COMPOUND INTEREST AND

PRESENT VALUE

McGraw-Hill/Irwin

Chapter Twelve

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

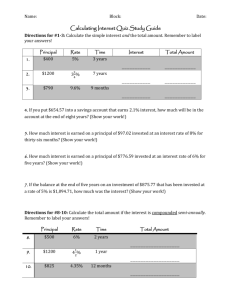

LEARNING UNIT OBJECTIVES

LU 12-1 Compound Interest (Future Value) – The Big Picture

1.

Compare simple interest with compound interest.

2.

Calculate the compound amount and interest manually and by

table lookup.

3.

Explain and compute the effective rate (APY).

LU 12-2 Present Value -- The Big Picture

1.

Compare present value (PV) with compound interest (FV).

2.

Compute present value by table lookup.

3.

Check the present value answer by compounding.

12-2

COMPOUNDING INTEREST

(FUTURE VALUE)

Compounding –

Compound Interest –

Involves the calculation of interest

periodically over the life of the loan or

investment

The interest on the principal plus the

interest of prior periods

Future Value (compound amount) –

Present Value –

The final amount of the loan or

investment at the end of the last

period

The value of a

loan or investment today

12-3

COMPOUNDING TERMS

Compounding Periods

Interest Calculated

Compounding Annually

Once a year

Compounding Semiannually

Every 6 months

Compounding Quarterly

Every 3 months

Compounding Monthly

Every month

Compounding Daily

Every day

12-4

FUTURE VALUE OF $1 AT 8% FOR FOUR

PERIODS (FIGURE 12.1)

Compounding goes from present value to future value

$5.00

$4.50

$4.00

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$0.00

Future

Value

Present

value

$1.00

0

After 1

period,

$1 is

worth

$1.08

After 2

periods,

$1 is

worth

$1.17

$1.08

$1.1664

1

2

Number of periods

After 3

periods,

$1 is

worth

$1.26

After 4

periods,

$1 is

worth

$1.36

$1.2597

$1.3605

3

4

12-5

FUTURE VALUE OF $1 AT 8% FOR

FOUR PERIODS (FIGURE 12.1)

Manual Calculation

Year 1

Year 2

Year 3

Year 4

$

1.00 $

1.08 $

1.17 $

1.26

0.08

0.08

0.08

0.08

Interest

$

0.08 $

0.09 $

0.09 $

0.10

Beg. Bal

1.00

1.08

1.17

1.26

End of year $

1.08 $

1.17 $

1.26 $

1.36

12-6

TOOLS FOR CALCULATING

COMPOUND INTEREST

Number of periods (N)

Number of years multiplied by

the number of times the

interest is compounded per

year

Rate for each period (R)

Annual interest rate divided by

the number of times the

interest is compounded per year

If you compounded $100 for 4 years at 8% annually,

semiannually, or quarterly, what is N and R?

Periods

Rate

Annually:

4x1=4

Annually:

8% / 1 = 8%

Semiannually:

4x2=8

Semiannually:

8% / 2 = 4%

Quarterly:

4 x 4 = 16

Quarterly:

8% / 4 = 2%

12-7

SIMPLE VERSUS COMPOUND INTEREST

Simple

Compounded

Bill Smith deposited $80 in a savings

account for 4 years at an annual

interest rate of 8%. What is Bill’s

simple interest and maturity value?

I=PxRxT

I = $80 x .08 x 4

I = $25.60

MV = $80 + $25.60

MV = $105.60

Bill Smith deposited $80 in a savings

account for 4 years at an annual

interest rate of 8%. What is Bill’s

interest and compounded amount?

Year 1

Year 2

Year 3

Year 4

$

80.00 $ 86.40 $ 93.31 $ 100.77

x .08

x .08

x .08

x .08

Interest

$

6.40 $

6.91 $

7.46 $

8.06

Beg. bal

80.00

86.40

93.31

100.77

End of year $

86.40 $ 93.31 $ 100.77 $ 108.83

Interest: $108.83 -- $80.00 = $28.83

12-8

CALCULATING COMPOUND AMOUNT

BY TABLE LOOKUP

Step 1. Find the periods: Years multiplied by number of times

interest is compounded in 1 year.

Step 2. Find the rate: Annual rate divided by number of times

interest is compounded in 1 year.

Step 3. Go down the period column of the table to the number

desired; look across the row to find the rate. At the

intersection is the table factor for the compound amount of

$1.

Step 4. Multiply the table factor by the amount of the loan. This

gives the compound amount.

