Uniform Guidance - Colorado Government Human Services

advertisement

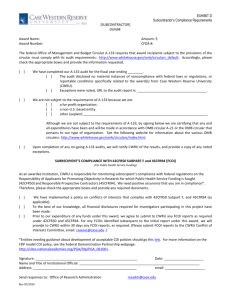

How the Changes to Single Audits and Federal Grant Rules Impact You Agenda Overview and History of the Super Circular Changes to Single Audit Requirements Changes to Federal Cost Principles Changes to Administrative Requirements Action Steps for Entities Receiving Federal Grants 2 Overview and History of the Super Circular Background Rules associated with federal grants are overseen by the Office of Management and Budget (OMB), which is part of the executive branch of the federal government OMB issues “Circulars” which set forth the various rules governing federal awards and audits of federal awards 4 Background Historically, Single Audit requirements have been located in OMB Circular A-133 Historically, cost principles guidance has been located as follows: OMB Circular A-21 – Educational Institutions OMB Circular A-87 – State Governments, Local Governments, Indian Tribes OMB Circular A-122 – Not-for-Profit Organizations 5 Background Guidance has been complicated and difficult to understand Cost principles differ between the three cost circulars Thus, OMB undertook a major project to overhaul and streamline federal award guidance 6 Project Objectives Streamline the federal grant-making process Increase the efficiency and effectiveness of federal programs Ease administrative burden for grant applicants Eliminate unnecessary and duplicative requirements 7 Project Objectives Focus on areas that achieve better outcomes at a lower cost Reduce the risk of waste, fraud and abuse 8 Project Timeline October 2011 – Council of Financial Assistance Reform (COFAR) established February 28, 2012 – Advance Notice of Proposed Guidance issued—contained preliminary ideas OMB was considering and was subject to public comment 9 OMB Super Circular January 31, 2013 – Proposed OMB Uniform Guidance issued—contained more refined, specific proposed OMB regulations and was also subject to public comment December 26, 2013 – Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards issued— represents final document containing final regulations 10 OMB Super Circular Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards is codified into Title 2, Part 200, of the Code of Federal Regulations Referred to as the “Super Circular” or “Omni Circular” 11 Circulars Replaced or Modified by Super Circular 12 Effective Dates Federal agencies must implement the requirements by December 26, 2014 Non-federal entities must implement the new administrative requirements and cost principles beginning December 26, 2014 Applies to new and incrementally funded awards issued on or after December 26, 2014 13 Effective Dates New Single Audit requirements are effective for fiscal years beginning on or after December 26, 2014 Thus, first effective for December 31, 2015 fiscal year ends Early implementation is not permitted 14 Structure of Super Circular Subpart A: Sets forth definitions and acronyms used throughout document Subpart B: General provisions including purpose of guidance, its applicability, and effective date Subpart C: Administrative requirements directed at federal agencies related to preaward activities and content of federal awards 15 Structure of Super Circular Subpart D: Administrative Requirements including procurement, internal control, and subrecipient monitoring Subpart E: Cost Principles guidance previously found in Circulars A-21, A-87 and A-122 Subpart F: Single Audit requirements previously found in Circulars A-133 and A-50 16 Questions 17 Changes to Single Audit Requirements Changes to Single Audit Threshold Single Audit threshold increased from $500,000 to $750,000 It is estimated that approximately 5,000 entities will be relieved from Single Audit requirement as a result Entities below this threshold must still make records available for review or audit by federal agencies, pass-through entities, and the Government Accountability Office 19 Major Program Determination Steps Determine Type A programs vs. Type B programs Determine high-risk/low-risk Type A programs Determine high-risk/low-risk Type B programs Select programs to audit as major Determine that adequate percentage of coverage has been achieved 20 Changes to Major Program Determination Currently, for entities expending < $100 million in federal awards, programs with greater than $300,000 in expenditures or 3% of total expenditures are considered “Type A” Makes it more likely they will be selected as major Have to be audited as major at least once every three years Super Circular increases the Type A threshold to $750,000 21 Changes to Major Program Determination Currently, Type A programs are considered high risk (and therefore must be audited as major) if: Program was NOT audited as a major program in one of the two preceding years; OR In the most recent year audited, the program had findings 22 Changes to Major Program Determination The Super Circular makes a Type A program high risk if, in the most recently audited period, the program: Did not receive an unmodified opinion; Had a material weakness in internal control; Had questioned costs exceeding 5% of the program’s expenditures 23 Changes to Major Program Determination Currently, threshold for performing risk assessment of Type B programs is $100,000 or 0.3% of total federal expenditures The Super Circular changes the Type B risk assessment threshold to 25% of the Type A threshold 24 Changes to Major Program Determination Under current guidance, the high-risk Type B programs selected as major must be: ½ of the high-risk Type B programs, OR One high-risk Type B for each low-risk Type A The Super Circular changes the first criteria to ¼ of the low-risk Type A programs 25 Changes to Major Program Determination Under current guidance, % of federal dollars that must be audited as major is: 50% for high-risk entities 25% for low risk entities Under the Super Circular, % of