Best Practices Texas Cooperatives

advertisement

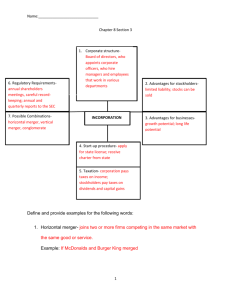

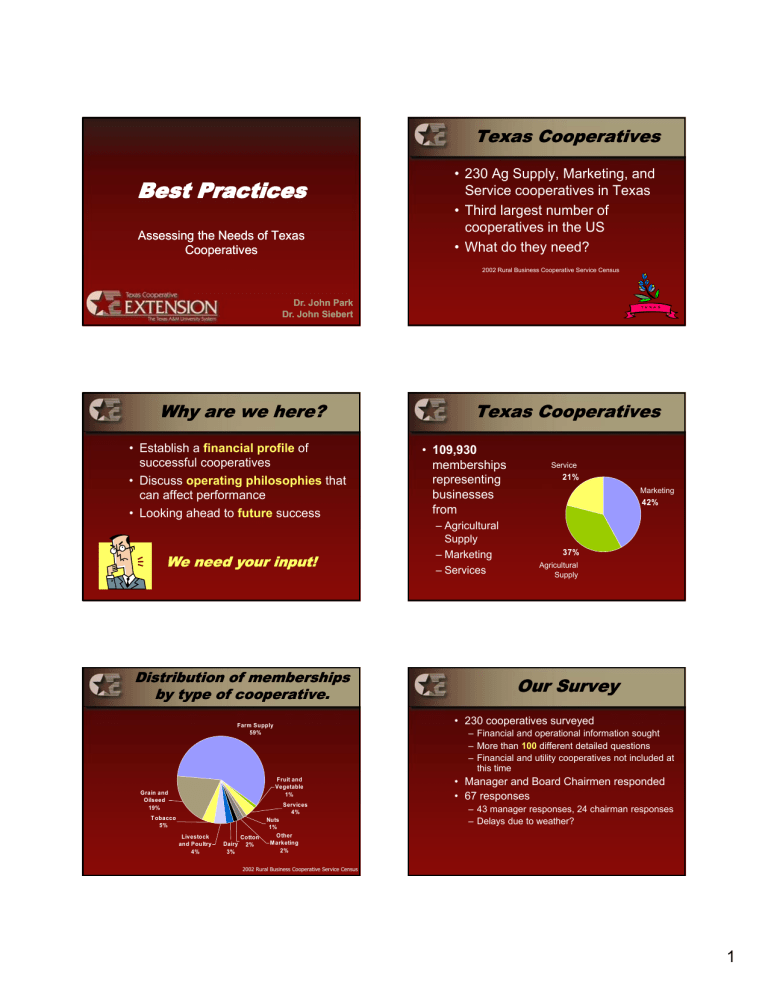

Texas Cooperatives Best Practices Assessing the Needs of Texas Cooperatives • 230 Ag Supply, Marketing, and Service cooperatives in Texas • Third largest number of cooperatives in the US • What do they need? 2002 Rural Business Cooperative Service Census Dr. John Park Dr. John Siebert Why are we here? • Establish a financial profile of successful cooperatives • Discuss operating philosophies that can affect performance • Looking ahead to future success We need your input! Distribution of memberships by type of cooperative. Livestock and Poultry 4% Dairy 3% Cotton 2% – Agricultural Supply – Marketing – Services Service 21% Marketing 42% 37% Agricultural Supply Our Survey – Financial and operational information sought – More than 100 different detailed questions – Financial and utility cooperatives not included at this time Fruit and Vegetable 1% T obacco 5% • 109,930 memberships representing businesses from • 230 cooperatives surveyed Farm Supply 59% Grain and Oilseed 19% Texas Cooperatives Services 4% Nuts 1% Other M arketing 2% • Manager and Board Chairmen responded • 67 responses – 43 manager responses, 24 chairman responses – Delays due to weather? 2002 Rural Business Cooperative Service Census 1 How do you rank business performance? Financial Performance • Pay attention to both short term and long term • Use industry acceptable benchmarks • Study for multiple years • For this case, we only have a one year snapshot Compare and Improve Two Measures of Performance Equity to Assets • Long Term: Total Stockholder & Patron Equity Total Assets • Equity / Assets measures control over your future = E/A • Short Term: Net Income Total Assets = ROA • CoBank prefers E/A > 50% Return on Assets Performance Matrix • Net Income / Assets measures short term performance 100% In Control 80% ROA 60% 8% • CoBank prefers ROA > 8% (or ROA > 5% in drought years) 40% 20% 0% 20% -20% -40% 30% 40% 50% 60% 50% E/A 70% 80% 90% 100% At Risk 2 Comparing In-Control and At-Risk Cooperatives IN CONTROL • E/A above 50% • ROA above 8% Actual Profiles In Control At Risk E/A 73% 42% ROA 21% - 5% $2.3 million $1.2 million $350,000 $650,000 $2.6 million - $150,000 AT RISK • E/A below 50% • ROA below 8% • 15 firms earned a • 6 firms earned a place in this group place in this group Current Liabilities Long Term Liabilities Net Income 13 14 Percent of Firms Ginning Cotton Percent of Firms in Fertilizer and Chemicals 50% 100% 83% 40% 40% 33% 75% 30% 50% 20% 27% 25% 10% 0% 0% In Control In Control At Risk At Risk 15 16 Percent of Firms Selling Fuel or Tires Average Stockholder Equity per Firm 60% $8,000,000 50% $7,000,000 50% $6,000,000 40% % 30% $4,000,000 20% 10% $1,500,000 $2,000,000 7% $0 0% In Control In Control At Risk 17 At Risk 18 3 Percent of Firms Without a Formal Equity Redemption Policy Performance