FINANCIAL AWARENESS

Checking & Savings Accounts

Lesson 3: Managing a Checking Account – Part 2

Instructor PowerPoint

Copyright © 2009, Thinking Media, a division of SAI Interactive, Inc. All rights reserved. The Career Ready 101 logo is a registered trademark and Career Ready 101 is

a trademark of SAI Interactive, Inc.

Sample Checking Account

Statement

Distribute Handout #1: Sample Checking

Account Statement

2

Checking Account Statement

Each month, you should receive a Checking

Account Statement or Bank Statement from

your bank detailing all of the transactions

for the specified time period.

It is extremely important to

review your bank statement

upon receipt to check for

discrepancies and errors.

3

Checking Account Statement

At most banks, if you do not report an error

or discrepancy within 60 days of receipt of

your statement you will be held responsible

for those transactions.

You should compare your

Transaction Register to the

monthly Checking Account

Statement and balance your

account.

4

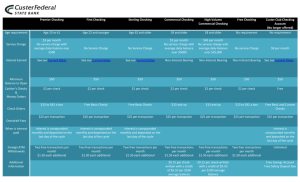

Reading a Bank Statement

Most monthly statements include the same information.

Bank and Customer Information

At the top of the statement you will see the bank name

and branch location and your personal information to

include name, address and account number.

You will also see the type

of account (i.e., checking,

savings, money market, etc.)

and the period of time for the

transactions.

5

Reading a Bank Statement

Summary Section

The summary section of the statement will

show the total amount for the specified time

period for the following:

• Beginning Balance (this should match the

Ending Balance on

your previous

statement)

6

Reading a Bank Statement

Summary Section Cont.

• Deposits & Credits (+) (includes all direct

and manual deposits and if applicable,

reversed charges)

• Net Interest Earned (+) (if checking account

earns interest)

• Automatic Transfers (+) (if you have funds

automatically transferred to your checking

account from another account)

7

Reading a Bank Statement

Summary Section Cont.

• Withdrawals (-) (includes all ATM and Debit

Card transactions and automatic payments)

• Fees (-) (if applicable, bank service charges)

8

Reading a Bank Statement

Summary Section Cont.

• Checks Converted (-) (These are checks that

were electronically converted by the

merchant.

• This process is similar to a debit card in that

the money is immediately deducted from

your account.)

• Checks (-) (checks that were written and

cleared during the specified time period)

9

Reading a Bank Statement

Summary Section Cont.

• Ending Balance (this is the balance in your

account as of the end of the specified time

period.

• Note: This Ending Balance does not usually

match the Balance in your Transaction

Register.

• You have to reconcile your account to

ensure it is balanced.

10

Reading a Bank Statement

Summary Section Cont.

• Minimum Balance (this is the lowest balance in

your account during the specified time period)

• Average Balance (this the average balance on your

account during the specified time period)

• Annual Percentage Yield Earned (if you have an

interest bearing checking account, this is the

annual percentage amount you earn on the

account.)

11

Reading a Bank Statement

Summary Section Cont.

• Interest This Period (if applicable, the amount of

interest earned during the specified time period.)

• YTD Interest (if applicable, the amount of interest

earned Year to Date (YTD) on the account. YTD is a

calendar year Jan. to Dec. and is used for tax

purposes.)

12

Exercise #2: Managing a

Checking Account

Distribute Exercise #2: Managing a Checking

Account.

You will use this handout throughout

Managing a Checking Account –

Part 2 to mark your

responses to questions.

13

Exercise #2: Managing a Checking Account

Question 1

Directions:

Circle the best answer to the question.

Question 1

Where on a Checking Account Statement would

you find the total amount of deposits?

A.

B.

C.

D.

Interest This Period section

Deposits & Credits section

Withdrawals section

Ending Balance section

14

Reading a Bank Statement

Deposits & Credits Section

This section of the statement will show a detailed

listing of all the deposit and credit transactions

during the specified time period.

It will include the transaction date, a description of

the transaction and the amount of the transaction

with the total deposits and credits.

15

Reading a Bank Statement

Interest Section

If applicable, this section will show a detailed

listing of the interest earned on the account

for the specified time period. It will include

the date the interest was posted to the

account and the amount.

16

Reading a Bank Statement

Automatic Transfers Section

If applicable, this section will show a detailed

listing of the automatic transfers to include

the date the transfer was posted to the

account, a description of the transfer and the

amount.

17

Reading a Bank Statement

Withdrawals Section

This section will show a detailed listing of all the ATM,

debit card and automatic payment transactions

during the specified time period.

It will include the transaction date, a description of

the transaction and/or business name and the

amount of the

transaction with

the total withdrawals.

18

Reading a Bank Statement

Fees Section

If applicable, this section will

detail all fees deducted from

the account.

It will include the date the fee was

deducted, a description of the fee

and the amount of the fee with the

total fees deducted from the account during

the specified time period.

19

Reading a Bank Statement

Checks Converted Section

This section will show a detailed list of the checks

that were converted by the merchant to an electronic

withdrawal.

It will include the date the check was converted, the

check number, a description of the transaction and/or

business name and the amount of the transaction

with a total of checks converted.

20

Reading a Bank Statement

Checks Converted Section Cont.

Note: Checks that are converted by a merchant to an

electronic withdrawal are not normally returned to the

bank.

Therefore, if you receive check

enclosures or check images with

your monthly statement, these checks

will not be included.

21

Reading a Bank Statement

Checks Section

This section will show a detailed list of all the checks

that were posted to your account during the specified

time period.

It will include the date, the check number and

amount.

The checks are listed in number order.

22

Reading a Bank Statement

Checks Section Cont.

If you see a (*) next to a check number, it means there

is a break in the check number sequence.

