CHAPTER

3

Consolidated Statements:

Subsequent to Acquisition

Fundamentals of Advanced Accounting

1th Edition

Fischer, Taylor, and Cheng

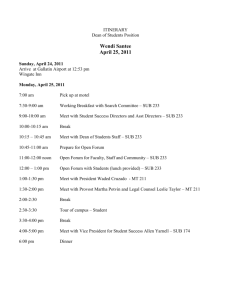

Consolidated Statements Subsequent to

Acquisition

Two basic methods to maintain the

parent’s investment account:

• Equity Method (Simple &

Sophisticated)

• Cost Method

Chapter 3, Slide #2

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Equity Method of Accounting for Investments

• Equity Method: Parent records income when

subsidiary reports income

– Parent used percent of ownership time sub’s net

income to record investment income

– Dividends treated as return of investment –

investment account is reduced

– Sophisticated Equity Method recognizes

amortization on the parent’s ledger for the

difference from book value to fair value.

Chapter 3, Slide #3

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Cost Method of Accounting for Investments

Cost Method: Parent records income

when subsidiary declares dividends

• Most commonly used method

• No adjustments to investment account

Chapter 3, Slide #4

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Example –

Company P and Subsidiary Company S

• Parent purchases 90% of Sub’s stock for

$145,000.

• Sub has equity accounts:

Common Stock $100,000

Retained Earnings 50,000

• 20X1 – Sub:

Net Income = $30,000, Dividends = $10,000

• 20X2 – Sub:

Net Loss = ($10,000), Dividends = $5,000

Chapter 3, Slide #5

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

D&D Schedule Example –

Company P and Subsidiary Company S

Price paid:

$ 145,000

Interest acquired:

Common stock

$ 100,000

Retained earnings

50,000

Total equity

150,000

Ownership interest

× 90% 135,000

Excess cost

10,000

Patent ……………………………

Annual

Life Amort.

$10,000

10 $1,000

Chapter 3, Slide #6

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Parent Recording of Subsidiary Income

(Year 1)

Investment balance

Year 1 income (90%):

Investment in Sub

Investment income

Equity

145,000

Sophisticated

Equity

Cost

145,000

145,000

27,000

26,000

no entry

27,000

26,000

(1,000 amort.)

Year 1 dividends(90%):

9,000

9,000

Dividend receivable

9000

Investment in Sub

Dividend income

Investment balance

163,000

162,000

Chapter 3, Slide #7

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

9,000

9,000

9,000

145,000

Parent Recording of Subsidiary Income

(Year 2)

Investment balance

Year 2 income (90%):

Investment Loss

Investment in Sub

Year 2 dividends (90%):

Dividend receivable

Investment in Sub

Dividend income

Investment balance

Equity

163,000

Sophisticated

Equity

Cost

162,000

145,000

9,000

10,000

9,000

4,500

no entry

10,000

(1,000 amort.)

4,500

4,500

149,500

4,500

4,500

147,500

Chapter 3, Slide #8

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

4,500

145,000

Worksheet Procedures

•

The RE of the Sub and the Investment account must

be at the same point in time

–

•

When adjusted to the same point in time, the excess

upon elimination will agree with the D&D on

purchase date

–

•

Eliminate entries during the year to complete alignment

Sophisticated Equity results in only the amortized balance

of the excess

The account adjustments made require amortization

for current and prior periods

–

No entries are made on either firm’s books for worksheet

eliminations

Chapter 3, Slide #9

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Worksheet Elimination Procedures

Key Description

CV Convert to Equity

Simple

Equity

Soph.

