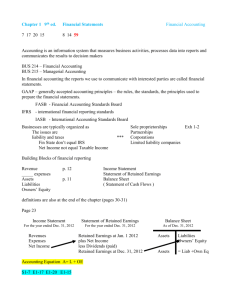

Financial Accounting and Accounting Standards

Chapter

22-1

C H A P T E R 22

ACCOUNTING CHANGES AND

ERROR ANALYSIS

Chapter

22-2

Intermediate Accounting

13th Edition

Kieso, Weygandt, and Warfield

Chapter

22-3

Learning Objectives

Chapter

22-4

Accounting Changes and Error Analysis

Accounting Changes

Changes in accounting principle

Changes in accounting estimate

Reporting in reporting entity

Correction of errors

Summary

Motivations for change of method

Error Analysis

Balance sheet errors

Income statement errors

Balance sheet and income statement effects

Comprehensive example

Preparation of statements with error corrections

Accounting Changes

Chapter

22-5

Accounting Alternatives:

1)

2)

Diminish the comparability of financial information.

Obscure useful historical trend data.

Types of Accounting Changes:

Change in Accounting Principle.

Changes in Accounting Estimate.

Change in Reporting Entity.

Errors are not considered an accounting change.

LO 1 Identify the types of accounting changes.

Changes in Accounting Principle

A change from one generally accepted accounting principle to another. Examples include:

Average cost to LIFO.

Completed-contract to percentage-of-completion.

Chapter

22-6

Adoption of a new principle in recognition of events that have occurred for the first time or that were previously immaterial is not an accounting change.

LO 2 Describe the accounting for changes in accounting principles.

Chapter

22-7

Changes in Accounting Principle

Three approaches for reporting changes:

1) Currently.

2) Retrospectively.

3) Prospectively (in the future).

FASB requires use of the retrospective approach.

Rationale - Users can then better compare results from one period to the next.

LO 2 Describe the accounting for changes in accounting principles.

Chapter

22-8

Changes in Accounting Principle

Retrospective Accounting Change Approach

Company reporting the change

1)

2) adjusts its financial statements for each prior period presented to the same basis as the new accounting principle.

adjusts the carrying amounts of assets and liabilities as of the beginning of the first year presented, plus the opening balance of retained earnings.

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Retrospective Accounting Change: Long-Term Contracts

Illustration: Denson Company has accounted for its income from long-term construction contracts using the completedcontract method. In 2010 the company changed to the percentage-of-completion method. Management believes this approach provides a more appropriate measure of the income earned. For tax purposes, the company uses the completedcontract method and plans to continue doing so in the future.

(We assume a 40 percent enacted tax rate.)

Chapter

22-9

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Income statements for 2008–2010

Illustration 22-1

Chapter

22-10

LO 3

Changes in Accounting Principle

Data for Retrospective Change Example

Illustration 22-2

Journal entry to record change at beginning of 2010:

Construction in Process

Deferred Tax Liability

Retained Earnings

220,000

Chapter

22-11

88,000

132,000

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Reporting a Change in Principle

Major disclosure requirements are as follows.

1. Nature and reason for the change in accounting principle.

2. The method of applying the change, and: a. A description of the prior-period information that has been retrospectively adjusted, if any.

b. The effect of the change on income from continuing operations, net income, any other affected line items.

c. The cumulative effect of the change on retained earnings or other components of equity or net assets as of the beginning of the earliest period presented.

Chapter

22-12

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Reporting a Change in Principle

Illustration 22-3

Chapter

22-13

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Retained Earnings Adjustment

Assuming a retained earnings balance of $1,360,000 at the beginning of 2008.

Illustration 22-4

Before Change

Chapter

22-14

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Retained Earnings Adjustment

Illustration 22-5

After Change

Chapter

22-15

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

E22-1 (Change in Principle—Long-Term Contracts):

Cherokee Construction Company changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during

2010. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows.

Chapter

22-16

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

E22-1 (Change in Principle—Long-Term Contracts):

Instructions: (assume a tax rate of 35%)

(b) What entry(ies) are necessary to adjust the accounting records for the change in accounting principle?

(a) What is the amount of net income and retained earnings that would be reported in 2010? Assume beginning retained earnings for

2009 to be $100,000.

