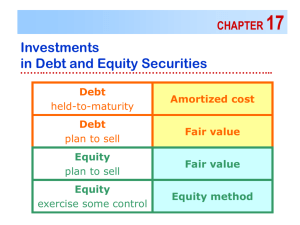

held-to-maturity securities

advertisement

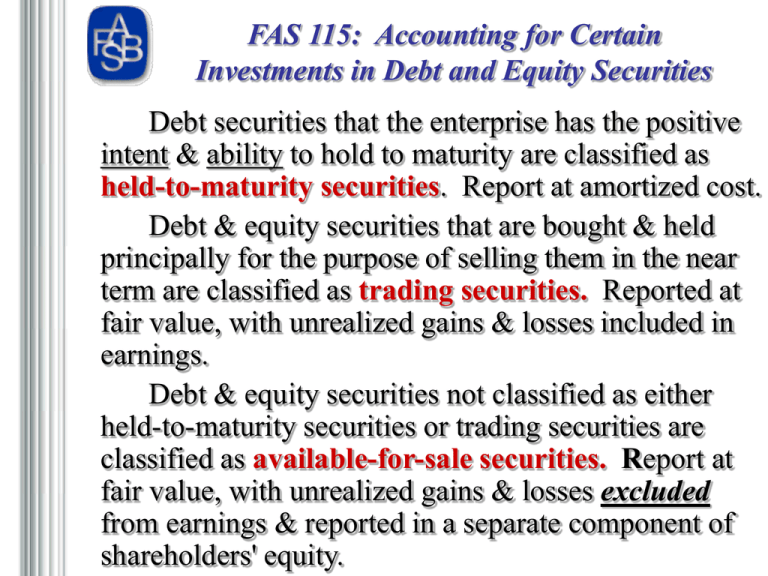

FAS 115: Accounting for Certain Investments in Debt and Equity Securities • Debt securities that the enterprise has the positive intent & ability to hold to maturity are classified as held-to-maturity securities. Report at amortized cost. • Debt & equity securities that are bought & held principally for the purpose of selling them in the near term are classified as trading securities. Reported at fair value, with unrealized gains & losses included in earnings. • Debt & equity securities not classified as either held-to-maturity securities or trading securities are classified as available-for-sale securities. Report at fair value, with unrealized gains & losses excluded from earnings & reported in a separate component of shareholders' equity. Investments in Debt & Equity Securities Category (based on intent) Held-to-maturity Debt securities Valuation (intent & ability) (amortize the discount or premium) Unrealized Holding Gains or Losses Amortized Cost Do not recognize Trading Securities Fair Value Interest when earned; gains & losses from sale Recognize in net income Interest when earned; gains & losses from sale Recognize as other comprehensive income & as separate component of stockholders’ equity Interest when earned; gains and losses from sale (short-term holdings Of debt or equity) Available-for-Sale Fair Value (intermediate to longer term holdings of debt or equity) Other Income Effects Account for held-to maturity debt securities at amortized cost Accounting for Held-to-Maturity Debt Securities (1st) Journalize Acquisition: Dr Held-to-Maturity Securities AmntPd Cr Cash AmntPd (2nd) Journalize Receipt of Interest Payment: Dr Cash AmntRecd Dr Held-to-Maturity Securities AmorDisc Cr Held-to-Maturity Securities AmorPrem Cr Interest Revenue Earned (3rd) Adjusting Entry: no “Mark to Market” adjustment …carry at amortized cost Held-to-Maturity Securities... may lose this classification under some circumstances: a. Evidence of a significant deterioration in the issuer's creditworthiness b. A change in tax law that eliminates or reduces the tax-exempt status of interest on the debt security (but not a change in tax law that revises the marginal tax rates applicable to interest income) c. A major business combination or major disposition (such as sale of a segment) that necessitates the sale or transfer of held-tomaturity securities to maintain the enterprise's existing interest rate risk position or credit risk policy d. A change in statutory or regulatory requirements significantly modifying either what constitutes a permissible investment or the maximum level of investments in certain kinds of securities, thereby causing an enterprise to dispose of a held-to-maturity security e. A significant increase by the regulator in the industry's capital requirements that causes the enterprise to downsize by selling held-to-maturity securities f. A significant increase in the risk weights of debt securities used for regulatory risk-based capital purposes. May not classify as Held-to-Maturity Securities … if ... if the enterprise anticipates that the security would be available to be sold in response to: a. Changes in market interest rates and related changes in the security's prepayment risk b. Needs for liquidity (for example, due to the withdrawal of deposits, increased demand for loans, surrender of insurance policies, or payment of insurance claims) c. Changes in the availability of and the yield on alternative investments d. Changes in funding sources and terms e. Changes in foreign currency risk The following conditions do not lose Held-to-Maturity Classification… if ... a.The sale of a security occurs near enough to its maturity date (or call date if exercise of the call is probable) that interest rate risk is substantially eliminated as a pricing factor. That is, the date of sale is so near the maturity or call date (for example, within 3 months) that changes in market interest rates would not have a significant effect on the security's fair value. b. The sale of a security occurs after the enterprise has already collected a substantial portion (at least 85 percent) of the principal outstanding at acquisition due either to prepayments on the debt security or to scheduled payments on a debt security payable in equal installments (both principal and interest) over its term. For variable-rate securities, the scheduled payments need not be equal. Account for available-for-sale & trading securities portfolios at fair value Investments in Available-for-Sale Securities (debt or equity) (1st) Journalize Acquisition: Dr Available-for-Sale Securities AmntPd Cr Cash AmntPd (2nd) Journalize Receipt of Interest/Dividend Payment: Dr Cash AmntRecd Dr Available-for-Sale Securities AmorDisc Cr Available-for-Sale Securities AmorPrem Cr Interest/Dividend Revenue Earned (3rd) Adjusting Entry -- Mark-to-Market against Equity: Securities Fair Value Adjustment—Available-for-Sale $$$GAIN Unrealized Holding Gain or Loss—Equity $$$GAIN Unrealized Holding Gain or Loss—Equity $$$LOSS Securities Fair Value Adjustment—Available-for-Sale $$$LOSS Investments in Trading Securities (debt or equity securities) (1st) Journalize Acquisition: Dr Trading Securities AmntPd Cr Cash AmntPd (2nd) Journalize Receipt of Interest/Dividend Payment: Dr Cash AmntRecd Cr Interest/dividend Revenue AmntRecd (3rd) Adjusting Entry -- Mark-to-Market against Income: Securities Fair Value Adjustment—Trading Unrealized Holding Gain or Loss—Income $$$GAIN $$$GAIN Unrealized Holding Gain or Loss—Income Securities Fair Value Adjustment—Trading $$$LOSS $$$LOSS The 4 reasons to buy the stocks of another company: • To make money -- fair value accounting • For influence ----- equity method • For control -------- consolidate results (covered in advanced accounting) Account for securities held for the purpose of influence (20% - 50% interest) using the equity method The Investment Account reflects the activity of the Equity Section on the Investee Company (adjusted for intercompany transactions) (as if the net assets were revalued at fair value) … based on the percentage ownership acquired Accounting for Equity Investments Classification: Purpose: Valuation: Valuation Accounts: Level of Influence A Trading B Available-for-Sale C 20-50% holdings Short-Term Gain Moderate to LT Gain For Influence Fair Value Fair Value Equity Security Fair Value Adjustement (TS or AFS) Unrealized Gain or Loss - Income or Equity None Little, if any Passive Interest Significant Dividends Received Income Income Reduce Investment Investee Net Income No Direct Impact No Direct Impact Increase Investment (net o f interco mpany gains & lo sses & after amo rtizatio n o f the dif the dif between the Co st o f the & the pro po rtio nate share o f B V o f assets) Investment in XYZ Account • Cost • Share of Income • Share of Losses • Dividends • Amortizations (but no amortization of any implied goodwill!!!) Accounting for Equity Securities Using the Equity Method Acquisition: Dr Investment in ABC Co. Cr Cash Dividend Receipt: Dr Cash Cr Investment in ABC Co. Income of Investee: Dr Investment in ABC Co. Dr Loss from ABC Co. (extraordinary) Cr Revenue from ABC Co. Cost Cost AmntRec’d AmntRec’d %NI %Extr %NIBX Dr Revenue from ABC Co. Amort Cr Investment in ABC Co. (1/N (Cost-BV)) Amort Adjusting Entry to Carry Investment at Fair Value: none … hold at Adjusted Cost (adjusted for Income & Add’l Depr) Fair Value Accounting Controversy 1. Measurement is based on intent. A subjective evaluation which will result in arbitrary classifications. 2. Gains recorded are based on trading. Selling "winners" and holding on to "losers." 3. Liabilities are recorded at cost, not fair value. Recognizing changes in asset values while ignoring similar changes in liabilities will lead to a high degree of volatility in income and stockholders' equity. 4. There is a great deal of subjectivity in fair values. Results in opportunity gains and losses being recognized in the financial statements… which may quickly reverse. Transfers Between Categories 1. Transfers between categories are accounted for at fair value. 2. The "fair value rule" assures that a company cannot escape recognition of fair value by simply transferring securities to held-to-maturity. 3. Appendix 18A illustrates the accounting entries to record the transfer of securities between categories. Impairment of Value. If the decline is judged to be other than temporary, the cost basis of the individual security is written down to a new cost basis. The amount of the write-down is accounted for as a realized loss. 1. For debt securities, the impairment test is to determine whether it is probable that the investor will be unable to collect all amounts due according to the contractual terms. 2. For equity securities, guidelines are less precise. Any time realizable value is lower than carrying amount, an impairment must be considered. Financial Statement Presentation: Comprehensive Income 1. Changes in unrealized gains and losses related to available-for-sale securities are reported as part of other comprehensive income, and reflected as a separate component of stockholders' equity. Comprehensive income may be reported in: (a) a combined statement of income & comprehensive income or, (b) a separate statement of comprehensive income beginning with net income, or (c) a statement of stockholders' equity. A derivative … is any financial instrument that derives its value from an outside benchmark. For example, a stock option is a derivative in that the value of the option is derived from the underlying price of the stock ... Specifically, the “option premium” is the sum of its “intrinsic value” (difference between its market price & its strike price) & its “time value” (based on the possibility that the option will be “in the money” before it expires). FASB’s definition of a “Derivative” ... “a derivative financial instrument is a futures, forward, swap, or option contract, or other financial instrument with similar characteristics.” includes: • interest rate caps or floors • fixed rate loan commitments • letters of credit ... they provide the holder with benefits of favorable movements in the price of an underlying asset or index with limited or no exposure to losses from unfavorable price movements, generally in return for a premium paid... FABB exposure draft April 14, 1994 Example Derivatives: Speculative Derivatives: • call options Derivatives to Hedge Risk: FAIR VALUE HEDGE • interest rate swap from fixed to variable rate CASH FLOW HEDGE • futures contracts - purchase side • interest rate swap from variable to fixed rate FAS 133: Accounting for Derivatives Use Speculation: Fair Value Hedge Cash Flow Hedge Accounting for the Accounting for the Derivative Hedge • Fair Value, unrealized • n/a holding G/L hit income • Fair Value, unrealized • Fair Value, G/L hit income holding G/L hit income • Fair Value, unrealized • Use other GAAP for the holding G/L hit equity hedged item & are reclassified in income when the hedged transaction’s cash flow affects earnings