Introduction to Accounting

advertisement

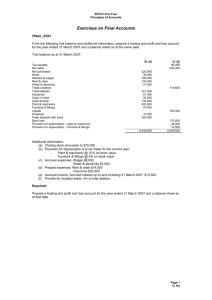

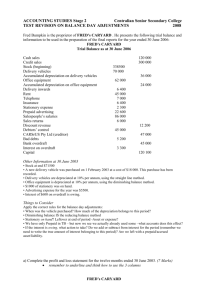

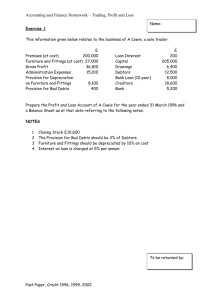

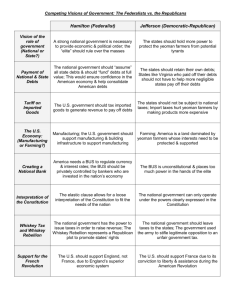

Financial and Managerial Accounting Depreciation and Bad Debts and Adjustments Outline of Lecture • • • • • Depreciation Bad Debts Provision for Bad Debts Exercises Adjustments Depreciation • According to IAS 16 ‘Depreciation is the measure of the cost of the tangible - fixed asset that has been consumed during the period’ In other words is the cost of using a fixed asset. Depreciation is recorded each year and has a dual effect: 1.Reduce the value of the fixed asset by the accumulative depreciation (total depreciation) in the balance sheet to reflect the wear and tear (damage, tiring, exhausting). In accounting we use the definition ‘accumulated depreciation’ and we mean by this the total amount of the loss of the fixed asset. 2.Record the depreciation charge as an expense in the income statement (profit and loss account). Lecturer: Chara Charalambous 3 Depreciation may arise from: • Use • Physical wear and tear • Passing of time • The fact that a fixed asset is old-fashion and imperfect because of the technology and market changes for e.g. the creation of a new machinery which is more specialized in a sector • Land has an unlimited life and so does not require depreciation, but buildings should be depreciated. • Depreciation of an asset begins when it is available for use. Lecturer: Chara Charalambous 4 Methods of calculating depreciation REDUCING BALANCE STRAIGHT LINE Depreciation charge is the same each year and so assumes that the benefit is consumed equally Useful for assets which provide equal benefit each year e.g. machinery A reducing amount of depreciation is charged each year and so assumes that more benefit is consumed in earlier years Useful for assets which provide more benefit in earlier years e.g. cars, IT equipment Lecturer: Chara Charalambous 5 Straight line method Depreciation Charged = Cost - Residual Value Useful life Or Depreciation = Cost* X% Straight line depreciation is often expressed as a percentage of original cost. Residual Value: the estimated disposal (clearance/removal/scrap) value of the asset at the end of its useful life. The residual value may be a second hand value or a scrap value: not a significant amount and is often zero. Useful Life: the estimated number of years during which the business will use the asset. The useful life does not necessarily equal the physical life of an asset. For e.g. Many business use a three year useful life for computers. This does not mean that the computer can no longer be used after three years, it means that the business is possible to replace the computer after three years due to a technological advancement. Lecturer: Chara Charalambous 6 Reducing balance method Depreciation Charged =Carrying value* X% Carrying value (CV) is the original cost of the fixed asset less the accumulated depreciation on the asset to date. Example 1: (reducing balance method) Chris, a trader, purchased a computer for € 1000 on August Y12 which he depreciates on the reducing balance method at 20% per annum. What is the depreciation charged for each of the first five years if the accounting year end is 31 July? Solution: Depreciation Charge Cumulative Depen 1.1000*20% 200 200 2.(1000-200)*20% 160 360 3.(1000-360)*20% 128 488 4.(1000-488)*20% 102 590 5. (1000-590)*20% 82 672 Lecturer: Chara Charalambous 7 Bad Debts • If sales are made on credit, there may be problems collecting the amounts owing from customers because some may refuse to pay their debt or they may declared bankrupt and unable to pay the amounts owing. At this case the debt is known as an irrecoverable debt or Bad Debt. As it will probably never be received, it is written off by writing it out of the ledger accounts completely. • The Bad debts amount is deducted from Debtors Lecturer: Chara Charalambous 8 Accounting for Bad Debts The debtors account is credited so as to reduce them, and an account named Bad Debts expense is debited. This expense is treated as all other expenses and for that reason is included in the income statement (profit and loss