Wolf Construction Feasibility - University of Colorado Boulder

advertisement

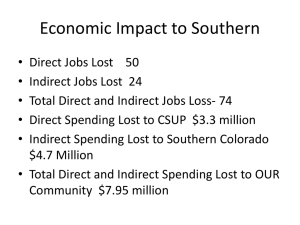

Peter Wolf Construction Feasibility Plan Parts I and II Prepared by: Kevin Mayer, Chris Walter, Tyler Wolf Introduction – Peter Wolf Construction The purpose of this feasibility plan is to assess the opportunity for a new “green” residential construction company located in Pueblo, Colorado. Peter Wolf Construction is dedicated to building homes that minimize the environmental impact of both the construction process and subsequent resident usage Market Analysis Market Size and Growth Single Family Building Permits Pueblo National 11000 1,800,000 10000 1,700,000 Pueblo Permits 1,500,000 8000 1,400,000 7000 1,300,000 6000 National Permits 1,600,000 9000 1,200,000 5000 1,100,000 1,000,000 4000 1998 1999 2000 2001 2002 2003 2004 2005 2006 Year Green Building Market Acceptance Projection Green 11000 600 10000 500 9000 400 8000 300 7000 200 6000 100 5000 4000 0 2001 2002 2003 2004 2005 2006 Year 2007 2008 2009 2010 Green Starts Traditional Starts Traditional National In 2006, an estimated 1.4 million homes were built with a total value over $500 billion. For 2007, it is expected that total construction will decline by about 15% but should return to steady growth thereafter. Green home building market size is now valued at $7 billion dollars. Green home construction is expected to grow to between 5% and 10% of U.S. housing starts by 2010 – up from 2% in 2005. This would equate to a market value between $19 billion and $38 billion. Pueblo In 2006, 7,169 New homes were constructed, down from 10,555 in 2005. 2007 sales are expected to be about 85% of 2006 figures as excess supply continues to dry up. Job growth rate tends to be the best indicator of future home sales. Several sources indicate Pueblo is a top 5 metro area for anticipated job growth. Green built home sales are expected to grow by over 30% per year through 2010. Less than $10M in 2005. Approximately $160M in 2010. Market Trends Green Building Environmental concerns such as global warming and reduced availability of natural resources have caused society to re-evaluate the way it lives. People have begun to realize that home construction and home usage results in a tremendous impact on the environment, accounting for approximately 40% of yearly carbon emissions. As a result, environmentally conscious consumers are demanding homes that minimize their impact on the environment. About 2% of homes built in 2005 were constructed using green techniques. This figure is projected to grow to between 5% and 10% by 2010. Industry experts familiar with the Pueblo market have estimated that less than 50 homes were built green in 2005 indicating that Pueblo is lagging the national trend. Other Housing Trends New Urbanism and Smart Growth – A flexible approach to growth development shifting away from urban sprawl and towards high density, transit oriented development Appreciation of Home Prices – A significant appreciation of home prices occurred between 2004 and 2006. Since then, prices have depreciated in many parts of the country but now seem to be stabilizing. We seem to be at the end of this short-term trend. Experts are predicting the pattern will revert to a more gradual increase in home prices, consistent with historical trends. Sub-Prime Lending – Over the past few years, the level of sub-prime lending had skyrocketed from 5% to 20% of home mortgages. This seems to be another short-term trend, related to the appreciation in housing prices, making a correction back to more traditional levels. During this correction, the housing market has seen high levels of inventory combined with a reduction in buyers. Effects production homebuilders the most. Baby Boomer Trend – The Baby Boomers are beginning to retire and are looking for ways to spend their disposable income. This has been beneficial to custom home builders as people have more money to spend on quality and customization. Pueblo Market Trends Pueblo job growth is expected to be twice the national average over the next few years. The Pueblo area has received praise from publications such as Forbes, Money Magazine, and US News indicating it is one of the top metro areas in the nation in terms of income growth, educational attainment, crime rate, net migration, cost of doing business, and overall quality of life. Market Segmentation Custom Versus Production Home Building Home buyers differ in the level of customization they require. Custom home builders satisfy customers with higher disposable incomes that are more likely to want housing features that meet their individual needs. Production home builders are good at providing cheaper homes for customers without the same levels of disposable income. Approximately 25% of home starts are by custom builders. Green Versus Traditional Construction To meet the growing trend of environmental consciousness, construction companies are providing homes that minimize consumption of non-renewable resources and fossil fuels. This segment is considered new and still emerging, constituting only about 2% of all housing