Accounting & Financial Analysis 1 Lecture 5 Bank Reconciliation

advertisement

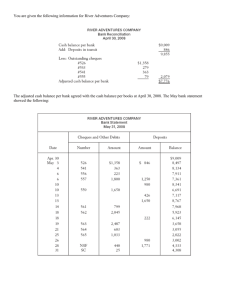

Accounting & Financial Analysis 1 Lecture 5 Bank Reconciliation Bank Reconciliation A Bank Reconciliation is the balancing of the Bank a/c balance as appears in the general ledger to the statement received from the bank. A bank reconciliation is generally prepared each month following the receipt of the bank statement. Bank’s point of view The bank statement is a listing of all the transactions that have been processed by the bank to the business account showing the balance from the point of view of the bank. T he balance of the business account is an amount of money that the bank owes to the business. Therefore the bank shows the balance on the statement as a “credit” (liability, amounts owing by the bank). The business point of view The amount of cash held in a bank is shown as a current asset in the Proprietary Ledger (Balance sheet) of the business and is recorded as a “debit” balance. Since all assets need to be verified for their accuracy the bank reconciliation will confirm that the amount shown as a current asset is correct and truly exists. It is important to make sure that the financial records of the business match those of the bank. The business generally asks the bank to post the statement as close to the end of month as possible so a reconciliation can be make before closing the month accounts. Unusual items Bank charges Bank Interest Dishonoured cheques Errors Unpresented cheques Deposits in transit The process of preparing a bank reconciliation The process of preparing a bank reconciliation is prescribed by the organisational policy and procedures and is generally as follows: 1. The bank reconciliation statement is to be prepared monthly and should form part of the management report presented to the meeting on the 10th day of each month (or other designated timeline). Compare the bank column of the cash payments journal to the debit side of the bank statement. Ticking all the amounts that balance. Compare the bank column of the cash receipts journal to the credit side of the bank statement. Ticking all the amounts that balance. Highlight any amounts that appear in the cash journals but not in the bank statement. (these will appear as reconciling items) Process items that appear in the bank statement but not in the cash journals (such as bank charges, bank interest, dishonoured cheques etc.) 2. 3. 4. 5. The process of preparing a bank reconciliation - 2 6. 7. 8. 9. 10. Any amounts that appear in the bank statement that need to be investigated should be referred to the appropriate staff member before processing to the cash journals. (these could be unknown debits or credits, amounts that do not match up – same cheque no. but different amounts) Total all columns of the cash receipts and cash payments journals. Transfer all column totals of the cash receipts and cash payments journals to the appropriate ledger accounts. Establish the balance on the general ledger bank account. Prepare the bank reconciliation statement as follows: Bank Reconciliation Statement Bank Reconciliation Statement as at …………. Balance as per bank statement $……. Add deposits that are not yet on bank statement $……. Less unpresented cheques (list cheque no. and amount) ($……) Balance as per general ledger bank a/c $…….. Common Bankrec adjustments 1. Whilst doing the reconciliation it is common to find various adjustments that need to be made. The following could be some of the required adjustments: The bank statement includes bank charges that have not been processed to the cash payments journal. These charges should be included in the cash payments journal before closing the journal and transferring the totals to the general ledger accounts. Common Bankrec adjustments - 2 2. The bank statement includes revenue (like bank interest) that has not been processed to the cash receipts journal. This revenue should be included in the cash receipts journal before closing the journal and transferring the totals to the general ledger accounts. 3. Dishonoured cheques (cheques returned, not paid out) account will be debited by the bank for the cheque value. If a customer gives you a cheque which you entered into the cash receipts journal and deposited into your bank account but the cheque was not honoured by the bank, you then have to reverse the original entry into your cash receipts journal by deducting the amount from the debtor’s column. The amount deducted is to appear in brackets. Common Bankrec adjustments - 3 Correction of errors this is when the bank shows a different amount to the one entered in the cash journals. Corrective action: First you reverse the entry in the same column as original – amount in brackets, then you enter the correct amount as a separate entry with same reference number. Summary The general ledger bank account shows the balance after all transactions processed by the business. This balance will be after all cheques paid out (even the ones that have not yet been presented to the bank for payment by the customer) and all deposits made (even the ones that have not yet been recorded by the bank). Therefore in order to view each of the transactions that affected the bank a/c during the month the comparison has to be between the Cash Journals (Receipts & Payments) and the bank statement. Process of Bank Reconciliation See MANUAL example on web Do MYOB Bank Reconciliation