a/c) and is reducing the net profit. Provision for Bad Debts If there is some doubt whether a customer can or will pay his debt, a provision for bad debts is created, these debts are not yet Bad Debts. However the creation of a provision for bad debts means that the possible loss is taking into consideration immediately. The amount of the original debt will still remain the same just in case the customer does eventually pay. • The Debtors are not reduced but we multiply the amount of Debtors with the percentage of the provision. The debtors amount remain the same – we are not reducing it as we did in the case of Bad Debts – because the customer may finally pay. Lecturer: Chara Charalambous 10 Accounting for Provision for Bad Debts • • • The account ‘Provision fro Bad Debts’ has a credit balance in contrast to the account ‘Bad Debts’ which has debit b/ce. The Provision for Bad Debts goes indirectly to the profit and loss through the account Bad Debts. We add the amount of provision for Bad Debts in the amount of Bad Debts. The balance, at the end of the year, of the a/c ‘Provision for Bad Debts’ goes to balance sheet below Debtors and is deducted there from Debtors to show the net Debtors. Lecturer: Chara Charalambous 11 Example 1: Stamp Ltd has opening balances at 1ST Jan Y12 Debtors €68000. During the year the company made credit sales €354000 and received cash later from the clients €340000. At 31st Dec Y12 the company find out that €2000 of the clients are Bad Debts and also believes that 5% of the remaining clients will might not pay and since this is not sure the accountant makes a provision for Bad Debts. Required: 1. find the amount of Provision for Bad Debts that will added to Bad Debts amount. 2.find the amount of Bad Debts which will go to Profit and Loss 3. Show how Debtors will be presented in the Balance Sheet Lecturer: Chara Charalambous 12 Provision for Bad Debts • If there is already an opening amount in the account ‘Provision for Bad Debts’ then only the movement (difference) in the provision is charged to the Profit & Loss through ‘Bad Debts’ (closing provision less opening provision) Lecturer: Chara Charalambous 13 • If an exercise with trial balance is given to you and you have the amount of Debtors and the amount of Bad Debts in the trial balance it means that bad debts have already been deducted from debtors and so you should not deduct it. • What you have to do is to find the new provision for bad debts : 1 .Debtors* provision % and then 2 . deduct from the new provision the old and then 3 . add the difference in the bad debts amount. Example 2: Stamp Ltd has opening balances at 1ST Jan Y12 Debtors €68000 and Provision for Bad Debts €3400. During the year the company made credit sales €354000 and received cash later from the clients €340000. At 31st Dec Y12 the company find out that €2000 of the clients are Bad Debts and also believes that 5% of the remaining clients will might not pay and since this is not sure the accountant makes a provision for Bad Debts. Required: 1. find the amount of Provision for Bad Debts that will added to Bad Debts amount 2.find the amount of Bad Debts which will go to Profit and Loss 3. Show how Debtors will be presented in the Balance Sheet Lecturer: Chara Charalambous 15 Accruals Basis of Accounting The income statement for a period is prepared following the accruals concept: the income and expenses are recorded as they happened in the period regardless of whether cash has been received or paid . Therefore the profit of e.g. Y12 is calculated as following: Sales Y12 ( not only cash sales but also credit sales) Plus other income - e.g. from interests or rents (paid to the firm and this not paid yet but third parties e.g. banks owe the income to the company because It concerns the specific period) Less Purchases Y12 (not only cash purchases but also credit purchases) Less Expenses happened in Y12 ( rent, electricity ,telephone paid and those not paid yet but they concern the period we study and the firm has debt on them) RESULT : NET PROFIT/LOSS 16 1. Accrued Expenditure • • An accrual arises where expenses of the business, relating to the year, have not been paid by the year end. In this case the expense not paid it included in the total expenses in the income statement, and therefore deducted from the income so as to calculate the Net Profit, and it also goes to Balance sheet in the current liabilities side and is called Accrued Expenses. 