Good To Great: Why Some Companies Make the Leap…and Others

advertisement

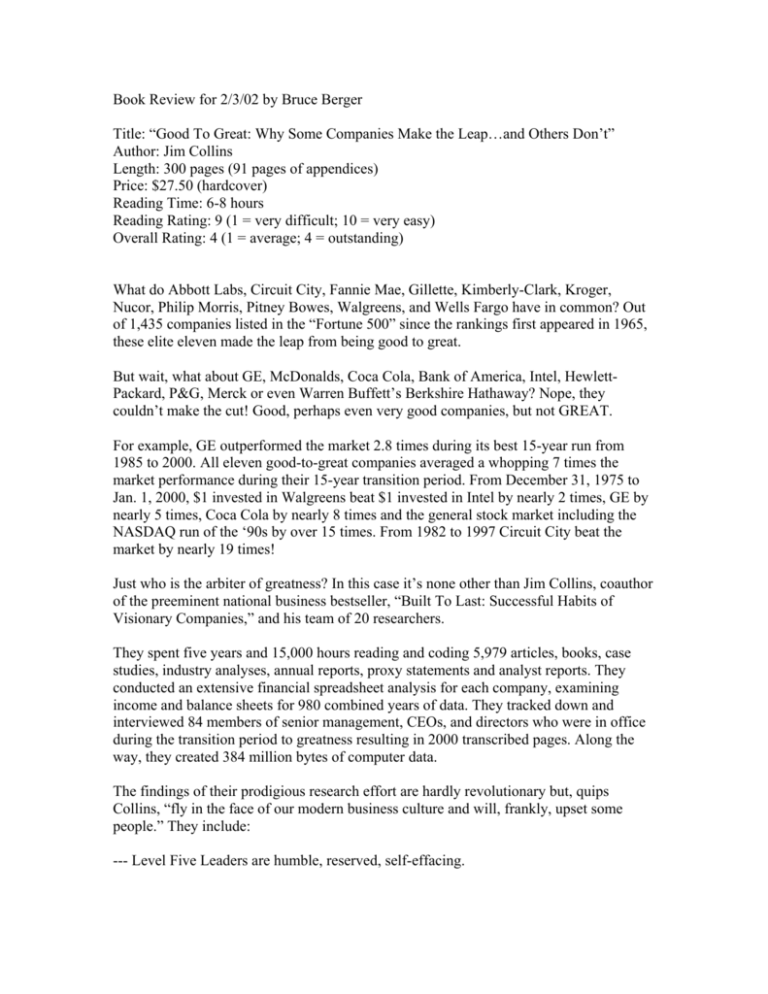

Book Review for 2/3/02 by Bruce Berger Title: “Good To Great: Why Some Companies Make the Leap…and Others Don’t” Author: Jim Collins Length: 300 pages (91 pages of appendices) Price: $27.50 (hardcover) Reading Time: 6-8 hours Reading Rating: 9 (1 = very difficult; 10 = very easy) Overall Rating: 4 (1 = average; 4 = outstanding) What do Abbott Labs, Circuit City, Fannie Mae, Gillette, Kimberly-Clark, Kroger, Nucor, Philip Morris, Pitney Bowes, Walgreens, and Wells Fargo have in common? Out of 1,435 companies listed in the “Fortune 500” since the rankings first appeared in 1965, these elite eleven made the leap from being good to great. But wait, what about GE, McDonalds, Coca Cola, Bank of America, Intel, HewlettPackard, P&G, Merck or even Warren Buffett’s Berkshire Hathaway? Nope, they couldn’t make the cut! Good, perhaps even very good companies, but not GREAT. For example, GE outperformed the market 2.8 times during its best 15-year run from 1985 to 2000. All eleven good-to-great companies averaged a whopping 7 times the market performance during their 15-year transition period. From December 31, 1975 to Jan. 1, 2000, $1 invested in Walgreens beat $1 invested in Intel by nearly 2 times, GE by nearly 5 times, Coca Cola by nearly 8 times and the general stock market including the NASDAQ run of the ‘90s by over 15 times. From 1982 to 1997 Circuit City beat the market by nearly 19 times! Just who is the arbiter of greatness? In this case it’s none other than Jim Collins, coauthor of the preeminent national business bestseller, “Built To Last: Successful Habits of Visionary Companies,” and his team of 20 researchers. They spent five years and 15,000 hours reading and coding 5,979 articles, books, case studies, industry analyses, annual reports, proxy statements and analyst reports. They conducted an extensive financial spreadsheet analysis for each company, examining income and balance sheets for 980 combined years of data. They tracked down and interviewed 84 members of senior management, CEOs, and directors who were in office during the transition period to greatness resulting in 2000 transcribed pages. Along the way, they created 384 million bytes of computer data. The findings of their prodigious research effort are hardly revolutionary but, quips Collins, “fly in the face of our modern business culture and will, frankly, upset some people.” They include: --- Level Five Leaders are humble, reserved, self-effacing. --- First Who …Then What. Get the right people on board, then figure out where to go. --- Confront the Brutal Facts (Yet Never Lose Faith) is aptly named the Stockdale Paradox after Vietnam prisoner of war Adm. Jim Stockdale who endured eight years of torture at the Hanoi Hilton. --- The Hedgehog Concept is by far the most critical key to achieving greatness. Each company crystallized their very core existence and it became their mantra. --- A Culture of Discipline If it doesn’t fit the Hedgehog Concept (e.g. acquisitions, ventures), they don’t do it. Period. --- Technology alone cannot make a company great. It has to be linked to and applied within the Hedgehog Concept. --- The Flywheel and the Doom Loop are metaphors for demonstrating how great companies start out slowly and methodically yet eventually reach the sustained momentum needed for breakthrough results. Finally, a how-to change management book based on empirical evidence. What we learned is not cutting edge new-age management or leadership magic. Rather, this book confirms a simple maxim: any organization can be great if it has the right people adhering to the right core belief in a very disciplined manner. Just look to Level Five Leaders such as John Wooden, Abraham Lincoln, or Cork Walgreen. Bruce D. Berger is a visiting professor of law in the marketing and business law department in the College of Business at Western Carolina University. He also has consulting and law practices.