ELECTRIC POWER SECTOR REFORM ACT –THE JOURNEY SO

advertisement

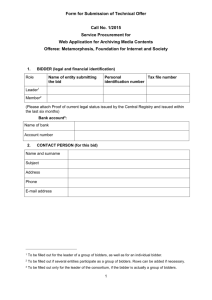

THE PRESIDENCY, NATIONAL COUNCIL ON PRIVATISATION UPDATE ON THE PRIVATIZATION OF PHCN SUCCESSOR COMPANIES By Atedo N A Peterside coN Member, National Council on Privatisation (NCP) and Chairman, NCP’s Technical Committee 11 December , 2012 1 Outline Early Milestones Achieved Transitional Market Arrangement Privatisation Strategy Transaction Update Emergence of Preferred Bidders Next Steps In The Disco and Genco Transactions Transmission Company of Nigeria (TCN) Outstanding Challenges Conclusion 2 Early Milestones Achieved - Passage of Electric Power Sector Reform Act (EPSRA) In March 2005 the National Assembly passed the Electric Power Sector Reform Act. The Act outlined the framework of the reform as follows: Unbundled the state owned power entity (NEPA) into generation, transmission and distribution segments; 3 Early Milestones Achieved cont’d… - Passage of EPSRA Provided for the transfer of assets , liabilities and staff of NEPA to PHCN and then to successor generation, transmission and distribution companies Created a competitive market for electricity services in Nigeria Set up an independent regulator Nigerian Electricity Regulatory Commission (NERC). 4 Early Milestones Achieved cont’d… -Unbundling In November Companies 2005, comprising 18 of New successor 6 generation companies, 1 transmission company and 11 distribution companies were incorporated; On 1st July 2006, the assets, liabilities and staff of PHCN were transferred to the successor companies, thereby granting the latter greater operational autonomy. 5 Early Milestones Achieved cont’d… -Market Codes/Rules/NELMCO Relevant market codes (Grid, Distribution, Performance, Metering etc) have been issued ; Companies to carry on the role of bulk trading in transition and liability management have been incorporated as Nigeria Bulk Electricity Trading Co Plc and Nigerian Electricity Liability Management Company (NELMCO) ; The Market Rules to guide the operations in the electricity industry were approved in 2009. 6 Transitional Market Arrangement -Bulk Trader The bulk trader was established in 2011 to Negotiate and enter into Power Purchase Agreements (PPAs) with privatised generation companies. Assume PHCN obligations under existing PPAs with Independent Power Producers (IPPs) [outstanding liabilities to be transferred to Nigerian Electricity Liability Management Company (NELMCo) – power and possible gas portfolio] . Negotiate and enter into PPAs with potential IPPs. Enter into Companies. Vesting Contracts with Distribution 7 Transitional Market Arrangement Cont’d... - Flow Chart GenCo1 GenCo2 GenCo3 Existing IPPs Existing IPPs Existing IPPs New IPPs GenCo4 GenCo5 GenCo6 POWER PURCHASE AGREEMENTS Additional Capacity PPAs BULK TRADER (NBET) VESTING CONTRACTS Eligible Customers DisCo 1 DisCo 2 DisCo 3 DisCo 4 DisCo 5 DisCo 6 DisCo 7 DisCo 8 DisCo 9 DisCo 10 DisCo 11 8 Privatization Strategy Approved privatisation strategy for the Successor Companies and TCN: Core investor sale Asset sale ( Non Core Assets) Management Contract Concessions Disco TranSysCo TCN Genco • Core Investor Sale (Sale of Equity) ••Management ManagementContract Contract • Core Investor Sale (Thermal) • Concession (Hydro) 9 Privatization Strategy Cont’d… -(Discos) To emerge as a core investor a bidder will be required to submit a proposal aimed at reducing Aggregate Technical, Commercial and Collection (ATC&C) losses over a five year period ; The level of losses that a bidder proposes to reduce will be incorporated in the Multi Year Tariff Order (MYTO); MYTO will stipulate the annual investment requirement, allowable operational expenditure, approved rate of return on equity and other allowable expenses for each distribution company; The selection criteria seeks to appoint an operator with the best technical, financial and managerial qualification for reducing ATC&C losses 10 Privatisation Strategy Cont’d…. - Gencos (Hydro) Generation • 2 Hydro Gencos up for Concession Hydro stations Kainji HydroElectric Plc (Comprising Kainji & Jebba Plants) •first hydro power station, established on the River Niger •total installed