Chapter 12 Acquisition / payment process

advertisement

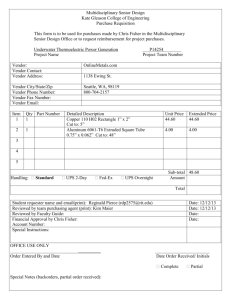

Chapter 12 Acquisition / payment process When you finish studying this chapter, you should be able to: • Explain the role and purpose of the acquisition / payment process • List and discuss, in order, the steps in the process • Identify and describe documents commonly used in the process • Suggest and evaluate internal controls associated with it • Explain the role of information technology in the process • Create and interpret flowcharts and data flow diagrams I. Porter’s value chain ACC 3113 – Accounting Information Systems Chapter 12 | Page 1 II. Acquisition / payment steps 1. Request goods / services based on monitored need 2. Authorize a purchase 3. Purchase goods / services 4. Receive goods / services 5. Disburse cash 6. Process purchase returns as necessary Acquisition / payment DFD: ACC 3113 – Accounting Information Systems Chapter 12 | Page 2 III. Documents 1. Purchase requisition a. Requests that the purchasing department order goods / services b. Originates in an operating department c. Terminates in the purchasing department 2. Purchase order a. Specifies items ordered, shipping terms and other information about the purchase b. Originates in the purchasing department c. Terminates with vendor 3. Receiving report a. Ensures that ordered goods have been received in good condition b. Originates in receiving department c. Terminates in various departments 4. Vendor invoice a. Requests payment from buying organization b. Originates with vendor c. Terminates in accounting department of buyer 5. Check a. Pays the vendor b. Originates in accounting c. Terminates with vendor ACC 3113 – Accounting Information Systems Chapter 12 | Page 3 IV. Internal controls 1. Inventory monitoring system 2. Justification for unusual goods 3. Conflict of interest policy 4. Criteria for supplier reliability and quality of goods 5. Strategic alliances 6. Document matching • Receiving reports with purchase orders • Receiving reports and purchase orders with invoices 7. Insurance and bonding 8. Internal audit department 9. Separation of duties: custody, recordkeeping, authorization 10. Employee monitoring systems 11. “Paid” stamps 12. Information technology, such as radio frequency identification (RFID) V. Information technology 1. Online vendor payments 2. Bar codes 3. Vendor lists 4. Inventory status checks 5. Transaction recording in the AIS ACC 3113 – Accounting Information Systems Chapter 12 | Page 4