Good to Great Companies

advertisement

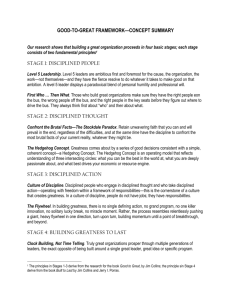

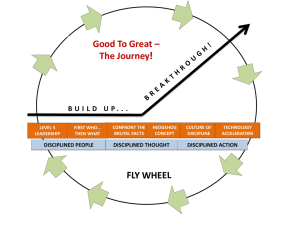

Good to Great Companies Picking Great Companies to Build the Greatest Portfolio and Using Such Techniques to Make You a Great Executive Eric Borzino, 4/11/2005 Today’s Objectives Show how an avg person can use non-financial techniques to pick great long-term holds Prove that “change” that leads to sustained stock gains cannot be pinpointed in a “great” company Are you investing in hedgehogs or foxes? Will YOU be a hedgehog or fox? These tips to identify companies are also applicable to YOUR future management careers Jim Collins Not as much of an idol as Peter Lynch Author of fine and popular books as Built to Last and Good to Great Taught at Stanford’s Graduate School of Business Founded his management research laboratory back home in Boulder Collins’ Laboratory Results Started with 1,435 good companies Found the companies that became great based on certain criteria over 40 year performance Company had to show good stock performance, capped with a transition point After transition, company had to generate stock returns that exceeded general market at least 3 times over 15 years independent of industry Being Good, Ain’t Good Enough Vast majority of good companies remain just that – good, not great 11 “great” companies were identified $1 invested in the general market since 1970 would yield $56 by year 2000 $1 invested evenly upon the 11 great companies would have yielded $471 by year 2000 All 11 companies had decent performance, until a transition occurred 11 “Great” Companies A few of the companies over the past 15 years that have been identified as great: Abbot Circuit City Fannie Mae Gillette Kimberly-Clark Wells Fargo Walgreens Philip Morris Kroger Nucor Pitney Bowes What factors do not lead to greatness? Larger-than-life celebrity leaders Good to great companies did not principally focus on what to do to become great Negative correlation 10 of the 11 good to great CEOs came from the firm Equally focused on what NOT to do And also what to STOP doing – diworsification Technology can accelerate a transformation, but cannot cause a transformation What factors do not lead to greatness – Part Duex? M&A played no role in igniting a transformation from good to great Good to great companies had no specific action or program to signify their transformations Two big ok companies joined together NEVER make one great company Sorry Sat for bursting the bubble Only in retrospect did the magnitude appear No outlandish, over published event or change Good to great companies were not in great industries, some were in terrible industries The Flywheel Cycle to Greatness People Thought Action Level 5 leadership First who…then what Confront the brutal facts Hedgehog concept Culture of discipline Technology accelerators Buildup BreakThrough Be Humble Yet Cool There are five levels of leaders Level 5 leaders, had one distinguishing characteristic: humility Level 5 leaders channel their ego needs away from themselves Larger goal is building a great company Ambition is first and foremost for the institution, not themselves Extreme blends of humility and intense will Egos Can Kill Absence of Level 5 leaders was the consistent factor that hindered greatness Level 5 leaders set up successors for success Other level leaders set up their successors for failure Or chose weak successors Good to great leaders never wanted to be largerthan life Ordinary people producing extraordinary results due to unwavering resolve to produce sustained results Large personal egos contributed to the demise or continued mediocrity of 2/3rd of comps Are You Level 5 Worthy? Abraham Lincoln Personal modest and shy nature Weren’t signs of weakness Darwin Smith – CEO of Kimberly Clark 1971 Generated stock returns 4.1 times the market Demolished rivals Scott Paper and P&G Resolve to do what’s best for company: sold the paper mills to concentrate on consumer products Wall Street called the move stupid – downgraded “I never stopped trying to become qualified for the job” Great, How Do You Find 5spot? If you listen to a CEO and he boosts of how his new ideas/programs will enhance returns Or how his strategies have already enhanced returns AVOID – got an ego and wants credit Level 5 leaders look outside the window to accredit Thanked others and luck Also never blamed bad luck when things when poorly, took credit for mistakes (unlike other leaders) The Flywheel Cycle to Greatness People Thought Action Level 5 leadership First who…then what Confront the brutal facts Hedgehog concept Culture of discipline Technology accelerators Buildup BreakThrough First Who NOT What Began achieving sustained success by first getting the right people on the bus Get the wrong people off the bus Then, figured out where to drive it Isn’t Strategy and Product Mas Importante? Why do it this way? Begin with “who” instead of “what, can more easily adapt to a changing world If you have the right people on the bus, problem of motivation and people managing are diminished If you have the wrong people, doesn’t matter whether you have the right direction b/c company will still not be great Teamwork Baby Good to great companies build deep and strong executive teams Decent companies followed a “genius” with a “thousand helpers” What happens if genius is wrong or leaves? Idiots… People are NOT your most important asset. The RIGHT people are. Look for companies with distinguished managers who have been in the company and work together over time Wells Fargo’s Success Early 1970s, then CEO Dick Cooley foresaw changes in the banking world, but did not know what or how Assembled an endless stream of talent – best team according to Warren Buffet Hired outstanding people whenever and wherever without a specific job in mind The Flywheel Cycle to Greatness People Thought Action Level 5 leadership First who…then what Confront the brutal facts Hedgehog concept Culture of discipline Technology accelerators Buildup BreakThrough Who Says Honor Doesn’t Matter All good to great managers first confronted the brutal facts of their current reality Impossible to make good decisions without being honest in the process Look for executives who admit to the reality of their industry – company to invest in Comparison companies were afraid to confront adversity, not the good to great companies Got to Stay Stiff and Hard Stockdale Paradox: Absolute faith that you can and will prevail in the end Same time, confront the most brutal facts of your current reality Leadership does not begin just with vision, begins with the right people confronting reality and sticking to a rigorous yet flexible plan The Flywheel Cycle to Greatness People Thought Action Level 5 leadership First who…then what Confront the brutal facts Hedgehog concept Culture of discipline Technology accelerators Buildup BreakThrough The Hedgehog and the Fox Ancient Greek parable: The fox knows many things The hedgehog knows one big thing Foxes pursue many ends and see the world in all of its complexity Hedgehogs simplify the world into a basic principle, see what’s essential, and ignore the rest The Big Three All good to great companies adhered to the Hedgehog Concept (three questions) What you can be the best in the world at What drives your economic engine What are you deeply passionate about Not the goal to be the best, but understanding of what you can be the best at Sometimes Need to Rethink If you cannot be the best in the world at your core business, then your core business cannot form the basis of your Hedgehog concept Best to look for companies that keep it simple Exotic companies in many different industries are like the fox and stretch themselves too thin As a manager, want to focus solely on your core and how to make it the best in the world What the Hell You Saying? Takeaways for investing: Look for companies with humble, yet passionate leaders Research the background of management to determine if the team was assembled with a “who” instead of “what” mentality Find out the culture of the firm, whether it is bureaucratic, dominated by a few executives, or open and willing to confront the brutal facts Keep an eye out for simple companies, with great people, hard-working culture, and not constantly featured in CNBC or Wall Street Journal Hedgehog Concept Most Important To remain great over time requires to strictly adhere to the Hedgehog Concept If the firm slides outside its hole, it will slide back down to mediocrity Good to great transformations never happen at once, unlike the WSJ likes to make it appear Happens slowly over time And can easily be tracked by looking at qualitative clues outside of ratios and DCFs