Lecture 2 Consumption and Investment

advertisement

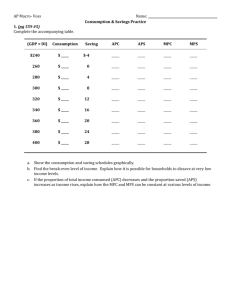

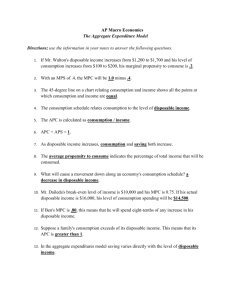

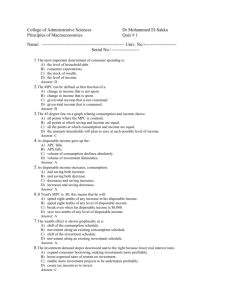

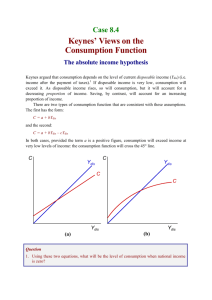

Principles of Macroeconomics Lecture 2 CONSUMPTION AND INVESTMENT Aims of Part 1 - To explain the concepts of consumption, saving and investment and their attributes - To explain the importance of these three concepts for the output of an economy WHAT IS CONSUMPTION? - Consumption is spending on final goods and services bought for the satisfaction gained or needs met by their use - It is the largest single component of GDP What are the major components of consumption? - Housing - Food - Motor vehicles - Medical care - Entertainment and recreation How is consumption related to income? €20,000 Saving €20,000 How is consumption related to income? When income increases, saving increases more than consumption €22,000 €20,000 MARGINAL PROPENSITY TO CONSUME (MPC) -The amount of extra consumption generated by an extra monetary unit of disposable income - In graphic terms it is expressed by the slope of the consumption function CONSUMPTION FUNCTION C A . CONSUMPTION EXPENDITURES . . G . F C . E . B. . D Z 450 DI DISPOSABLE INCOME MPC = CZ / BZ MARGINAL PROPENSITY TO CONSUME (MPC) - As Disposable Income increases, consumption increases as well but with a diminishing pace for each additional monetary unit of disposable income - In graphic terms it is expressed by the slope of the consumption function MARGINAL PROPENSITY TO SAVE (MPS) -The amount of extra saving generated by an extra monetary unit of disposable income - In graphic terms it is expressed by the slope of the savings function - It holds that MPS = 1 - MPC DETERMINANTS OF CONSUMPTION - Current Disposable Income: It has been empirically established that the course of consumption follows the course of disposable income - Long run income trends: People choose their consumption levels looking at both their current income and the prospects for their future income - Wealth: Accumulated wealth plays a key role in determining the level of consumption A Consumption Function for the United States, 1966-1996 1996 C 6,000 1990 CONSUMPTION EXPENDITURES ($blns) 3,000 FITTED CONSUMPTION FUNCTION 1980 C 1970 3,000 DISPOSABLE INCOME ($blns) 6,000 What is investment? In macroeconomics, investment is defined as the additions to the stock of productive assets of an economy. What is investment? Additions to the stock of productive assets of an economy are considered to be capital goods such as equipment, structures and changes in stocks. Determinants of investment - Revenues: Investment depends upon the revenues that will be generated by the state of overall economic activity - Costs: Investment depends upon its cost: the price of the capital good and the interest rate - Expectations: Investment is very sensitive in expectations and business confidence Determinants of investment Demand for investment curve Shifts in the investment demand curve Helpful reading Economics. Samuelson, & Nordhaus (2005) Ch. 22