Matrix 100% 100% 100% In Control 80% 75% ROA 60% 50% 27% 8% 25% 40% 20% 0% 20% 30% 40% 50% 60% 50% E/A 70% 80% 90% 100% -20% At Risk 0% -40% In Control At Risk 19 20 Member Evaluation of Cooperative Performance Operating Philosophies • What other measures should we be using? • What other measures are important for your cooperative? Percent Willing to Raise Margins to Survive and Prosper Percent Willing to Cut Costs to Survive and Prosper 30% 70% 60% 60% 27% 25% 50% 20% 40% 33% 17% 15% 30% 10% 20% 5% 10% 0% 0% In Control In Control At Risk 23 At Risk 24 4 Attention: At-Risk Firms Must Evaluate Cost Breakdown of Business Rivals • Knowing that you are in the At-Risk group can take politics out of your decisions • Its important when evaluating major changes to let staff calmly do the analysis • When you cut costs by $1, what is the best you can do to improve profit? 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Other Internet Rivals 2x More Competitors In Control National Chain Rivals Co-op Rivals At Risk 26 Membership Trends for Cooperatives “In Control” Membership Trends for Cooperatives “At Risk” 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% -25% or Worse -11 to 25% -10% No Change 10% +11 to 25% +25% or Better -25% or Worse -11 to 25% -10% No Change 10% +11 to 25% +25% or Better 27 28 We have identified our Top 25 customers We have taken steps to retain our Top 25 67% 70% 70% 60% 60% 50% 50% 40% 40% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% 0% In Control At Risk In Control 29 At Risk 30 5 We send out a board packet one week in advance 60% All directors are prepared for our board meeting 60% 53% 50% 50% 50% 40% 40% 33% 30% 30% 20% 20% 10% 10% 0% 33% 0% In Control At Risk In Control At Risk 31 32 What would you change to survive and prosper? Develop New Lines of Business Looking Ahead 67% 67% 60% Raise Margin Levels 33% 27% Cut Costs 17% Attitudes for Future Success Expand Volum e In Current Lines of Business 20% 17% 13% 17% Sell Assets 0% 20% 40% In Control Our Top 25 Customers 60% 80% At Risk Most Important Factors of Competition with Rivals Customer Focus We have not identified these customers 10% We have a general idea of their identities 33% 67% 40% Number of Competitors 40% Location of Our Company 0% 0% 20% 40% In Control 33% 50% Pricing Policies 10% We have specifically identified them We have identified and taken steps to retain them 64% M ember Loyalty 0% 60% At Risk 80% 50% 50% 67% 7% 50% 0% 20% 40% In Control 60% 80% Competitor Focus At Risk 6 Most Important Factors of Competition with Rivals 43% Employee Expertise 17% Dr. John Park 979-845-1751 jlpark@tamu.edu Dr. John Siebert 979-845-5800 j-siebert@tamu.edu 21% Leadership Experience 0% Unique Product or Service Offering Thoughts for Future Work? What is the value of good employees? 21% 0% 0% 10% 20% 30% In Control 40% At Risk 50% Dept. of Agricultural Economics Texas A&M University College Station, TX 77843-2124 7