starts. National Market Pueblo Market 2% 1% Green Building Traditional Building 98% 99% Market Threats Short Term Mortgage Market – A collapsing sub-prime mortgage market may negatively effect the number of homebuyers in the future. Our assumption is that sub-prime lending problems will correct themselves over the long run. Slowing amount of housing starts – 2007 is expected to be the second consecutive year of declining housing starts as excess inventory continues to dry up. In 2008 and beyond, housing starts are expected to grow at a more historical rate. 2006 Single-family home starts slid 18% 2006 Building permits declined 2.8% Long Term Codes, Regulations & Standards – The environmental enlightenment trend is already starting to manifest in new codes and regulations. This is a threat that all construction companies will have to face in the upcoming years. Keeping ahead of these regulations could translate into a competitive advantage. Relaxation of environmental regulations would be a disadvantage since our focus is on green building, however, such a scenario is unlikely. Drop in the oil prices – One reason that consumers are attracted to green construction is that it results in lower utility costs. Should oil prices drop, the benefit disappears, slowing product adoption. Oil price projections are all over the board and it is hard to predict future prices. This same threat holds for other fossil fuels such as coal and natural gas. Consumer Apathy – The green market has only recently emerged so consumer acceptance is still low. Our assumption is that green home construction will follow the standard Bass model for product acceptance. However, determining when the early majority will begin accepting our product is unclear. If it takes a long time, strong growth will prohibited. Minimal Barriers to Entry – It is not overly difficult for existing companies to make the switch to green construction. There will be some change issues to overcome from an operational point of view but the financial and knowledge barriers are minimal. As the green construction market grows and becomes more profitable, we expect the level of competition to increase proportionately. Market Opportunities and Niches Opportunities Green building is a new area of home construction that has caused significant disruption to the traditional home construction market Green legislation is gaining momentum. More friendly regulations and incentives will create additional market opportunities. Niches Green Building – Construction of environmentally friendly homes. This product typically costs anywhere from 3% to 5% more to build than a traditional home but the homeowner usually can recoup the costs through cheaper utility bills. This method of construction tries to reduce the environmental impact of both home construction and home use. Zero Energy Homes – Extreme end of green building where homes produce all of the energy that they consume. Most environmentally conscious method of construction but comes at a higher cost. Attractive only to the most environmentally conscious customers. Off Grid Living – Addresses the needs of consumers who want to build in an area where public utilities are unavailable and the connection to public utilities is cost prohibitive. Renewable energies – Provide renewable energy solutions such as solar, hydroelectric and wind power (small turbine). Multi-Family Green Homes – Green building but for multi-family structures such as duplexes and apartment buildings. Smart Homes – Integration of technology that monitors and controls various housing functions such as lighting, security and access, home theater / entertainment, communication, heating and cooling, and irrigation. Distribution Channels Product Distribution Channels On-site Construction – All of the construction is performed on-site. This is the most common form of home construction. Prefab Construction – Various parts of the home are made at an offsite location, shipped to the construction site and assembled into a final product. This dramatically reduces on-site efforts and reduces defect rates. The disadvantages are that it costs more in design costs and builders are limited in the types of designs and features they can offer. New Distribution Channels None Market Analysis - Conclusion Positives We feel that long-term home construction prospects are very attractive for the Pueblo metro area. The city boasts some of the most attractive economic statistics in the nation: job growth, income growth, net migration, etc. Additionally, the people moving to Pueblo tend to have a higher education and higher disposable income. These demographics traditionally point to a higher consumer acceptance of green home features. Pueblo’s green home construction segment should experience significant growth from less than $10M in 2005 to approximately $160M by 2010. Green building is a national trend that has gained significant momentum in the past few years. Industry experts across the board are stating that the switch is for real and is not a fad. It is shaping up to be the future of the industry yet it is only just entering its growth phase. Negatives