capacity, 1344 MW •Current capacity 317MW Shiroro Hydro Electric Plc •on the Shiroro Gorge on the River Kaduna •newest Hydro Station established in 1990 •installed capacity, 600 MW •Current Capacity. All units are available but plant is down due to Low water level 11 Privatisation Strategy Cont’d… - Gencos (Thermal) Generation • 4 remaining Thermal Generation Plants slated for core investor sell Geregu Power PLC •Kogi State •installed capacity, 414 MW •on stream Available Capacity 414 MW •c 2007 •Available Capacity 414 Sapele Power Plc • Delta State •Built 1978 • Installed Capacity 1020 •Available capacity 100 MW Ughelli •Delta area •Built between 1966 and 1975 •installed capacity, 900 MW •Available capacity 150 MW Afam Power Plc Comprising of Afam I-V • Rivers State •Built 1976 •Installed Capacity 776 •Available capacity 90 MW 12 Transaction Update Beginning in December 2010, BPE, re-started the privatisation of the PHCN Successor Companies. • The Requests for Expression of Interest were followed by a series of Road Shows to promote the transactions. Road shows were held in: • Lagos, Nigeria • Dubai, United Arab Emirates • London, Great Britain • New York, United States • Johannesburg, South Africa BPE received 331 EOIs on March 4, 2011 and subsequently evaluated them 13 100 80 60 40 20 0 Transaction Update Cont’d... -Shortlist of Bidders Firms Short Listed Firms Purchasing Bid Documents Short Listed Firms Purchasing Bid Documents Percentage Hydro 40 35 88% Thermal 87 56 64% Distribution 80 72 90% 207 163 79% Total 14 Transaction Update Cont’d... - Timelines Milestone Date Achieved Draft Industry Agreements Posted August 15, 2011 Deadline to confirm intention to bid, $20,000 fee due for purchase of RFP documents Issuance of RFP, Information Memorandum Documents August 26, 2011 September 1, 2011 Access to virtual Data Room September 1, 2011 Pre-Due Diligence Conference October 14, 2011 Opening of Physical Data Rooms October 24, 2011 Bidders’ Site Visits November 14- January 30, 2011 Transaction and Industry Review Conference November 28 and 29, 2011 15 Transaction Update Cont’d... - Timelines Committed Bid Timeline Milestone Issue Revised Legal Documents Generation Date March 30, 2012 Distribution Date March 30, 2012 Submission of Comments by Bidders April 20, 2012 April 20, 2012 on the Legal Documents Distribution/Issuance of Final May 11, 2012 May 11, 2012 Industry and Bid Documents Bid Submission July 17, 2012 July 31, 2012 August 14, August 28, Finalize Technical Evaluation 2012 2012 NCP Approval of Technical August 28, September 11, Evaluation 2012 2012 Deadline for Submission of PostSeptember October 12, Qualification Security 18, 2012 2012 September October 16, Financial Bid Opening 25, 2012 2012 NCP Approval and Announcement of October 29, October 29, Preferred Bidder 2012 2012 16 Transaction Update Cont’d... - Tariff and Gas Price A cost reflective tariff came on stream on June 1,2012 Commercialization of the Gas-to-Power sub-sector • Gas price being transitioned up to export parity by 2015 • Working towards ensuring that the gas agreements have a term of 15- 20 years or more back to back with other industry agreements. 17 Transaction Update Cont’d... Securitization • Nigeria is working closely with the World Bank to put in place a Partial Risk Guarantee for the Power Sector Power Sector Incentives • A series of incentives for the power sector has been recommended to MOF Rural Electrification Agency • The Ministry of Power has developed a draft policy that is market driven and utilizes the power of the private sector to improve rural electrification Transitional Subsidy • In order to mitigate potential “rate shock” to end consumers, a transitional subsidy of N50 billion has been allocated by the MOF in the 2012 budget and captured in MYTO 2 for R1& R2 customers 18 -Bid Receipt and Evaluation Bid submission and evaluation process: July 17, 2012, 25 proposals were received for the GENCOs. July 31, 2012, 54 proposals were received for the DISCOs 3 (three) committees (with members from BPE, NERC, MOP, NEXANT, CPCS & NIAF) were constituted to evaluate the bids Officials from the Economic and Financial Crimes Commission (EFCC) and Independent Corruption Practices Commission (ICPC) and SSS served as observers Following the conclusion of the evaluation of the technical bids, the Technical Committee (TC) of NCP reviewed the evaluation reports for the Gencos and Discos on August 10 and September 6, 2012 respectively for correctness and fairness. For the Discos, the TC considered and deliberated on issues of firms that scored marginally below the 750 benchmark (i.e. borderline cases) and few other related issues. 