Chapter

22-17

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Example: Pre-Tax Income from Long-Term Contracts

35%

PercentageCompleted Tax

Date of-Completion Contract Difference Effect

2009

2010

$ 780,000

700,000

$ 610,000

480,000

170,000

220,000

59,500

77,000

Net of

Tax

$ 110,500

143,000

Journal entry

2010 Construction in progress

Deferred tax liability

Retained earnings

Chapter

22-18

170,000

59,500

110,500

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Example: Comparative Statements

Income

Statement

Statement of

Retained

Earnings

Pre-tax income

Income tax (35%)

Net income

Beg. Retained earnings

Accounting change

Beg. R/Es restated

Net income

End. Retained earnings

2010

$ 700,000

245,000

$ 455,000

$ 496,500

110,500

$ 607,000

455,000

$ 1,062,000

Restated

2009

$ 780,000

273,000

$ 507,000

$ 100,000

100,000

507,000

$ 607,000

Previous

2009

$ 610,000

213,500

$ 396,500

$ 100,000

100,000

396,500

$ 496,500

Chapter

22-19

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Direct and Indirect Effects of Changes

Direct Effects The FASB takes the position that companies should retrospectively apply the direct effects of a change in accounting principle.

Indirect Effects do not change prior-period amounts.

Chapter

22-20

LO 3 Understand how to account for retrospective accounting changes.

Changes in Accounting Principle

Impracticability

Companies should not use retrospective application if one of the following conditions exists:

1.

Company cannot determine the effects of the retrospective application.

2.

Retrospective application requires assumptions about management’s intent in a prior period.

3.

Retrospective application requires significant estimates that the company cannot develop.

Chapter

22-21

If any of the above conditions exists, the company prospectively applies the new accounting principle.

LO 4 Understand how to account for impracticable changes.

Chapter

22-22

Changes in Accounting Estimate

The following items require estimates.

1.

Uncollectible receivables.

2.

Inventory obsolescence.

3.

Useful lives and salvage values of assets.

4.

Periods benefited by deferred costs.

5.

Liabilities for warranty costs and income taxes.

6.

Recoverable mineral reserves.

7.

Change in depreciation methods.

LO 5 Describe the accounting for changes in estimates.

Changes in Accounting Estimate

Prospective Reporting

Companies report prospectively changes in accounting estimates. They account for changes in estimates in

1. the period of change if the change affects that period only, or

2. the period of change and future periods if the change affects both.

The FASB views changes in estimates as normal recurring corrections and adjustments and prohibits retrospective treatment.

Chapter

22-23

LO 5 Describe the accounting for changes in estimates.

Change in Estimate Example

Illustration: Arcadia High School (Phoenix), purchased equipment for $510,000 which was estimated to have a useful life of 10 years with a salvage value of $10,000 at the end of that time. Depreciation has been recorded for 7 years on a straight-line basis. In 2008 (year 8), it is determined that the total estimated life should be 15 years with a salvage value of $5,000 at the end of that time.

Required:

What is the journal entry to correct prior years’ depreciation expense?

Required

Calculate depreciation expense for 2008.

Chapter

22-24

LO 5 Describe the accounting for changes in estimates.

Change in Estimate Example After 7 years

Equipment cost

Salvage value

Depreciable base

Useful life (original)

Annual depreciation

$510,000

- 10,000

500,000

First, establish

NBV at date of change in estimate.

10 years

$ 50,000 x 7 years = $350,000

Chapter

22-25

Balance Sheet (Dec. 31, 2007)

Fixed Assets:

Equipment $510,000

Accumulated depreciation 350,000

Net book value (NBV) $160,000

LO 5 Describe the accounting for changes in estimates.

Change in Estimate Example

Net book value $160,000

Salvage value (if any) 5,000

Depreciable base 155,000

Useful life

Annual depreciation

8 years

$ 19,375

Second, calculate depreciation expense for 2008.

Chapter

22-26

Journal entry for 2008

Depreciation expense

Accumulated depreciation

19,375

19,375

Solution on notes page

LO 5 Describe the accounting for changes in estimates.

Changes in Accounting Estimate

Chapter

22-27

Disclosures

Companies need not disclose changes in accounting estimate made as part of normal operations, such as bad debt allowances or inventory obsolescence, unless such changes are material.

However, for a change in estimate that affects several periods (such as a change in the service lives of depreciable assets), companies should disclose the effect on income from continuing operations and related pershare amounts of the current period.

LO 5 Describe the accounting for changes in estimates.

Change in Reporting Entity

Examples of a change in reporting entity are:

1.

Presenting consolidated statements in place of statements of individual companies.

2.

Changing specific subsidiaries that constitute the group of companies for which the entity presents consolidated financial statements.

3.

Changing the companies included in combined financial statements.

4.

Changing the cost, equity, or consolidation method of accounting for subsidiaries and investments.

Reported by changing the financial statements of all prior periods presented.

Chapter

22-28

LO 6 Identify changes in a reporting entity.

Correction of Errors

Chapter

22-29

Accounting errors include the following types:

1.