federal dollars that must be audited as major is: 40% for high-risk entities 20% for low risk entities 26 Changes to Low-Risk Auditee Criteria Currently, an entity is a low risk auditee if: Single Audits were performed in each of the past two years unmodified opinions on the financial statements and SEFA in past two years No material weaknesses in internal control in the past two years No material noncompliance or questioned costs >5% of expenditures for a given award in past two years 27 Changes to Low-Risk Auditee Criteria The Super Circular includes modifications to this, such as: Clearly indicates that the federal clearinghouse submission must have been submitted on time The auditor must NOT have indicated that there is substantial doubt about the entity’s ability to continue as a going concern Removes the option for waivers in this area 28 Findings Currently, a Single Audit finding is required if known or likely questioned costs exceed $10,000 The Super Circular increases this threshold to $25,000 Must include a description of how questioned costs were calculated 29 Findings Findings will now include a perspective section, indicating whether finding is isolated or systemic and the type of sampling used Repeat findings must be identified as such and prior year finding number provided Summary schedule of prior audit findings must include financial statement findings also, and provide a reason why findings recurred 30 Compliance Requirements Proposed OMB Uniform Guidance issued on January 31, 2013 by the OMB suggested a reduction of the types of compliance requirements from 14 to 6 31 Compliance Requirements 32 Compliance Requirements Changes to Compliance Requirements have been deferred and will be considered as part of the annual Compliance Supplement process 2015 Compliance Supplement is expected to be published in April 2015 Will include changes as a result of the Super Circular, and any changes to compliance requirements 33 Federal Audit Clearinghouse Submission Reminders New federal audit clearinghouse (FAC) website became effective starting with fiscal year 2013 submissions The FAC web-site began accepting fiscal year 2014 submissions on October 20, 2014 34 Federal Audit Clearinghouse Submission Reminders FAC website has posted notices indicating that the following requirements will be effective with submissions made on or after January 2, 2015: Must use new standard finding numbering system (2014-001 through 2014-999) Audit submissions must be unlocked, unencrypted and in a text-searchable PDF format 35 Questions 36 Changes to Federal Cost Principles Cost Principles– Key Changes Indirect Cost Rates Time and Effort Reporting Other Miscellaneous Changes 38 Indirect Cost Rates Non-federal entities have the option to extend negotiated indirect cost rate for up to four years Only allowed once per negotiated rate cycle Approval of cognizant agency is required There must be no major changes to the entity’s indirect costs Cannot negotiate rate during the extension period 39 Indirect Cost Rates Entities that have never had a negotiated indirect cost rate may utilize a minimum flat rate of 10% Only available if entity receives less than $35 million in federal funding per year Must keep documentation of this decision on file 40 Indirect Cost Rates Pass-through entities required to either: Honor the indirect cost rate negotiated by a subrecipient at the federal level Negotiate a rate with the subrecipient in accordance with federal guidelines Provide a minimum flat rate 41 Time and Effort Reporting Big picture changes: Greater flexibility in time and effort reporting Focuses on internal controls that should be in place to justify salaries and wages, and provides latitude in meeting those standards Personnel activity reports encouraged but no longer required 42 Time and Effort Reporting Records supporting salaries and wages must: Be supported by a system of internal control which provides reasonable assurance that charges are accurate, allowable, and properly allocated Be incorporated into the entity’s official records Reasonably reflect the total activity for which the employee is compensated, not exceeding 100% of compensated activities 43 Time and Effort Reporting Records supporting salaries and wages must: Comply with the established accounting policies and practices of the entity Support the distribution of the employee’s salary or wages among specific activities or cost objectives 44 Time and Effort Reporting Budget estimates determined before services are performed: Do NOT qualify as support for payroll costs May be used for interim accounting purposes under certain circumstances if trued up later 45 Time and Effort Reporting Use of percentages and estimates: Records may reflect distribution of time as a percentage as opposed to by hours Rules acknowledge that some estimates are necessary to allocate time between teaching, research, service and administration in an academic setting 46 Time and Effort Reporting If records meet the requirements described above, entities will not be required to provide any additional support or documentation for the work performed If records do NOT meet the requirements described above, the federal government may require personal activity reports, certifications, or equivalent documentation 47 Time and Effort Reporting For non-exempt employees, records indicating the total number of hours worked each day are still required pursuant to Department of Labor regulations The regulations encourage cognizant agencies to approve alternative proposals based on outcomes or milestones for program performance. If approved, these would be an acceptable alternative for the time and effort reporting requirements. 