19 Transaction Update Cont’d… NCP approved 9 prequalified bidders for the GENCOs on August 14, 2012 while 31 prequalified bidders were approved by NCP for the DISCOs on September 18, 2012. Financial bid opening ceremony was held on September 25, 2012 for the Gencos and October 16, 2012 for the Discos. NCP on October 29, 2012 approved the 5 (five) preferred bidders for Genco & 10 preferred bidders for Disco. US$1,001,654,534 expected from sale of 5 Gencos transactions and US$1,419,000,000 from sale of 10 Discos transactions. 20 Emergence Of Preferred Bidders -NCP Approved Bidders List For Gencos Bidder SC Bidding Price Reserve Price Amperion Geregu US$128,520,000 Offer below reserve price Mainstream Kainji US$50,760,666 Above reserve price Final Price US ($) $132,000,000 $50,760,666 & Commencement Fee $237,870,000 Comments Preferred bidder Preferred bidder North – South Shiroro US$23,602,484.87 Above reserve price $23,602,484.87 & Commencement fee $111m Preferred Bidder Transcrop/ Woodrock Ughelli $300,000,000 Above reserve price $300,000,000 Preferred bidder 21 -NCP Approved Bidders List For Gencos Bidder SC Bidding Price Reserve Price Final Price US ($) Comments Feniks Ughelli $54,000,000 To request match reserve price CMEC/ Eurafric Sapele $201,000,000 Above reserve price $201,000,000 Preferred bidder JBNNestoil Sapele $80,000,000 Below reserve price $106,500,000 Reserve bidder N/A Reserve bidder 22 Emergence Of Preferred Bidders Cont’d … -Outcome of the Disco financial bid opening and consistency test/ NCP approval SPV/Comp/ Consortium ATC&C Loss Proposed Ranking of ATC&C Loss Percentage Above/ Below Average of other Bids Outcome of Consistency Test (i.e. Net Present Value) Recommendations & NCP Approval ABUJA Interstate Electrics Ltd KANN Consortium Utility Company Ltd 21.62% 18.43% 1 2 17.31% -14.75% Negative NPV (N146, 581,184,000.00) Failed initial consistency Test Positive NPV N106,717,355,000.00 Preferred Bidder Positive NPV N58,104,747,000.00 Preferred Bidder BENIN VIGEO Power Limited Southern Electricity Distribution Company (SEDC) 21.78% 17.72% 1 2 22.91% -18.64% They were disqualified for submitting multiple bids 23 Emergence Of Preferred Bidders Cont’d … -Outcome of the Disco financial bid opening and consistency test/ NCP approval SPV/Comp/ Consortium ATC&C Loss Proposed Ranking of ATC&C Loss Percentage Above/ Below Average of other Bids Outcome of Consistency Test (i.e. Net Present Value) Recommendations & NCP Approval EKO Integrated Energy Distribution & Marketing Ltd 21.43% 1 25.62% Positive NPV N64,721,679,000.00 Positive NPV N79,815,618,000.00 New Electricity Distribution Company Consortium (NEDC)/KEPCO 20.43% 2 18.37% West Power & Gas 18.55% 3 5.18% Honeywell Energy Resources International Ltd 16.33% 4 -9.68% SEPCO-Pacific Energy Consortium 15.70% 5 -13.76% OANDO Consortium 14.29% 6 -22.71% Positive NPV N85,819,699,830.00 3rd choice (cannot win) Can not win because they are the preferred bidders of Ikeja Preferred Bidder Reserve bidder 24 Emergence Of Preferred Bidders Cont’d … -Outcome of the Disco financial bid opening and consistency test/ NCP approval SPV/Comp/ Consortium ATC&C Loss Proposed Ranking of ATC&C Loss Percentage Above/ Below Average of other Bids Outcome of Consistency Test (i.e. Net Present Value) Recommendations Positive NPV N47,822,316,000.00 Initially failed Consistency Test with negative NPV of N124,376,096,000.00 but got reprieve for the NPV to be recomputed / Preferred bidder ENUGU Interstate Electrics Ltd Eastern Electric Nigeria (EEN) Ltd 20.83% 15.99% 1 2 30.27% -23.24% Positive NPV N48,634,376,000.00 Reserve Bidder IBADAN Integrated Energy Distribution & Marketing Ltd New Electricity Distribution Company Consortium 17.46% 1 10.82% Positive NPV