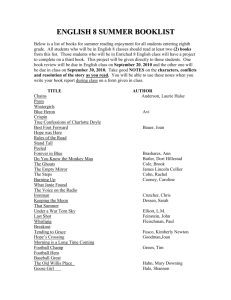

Ann Taylor Business Plan

advertisement

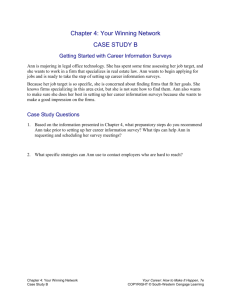

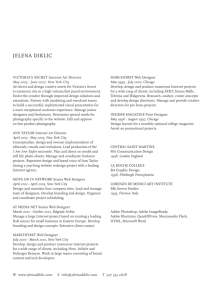

“Taylor”ing for Success Ann Taylor Market Strategy Santa Clara University MBA March 10, 2010 By Kathleen Cronin 1 Background 50 years: Evolved to become nationally recognized brand Two businesses: Ann Taylor and LOFT Designs clothes for well dressed woman, “ANN” Ann Taylor: Chic, professional Loft: Casual needs of same customer segment Generates $2B in annual revenue 50 Years Designing Clothes for Well Dressed Woman 2 2 Why Strategic Change Required? Strategic Restructuring Program announced in Feb 2008 • • • • Objective: Reduce costs and improving operating margins Primary Focus: Enhance brand value and refine marketing campaigns Totaled $140M in planned investment costs Expected annualized savings of $125M Harsh decline in Net Income in 2009 • • • • Economic conditions Company cost structure issues Failure of design team to meet customer trends Too focused on expansion Ann Taylor Quarterly Net Income: 2003 - 2009 60 000 40 000 Kay Krill named as CEO 20 000 Strategic Restructuring Program Announced Restructuring Program Expansion 1 0 -20 000 -40 000 -60 000 -80 000 -100 000 Excludes $286 M goodwill impairment charge in Jan 09 Stock Market Crash Restructuring Program Expansion 2 3 Specialty Women’s Retail Industry Five Force Analysis Industry Sales in ‘09: $38B MEDIUM / HIGH BUYER POWER -Low switching costs -Rewards program deters switching -Trends easily imitable -Low backward integration HIGH COMPETITIVE RIVALRY -Multiple competitors High -Low industry growth -Low exit barriers due to mfg -Fairly transparent strategies (latest trends) Low 1-Competitive Rivalry 2-Buyer Power 3-New Entrants MEDIUM THREAT OF NEW ENTRANTS -Create subsidiaries to leverage distribution channels -Word of mouth drives buying decisions -No switching cost -High capital requirements - Import restrictions could drive manufacture in-house 4-Substitution Threat 5-Supplier Power Medium Threat of Substitutes -Changing lifestyles allow less time to shop -Increasing usage of e-shopping -Economic decline caused switch to discount stores -V-P tradeoff: Low, but promotions will increase V-P Low Power of Suppliers -Asian suppliers cheap; make small profit -Low supplier concentration: multiple manufacturers make clothes -Low threat to forward integrate -Medium for Lack of substitutes Mature, Fragmented, Unattractive4 Market 4 Macro Economic Analysis Global Government/Regulatory -Expanding internationally -Asia, Middle East, Russia growing markets -European market continues to lead w/ fashion -International firms entering U.S. -Reduced trade regulation -Reduced cost benefit with offshore manufacturing -Free Trade Agreement lowering tariffs -Ship fabric without import duties -Promotion of operations in certain regions (tax breaks) Environmental Technological -Push to “Go-Green” in supply chain, product offerings -Eco-friendly causes transformation on customers -Now part of brand image -Develop brands specific to eco-friendly materials -Causes better material selection -Monitoring supplier qualification processes -Point of sale via use of bar code scanners -Online marketplace allows for real-time transactions -Social networking primary educational tool -Hear of product launches, compare prices, -New sites allow purchases at more of a discount -Less brand loyalty with internet sales Economic Factors Driving Increased Competition 5 Customer Analysis: Market Penetration Total U.S. Population (in Millions) 282M Potential Market (All Females) Avg Household Income $32K (25 or older) 144M (51%) Avg Income $26K (25 or older) Age Breakout >65 = 13.5% 55-64 = 9.4% 35-54 = 29.6% 25-34 = 13.5% 15-24 = 13.5% <15 = 20.5% U.S. Social Class Breakdown Upper Class $500K+): 1% Upper Middle (>$100K): 15% Lower Middle($35-$75K): 32% Working Class($16-30K): 32% Lower Class (<$16K): 14% Total Available Market 22M (16% of all females) Defined as women with income >$35K Ages 25 & up Age Breakout 55&above = 20% 45-54 = 31% 35-44 = 29% 25-34= 20% Served Market 11M (50% of TAM) Defined as women ages 