Equity

Cost

CY1 Eliminate Sub Income

CY2 Eliminate intercompany dividends

EL

Eliminate parent’s % of sub equity

Distribute excess per D&D

schedule

Amortize excess

D

A

Chapter 3, Slide #10

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Worksheet Elimination Entries –

Simple Equity

CY1 Sub Income - Par

Invest. In Sub - Par

27,000

27,000

(Eliminates current year income and creates date alignment)

CY2 Invest. In Sub - Par

9,000

Dividends Declared - Sub

9,000

(Eliminates intercompany dividends)

EL

Common Stock - Sub

Retained Earnings - Sub

Invest. In Sub - Par

90,000

45,000

(Eliminates investment account against 90% of equity)

Chapter 3, Slide #11

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

135,000

Worksheet Elimination Entries –

Simple Equity Continued

D

Patent

10,000

Invest. In Sub - Par

10,000

(Eliminates balance of investment account and distributes to

proper accounts)

A

Patent Amort. Expense 1,000

Patent

1,000

(Amortized excess cost of the patent over its 10 year life)

Chapter 3, Slide #12

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Simple Equity: Worksheet 3-1 Year 1

Selected Accounts

Investment in Sub

Patent

Other net assets

Com. Stock – Par

RE – Parent

Com. stock – Sub

RE – Sub

Revenue

Expenses

Patent Amort.

Subsidiary Income

Dividends declared

Trial Balances

Parent

Sub

163,000

227,000

(200,000)

(123,000)

(100,000)

60,000

Eliminations

Dr

Cr

CY2 9,000

CY1 27,000

EL 135,000

D 10,000

D 10,000

A

1,000

170,000

(100,000)

(50,000)

(80,000)

50,000

EL 90,000

EL 45,000

A

1,000

CY1 27,000

(27,000)

10,000

Chapter 3, Slide #13

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

CY2

9,000

Review of Worksheet Procedures

• Elimination of equity income and

intercompany dividends returns investment

to Jan. 1 for date alignment

• Excess is distributed per D&D; amortized for

current and prior years

• IDS (income distribution schedule) is used to

allocate income to P & S

– All excess amortizations go to P; only P’s share

is recorded initially

Chapter 3, Slide #14

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Features of Consolidated Statements

• Consolidated net income is total income

earned by the entity.

– Consolidated net income is distributed to:

• Parent

• Non-Controlling interest

• Retained Earnings statement

– Shows only controlling interest

• Consolidated Balance Sheet reports

NCI as subdivision of equity

Chapter 3, Slide #15

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Worksheet Elimination Entries –

Cost Method

CY2

Dividend Income - Par

Dividends Declared - Sub

9,000

9,000

(Eliminates intercompany dividends)

EL

Common Stock - Sub

Retained Earnings - Sub

Invest. In Sub - Par

90,000

45,000

135,000

(Eliminates investment account against 90% of equity)

D

Patent

Invest. In Sub - Par

10,000

10,000

(Eliminates balance of investment account and distributes to proper accounts)

A

Patent Amort. Expense

Patent

1,000

(Amortized excess cost of the patent over its 10 year life)

Chapter 3, Slide #16

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

1,000

Cost Method: Worksheet 3-3 Year 1

Selected Accounts

Investment in Sub

Patent

Other net assets

Com. Stock – Par

RE – Parent

Com. stock – Sub

RE – Sub

Revenue

Expenses

Patent Amort.

Subsidiary Income

Dividends declared

Trial Balances

Parent

Sub

145,000

227,000

(200,000)

(123,000)

(100,000)

60,000

Eliminations

Dr

Cr

EL 135,000

D 10,000

D 10,000

A

1,000

170,000

(100,000)

(50,000)

(80,000)

50,000

EL 90,000

EL 45,000

A

CY2

(9,000)

10,000

Chapter 3, Slide #17

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

1,000

9,000

CY2

9,000

Subsequent years – Cost Method

• For periods after the first year, date

alignment will not exist.

– Balance of parents investment account ≠ sub’s

retained earnings.

• Calculate simple equity balance for

investment account.

• Record entry to adjust investment

account.