12-9

FUTURE VALUE OF $1 AT COMPOUND

INTEREST (TABLE 12.1)

Future value of $1 at compound interest (Partial)

Period

1%

1.50%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1

1.0100

1.0150

1.0200

1.0300

1.0400

1.0500

1.0600

1.0700

1.0800

1.0900

1.1000

2

1.0201

1.0302

1.0404

1.0609

1.0816

1.1025

1.1236

1.1449

1.1664

1.1881

1.2100

3

1.0300

1.0457

1.0612

1.0927

1.1249

1.1576

1.1910

1.2250

1.2597

1.2950

1.3310

4

1.0406

1.0614

1.0824

1.1255

1.1699

1.2155

1.2625

1.3108

1.3605

1.4116

1.4641

5

1.0510

1.0773

1.1041

1.1593

1.2167

1.2763

1.3382

1.4026

1.4693

1.5386

1.6105

6

1.0615

1.0934

1.1262

1.1941

1.2653

1.3401

1.4185

1.5007

1.5869

1.6771

1.7716

7

1.0721

1.1098

1.1487

1.2299

1.3159

1.4071

1.5036

1.6058

1.7138

1.8280

1.9487

8

1.0829

1.1265

1.1717

1.2668

1.3686

1.4775

1.5938

1.7182

1.8509

1.9926

2.1436

9

1.0937

1.1434

1.1951

1.3048

1.4233

1.5513

1.6895

1.8385

1.9990

2.1719

2.3579

10

1.1046

1.1605

1.2190

1.3439

1.4802

1.6289

1.7908

1.9672

2.1589

2.3674

2.5937

11

1.1157

1.1780

1.2434

1.3842

1.5395

1.7103

1.8983

2.1049

2.3316

2.5804

2.8531

12

1.1260

1.1960

1.2682

1.4258

1.6010

1.7959

2.0122

2.2522

2.5182

2.8127

3.1384

13

1.1381

1.2135

1.2936

1.4685

1.6651

1.8856

2.1329

2.4098

2.7196

3.0658

3.4523

14

1.1495

1.2318

1.3195

1.5126

1.7317

1.9799

2.2609

2.5785

2.9372

3.3417

3.7975

15

1.1610

1.2502

1.3459

1.5580

1.8009

2.0789

2.3966

2.7590

3.1722

3.6425

4.1772

12-10

CALCULATING COMPOUND AMOUNT

BY TABLE LOOKUP

Pam Donahue deposits $8,000 in her savings account that pays 6%

interest compounded quarterly. What will be the balance of her

account at the end of 5 years?

Periods (N) = 4 x 5 = 20

Rate (R) = 6%/4 = 1.5%

Table Factor = 1.3469

Compounded Amount:

$8,000 x 1.3469 = $10,775.20

12-11

NOMINAL AND EFFECTIVE RATES (APY)

OF INTEREST

Nominal Rate (stated rate) –

The rate on which the bank calculates interest

Effective rate (APY) = Interest for 1 year

Principal

12-12

CALCULATING EFFECTIVE RATE APY

12-13

NOMINAL AND EFFECTIVE RATES (APY)

OF INTEREST COMPARED (FIGURE 12.3)

12-14

COMPOUNDING INTEREST DAILY

(TABLE 12.2)

Interest on a 1% deposit compounded daily--360 day basis

Period

6.00%

6.50%

7.00%

7.50%

8.00%

8.50%

9.00%

9.50%

10.00%

1

1.0618

1.0672

1.0725

1.0779

1.0833

1.0887

1.0942

1.0996

1.1052

2

1.1275

1.1388

1.1503

1.1618

1.1735

1.1853

1.1972

1.2092

1.2214

3

1.1972

1.2153

1.2337

1.2523

1.2712

1.2904

1.3099

1.3297

1.3498

4

1.2712

1.2969

1.3231

1.3498

1.3771

1.4049

1.4333

1.4622

1.4917

5

1.3498

1.3840

1.4190

1.4549

1.4917

1.5295

1.5862

1.6079

1.6486

6

1.4333

1.4769

1.5219

1.5682

1.6160

1.6652

1.7159

1.7681

1.8220

7

1.5219

1.5761

1.6322

1.6904

1.7506

1.8129

1.8775

1.9443

2.0136

8

1.6160

1.6819

1.7506

1.8220

1.8963

1.9737

2.0543

2.1381

2.2253

9

1.7159

1.7949

1.8775

1.9639

2.0543

2.1488

2.2477

2.3511

2.4593

10

1.8220

1.9154

2.0136

2.1168

2.2253

2.3394

2.4593

2.5854

2.7179

15

2.4594

2.6509

2.8574

3.0799

3.3197

3.5782

3.8568

4.1571

4.4808

20

3.3198

3.6689

4.0546

4.4810

4.9522

5.4728

6.0482

6.6842

7.3870

25

4.4811

5.0777

5.7536

6.5195

7.3874

8.3708

9.4851

10.7477

12.1782

30

6.0487

7.0275

8.1645

9.4855

11.0202

12.8032

14.8747

17.2813

20.0772

12-15

COMPOUNDING INTEREST DAILY

Use Table 12.2 to calculate what $1,500 compounded daily for

5 years will grow to at 7%.