In the short term, this market is unattractive because home sales are predicted to decline substantially over the next year or two. Even when the market picks up, there will be a period where the market remains unfriendly to new companies as existing companies get back to the sales levels they have grown accustomed to. We expect things to look better around the 20082009 timeframe. Competitive Analysis Competitor Description Production Home Builders – Large construction companies that compete primarily on cost, offering a small number of home designs, building the same house over and over. Profitability comes from established economies of scale. This industry is dominated by a few large companies that are hard to compete with without a lean and established operation. During down times in the business cycle, these companies are willing to sell homes at a loss as a method of inventory control making it difficult for smaller companies to compete. Industry Leaders in Pueblo: Oakwood Homes, Clayton Homes, New Wave Homebuilders Custom Home Builders – Service customers who desire a home that is customized to their needs. Additional design efforts make these homes more expensive and more difficult to build. Cost is less important in this segment and instead companies compete on the basis of quality and home features. Companies vary in the level of customization they provide, ranging from slightly more customizable than a production home to a start-from-scratch home concept. The additional cost over a production home is proportional to the additional design efforts. Industry Leaders in Pueblo: Patagonia – Colorado Homes, French Custom Homes, Nancy L. Custom Homes Green Home Builders – Green homes minimize the environmental impact of both construction and customer usage. They tend to be more comfortable and healthier than their traditional counterparts. Typically, these homes cost 3-5% more than a traditional home, making it attractive only to environmentally conscious consumers. Green construction companies are showing up more frequently as custom homebuilders although production homebuilders are beginning to make the switch in other parts of the country. Industry Leaders in Pueblo: Competition in this segment is weak with only three companies offering any type of green product. This area is far from saturated, primarily because everyone is still trying to figure out how to promote and sell their product. On-Point –- Green Home Construction Consultants. Don’t actually build homes. Green Rem –– Small company that focuses on green remodels and not on ground-up construction Energy Built Homes –- They claim they are a green builder but all they are doing is making their homes energy efficient. This company doesn’t focus on any of the other aspects of green construction such as preservation of natural resources or using renewable energies. Competitor Matrix On-Point Green Rem Energy-Built PeterWolf Product Breadth Narrow – consulting only Narrow – only do remodels Moderate – Energy efficient homes Diverse – Provide a variety of green solutions Product Features Consulting only Green / Energy Efficiency (remodel only) Energy Efficiency Green / Energy Efficiency / Renewable Energy / Smart Homes Need they Satisfy Green consulting services Green remodeling solutions Ground Up Construction – Energy Efficiency only Ground Up – Green Solutions Expertise Good expertise in green solutions Good expertise in green solutions Good expertise in construction. Low expertise in green solutions Moderate expertise in green solutions and construction. Price N/A – don’t build homes N/A – don’t build homes Average – vary the level of green to meet the customer’s budget Slightly more than average – green features will come standard Size Very small – just getting started Very small – two man show that is just getting started Small – Build less than 10 homes per year in the Pueblo area. Father and son operation Conceptual only – goal is to be building 25 homes per year by fifth year of operation. Strategic Alliances With Green Rem With On-Point None None…yet. Basis of Competition Green Home Building Features Environmental Impact Energy Savings Customer Satisfaction Reputation Price Value Production Home Building Quality Design Architecture Customizability Custom Home Building Barriers to entry Home Construction – These barriers are general to the home construction industry Financing – Money is needed to make initial land purchases which are likely cost hundreds of thousands of dollars. Also, because of the market’s cyclical nature, inventory can be hard to sell at times, requiring a company to maintain a higher operating cash budget. Reputation – In the home construction industry, reputation is everything. It can be difficult for new companies to prove their product. Getting customers can be difficult without a portfolio of completed homes to show customers. Economies of Scale – A large, efficient operation is needed to compete with production homebuilders. A company must be able to build many homes at competitive prices. Green Home Construction – These are additional barriers to entry for companies competing