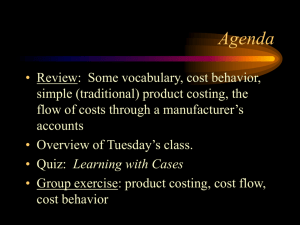

Week 1: Activity Based Costing - Discussions

advertisement