A change from an accounting principle that is not generally accepted to an accounting principle that is acceptable.

2.

Mathematical mistakes.

3.

Changes in estimates that occur because a company did not prepare the estimates in good faith.

4.

Failure to accrue or defer certain expenses or revenues.

5.

Misuse of facts.

6.

Incorrect classification of a cost as an expense instead of an asset, and vice versa.

LO 7 Describe the accounting for correction of errors.

Chapter

22-30

Correction of Errors

All material errors must be corrected.

Record corrections of errors from prior periods as an adjustment to the beginning balance of retained earnings in the current period.

Such corrections are called prior period adjustments .

For comparative statements, a company should restate the prior statements affected, to correct for the error.

LO 7 Describe the accounting for correction of errors.

Chapter

22-31

Correction of Errors

Illustration: In 2011 the bookkeeper for Selectro Company discovered an error:

In 2010 the company failed to record $20,000 of depreciation expense on a newly constructed building. This building is the only depreciable asset Selectro owns. The company correctly included the depreciation expense in its tax return and correctly reported its income taxes payable.

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration: Selectro’s income statement for 2010 with and without the error.

Illustration 22-19

Show the entries that Selectro should have made and did make for recording depreciation expense and income taxes.

Chapter

22-32

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration: Show the entries that Selectro should have made and did make for recording depreciation expense and income taxes.

Illustration 22-20

Correcting

Entry in

2011

Chapter

22-33

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration: Show the entries that Selectro should have made and did make for recording depreciation expense and income taxes.

Illustration 22-20

Correcting

Entry in

2011

Chapter

22-34

Retained Earnings 12,000

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration: Show the entries that Selectro should have made and did make for recording depreciation expense and income taxes.

Illustration 22-20

Correcting

Entry in

2011

Chapter

22-35

Retained Earnings

Deferred Tax Liability

12,000

8,000

Reversal

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration: Show the entries that Selectro should have made and did make for recording depreciation expense and income taxes.

Illustration 22-20

Correcting

Entry in

2011

Chapter

22-36

Retained Earnings

Deferred Tax Liability

12,000

8,000

Accumulated Depreciation—Buildings

Record

20,000

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Illustration (Single-Period Statement): Assume that

Selectro Company has a beginning retained earnings balance at January 1, 2011, of $350,000. The company reports net income of $400,000 in 2011.

Illustration 22-21

Chapter

22-37

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Comparative Statements

A company should

1. make adjustments to correct the amounts for all affected accounts reported in the statements for all periods reported.

2. restate the data to the correct basis for each year presented.

3. show any catch-up adjustment as a prior period adjustment to retained earnings for the earliest period it reported.

Chapter

22-38

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Woods, Inc.

Statement of Retained Earnings

For the Year Ended December 31, 2010

Balance, January 1

Net income

Dividends

Balance, December 31

$ 1,050,000

360,000

(300,000)

$ 1,110,000

Before issuing the report for the year ended December 31, 2010, you discover a $62,500 error that caused the 2009 inventory to be overstated (overstated inventory caused COGS to be lower and thus net income to be higher in 2009). Would this discovery have any impact on the reporting of the Statement of Retained Earnings for 2010? Assume a 20% tax rate.

Chapter

22-39

LO 7 Describe the accounting for correction of errors.

Correction of Errors

Woods, Inc.

Statement of Retained Earnings

For the Year Ended December 31, 2010

Balance, January 1, as previously reported

Prior period adjustment, net of tax

Balance, January 1, as restated

Net income

Dividends

Balance, December 31

$ 1,050,000

(50,000)

1,000,000

360,000

(300,000)

$ 1,060,000

Chapter

22-40

Solution on notes page LO 7 Describe the accounting for correction of errors.

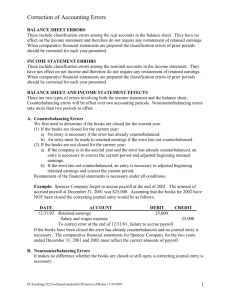

Summary of Accounting Changes and Errors

Illustration 22-23

Chapter

22-41

LO 7 Describe the accounting for correction of errors.

Summary of Accounting Changes and Errors

Illustration 22-23

Chapter

22-42

LO 7 Describe the accounting for correction of errors.

Chapter

22-43

Motivations for Change of

Accounting Method

Why companies may prefer certain accounting methods. Some reasons are:

1.

2.

Political costs.

Capital Structure.

3.

4.

Bonus Payments.

Smooth Earnings.

LO 8 Identify economic motives for changing accounting methods.

Error Analysis

Companies must answer three questions:

1.