17 Example 1: The electricity bill for the company A Ltd was for the year end 31st Dec Y12 €12000. But in Y12 it was paid only €9000 and the rest €3000 was paid in Jan of Y13. Required: 1.Prepare the accounts in the General ledger affected from the above transactions and 2.show where each amount finally goes.3.Prepare the extract of B/ce Sheet and the Profit and loss a/c 18 Electricity Cash Cash 9000 Profit & Loss 12000 Accrued Exp c/d 3000 12000 Electricity 9000 12000 Accrued exp b/d 3000 Profit & Loss a/c Gross Profit x Less Expenses Electricity 12000 Balance Sheet as at 31st Dec Y12 Current Liabilities Accrued Expenses 3000 19 2. Prepaid Expenditure • • A prepayment arises where some of the following year’s expenses have been paid in the current year. In this case, it is necessary to remove that part of the expense which is not relevant to this year, and therefore must not be deducted from the income of this year, and create a corresponding account in the Balance Sheet in the side of assets named Prepaid expenses. 20 Example 2: The insurance bill for the company A Ltd was for the year end 31st Dec Y12 €24000. But in Y12 it was paid €30000 for insurance expenses. The owner of the company wanted to prepaid in this way future charges of insurance. Required: 1.Prepare the accounts in the General ledger affected from the above transactions and 2.show where each amount finally goes.3.Prepare the extract of B/ce Sheet and the Profit and loss a/c 21 Insurance Cash Cash 30000 Profit & Loss 24000 Insurance 30000 Prepaid Exp c/d 6000 30000 30000 Prepaid B/ce b/d 6000 Profit & Loss a/c Gross Profit x Less Expenses Insurance 12000 Balance Sheet as at 31st Dec Y12 Current Assets Prepaid Expenses 6000 22 SUMMARY: EXPENSE A/C Prepaid exp b/d Cash payments Accrued exp c/d x Accrued exp b/d x x Profit & Loss a/c x x Prepaid exp c/d x x x 23 3. Accrued Income • Accrued income arises where income has been earned in the accounting period but has not yet been received. In this case we mean the income from other sources than the clients for e.g. the bank interest, rents e.t.c) • In this case, it is necessary to record the whole (paid + unpaid) income in the income statement and create a corresponding asset in the statement of financial position (called accrued income). 24 Example 3: • A business earns income in Y12 from bank interest €300 per month. However during Y12 the business received only €3000 instead of €3600 (300*12). Required: 1.Prepare the accounts in the General ledger affected from the above transactions and 2.show where each amount finally goes. 3.Prepare the extract of B/ce Sheet and the Profit and loss a/c 25 Bank Interest Income Profit &Loss 3600 Bank Bank 3000 Accrued Income c/d 600 3600 Bank Interest 3000 3600 Accrued Income B/ce b/d 600 Profit & Loss a/c Gross Profit x Add Bank Interest 3600 X Balance Sheet as at 31st Dec Y12 Current Assets Debtors X Accrued Income 600 26 4. Prepaid Income • Prepaid income arises where income has been received in the accounting period but which relates to the next accounting period. • In this case, it is necessary to remove the income not relating to the year from the income statement and create a corresponding/resulting current liability in the statement of financial position (called prepaid income). 27 Example 4: A business rents out a property at an income of € 4000 per month. €64000 has been received in the year ended 31 Dec Y12. Required: What is the year-end liability and what is the rental income for the year? Show the relevant entries in the ledger accounts and the financial statements. 28 Rent Income Profit & Loss 48000 Bank (4000*12) Prepaid Income c/d 16000 64000 Bank 64000 Rent 64000 64000 Prepaid Income b/d 16000 Profit & Loss a/c Gross Profit x Add Rent 48000 X Balance Sheet as at 31st Dec Y12 Current Liabilities Creditors X Prepaid Income 600 29 SUMMARY: INCOME A/C Accrued Income b/d X Prepaid Income b/d Profit & Loss a/c X Cash payments Prepaid Income c/d X Accrued Income c/d x X X X x 30