment on whether this is an appropriate allocation base. The Segmented Income Statement The segment margin of the individual tax division is negative. In the long run, the individual tax division is not profitable. Before the firm decides to eliminate the individual tax division, what other quantitative and qualitative factors should they consider? Segment Performance and ABC ABC can affect the classification of costs as traceable or common. When ABC is used, batch level and product level activities and costs are driven by factors such as the number of setups, parts, customer orders, supervision hours, etc. Investment Centers and Measures of Performance Key Concept Evaluating investment centers requires focusing on the level of investment required in generating a segment’s profit. Investment Centers and Measures of Performance And what do you plan to use to justify your decision to remodel these facilities? Performance reports focus on measures specifically developed to focus on the level investment required, such as return on investment, residual income, and economic value added. Investment Centers and Measures of Performance Does the manager of a local branch of a national bank likely manage a profit or investment center? What about the manager of the local Pizza Hut? What about the manager of an independent pizza restaurant or clothing store who is also the owner of that store? Return on Investment (ROI) ROI measures the rate of return generated by an investment center’s assets. ROI = Margin X Turnover Margin = Net Operating Income /Sales Turnover = Sales/Average Operating Assets Net Operating Income ROI = Sales X Sales Average Operating Assets Return on Investment (ROI) Net Operating Income: Income before interest and taxes Operating Assets: Cash, accounts receivable, inventory, and property, plant and equipment Return on Investment (ROI) Pause and Reflect Why might investing in new assets decrease ROI? Will ROI always go down when new equipment is purchased? Return on Investment (ROI) What do I need to do to increase my ROI? Increase sales revenue Reduce operating costs Reduce investment in operating assets Return on Investment (ROI) How do you increase sales revenue? Either by increasing sales volume without changing the sales price or by increasing the sales price without affecting volume. Return on Investment (ROI) How do you reduce operating costs? The decrease can be in the variable or fixed costs. The key is that any decrease in operating costs will increase operating income and have a positive impact on ROI. Return on Investment (ROI) How do you decrease the amount of operating assets? Although this may be difficult to do in the short run with property, plant and equipment, AOA can be reduced by better management of accounts receivable, a reduction in inventory levels, and so on. Residual Income Residual Income: the amount of income earned in excess of some predetermined minimum level of return on assets. The higher the residual income of an investment center, the better. Residual Income Residual Income = Net Operating Income - ( Average Operating Assets X Minimum Required Rate of Return) If net income is $60,500, average operating assets are $100,000, and the required ROI is 20%, what is the RI? RI = $60,500 - ($100,000 X .20) RI = $40,500 More Topics Economic Value Added Segment Performance and Transfer Pricing Transfer Price at Market Transfer Price at Cost Negotiated Transfer Prices A General Model for Computing Transfer Prices International Aspects of Transfer Pricing Economic Value Added (EVA) EVA tells management whether shareholder wealth is being created by focusing on whether after-tax profits are greater than the cost of capital. Economic value added = After-tax operating profit - (Total assets - Current liabilities) x Weighted average cost of capital) Economic Value Added (EVA) How is EVA different from residual income? 1. EVA is based on after-tax operating profit. 2. Assets are often shown net of current liabilities. 3. Companies may modify income and asset measurements based on GAAP. 4. EVA considers the actual cost of capital, both debt and equity instead of a minimum rate of return. Segment Performance and Transfer Pricing Transfer pricing is needed when segments within the same company sell products or services to one another. The three approaches to establishing transfer prices are: Use the market price if it is available. Base the transfer price on the cost of the product transferred. Let the buyer and seller negotiate the price. Segment Performance and Transfer Pricing I knew accepting that transfer price would lower my ROI too far! If managers of the separate divisions are evaluated based on profit or other performance measures like ROI or EVA, the transfer price becomes very important. Transfer Price at Market If there is an outside market for the product being transferred between divisions, the transfer price should be based on the market price of the product. However, the buyer and seller must be allowed to go outside if doing so would create a better profit. Transfer Price at Cost If no outside market exists, or when the selling division has excess capacity, transfer prices are often established based on the cost of the product being transferred. Transfer Price at Cost No Outside Market Using Birdie-Maker as an example, how should they set a price for a grip that cannot be sold to other club manufacturers? Transfer Price at Cost Using the Decision Model: Step 1 - Establish a transfer price for grips that are to be sold to the club division. Step 2 - Set a price that does not adversely affect either manager of the firm and maximizes overall profit. Transfer Price at Cost Step 3 - Establish the transfer price at: The variable manufacturing costs of making the grips The full cost of making the grips A price so that the grip division earns an acceptable profit Transfer Price at Cost Step 4 - Which decision should Birdie Maker make? Negotiated Transfer Price Transfer prices are negotiated between buyer and seller and end up somewhere between cost and the market price. A General Model for Computing Transfer Prices Minimum Transfer Price = Variable Costs of Producing and Selling + Contribution Margin Lost on Outside Sales A General Model for Computing Transfer Prices Key Concept The transfer price that provides the most benefit to the company as a whole is the one that should be chosen. International Aspects of Transfer Pricing The focus of transfer pricing when international divisions are involved centers on minimizing taxes, duties, and foreign exchange risks. Managers must also be aware and sensitive to geographic , political, and economic circumstances in the environment in which they operate. End of Chapter 11 Which costs are you responsible for in your budget?