DR Investment in Sub – Par

CR RE 1/1/20X2 - Par

Chapter 3, Slide #18

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Effect of Sophisticated Equity Method on

Consolidation

• Parent amortizes excess costs of net

assets

• Investment account includes only

unamortized costs

Chapter 3, Slide #19

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Worksheet Elimination Entries –

Sophisticated Equity Method

CY1

Sub Income - Par

Invest. In Sub - Par

(Eliminates current year income and

CY2

26,000

26,000

creates date alignment)

Invest. In Sub - Par

Dividends Declared - Sub

9,000

9,000

(Eliminates intercompany dividends)

EL

Common Stock - Sub

Retained Earnings - Sub

Invest. In Sub - Par

90,000

45,000

135,000

(Eliminates investment account against 90% of equity)

D

Patent

Invest. In Sub - Par

10,000

10,000

(Eliminates balance of investment account and distributes to proper accounts –

includes only UNAMORTIZED excess cost)

Chapter 3, Slide #20

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Sophisticated Equity Method: Year 1

Selected Accounts

Investment in Sub

Patent

Other net assets

Com. Stock – Par

RE – Parent

Com. stock – Sub

RE – Sub

Revenue

Expenses

Patent Amort.

Subsidiary Income

Dividends declared

Trial Balances

Parent

Sub

162,000

227,000

(200,000)

(123,000)

(100,000)

60,000

Eliminations

Dr

Cr

CY2 9,000

CY1 26,000

EL 135,000

D 10,000

D 10,000

A 1,000

170,000

(100,000)

(50,000)

(80,000)

50,000

EL 90,000

EL 45,000

A

1,000

CY1 26,000

(26,000)

10,000

Chapter 3, Slide #21

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

CY2

9,000

Disclosure Concerns

•

Consolidated net income – The net income of the

consolidated entity

•

NCI share of income – This is the NCI share of

consolidated net income; it has often (incorrectly)

been treated as an expense.

•

Controlling share of net income – This is the

controlling share of consolidated net income; it has

often (incorrectly) been treated as consolidated net

income (the NCI share having been deducted)

•

Total NCI – Best theory is to show as aggregated

part of total equity

– Some have shown it as liability or put it between liabilities

and equity

Chapter 3, Slide #22

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

During-the-Year Purchases

Option 1 - Close Books

(WS 3-7)

• D&D includes Sub RE

on purchase date

• WS includes Sub

operations for only later

part of year

Option 2 - Books Open

(WS 3-8)

• D&D has Beginning of

year RE and

“Purchased Income”

• WS includes Sub

operations for entire

year

• Purchased income is

used to remove income

prior to purchase

Chapter 3, Slide #23

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Goodwill Impairment Losses

• If remaining goodwill is estimated to be less

book value of goodwill, record a goodwill

impairment loss.

• Impairment loss is reported on consolidated

income statement for period in which it

occurs.

• Presented before-tax basis.

Two options for impairment losses:

• Record loss on parent’s books

• Record loss on consolidated worksheet.

Chapter 3, Slide #24

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Goodwill Impairment Losses - Calculation

Company P purchased 80% interest in

Company S in 20X2 resulting in $165,000

of Goodwill.

20X4 information is as follows:

Invest in Sub (Soph. Equity)

Estimated fair value of S. Co.

Est. fair value of net assets

$800,000

900,000

850,000

Chapter 3, Slide #25

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Goodwill Impairment Losses - Calculation

• Step one – determine if Goodwill is impaired:

Investment in Sub

Fair value of investment

$800,000

720,000*

*($900,000 total fair value x 80% ownership)

If investment account exceeds fair value,

calculate impairment.

• Impairment calculation:

Est. fair value of company

Est. fair value of net assets

Est. goodwill

$900,000

850,000

50,000

Parent’s % of goodwill = $50,000 x 80% =

$40,000

Original goodwill calculation

165,000

Goodwill Impairment

(125,000)

Chapter 3, Slide #26

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.

Tax Issues: Tax-Free Exchange

•

Occurs when seller is not taxed; buyer gets book

value for future depreciation

•

Adjustment from market to book accompanied by

DTL = tax % market adjustment

•

DTL has same priority as the related asset.

•

DTL is amortized over same period as asset

adjustment; increases tax liability in future years

•

Tax loss carryover is asset recorded in purchase;

there are limits on its use in year of purchase and

later years

Chapter 3, Slide #27

Copyright 2008 by Thomson South-Western, a part of The Thomson Corporation. All rights reserved.