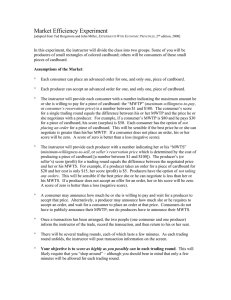

Market Efficiency Experiment

advertisement

Market Efficiency Experiment [adapted from Ted Bergstrom and John Miller, EXPERIMENTS WITH ECONOMIC PRINCIPLES, 2nd edition, 2000] In this experiment, the instructor will divide the class into two groups. Some of you will be producers of small rectangles of colored cardboard; others will be consumers of these small pieces of cardboard. Assumptions of the Market: Each consumer can place an advanced order for one, and only one, piece of cardboard. Each producer can accept an advanced order for one, and only one, piece of cardboard. The instructor will provide each consumer with a number indicating the maximum amount he or she is willing to pay for a piece of cardboard: the “MWTP” (maximum-willingness-to-pay, or consumer’s reservation price) is a number between $1 and $100. The consumer’s score for a single trading round equals the difference between his or her MWTP and the price he or she negotiates with a producer. For example, if a consumer’s MWTP is $80 and he pays $30 for a piece of cardboard, his score (surplus) is $50. Each consumer has the option of not placing an order for a piece of cardboard. This will be sensible if the best price he or she can negotiate is greater than his/her MWTP. If a consumer does not place an order, his or her score will be zero. A score of zero is better than a loss (negative score). The instructor will provide each producer with a number indicating her or his “MWTS” (minimum-willingness-to-sell, or seller’s reservation price which is determined by the cost of producing a piece of cardboard [a number between $1 and $100]). The producer’s (or seller’s) score (profit) for a trading round equals the difference between the negotiated price and her or his MWTS. For example, if a producer takes an order for a piece of cardboard for $20 and her cost is only $15, her score (profit) is $5. Producers have the option of not taking any orders. This will be sensible if the best price she or he can negotiate is less than her or his MWTS. If a producer does not accept an offer for an order, her or his score will be zero. A score of zero is better than a loss (negative score). A consumer may announce how much he or she is willing to pay and wait for a producer to accept that price. Alternatively, a producer may announce how much she or he requires to accept an order, and wait for a consumer to place an order at that price. Consumers do not have to publicly announce their MWTP; nor do producers have to announce their MWTS. Once a transaction has been arranged, the two people (one consumer and one producer) inform the instructor of the trade, record the transaction, and then return to his or her seat. There will be several trading rounds, each of which lasts a few minutes. As each trading round unfolds, the instructor will post transaction information on the screen. Your objective is to score as highly as you possibly can in each trading round. This will likely require that you “shop around” – although you should bear in mind that only a few minutes will be allowed for each trading round. Market Efficiency Experiment Warm-Up Exercises After reading the set-up for this experiment on the previous page, please check your understanding by answering the following questions. Suppose that a supplier with a MWTS of $20 meets a demander with a MWTP of $40. 1. If the supplier sells a cardboard rectangle to the demander for a negotiated price of $35, how much profit will the supplier make? __________ 2. How much of a surplus will the demander realize? __________ 3. How much is the total surplus (seller’s profit + consumer’s surplus) made by the two traders? __________ 4. What is the highest price that the two could negotiate that would permit both the seller and the buyer to make a surplus? __________ 5. If this price were to be negotiated, how much would the sum of the buyer’s surplus and seller’s profits be? __________ 6. What is the lowest price that the two could negotiate that would permit both the seller and the buyer to make a surplus? __________ 7. If this price were to be negotiated, how much would the sum of the buyer’s surplus and seller’s profits be? __________