N78,138,907,000.00 Positive NPV N98,583,637,000.00 17.14% 2 7.70% Preferred Bidder (1st Choice) Reserve Bidder 25 Emergence Of Preferred Bidders Cont’d … -Outcome of the Disco financial bid opening and consistency test/ NCP approval SPV/Comp/ Consortium ATC&C Loss Proposed Ranking of ATC&C Loss Percentage Above/ Below Average of other Bids Outcome of Consistency Test (i.e. Net Present Value) Recommendations IKEJA Integrated Energy Distribution & Marketing Ltd New Electricity Distribution Company Consortium (NEDC)/KEPCO VIGEO Holdings, Gumco, African Corporation AFC & CESC Consortium Positive NPV N67,272,911,000.00 22.51% 1 27.43% 4th choice (cannot win) Positive NPV N88,540,556,000.00 20.43% 19.27% 2 3 Preferred bidder 13.00% 5.23% West Power & Gas Ltd 18.08% 4 -2.53% Honeywell Energy Resources International Ltd 16.25% 5 -14.09% OANDO Consortium 14.29% 6 -25.99% Positive NPV N77,880,326,000.00 Reserve Bidder Positive NPV N94,272,764,640.00 26 Emergence Of Preferred Bidders Cont’d … -Outcome of the Disco financial bid opening and consistency test/ NCP approval SPV/Comp/ Consortium ATC&C Loss Proposed Ranking of ATC&C Loss Percentage Above/ Below Average of other Bids Outcome of Consistency Test (i.e. Net Present Value) Recommendations Preferred Bidder JOS Aura Energy Ltd 16.22% 1 N/A Positive NPV N31,348,520,000.00 21.21% 1 N/A Positive NPV N57,111,771,000.00 Preferred Bidder 19.55% 1 N/A Positive NPV N49,930,017,000.00 Preferred Bidder KANO Sahelian Power SPV Ltd PORTHARCOURT 4Power Consortium YOLA Integrated Energy Distribution & Marketing Ltd 18.58% 1 N/A Positive NPV N24,282,261,000.00 Preferred Bidder (2nd Choice) 27 In every case, the "eligible" bidder with the highest ATC&C won except for Abuja Disco, Emergence Of Preferred Bidders Cont’d … -Plan B Eligible prequalified bidders have been invited to express an interest in afam genco and kaduna disco on or before 31st january 2013. Thereafter, the sale of these two successor companies will proceed. 28 Next Steps in the Disco and Genco Transactions A Preferred Bidder’s Bank Guarantee for fifteen percent (15%) of the transaction value within fifteen (15) business days of notification from the Bureau of Public Enterprises. The designated Preferred Bidder will be invited for negotiations with BPE. Within fifteen (15) Business Days after signing of the Sale and Purchase Agreement or the Shareholders’ Agreement, whichever is earlier, or at a mutually agreed earlier time, the Bidder shall make a down payment of twenty-five percent (25%) of the share purchase price. 29 Next Steps in the Disco and Genco Transactions Cont’d... Within six (6) months after signing of the Sale and Purchase Agreement or the Shareholders’ Agreement, whichever is earlier, or at a mutually agreed upon time, the Bidder will be required to pay the outstanding seventy five (75%) of the share purchase price to complete the transaction. Handover of the successor company to the preferred Bidder. At the close of business on 23 November, 2012 all 5 gencos preferred bidders and 10 disco preferred bidders submitted their post qualification bankers guarantee for a total sum of $335 million. This qualifies negotiations. all the bidders to be invited for 30 Transmission Company of Nigeria (TCN) A successor company of PHCN; Incorporated in November 2005 following enactment of EPSR Act 2005; Owns and operates the transmission system from 132kV and above; Currently functions as an integrated Transmission Service Provider (TSP), System Operator (SO) and Market Operator (MO). 31 Transmission Company of Nigeria (TCN) Cont’d… -Functions TSP SO MO •Design, specification, construction and commissioning of transmission assets •Inspection, preventive, corrective and planned maintenance of installations •Connections to network •Efficient generation scheduling and dispatch •Demand forecasting , system and operational planning •Enforcement of Grid Code compliance •Fault management and system restoration (after collapses) •Bulk electricity metering •Electricity market settlements (balancing energy and cash) •Management of payments from Discos and payments to Gencos 32 Transmission Company ofNigeria(TCN) Cont’d… -Importance of TCN TCN is an indispensable link