What type of error is involved?

2.

3.

What entries are needed to correct for the error?

After discovery of the error, how are financial statements to be restated?

Companies treat errors as prior-period adjustments and report them in the current year as adjustments to the beginning balance of Retained Earnings.

Chapter

22-44

LO 9 Analyze the effect of errors.

Chapter

22-45

Balance Sheet Errors

Balance sheet errors affect only the presentation of an asset, liability, or stockholders’ equity account.

When the error is discovered in the error year, the company reclassifies the item to its proper position.

If the error is discovered in a prior year, the company should restate the balance sheet of the prior year for comparative purposes.

LO 9 Analyze the effect of errors.

Chapter

22-46

Income Statement Errors

Improper classification of revenues or expenses.

A company must make a reclassification entry when it discovers the error in the error year.

If the error is discovered in a prior year, the company should restate the income statement of the prior year for comparative purposes.

LO 9 Analyze the effect of errors.

Balance Sheet and Income Statement Errors

Errors affecting both balance sheet and income statement.

This type of error classified as:

1.

Counterbalancing errors

2.

Noncounterbalancing errors

Chapter

22-47

LO 9 Analyze the effect of errors.

Balance Sheet and Income Statement Errors

Counterbalancing Errors

Will be offset or corrected over two periods.

If company has closed the books: a.

If the error is already counterbalanced, no entry is necessary.

b.

If the error is not yet counterbalanced, make entry to adjust the present balance of retained earnings.

Chapter

22-48

For comparative purposes, restatement is necessary even if a correcting journal entry is not required.

LO 9 Analyze the effect of errors.

Balance Sheet and Income Statement Errors

Counterbalancing Errors

Will be offset or corrected over two periods.

If company has not closed the books: a.

If error already counterbalanced, make entry to correct the error in the current period and to adjust the beginning balance of Retained Earnings.

b.

If error not yet counterbalanced, make entry to adjust the beginning balance of Retained Earnings.

Chapter

22-49

LO 9 Analyze the effect of errors.

Balance Sheet and Income Statement Errors

Noncounterbalancing Errors

Not offset in the next accounting period.

Companies must make correcting entries, even if they have closed the books.

Chapter

22-50

LO 9 Analyze the effect of errors.

Error Analysis Example

E22-19 (Error Analysis; Correcting Entries): A partial trial balance of Dickinson Corporation is as follows on

December 31, 2010.

Dr.

Cr.

Supplies on hand $ 2,500

Accured salaries and wages

Interest receivable

Prepaid insurance

5,100

90,000

$ 1,500

Unearned rent 0

Accured interest payable 15,000

Instructions

(a) Assuming that the books have not been closed, what are the adjusting entries necessary at December 31, 2010?

Chapter

22-51

LO 9 Analyze the effect of errors.

Error Analysis Example

(a) Assuming that the books have not been closed , what are the adjusting entries necessary at December 31, 2010?

1.

A physical count of supplies on hand on December 31,

2010, totaled $1,100.

Supplies expense

Supplies on hand

1,400

1,400

2.

Accrued salaries and wages on December 31, 2010, amounted to $4,400.

Salaries and wages expense

Accured salaries and wages

2,900

2,900

Chapter

22-52

Solution on notes page LO 9 Analyze the effect of errors.

Error Analysis Example

(a) Assuming that the books have not been closed , what are the adjusting entries necessary at December 31, 2010?

3.

Accrued interest on investments amounts to $4,350 on

December 31, 2010.

Interest revenue

Interest receivable

750

750

4.

The unexpired portions of the insurance policies totaled

$65,000 as of December 31, 2010.

Insurance expense

Prepaid insurance

25,000

25,000

Chapter

22-53

Solution on notes page LO 9 Analyze the effect of errors.

Error Analysis Example

(a) Assuming that the books have not been closed , what are the adjusting entries necessary at December 31, 2010?

5.

$24,000 was received on January 1, 2010 for the rent of a building for both 2010 and 2011. The entire amount was credited to rental income.

Rental income

Unearned rent

12,000

12,000

6.

Depreciation for the year was erroneously recorded as

$5,000 rather than the correct figure of $50,000.

45,000

Chapter

22-54

Depreciation expense

Accumulated depreciation

Solution on notes page

45,000

LO 9 Analyze the effect of errors.

Error Analysis Example

E22-19 (Error Analysis; Correcting Entries) A partial trial balance of Dickinson Corporation is as follows on December

31, 2010.

Dr.

Cr.

Supplies on hand $ 2,500

Accured salaries and wages

Interest receivable

Prepaid insurance

5,100

90,000

$ 1,500

Unearned rent 0

Accured interest payable 15,000

Instructions

(b) Assuming that the books have been closed , what are the adjusting entries necessary at December 31, 2010?