48 Dependent Care Costs for Conferences In an effort to encourage entities to have family-friendly policies, the following costs are allowable: For hosts of conferences, the cost of identifying (but not providing) locally available child-care resources Temporary dependent care costs that result directly from travel to conferences 49 Required Certifications The annual and final fiscal reports or vouchers requesting payment under a federal award must include a certification Certification must be signed by an official that can legally bind the organization 50 Certification Language “By signing this report, I certify to the best of my knowledge and belief that the report is true, complete, and accurate, and the expenditures, disbursements and cash receipts are for the purposes and objectives set forth in the terms and conditions of the Federal award. I am aware that any false, fictitious, or fraudulent information, or the omission of any material fact, may subject me to criminal, civil or administrative penalties for fraud, false statements, false claims or otherwise. (U.S. Code Title 18, Section 1001, and Title 31, Sections 3729-3730 and 3801-3812).” 51 Other Requirements Section 200.407 of the Super Circular provides one location that entities can consult for all circumstances in which prior approval from the federal awarding agency is required. Increases the threshold to $50 million from $25 million for filing a cost-accounting disclosure statement for approval by the funding agency 52 Other Requirements For fiscal years beginning on or after January 1, 2016, financing costs associated with patents and computer software are allowable Note that the cost principles included in Subpart E do not include cost principles for hospitals. OMB has indicated that these will be added at a later date. 53 Questions 54 Changes to Administrative Requirements Administrative Requirements – Key Changes Procurement Requirements Contractor vs. Subrecipient Determination Pass-Through Entity Responsibilities Internal Control Property Standards Interest Earned on Advances Personally Identifiable Information 56 Procurement Requirements The Super Circular defines five methods of procurement to be used: Micro purchases – less than $3,000 (or $2,000 for construction subject to Davis Bacon) Small purchases – $3,000 to $150,000 (the Simplified Acquisition Threshold) Sealed bid purchases – Over $150,000; preferred for construction 57 Procurement Requirements The Super Circular defines five methods of procurement to be used: Competitive proposal purchases – Over $150,000; used when a sealed bid is not appropriate Noncompetitive purchases – special circumstances applicable to all levels 58 Micro Purchases Purchase orders may be awarded without soliciting competitive quotations if costs are considered reasonable by the entity To the extent possible, purchases must be distributed equitably among qualified suppliers 59 Small Purchases Price or rate quotations must be obtained from an adequate number of qualified sources The number of quotations obtained and the form of the quotations (e.g. writing, orally, price list on website, generated by online search engine) are up to the entity 60 Sealed Bid Purchases Bids are publicly solicited Firm, fixed price contract awarded to lowest responsible bidder Invitation for bids must be publicly solicited providing sufficient response time before the bid opening Invitation must include necessary specifications for the bidder to properly respond 61 Sealed Bid Purchases Bids are opened at the time and place prescribed in the invitation for bids Any and all bids may be rejected if there is a sound documented reason 62 Conditions Necessary for Sealed Bid Purchases Complete, adequate, and realistic specification or purchase description is available Two or more responsible bidders are willing and able to compete effectively for the business The procurement lends itself to a firm fixed price contract and the selection of a successful bidder can be made principally on the basis of price 63 Competitive Proposal Purchases Used when conditions are not appropriate for sealed bids Requests for proposals are publicized and identify evaluation factors Proposals solicited from an adequate number of qualified sources Must use written method for conducting technical evaluations of the proposals received 64 Competitive Proposal Purchases Contracts awarded to the responsible firm whose proposal is most advantageous to the program, with price and other factors considered For architectural and engineering services, it is acceptable to evaluate competitors’ qualifications, select the most qualified, and then negotiate a fair and reasonable price 65 Noncompetitive purchases Only permitted when one or more of the following circumstances apply: The item is only available from a single source Public exigency or emergency Federal awarding agency or pass-through entity authorizes noncompetitive proposals After solicitation of a number of sources, competition is determined inadequate 66 The Procurement “Claw” 67 Contractor vs. Subrecipient The term “contractor” replaces the term “vendor” going forward The Super Circular provides guidance to differentiate between contractor and subrecipient Must look to substance of the award, not merely titles used 68 Subrecipient A subaward is for the purpose of carrying out a portion of the Federal Award Creates a Federal assistance relationship with the subrecipient 69 Characteristics of a Subrecipient Determines who is eligible to receive assistance Has its performance measured against objectives of a federal program Has a responsibility for programmatic decision making Must adhere to federal program requirements Uses funds to carry out a program for a public purpose 70 Contractor A contract is for the purpose of obtaining goods and services for entity’s own use Creates a procurement relationship with the contractor 71 Characteristics of a Contractor Provides goods/services within normal business operations Provides similar goods/services to many purchasers Normally operates in a competitive environment Provides goods/services ancillary to program Not subject to federal compliance requirements 72 Pass-Through Entity Responsibilities The Super circular requires that pass-through entities clearly communicate that an award is federal in origin and specifies data elements that pass-through entities must provide to subrecipients. 