in the electricity value chain NIPP Generation –successor companies Jebba Hydro Market Kainji Hydro Shiroro Hydro Egbin Delta Afam Sapele IPP’s Operator Transmission and System Operator Distribution Abuja Kaduna Enugu Ikeja Ibadan Jos Port Harco Eko Benin Kano Yola Customers Low Voltage Medium Voltage High Voltage 33 Transmission Company of Nigeria (TCN) Cont’d… -Rationale for TCN Management Contract The need to place TCN on the path of best practice, reliability and self sustenance in order to ensure predictability and security of the transmission system; Management contractor will bring in external experience on sector development The current design of the management contract provides clear targets and incentives Contractual obligation for capacity building of TCN staff to enable them for future roles post-management contract The Management contractor will enable the complete unbundling and independent operation of the System and Market Operator functions into an Independent System Operator, allowing the entities to concentrate on their core functions and thus further enrich the industry. 34 Transmission Company of Nigeria (TCN) Cont’d … Selection of Management Contractor Role of MC is to reposition TCN for financial sustainability and capacity and ability to exceed demanded service delivery. The process of selecting an MC for TCN started in February 2006. 3 firms – ESBI, Terna Rete Elettrica Internazionale, and Power Grid Corporation were shortlisted. Financial bids were opened on September 12, 2007 and upon equalization of technical and financial scores , Power Grid scored the highest. It was in the process of obtaining NCP approval that FG suspended the power sector reform program. 35 Cont’d … Selection of Management Contractor On December 19, 2011 fresh RFPs were issued to ESBI, PGC and MHI. ESBI declined to participate. Bids were submitted on February 29, 2012 & Technical bid evaluation was conducted on March 8 and 9, 2012. Manitoba Hydro International (MHI) scored 82.49 % to beat the minimum score of 75% ,while Power Grid Corporation (PGC) scored 61.92% and thus failed to pre-qualify for opening of their financial bid. MHI’s financial bid was opened on Tuesday April 3 at a well attended ceremony and negotiations commenced immediately after. NCP approved the technical evaluation result and our request to commence negotiations with MHI. After signing of contract major crisis broke out over due process in the selection of the MC but this has been resolved with BPP. 36 Cont’d … - Current Status of MHI Contract The BPP issued a letter of “Ratification” to BPE on the following terms: List of reimbursable to be included in Contract as an addendum; The contract to be signed afresh between MHI, BPE and TCN and DG to sign only for BPE and Ministry of finance to sign for TCN to be witnessed by Legal adviser of TCN; The contract sum is for US$ 23, 605,514.00; The review of the contract has been done. 37 Transmission Company of Nigeria (TCN) Cont’d … - Current Status of MHI Contract The BPE and Ministry of Power need to conclude on all contractual issues pertaining to the smooth take off of the MC. The TCN board needs to be constituted . The Independent expert identified and appointed. needs to be Outstanding invoice payments need to be concluded. The Ministry and BPE should work together 38 so that MHI takes over fully and in line with Outstanding Challenges Resolution of labor Issues fundamental for the close of the transaction Resolving the issue of Land Titles for properties that have none Addressing Transitional issues that will come up before hand over of the transaction Concluding negotiations successfully with all the preferred bidders. Valuation of state Government investments in the discos Resolution of all issues to do with TCN 39 Conclusion The process for the privatization of PHCN successor companies has reached an advanced stage. With the selection of preferred bidders we are likely to close the transaction with the preferred bidders for 5 gencos and 10 discos by mid 2013. Sale of Kaduna disco and Afam genco will conclude later. To achieve the above time line we must continue to work very closely with all critical stakeholders. 40 THANK YOU 41