Managerial Accounting Chapter 8

advertisement

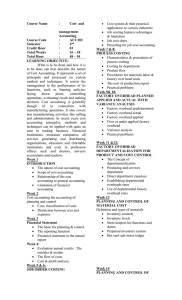

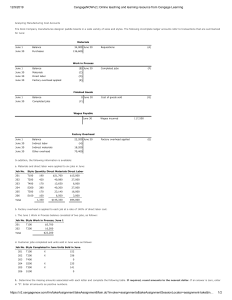

Chapter 35 Managerial Accounting Cost Allocation Concepts Prepared by Diane Tanner University of North Florida 2 Trend Towards Indirect Costs Automated manufacturing environments experience overhead costs that exceed 60% of total product costs Recent trends Reduction of direct costs Creates greater indirect costs More services provided Very little direct costs High levels of indirect costs Why Do We Allocate Costs? 1. GAAP requires full cost information 2. To make decisions of pricing, expansion, product dropping, cost-plus contracts, etc. 3. Make managers conserve resources 4. Create incentives for evaluating efficiency of ‘fee’ based company services 3 Criteria Used When Selecting Allocation Bases Problem: Identifying a relationship with indirect fixed costs is not feasible Relative Benefits To allocate more costs to the cost objectives that benefit most from incurring the cost Ability to To allocate more costs to most profitable products Bear Costs Equity To allocate fairly and equitably http://news.bbc.co.uk/2/hi/europe/1759791.stm 4 5 Approaches to Assigning Overhead Costs Traditional allocation A single “plant-wide” overhead rate used for entire factory Normal costing Simple to use Traditional allocation bases Direct labor cost Direct labor hours Machine hours Units produced Activity-based costing Multiple overhead rates—one for each activity Expensive to implement More accurate product costing 6 Concerns of Using One Overhead Rate Can distort unit product costs Direct labor and other volume-based rates are not highly correlated with overhead costs I.e., not all overhead costs increase for the same reason Single allocation basis does not reflect the activity for all overhead costs 6 What is a Cost Object? A product, job, service provided, batch, or department that will receive a portion of a cost allocation Something for which we want to know its cost 7 8 What is a Cost Pool? A grouping of individual costs whose total is allocated using one allocation base Often based on departments or the output of a particular process in a company Usually consists of both variable and fixed costs Sometimes called a cost bucket 9 What is a Cost Driver? An activity that causes the cost pool to increase Often called an activity base because more of the activity ‘drives’ a cost up # of Customers Products Cost Objects Activity Bases # of DL Hours # of Employees # Sq. Feet # of Inspections # of packages Amt. of DL$ # of Crates Cost Hierarchies • Cost hierarchies are levels in which costs occur. Facility-level activities • Factory costs that impact all the products produced in a factory, such as depreciation on the factory building, factory insurance, factory janitors, factory supplies Product-level activities • Costs specific to particular products such as training employees how to produce it, quality control on a product, etc. Batch-level activities • Costs specific to particular batches of products such as machine setup for a particular product, machine maintenance between each batch, etc. Unit-level activities • Costs performed every time a product is produced. They are usually variable and correlate to the number of products produced, such as packaging, sanding a product edge, printing labels, etc. 10 The End 11