Missing check numbers may appear in

the Checks Converted section of the

statement or they have not cleared

your account yet.

Note: The totals shown at the bottom

of each section should match the totals

shown in the Summary Section of the

statement.

23

Reading a Bank Statement

Daily Balance Summary Section

This section will show your daily account balance for

every business day during the specified time period.

You can look for trends in highs and lows and try to

adjust your budget to better manage your money.

Check Enclosures or Check Images

If applicable, your processed checks or

check images will be included with the

statement.

You can use this information to balance

your account or keep them as proof of

payment.

24

Reading a Bank Statement

Account Balance Worksheet

Most bank statements include an Account

Balance Worksheet that you can use to

reconcile your account to make sure you

balance.

25

Exercise #2: Managing a Checking Account

Question 2

Question 2

What is an automatic transfer?

A. When a payment is automatically withdrawn from

your account

B. When funds are automatically transferred to your

account from another account

C. When a payment is electronically withdrawn from

your account

D. When a written check is converted to an electronic

withdrawal

26

Exercise #2: Managing a Checking Account

Question 2 – Answer

Question 2

What is an automatic transfer?

A. When a payment is automatically withdrawn from your account

B. When funds are automatically transferred to your account

from another account

C. When a payment is electronically withdrawn from your account

D. When a written check is converted to an electronic withdrawal

Answer

B. An automatic transfer is when funds are automatically

transferred to your account from another account.

27

Exercise #2: Managing a Checking Account

Question 3

Directions:

Study the attached Bank Statement, then answer the

question.

Question 3

What is the Ending Balance on this bank statement?

A. $1,203.43

B. $928.00

C. $1,175.10

D. $542.32

28

Exercise #2: Managing a Checking Account

Question 3 – Answer

Directions:

Study the attached Bank Statement, then answer the

question.

Question 3

What is the Ending Balance on this bank statement?

A. $1,203.43

B. $928.00

C. $1,175.10

D. $542.32

Answer

C. The Ending Balance on this

bank statement is $1,175.10.

29

Sample Account Balance

Worksheet

Distribute Handout #2: Sample Account

Balance Worksheet

30

Balancing a Bank Statement

Upon receipt, take the time to balance your

Transaction Register to your monthly

Checking Account Statement.

Remember the quicker you respond to an

error or discrepancy, the more likely you will

be able to resolve the issue.

31

Balancing a Bank Statement

First, compare and check-off all

of the transactions that are on

the Checking Account Statement

in your Transaction Register.

Remember there is a Checkmark

column in your Transaction

Register for this purpose.

32

Balancing a Bank Statement

If there is an item on your statement that is

not listed in your Transaction Register,

determine if it is correct.

If the item is correct, write it in your

Transaction Register and subtract

it from your balance.

If the item is incorrect, call your

bank immediately to have it

investigated.

33

Balancing a Bank Statement

Remember to also write and deduct any

service charges and fees in your Transaction

Register.

If your checking account earns interest, list

the interest in the Deposit or Credit (+)

section and add it to your

account balance.

34

Balancing a Bank Statement

The following are the steps to follow to balance

your Checking Account Statement:

Step 1

Using the Account Balance

Worksheet included on your

Checking Account Statement,

write the amount shown on your

statement for the Ending Balance

where indicated.

35

Balancing a Bank Statement

Step 2

Add up all deposits which are not included on

the statement and write this amount where

indicated on the Account Balance Worksheet.

Step 3

Add up the Ending Balance and additional

deposits. Write this amount where indicated on

the worksheet.

36

Balancing a Bank Statement

Step 4

Using your Transaction Register, list all of the checks,

ATM and debit card withdrawals that are not included

on the statement where indicated on

the Account Balance Worksheet.

Add these outstanding transactions

together and write the total where

indicated on the worksheet.

37

Balancing a Bank Statement

Step 5

Subtract the total outstanding

transactions from the Ending

Balance and additional deposits

total.

This amount should equal your

Transaction Register balance.

38

Troubleshooting Account Balance

If your account does not balance, compare each

transaction on the statement to your register again

checking closely for the following:

• Look for a transaction in your register that

matches or is close to the amount you are off.

• Look for transposed numbers (i.e., wrote $12

instead of $21).

• If the receipt was difficult to read, you could be

off by a couple of dollars or cents.

39

Troubleshooting Account Balance

• Did you lose a receipt and guess at the

amount?

• Did you write down the amount

before taxes?

After double checking your

account and addition, if you

still cannot locate the discrepancy

contact your local bank branch for

their assistance.

40

Exercise #3: Balancing a

Checking Account

Distribute Exercise #3: Balancing a Checking

Account

Directions: Look at the Checking Account Statement,

Account Balance Worksheet and Transaction Register,

then answer this question.

Question

Why doesn’t the Account Balance

Worksheet and Transaction

Register balance?

41

Exercise #3: Balancing a Checking

Account – Instructor Guide

Troubleshooting Error in Account

When your Transaction Register balance does not

match the balance on the Account Balance

Worksheet, you need to subtract to determine how

much you are off.

First look for a transaction in

your register that matches or

is close to the amount you are off.

42

Troubleshooting Error in Account Cont.

If you still cannot locate the error, next compare

each transaction on the statement to your register

again checking closely for transposed numbers or

incorrect amounts.

In the example, the Debit Card purchase on 10/9 at

Dale’s Bowling Alley was written as $50.30 instead

of $55.30, thus making the account off by $5.

43

Troubleshooting Error in Account Cont.

You can see how easy it is to make a simple

mistake. You need to update your Transaction

Register regularly and double-check that your

entries and math are correct.

44

Lesson 3: Managing a Checking

Account – Part 2

END OF LESSON

NEXT SECTION

LESSON 3: MANAGING A CHECKING

ACCOUNT– PART 3