in the green home construction segment Finding Customers – This barrier includes educating customers and generating product awareness. Only a small portion of customers actively seek a green home. Most don’t understand the benefits and are not willing to pay a 3-5% upfront cost increase even if it means a reduced monthly expense. Expertise – Green construction requires a specific knowledge base that can be difficult to come by. A company used to traditional methods of construction will go through growing pains when converting to green building. Control over Prices, Costs and Channels Low 4 Medium 1 2 High 3 1. Material Cost – Dependent on type of construction: Green construction typically incurs 35% higher material costs than traditional construction. Builders can decrease costs, but quality of production suffers. 2. Home Prices – Dependent on quality of construction. Local markets dictate the selling price in any segment. Green homes have not been proven to yield a higher sale price than comparably-equipped, traditionally-built homes. 3. Subcontractor Costs – In Pueblo, subcontractors are plentiful. This high level of competition allows for shopping around but decreased expense in this category usually relates directly to quality of workmanship. Costs in Pueblo are comparable to those in the national markets. 4. Distribution Channels – On-site & prefabricated models are typical methods to extend product to customer. Custom homes are designed with the buyer and the architect collaborating. Market Domination and Rivalry Production home builders This industry segment is dominated by a small number of larger companies that control a significant share of the market. Rivalry is fierce, especially in times of economic hardship. Some smaller companies compete but do not have any sustainable advantages. Custom Home Builders Made up mostly of medium and small companies. The degree of rivalry is significant due to the sheer number of competitors. No single company or group of companies has established market domination. Green Builders Few companies are competing in this segment so rivalry between green builders is low. In fact, many of these companies tend to work together to help promote segment growth. However, there will be times when the customer is impartial to having a green home. In these cases, the green builder will have to compete with other custom builders, which increases the level of competition substantially. Currently, the primary focus is on determining which product features to offer and how to generate sales. Competitive Analysis – Conclusion Positives No companies in Pueblo are building fully green homes. Given that Pueblo demographics suggest this type of product would be accepted, we feel this is an underserved segment of the market. Negatives There are few barriers to prohibit existing companies from making the switch to green construction. As the market gets bigger, we expect more and more companies to enter this segment of construction. More than likely, there are several companies currently trying to make the switch. We expect a dramatically different competitive landscape two years from now. Factors for Success Having a strong network is key to competing effectively. This includes subcontractors, financiers, and suppliers alike. Success is directly proportional to company reputation Growing a residential construction business means having enough financial capital to buy the best locations and being able to ride out inventory surpluses. References •Anatomy of a Housing Recovery, by Frank Nothaft, Amy Crews Cutts, Calvin Schnure, Nela Richardson- December 8, 2006; http://www.freddiemac.com/news/finance/outlooks/Dec_06_frecom_outlook.html •Construction Industry Intelligence Report - 2006, McGraw Hill Construction; http://www.construction.com/Analytics/CIIR_G/2006/Fall_FullArticles.asp •Florida has 5 of the 10 Best Job Markets, Vegas and Phoenix runners-up, by G. Scott Thomas. http://www.preconstructionprograms.com/real_estate/florida/florida_job_growth.php •Going your Own Way, by Megan Barnett, US News; http://www.usnews.com/usnews/biztech/articles/050321/21Colorado.htm •Green Building Guidelines to Become a Standard, by Calli Schmidt, Nation’s Building News; http://www.nbnnews.com/NBN/issues/2006-05-29/Codes+and+Standards/index.html •It’s All Linked: Mortgage Troubles can Roil Economy, by Steve Jordon, Builder Online, http://www.builderonline.com/industry-news.asp?sectionID=30&articleID=451037 •While Housing Withers, ‘Green’ Materials Bloom, by Jim Carlton, The Wall Street Journal Online, http://www.realestatejournal.com/buildimprove/20070222-carlton.html?refresh=on •Colorado Outlook: News of Colorado’s Economy and Budget, State of Colorado – Division of Financial Management; March 2006 XXVIII No.9 http://dfm.Colorado.gov/Publications/EAB/Outlook/IO2006/outlookmarch2006.pdf References – continued BUILDER Online: Home Building News, Home Plans, Home Design Ideas and Building Products for Home Builders. http://www.builderonline.com/content/resources/businessmarket-data-research-stats.asp?channelID=74&sectionID=124 (accessed March 14, 2007). Comfort Zone: Creating