73 Pass-Through Entity Responsibilities Data to communicate to subrecipients: Subrecipient name Subrecipient DUNS number Federal Award Identification Number (FAIN) Federal Award Date Subaward Period of Performance Start and End Date Amount of Federal Awards Obligated by This Action 74 Pass-Through Entity Responsibilities Data to communicate to subrecipients: Total Federal Awards Obligated to Subrecipient Total Amount of Federal Award Federal award project description Federal Award Date Name of Federal Awarding Agency Name of Pass-Through Entity Contact Name For Awarding Official 75 Pass-Through Entity Responsibilities Data to communicate to subrecipients: CFDA Number and Name Identification of Whether the Award is R&D Indirect Cost Rate for The Award (including if the de minimis rate is used) 76 Pass-Through Entity Responsibilities The Super Circular requires entities to perform risk assessment procedures over subrecipients to determine the appropriate level of subrecipient monitoring necessary 77 Pass-Through Entity Responsibilities Pass-through entities must monitor subrecipients by: Reviewing financial and programmatic reports required by the pass-through entity Ensuring timely and appropriate action is taken to resolve all deficiencies pertaining to the federal award identified through audits and on-site reviews Issuing a management decision for audit findings pertaining to the federal award 78 Pass-Through Entity Responsibilities Pass-through entities must monitor subrecipients by: Provide training to subrecipients as necessary Performing on-site reviews as necessary Arranging for agreed-upon procedures engagements as necessary Verify that each subrecipient has a Single Audit performed if required to do so 79 Internal Control The Super Circular explicitly requires that entities establish and maintain effective internal control that provides assurance that an entity is managing federal awards in compliance with federal statutes, regulations, and terms and conditions of federal awards Much more explicit than current grant-related requirements 80 Internal Control The Super Circular states that an entity’s internal controls “should” be in compliance with: GAO’s Standards for Internal Controls in the Federal Government (Green Book) COSO’s Internal Control Integrated Framework COFAR’s Q&A document issued in August 2014 clarifies that “should” in this context means these frameworks are best practices, not a prescriptive requirement 81 Property Standards Computers are considered to be supplies (not equipment) if acquisition cost is below the lesser of $5,000 or the client’s capitalization threshold Equipment no longer needed for federal award with fair market value < $5,000 may be retained, sold or disposed of with no further obligation to the federal awarding agency 82 Property Standards For equipment no longer needed for federal award with fair market value > $5,000, the entity must request disposition instructions from the federal awarding agency If no disposition instructions within 120 days, entity may sell or dispose of the equipment Federal agency is entitled to its proportional share of fair market value or sales proceeds 83 Interest Earned on Advances Threshold below which interest earnings may be retained increased from $250 to $500 All required interest earning remittances must be remitted annually to specific Department of Health and Human Services address Previously, entities were required to remit this interest “promptly” to each federal awarding agency 84 Personally Identifiable Information (PII) Super Circular defines protected PII—first name or first initial and last name in combination with: Social security number Passport number Credit card number Clearances Bank numbers 85 Personally Identifiable Information (PII) Specifies protected PII—first name or first initial in last name in combination with: Biometrics Date or place of birth Mother’s maiden name Criminal, medical and financial records Educational transcripts 86 Personally Identifiable Information (PII) Requires entities to take reasonable steps to safeguard protected PII Requires that auditee certify that there is no protected PII in submitted Single Audit reporting package 87 Questions 88 Action Steps Action Steps to Prepare for Implementation of Super Circular Determine that your procurement procedures are in compliance with the Super Circular Determine that your time and effort reporting system is in compliance with the Super Circular Evaluate whether you will request an indirect cost rate extension or use the 10% de minimis rate Using the new criteria in the Super Circular, make contractor vs. subrecipient determinations 90 Action Steps to Prepare for Implementation of Super Circular Determine whether you are providing subrecipients the required information and that you are performing required monitoring steps Evaluate your internal control structure—does it measure up to COSO and/or the Green Book? Determine that your financial reporting system tracks and captures all necessary data for federal awards 91 Action Steps to Prepare for Implementation of Super Circular Evaluate property purchased with federal funds—will you dispose of any of it given the new guidelines? Ensure required certifications are in place for annual and final reports and identify certifying official Evaluate the impact of the changes to Single Audit requirements, and determine the status of prior year audit findings 92 Action Steps to Prepare for Implementation of Super Circular Verify that your Single Audit report will meet the latest FAC requirements for finding numbering and text searchability Determine that you have appropriate internal controls in place to safeguard PII 93 Questions 94