25-44 Income $35K and up 135M ANN Targets 50% of U.S. Market 6 Customer Segmentation of Women’s Apparel Industry SEGMENT DEMOGRAPHIC BENEFIT SOUGHT (Key Values) 1 Fashion Forward, Chic Primary Age Group: 15-36 “Hip Singles” Always up to date on latest trends Frequent shoppers Often accessorize w/ outfit Shops for clothes at primarily specialty retail stores Embrace new trends, extension of personality Educated about new fashion Become knowledgeable before purchase Top preferred product offerings: Style, proper fit, style, discounts offered Spend significant portion of income on clothes 2 Modern, Updated Classic Primary Age Group: 25-44 “Professional career woman” Simplicity but occasional wardrobe update Sometimes accessorize w/ outfit – this increasing Shops for clothes at mixture of specialty retail stores, department stores, discounted stores Top preferred product offerings: Proper fit, style, price, ability to mix/match Looks for versatile, modern clothing staples Prefer non-iron pieces and ability to wash versus Spends discretionary income on clothes Reside in middle; Stay with moderate updates Less likely to jump on anything trendy 3 Traditional, Conservative Primary Age Group: 35+ “Suburban Mother” or “Conservative Retiree” Sticks to basics Rarely accessorizes w/ outfit Occasional shopper Desire to save money on clothes Top preferred product offerings: Proper fit, versatility, price, location, & durability Does not follow latest trends Little desire to stand out or make statement Looks for all-in-one store at good price Looks for one clothing that works everywhere Target Segment: Modern / Updated Classic 7 Market Share of Top 15 Competitors Total Market Value: $107B Values in % Ann Taylor Stores 0,7 Macy’s (US) 1,0 Ann Taylor LOFT 1,8 1,1 Gap -Women - US Other Women’s Retail 6,4 22,8 Banana Republic - Women - US 0,1 2,7 Macy's - Women 0,3 1,4 1,1 1,0 Anne Klein Nordstrom - Women 1,9 1,0 1,2 5,0 J. Crew - women Talbots - US New York and Co Coldwater Creek 4,7 Charming Shoppes Saks 1,5 Dress barn 0,8 Kohls - women TJ Maxx - women - US Other Department Stores 43,5 Chicos FAS Cato Group Other - Department stores Other - Retail stores Very Saturated Market 8 Video: THE NEW ANN Classic. Versatile. Fresh. 9 Corporate Leadership Kay Krill President and CEO Appointed Oct 2005 Christine Beauchamp Gary Muto Brian Lynch President, Ann Taylor President, LOFT President, Corporate Operations Appointed Aug 2008 Appointed Nov 2008 Appointed Jul 2008 Paula Zusi Executive Vice President Chief Supply Chain Officer Michael Nicholson Executive Vice President CFO and Treasurer Barbara Eisenberg Executive Vice President General Counsel and Corp Sec Appointed Sept 2008 Appointed Jul 2008 Appointed Mar 2005 Lisa Axelson Senior Vice President Design Mary Kay O’Connor Wente Senior Vice President Director of Stores Michael Kingston Senior Vice President Chief Information Officer Appointed Oct 2008 Appointed Oct 2008 Appointed May 2006 New Leadership Since 2008 10 10 Corporate Timeline Celebrations line introduced 2005 2006 Kay Krill appointed CEO LOFT Maternity Collections Axelson line line LOFT Outlet became SVP introduced introduced introduced of Design 2007 2008 Beauty line introduced Plans for “Modern Boomers” division began 2010 2009 Beauchamp becomes Ann Taylor President Strategic restructuring plan began LOFT Maternity pulled from stores, only online Increased Organic Development 11 Ann Taylor Competitive Advantage Ann Taylor is superior to other clothing lines because it provides the professional woman with a chic, sophisticated look using high quality materials for professional and special occasions. Loft is superior to other clothing lines because it provides the professional woman with casual, fashionable and fun styles for professional and special occasions. Jones Apparel Competitive Market Drives Need for Strategic Change 12 12 Sales Growth: Ann Taylor Vs. Competition Future Profitability Dependent on Pace and Quality of Bottom Line Growth 13 FCF Across Competitors: ’05 – ‘09 ANN Shows Poor Performance with Negative ROE 14 Distribution Channels Provide modern styles that are versatile across all