Chapter

22-55

LO 9 Analyze the effect of errors.

Error Analysis Example

(b) Assuming that the books have been closed , what are the adjusting entries necessary at December 31, 2010?

1.

A physical count of supplies on hand on December 31,

2010, totaled $1,100.

Retained earnings

Supplies on hand

1,400

1,400

2.

Accrued salaries and wages on December 31, 2010, amounted to $4,400.

Retained earnings

Accured salaries and wages

2,900

2,900

Chapter

22-56

Solution on notes page LO 9 Analyze the effect of errors.

Error Analysis Example

(b) Assuming that the books have been closed , what are the adjusting entries necessary at December 31, 2010?

3.

Accrued interest on investments amounts to $4,350 on

December 31, 2010.

Retained earnings

Interest receivable

750

750

4.

The unexpired portions of the insurance policies totaled

$65,000 as of December 31, 2010.

Retained earnings

Prepaid insurance

25,000

25,000

Chapter

22-57

Solution on notes page LO 9 Analyze the effect of errors.

Error Analysis Example

(b) Assuming that the books have been closed , what are the adjusting entries necessary at December 31, 2010?

5.

$24,000 was received on January 1, 2010 for the rent of a building for both 2010 and 2011. The entire amount was credited to rental income.

Retained earnings

Unearned rent

12,000

12,000

6.

Depreciation for the year was erroneously recorded as

$5,000 rather than the correct figure of $50,000.

45,000

Chapter

22-58

Retained earnings

Accumulated depreciation

Solution on notes page

45,000

LO 9 Analyze the effect of errors.

One area in which iGAAP and U.S. GAAP differ is the reporting of error corrections in previously issued financial statements. While both GAAPs require restatement, U.S. GAAP is an absolute standard—that is, there is no exception to this rule.

The accounting for changes in estimates is similar between U.S.

GAAP and iGAAP.

Chapter

Under U.S. GAAP and iGAAP, if determining the effect of a change in accounting principle is considered impracticable, then a company should report the effect of the change in the period in which it believes it practicable to do so, which may be the current period.

22-59

Chapter

22-60

Under iGAAP, the impracticality exception applies both to changes in accounting principles and to the correction of errors. Under U.S.

GAAP, this exception applies only to changes in accounting principle.

IAS 8 does not specifically address the accounting and reporting for indirect effects of changes in accounting principles. As indicated in the chapter, U.S. GAAP has detailed guidance on the accounting and reporting of indirect effects.

Chapter

22-61

Change From The Equity Method

Change from the equity method to the fair-value method.

Earnings or losses previously recognized under the equity method should remain as part of the carrying amount of the investment.

The cost basis is the carrying amount of the investment at the date of the change.

The investor applies the new method in its entirety.

At the next reporting date, the investor should record the unrealized holding gain or loss to recognize the difference between the carrying amount and fair value.

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Dividends in Excess of Earnings

Accounted for such dividends as a reduction of the

investment carrying amount, rather than as revenue.

Reason: Dividends in excess of earnings are viewed as a a reduction of the equity investment.

Chapter

22-62

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Dividends in Excess of Earnings

Illustration: On January 1, 2009, Investor Company purchased

250,000 shares of Investee Company’s 1,000,000 shares of outstanding stock for $8,500,000. Investor correctly accounted for this investment using the equity method. After accounting for dividends received and investee net income, in 2009, Investor reported its investment in Investee Company at $8,780,000 at

December 31, 2009. On January 2, 2010, Investee Company sold

1,500,000 additional shares of its own common stock to the public, thereby reducing Investor Company’s ownership from 25 percent to 10 percent.

Chapter

22-63

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Dividends in Excess of Earnings

Illustration 22A-1

Chapter

22-64

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Impact on Investment Carrying Amount

Illustration 22A-2

2010 &

2011

2012

Chapter

22-65

Cash

Dividend Revenue

400,000

400,000

Cash

Available-for-Sale Securities

Dividend Revenue

Solution on notes page

210,000

60,000

150,000

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Chapter

22-66

Change To The Equity Method

Companies use retrospective application.

The carrying amount of the investment, results of current and prior operations, and retained earnings of the investor are adjusted as if the equity method has been in effect during all of the previous periods.

Companies also eliminate any balances in the Unrealized

Holding Gain or Loss—Equity account and the Securities

Fair Value Adjustment account.

LO 10 Make the computations and prepare the entries necessary to record a change from or to the equity method of accounting.

Copyright

Chapter

22-67

Copyright © 2009 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.