Chapter 9

advertisement

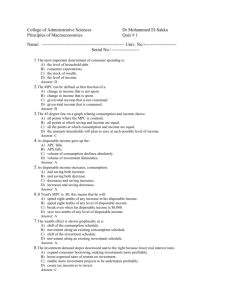

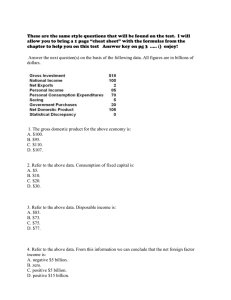

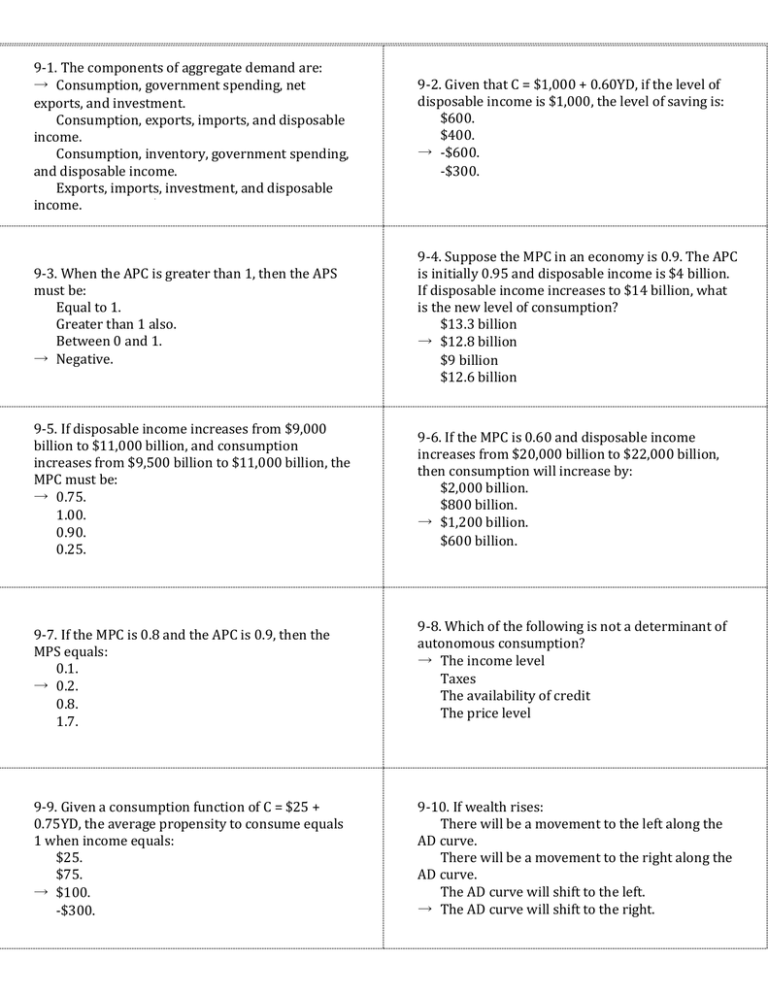

9-1. The components of aggregate demand are: → Consumption, government spending, net exports, and investment. Consumption, exports, imports, and disposable income. Consumption, inventory, government spending, and disposable income. Exports, imports, investment, and disposable income. 9-2. Given that C = $1,000 + 0.60YD, if the level of disposable income is $1,000, the level of saving is: $600. $400. → -$600. -$300. 9-3. When the APC is greater than 1, then the APS must be: Equal to 1. Greater than 1 also. Between 0 and 1. → Negative. 9-4. Suppose the MPC in an economy is 0.9. The APC is initially 0.95 and disposable income is $4 billion. If disposable income increases to $14 billion, what is the new level of consumption? $13.3 billion → $12.8 billion $9 billion $12.6 billion 9-5. If disposable income increases from $9,000 billion to $11,000 billion, and consumption increases from $9,500 billion to $11,000 billion, the MPC must be: → 0.75. 1.00. 0.90. 0.25. 9-6. If the MPC is 0.60 and disposable income increases from $20,000 billion to $22,000 billion, then consumption will increase by: $2,000 billion. $800 billion. → $1,200 billion. $600 billion. 9-7. If the MPC is 0.8 and the APC is 0.9, then the MPS equals: 0.1. → 0.2. 0.8. 1.7. 9-9. Given a consumption function of C = $25 + 0.75YD, the average propensity to consume equals 1 when income equals: $25. $75. → $100. -$300. 9-8. Which of the following is not a determinant of autonomous consumption? → The income level Taxes The availability of credit The price level 9-10. If wealth rises: There will be a movement to the left along the AD curve. There will be a movement to the right along the AD curve. The AD curve will shift to the left. → The AD curve will shift to the right. 9-2. Aggregate demand is composed of all spending categories that make up GDP. 9-1. Saving will be negative when consumption exceeds disposable income. 9-4. Consumption will rise by the change in disposable income multiplied by the MPC. In this case consumption is initially $3.8 billion (.95 × 4). When income increases by $10 billion, the increase in consumption will be $9 billion (0.9 × 10). Therefore the total consumption will be $12.8 billion ($3.8 + $9). 9-3. In this case, consumption exceeds disposable income and the consumer is dissaving. 9-6. Consumption spending will rise by the change in disposable income multiplied by the MPC. (2000 × 0.60 = $1200) 9-5. The MPC is equal to the change in consumption spending divided by the change in disposable income. (1500/2000 = .75) 9-8. MPS plus MPC equals one, so MPS must be equal to 0.2. 9-7. MPS plus MPC equals one, so MPS must be equal to 0.2. 9-10. More wealth leads consumers to feel more confident and therefore to spend more freely. 9-9. When disposable income is $100, the consumer is spending all of their income (C = 25 + .75 × 100 = $100) and saving none. 9-11. If the availability of credit increases, then: There will be a movement to the left along the AD curve. There will be a movement to the right along the AD curve. The AD curve will shift to the left. → The AD curve will shift to the right. 