occasions and needs Corporate Businesses (Brands) Distribution Products AnnTaylor Stores Corporation 31% of Revenue* 411 Stores (US & Puerto Rico) LOFT 50% of Revenue* 524 Stores 510 Stores 14 Stores Ann Taylor Chic, sophisticated feminine clothing for professional 320 Stores & special occasions Ann Taylor Beauty Total Employees: 18,400 employees Total Stores: 935 stores Lingerie 91 Stores Ann Taylor Factory Professional and Casual Clothing Accessories Ann Taylor Online Sleepwear *Based on 2008 revenue; 19% of revenue is “Other” category LOFT Wedding Accessories Ultimate casual, fashionable & fun retail destination LOFT Outlet Casual and Professional Clothing LOFT Online Maternity Distribution channels: Malls, urban/suburban centers Outlets centers Online stores Strong Distribution Channels 15 Social Media Fan Count Ann Taylor Brands = 4% 1% 3% Company 1% Ann Taylor Ann Taylor 13,000 Loft Loft 38,000 Talbots 15,000 Macy's 374,000 Talbots 43% 30% Macy's Nordstrom J. Crew 18% 4% Fan Count Gap Nordstrom 56,000 J. Crew 219,000 Gap 537,000 Small Presence on Social Media 16 Recommendations: Short-Term Improve Value Position with Customers Better communicate refreshed brand image • • • • Improve social networking site Offer frequent promotions Increase online advertising Offer in-store networking/product launch events Build customer relationships • Track customer engagement • Continue to use MarketWorks to track trends • Refine use of ATLAS system Sustain cost parity • Invest in Radio Frequency Identification (RFID) • Improve operational efficiencies with inventory 17 Recommendations: Long-Term Leverage Core Competencies and Resources Partner with supply chain management firm • Provides company with new process knowledge • Diversifies sourcing risk • Identify higher quality materials Expand store size and accessories market • Follows trend of outfit diversification • Allows for larger variety of accessories • Creates destination to find more of their wardrobe Broaden customer segment into Boomer Market • Fast growing market with high discretionary income • Leverage resources to achieve expansion 18 BACKUP 19 Vertical Integration: ANN : Competitors 20 Value-Price-Cost Wedge Ann Taylor : Competition Relative V - P Relative P - C 114 90 100 94 90 $290 100 $400 $375 106 114 108 $345 $310 $295 $280 97 90 115 83 120 Relative V - P Relative P - C 47 48 $145 50 $105 46 47 60 50 57 LOFT Macys $125 $100 $100 42 54 J. Crew Gap Talbots Average Value Minus Cost Position 21 21 Profitability Ratios 22 Activity Ratios 23 Liquidity Ratios / Z-Scores 24 Competitive Price Comparisons 25 Ann Taylor VRIO Analysis 26 Competitors’ VRIO Analysis 27 27 Competitors’ VRIO Analysis 28 28 Value Chain Analysis PROCUREME NT 1. Centralized non-merchandize procurement system 2. Centralized distribution center in Louisville 3. Diversified sourcing network with multiple suppliers TECHNOLOG Y 1. Marketworks, customer-database 2. Partnership with Cisco for inventory management system 3. ATLAS, in-store operational efficiency monitoring program HUMAN RESOURCE MANAGEMENT 1. Leadership focused on operational 2. Strong design team efficiencies 3. Employee training 1. Over 900 store locations INFRASTRUCTUR 2. Multiple retail channels - stores, online, phone E 1. Get finished clothes from outsourced manufacturing suppliers and store inethical Louisville 2. Enforce guidelines distribution center with suppliers 3. Procure nonmerchandize items INBOUND LOGISTICS 1. Design clothes to meet market 2. Drive in-store trends operational 3. Increase inventory efficiency turnover ratio 1. Customize inventory carried in store 2. Breadth of line 3. Operated under mutiple brands - Ann Taylor, LOFT and outlets OPERATION S LEGEND: Driver impact OUTBOUND LOGISTICS Value driver impact 1. In-store customer service 2. Reduced shipping time 2. Multiple channels 3. Personalized Personalized 3. 3. Young models such recommendations recommendations and 4. Credit Card card loyalty as Heidi Klum to target 4. database driven marketing Credit loyalty program younger customer base program 1. Multiple locations MARKETIN G & SALES SERVICE Cost 29 Boomer Implementation Timeline 30