August 5

Intercorporate Entities, i.e., consolidations, equity investments, partnerships

Chapter 7

Acquisitions

• Purchase (old and new)

– Goodwill

– mark-to-market analogy

• Pooling

– Simply added BVs of assets and liabilities

– No reflection of MVs at purchase

– 12 criteria (p. 467)

– practice no longer allowed under GAAP

Equity Investments

• Majority => > 50%

– control

– consolidated (Vs. acquired)

• Minority Active => 20% to 50%

– create an asset and adjust for share in NI and dividends

– Equity method

• Minority Passive => < 20%

– mark to market

– Market value method

Comprehensive Income

• Stockholder Equity impact (SFAS 130)

– as compared with I/S impact

• Arises from

– hedging (foreign currency and other derivatives) (SFAS 133)

– pension reporting

– certain mark to market adjustments

Segment Reporting

(SFAS 131)

• Reportable operating segments

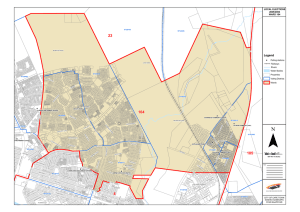

• Geographic coverage

• Major customers

• Be able to identify unique risk in each

Segments, continued

• What is reported?

• Operating segments:

– Sales

– Profit / Loss

– Assets

• Customers: (if

10%)

– Have to report sales

– Often named

• Geographic Segments:

– Sales and fixed assets

Chapter 8

Profitability

ROA and ROE expanded

ROA, as a function of:

• Operating Leverage

– i.e., fixed costs (committed and discretionary)

• Business Cycle

• Product Life Cycle

Leverage

• Earn a higher return than the cost of the investment

• Operating Leverage

– Reflects investment in fixed costs

– Measure as fixed costs (expense) as a percent of total expenses

Strategic Management

• Life cycle of a firm

–Introduction

–Growth

–Maturity

–Decline

Industry-Specific ROA

Problems

• High Tech

• Airlines / Travel and Transport

• Service firms

• Retailers

Expand to ROCE

• ROCE = ROA x CEL x CSL

• Reversion to the Mean