9-12. Investment spending includes expenditures on all of the following except: → Stocks and bonds. Equipment. Inventory. Plant or office building. 9-13. Which of the following will cause a decrease in U.S. gross exports? An increase in foreign consumer income → A decrease in foreign business investment An increase in foreign wealth. A decrease in U.S. consumer income 9-14. Which of the following will cause an increase in U.S. imports? → An increase in U.S. consumer confidence An increase in foreign consumer income An increase in foreign business investment A decrease in U.S. wealth 9-15. A recessionary gap: Would cause a depletion of inventories. Would occur if total output were less than aggregate demand. → Is the amount by which the rate of actual spending falls short of full-employment GDP. Is the amount by which total spending exceeds GDP. 9-16. Which of the following occurs when the spending on final goods and services exceeds fullemployment GDP? Inventory accumulation Unemployment → Inflationary gap Recessionary gap 9-17. Demand-pull inflation is caused by: An increase in aggregate supply. An increase in resource costs as an economy's production capacity is approached. An increase in inventories. → Excessive aggregate demand in relation to an economy's production capacity. 9-12. Stocks and bonds represent how one chooses to hold one's wealth rather than physical capacity. 9-11. More wealth leads consumers to feel more confident and therefore to spend more freely. 9-14. When consumers feel good about the economy, they will consume more of all goods, including imports. 9-13. If investment abroad falls, the demand for U.S. capital goods will decline as our trading partners have less need of them. 9-16. When aggregate demand exceeds full employment GDP, resources are being over-used and bidding wars will drive up their prices, creating inflation. 9-15. The recessionary gap indicates many resources are not being used, so unemployment will be high. 9-17. When aggregate demand increases, production is unable to keep up with spending and so prices rise as a result 9-18. Using Figure 9.1, dissaving occurs at all income levels: Above $2,000 billion. Above $3,000 billion. → Below $2,000 billion. Below $3,000 billion. 9-19. Using Figure 9.6, if full employment occurs at QC then aggregate demand is: Too great causing cyclical unemployment. Too small causing demand-pull inflation. → Too small causing cyclical unemployment. Just right. Since macro equilibrium falls to the left of the fullemployment level of output, there will be a recession and cyclical unemployment. 9-20. Using Figure 9.6, if full employment occurs at QA then aggregate demand is: Just right. → Too great causing an inflationary gap. Too small causing an inflationary gap. Too great causing a recessionary gap. 9-18. At any level to the left of the intersection of the consumption function and the 45-degree line dissaving occurs. 9-19. Since macro equilibrium falls to the left of the full-employment level of output, there will be a recession and cyclical unemployment. 9-20. Since macro equilibrium falls to the right of the full-employment level of output, there will be an inflationary gap.