N=5

R = 7%

Factor, 1.4190

$1,500 x 1.4190 = $2,128.50

12-16

PRESENT VALUE OF $1 AT

8% FOR FOUR PERIODS (FIGURE 12.4)

Present value goes from the future value to the present value

$1.20

$1.10

$1.00

$0.90

$0.80

$0.70

$0.60

$0.50

$0.40

$0.30

$0.20

$0.10

$0.00

Future Value

Present

value

$.7350

0

$.7938

1

$.8573

2

$.9259

3

$1.0000

4

Number of periods

12-17

CALCULATING PRESENT VALUE BY

TABLE LOOKUP

Step 1. Find the periods: Years multiplied by number of times

interest is compounded in 1 year.

Step 2. Find the rate: Annual rate divided by number of times

interest is compounded in 1 year.

Step 3. Go down the Period column of the table to the number

desired; look across the row to find the rate. At the

intersection of the two columns is the table factor for the

compound value of $1.

Step 4. Multiply the table factor by the future value. This is the

present value.

12-18

PRESENT VALUE OF $1 AT END PERIOD

(TABLE 12.3)

Present value of $1 at end period (partial)

Period

1%

1.50%

2%

3%

4%

5%

6%

7%

8%

9%

1

0.9901

0.9852

0.9804

0.9709

0.9615

0.9524

0.9434

0.9346

0.9259

0.9174

0.9091

2

0.9803

0.9707

0.9612

0.9426

0.9246

0.9070

0.8900

0.8734

0.8573

0.8417

0.8264

3

0.9706

0.9563

0.9423

0.9151

0.8890

0.8638

0.8396

0.8163

0.7938

0.7722

0.7513

4

0.9610

0.9422

0.9238

0.8885

0.8548

0.8227

0.7921

0.7629

0.7350

0.7084

0.6830

5

0.9515

0.9283

0.9057

0.8626

0.8219

0.7835

0.7473

0.7130

0.6806

0.6499

0.6209

6

0.9420

0.9145

0.8880

0.8375

0.7903

0.7462

0.7050

0.6663

0.6302

0.5963

0.5645

7

0.9327

0.9010

0.8706

0.8131

0.7599

0.7107

0.6651

0.6227

0.5835

0.5470

0.5132

8

0.9235

0.8877

0.8535

0.7894

0.7307

0.6768

0.6274

0.5820

0.5403

0.5019

0.4665

9

0.9143

0.8746

0.8368

0.7664

0.7026

0.6446

0.5919

0.5439

0.5002

0.4604

0.4241

10

0.9053

0.8617

0.8203

0.7441

0.6756

0.6139

0.5584

0.5083

0.4632

0.4224

0.3855

11

0.8963

0.8489

0.8043

0.7224

0.6496

0.5847

0.5268

0.4751

0.4289

0.3875

0.3505

12

0.8874

0.8364

0.7885

0.7014

0.6246

0.5568

0.4970

0.4440

0.3971

0.3555

0.3186

13

0.8787

0.8240

0.7730

0.6810

0.6006

0.5303

0.4688

0.4150

0.3677

0.3262

0.2897

14

0.8700

0.8119

0.7579

0.6611

0.5775

0.5051

0.4423

0.3878

0.3405

0.2992

0.2633

15

0.8613

0.7999

0.7430

0.6419

0.5553

0.4810

0.4173

0.3624

0.3152

0.2745

0.2394

10%

12-19

COMPARING COMPOUND INTEREST (FV)

(TABLE 12.1) WITH

PRESENT VALUE (PV) (TABLE 12.3)

Compound value Table 12.1

Table

Present Future

12.1

Value

Value

1.3605 x $80 = $108.84

Present value Table 12.3

Table

Future

Present

12.3

Value

Value

(N = 4, R = 8%)

(N = 4, R = 8%)

We know the

present dollar

amount and find

what the dollar

amount is worth in

the future.

.7350

x

$108.84 = $80.00

We know the

future dollar

amount and find

what the dollar

amount is worth in

the present.

12-20

CALCULATING PRESENT VALUE AMOUNT

BY TABLE LOOKUP

Rene Weaver needs $20,000 for college in 4 years. She can earn 8% compounded

quarterly at her bank. How much must Rene deposit at the beginning of the year to

have $20,000 in 4 years?

Invest

Today

Periods (N) = 4 x 4 = 16

Rate (R) = 8%/4 = 2%

Table Factor = .7284

Compounded Amount:

$20,000 x .7284 = $14,568

12-21