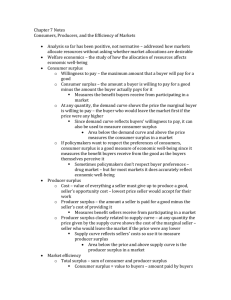

Notes for Chapter 4

advertisement

Notes for Chapter 4 ECON 2390 Objectives To define Economic efficiency Explanation of how markets work Fairness and social efficiency Social costs External costs and benefits Refine the concept of public goods 2 Economic Efficiency Efficiency is measured in a market context. A market is a social mechanism whereby humans can exchange goods and services Common markets Labour Services (accounting, education… Goods (housing, cars…) Others (?) All markets have two key elements Demand (relation between quantity of outputs and marginal willingness to pay) Supply (relation between quantity of output and marginal willingness to produce) 3 Efficient allocation TP MW Price A C M Equilibrium occurs when MWTP = MC At this position, consumer surplus plus producer surplus is greatest B P1 Q1 Demand = supply. Quantity 4 Efficiency and equilibrium At the equilibrium position in the demand supply relation, there is no incentive fro anyone to change prices or quantities. Changes on the consumer side include: Wealth Income Population. Changes on the producer side include: Technology that reduces costs Shortages in key supplies (oil) that raise costs and shift supply. 5 The Norm of Perfect Competition If: Each buyer and seller is small – no monopoly (single seller) or monopsony (single buyer). A market has Many buyers and sellers. Perfect information exists (all buyers and sellers have the same, full knowledge of market opportunities and any change is known by all instantaneously). The costs of becoming a buyer or seller are negligible. Then: Prices will reflect only the cost of production and no “extra” profit will be earned. No seller will earn more or less than any other seller. The economic rationale for intervention to adjust the distribution of benefits (goods and services) that would exist in a competitive equilibrium. 6 Changes in social surplus Consumer surplus is the difference between the personal assessment of value and price. Producer surplus is difference between the price and the willingness to sell price. Social surplus is the sum of consumer and producer surplus. Implications of perfect competition 1. Prices reflect the full cost of production. 2. No profit is earned, no rent is earned. 3. Prices adjust instantaneously to any shock. 7 Small problem – perfect competition never exists But then neither do perfect children, perfect spouses, etc. That does not prevent us from imaging an ideal against which to compare the existing state, and under some conditions to effect a policy change This seems like an ideal world, except: no incentive to innovate, explore or do anything new. technical and social change do not occur. Imperfection impels change 8 Main deviations from perfect competition Public goods – goods and services where the value cannot be entirely appropriated by the seller/producer Pure public good – production means that anyone can share without having to pay (radio broadcasts) Mixed public good – production involves benefits/harms that are exist, but the purchaser still retains much of the benefit, the producer does not bear all of the costs.. Market failure – private costs/benefits diverge from public costs/benefits. 9 Two important deviations from perfect competition Monopoly/monopsony (single seller or buyer) Sellers use trademarks, predatory pricing and coercive tactics to extract extra income from consumers/taxpayers. Natural monopoly conferred by technical features that allow the incumbent supplier to enjoy falling costs (increased profits) arising from expansion, thereby preventing entrants. Externalities (pollution) Consumers and producers (more often) create by-products that affect the welfare of those who are not direct parties to transactions. This means that the cost to the consumer (private cost) does not include all costs since some are borne by those who may not consume the product directly. 10 Why does government exist? Three main rationales for public sector action: 1. 2. 3. Market failure (consumer ignorance of mortgages, pollution) Externalities (public goods and bads) Distributional unfairness (poverty) Market failure typically evokes a regulatory response (e.g., consumer education, fair lending laws, securities regulation). Public goods encourage government to supplement private sector provision of a good or services (e.g., subsidization of crop insurance, subsidization of vaccines, public education). Distributional fairness can result in regulatory, direct provision of a service, or direct cash transfer Laws regarding usury, anti-discrimination legislation Public housing National child benefit, progressive tax, GST rebate for lower income households 11 Government provided goods and services Pure Public Goods Public Goods Market Failure Defence, public health, external trade, education, transportation infrastructure Risk management Subsidies to basic research, northern geo-science mapping Information failures Moral hazard, asymmetric information, time myopia.. External effects Pollution control, subsidies to education, compulsory vaccination... Decreasing Cost Regulation (price, profits, revenues..), nationalization Market Manipulation Prosecution, fines, incarceration ... Monopoly Merit Goods Definition of government initiatives Social marketing to promote a goal (articulation of goal or intent; guidance on preferred behaviour) Expenditures on goods and services Direct resource commitments on goods (public housing, vaccination) Direct resource commitments on services (consumer information, training) Tax expenditures (tax deductions and credits awarded to citizens and businesses to behave, spend, invest, etc.) Grants/contributions/contracts to third parties to perform services Legislation is a general framework for how citizens conduct themselves (smoking bans, criminal code) and requires political assent. Regulation modifies elements of legislation (changes to the speed limit) and can be completed by administrative fiat. 13 Information Failure Moral hazard Market participants alter their behaviour in response to the divergence of public and private costs Taxes/subsidies cause market participants to purchase/sell less/more than would have occurred with prices equal to the marginal cost Asymmetry of information Sellers are typically more informed than buyers Prisoners paradox - information lack produces sub-optimal outcomes Uncertainty about other players reactions causes poor decisions Nash equilibrium exists when I account for your probable reaction to my choices. Equilibrium exists when we have all adjusted and readjusted to each others choices/decisions. 14 Government provided goods and services Public Goods Merit Goods Quality of Life Support for arts ,recreational sports, community centres, ethno cultural support... Nationalism Support for elite arts and sports,... Redistribution Progressive income tax, National Child Benefit, GST rebate... Safety Net Social assistance, employment insurance, farm safety nets, workers’ compensation... Equity, Fairness Demand (MWTP) for public goods Recall that consumption of a private good is internal between the consumer and producer. Buying and eating a hamburger is internal to the cook/seller and the eater/buyer, We get to a total demand (MWTP) by adding horizontally. Consumption of a public good involves some externality. Clean air is a public good, since it involves non-rivalry (my consumption does not reduce your consumption) and nonexclusion (I cannot limit or exclude you). We get to total demand by adding vertically. 16