P7-5. LG 4: Common Stock Valuation–Zero Growth: Po = D1 ¸ ks

advertisement

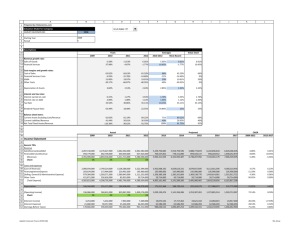

P7-5. LG 4: Common Stock Valuation–Zero Growth: Po D1 ks Basic Po $2.40 0.12 Po $20 (b) Po $2.40 0.20 Po $12 (c) As perceived risk increases, the required rate of return also increases, causing the stock price to fall. (a) P7-6. LG 4: Common Stock Valuation–Zero Growth Intermediate Value of stock when purchased $5.00 $31.25 0.16 $5.00 $41.67 0.12 Sally’s capital gain is $10.42 ($41.67 $31.25). Value of stock when sold P7-10. LG 4: Common Stock Value–Constant Growth: Po D1 (ks g) Intermediate Computation of growth rate: FV PV (1 k)n $2.87 $2.25 (1 k)5 $2.87 $2.25 FVIFk%,5 1.276 FVIFk%,5 g k at 5% P7-15. LG 5: Free Cash Flow Valuation Challenge (a) The value of the total firm is accomplished in three steps. (1) Calculate the present value of FCF from 2012 to infinity. FCF $390,000(1.03) $401,700 $5,021,250 0.11 0.03 0.08 (2) Add the present value of the cash flow obtained in (1) to the cash flow for 2011. FCF2011 $5,021,250 390,000 $5,411,250 (3) Find the present value of the cash flows for 2004 through 2008. Year 2007 2008 2009 2010 2011 FCF PVIF11%,n PV $200,000 0.901 $180,200 250,000 0.812 203,000 310,000 0.731 226,610 350,000 0.659 230,650 5,411,250 0.593 3,208,871 Value of entire company, Vc $4,049,331 (b) Calculate the value of the common stock. VS VC VD VP VS $4,049,331 $1,500,000 $400,000 $2,191,331 $2,191,331 $10.96 (c) Value per share 200,000 P7-16. LG 5: Using the Free Cash Flow Valuation Model to Price an IPO Challenge (a) The value of the firm’s common stock is accomplished in four steps. (1) Calculate the present value of FCF from 2011 to infinity. FCF $1,100,000(1.02) $1,122,000 $18,700,000 0.08 0.02 0.06 (2) Add the present value of the cash flow obtained in (1) to the cash flow for 2010. FCF2010 $18,700,000 1,100,000 $19,800,000 (3) Find the present value of the cash flows for 2004 through 2007. Year 2007 2008 2009 2010 FCF PVIF11%,n PV $700,000 0.926 $648,200 800,000 0.857 685,600 950,000 0.794 754,300 19,800,000 0.735 14,533,000 Value of entire company, Vc $16,621,100 (4) Calculate the value of the common stock using equation 7.8. VS VC VD VP VS $16,621,100 $2,700,000 $1,000,000 $12,921,100 $12,921,100 $11.75 Value per share 1,100,000 (b) Based on this analysis the IPO price of the stock is over valued by $0.75 ($12.50 $11.75) and you should not buy the stock. (c) The value of the firm’s common stock is accomplished in four steps. (1) Calculate the present value of FCF from 2011 to infinity. FCF $1,100,000(1.03) $1,133,000 $22,660,000 0.08 0.03 0.05 (2) Add the present value of the cash flow obtained in (1) to the cash flow for 2010. FCF2010 $22,660,000 1,100,000 $23,760,000 (3) Find the present value of the cash flows for 2004 through 2007. Year 2007 2008 2009 2010 FCF PVIF11%,n PV $700,000 0.926 $648,200 800,000 0.857 685,600 950,000 0.794 754,300 23,760,000 0.735 17,463,000 Value of entire company, Vc $19,551,700