a Middle Ground for Green Building and Great Profits. http://www.builderonline.com/industry-news.asp?sectionID=718&articleID=2868 (accessed March 14, 2007). Market structure - Wikipedia, the free encyclopedia. http://en.wikipedia.org/wiki/Market_form (accessed March 14, 2007). Population Projections. http://www.valleycountyeconomicdevelopment.com/pages/PopulationProjections.htm (accessed March 14, 2007). ReferenceUSA. http://reference.infousa.com/bd/matrix_list.asp (accessed March 14, 2007). Seeing Green. http://www.builderonline.com/industrynews.asp?sectionID=13&articleID=322693 (accessed March 14, 2007). USATODAY.com - Building 'green' reaches a new level. http://www.usatoday.com/news/nation/2006-07-26-green-construction_x.htm (accessed March 14, 2007). Peter Wolf Construction Feasibility Plan Part III Prepared by: Kevin Mayer, Chris Walter, Tyler Wolf Venture Description Shelter is one of the most influential aspects of a person’s life, making the purchase of a new home an important and impacting decision. At the same time, a home requires significant amounts of natural resources to carry out its function of providing comfort and safety. Global environmental issues, such as climate change, have awoken society to the fact that we must start looking towards a sustainable future. Consumers have begun looking for ways to live their lives that are less harmful to the environment. Peter Wolf Construction is a custom home builder located in Pueblo, Colorado. Our concept is to provide custom homes that not only are beautiful and comfortable but also good for the environment. We will incorporate the principles of sustainability into each home, striving to maximize resource efficiency, minimize carbon dioxide emissions, reduce construction waste, utilize recycled materials, provide healthy living environments, and promote other sustainable business practices. Our customers will be doubly satisfied knowing that not only do they own an attractive home designed to keep them safe and comfortable but that they have also made a purchase that benefits the rest of society as well. Market Analysis Market Size and Growth Green Penetration into Pueblo Market 11000 600 10000 500 9000 400 8000 300 7000 200 Green Starts Traditional Starts National Market In 2006, an estimated 1.4 million homes were built with a total value over $500 billion. For 2007, it is expected that total construction will decline by about 15% but should return to steady growth thereafter. Green home building market size is now valued at $7 billion dollars. Green home construction is expected to grow to between 5% and 10% of U.S. housing starts by 2010 – up from 2% in 2005. This would equate to a market value between $19 billion and $38 billion. 6000 100 5000 4000 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Year Pueblo Market In 2006, 7,169 New homes were constructed, down from 10,555 in 2005. 2007 sales are expected to be about 85% of 2006 figures as excess supply continues to dry up. Job growth rate tends to be the best indicator of future home sales. Several sources indicate Pueblo is a top 5 metro area for anticipated job growth. Green built home sales are expected to grow by approximately 30% per year through 2010. Less than $10M in 2005. Approximately $108M in 2010. Pueblo Market Statistics Volume Unit Volume Total Homes Built in 2006 $1,696 million 7,169 Green Homes Built in 2006 $17,745 million < 75 (1% of market) Green Home Projection For 2010 $107,846 million 375 (5.7% of market) Market Trends Green Building Environmental concerns such as global warming and reduced availability of natural resources have caused society to re-evaluate the way it lives. People have begun to realize that home construction and home usage results in a tremendous impact on the environment, accounting for approximately 40% of yearly carbon emissions. As a result, environmentally conscious consumers are demanding homes that minimize their impact on the environment. About 2% of homes built in 2005 were constructed using green techniques. This figure is projected to grow to between 5% and 10% by 2010. Industry experts familiar with the Pueblo market have estimated that less than 50 homes were built green in 2005 indicating that Pueblo is lagging the national trend. Other Housing Trends New Urbanism and Smart Growth – A flexible approach to growth development shifting away from urban sprawl and towards high density, transit oriented development, and green building design. Appreciation of Home Prices – A significant appreciation of home prices occurred between 2004 and 2006. Since then, prices have depreciated in many parts of the country but now seem to be stabilizing. We seem to be at the end of this short-term trend. Experts are predicting the pattern will revert to a more gradual increase in home prices, consistent with historical trends. Sub-Prime Lending – Over the past few years, the level of sub-prime lending had skyrocketed from 5% to 20% of home mortgages. This seems to be another short-term trend, related to the appreciation in housing prices, making a correction back to more traditional levels. During this correction, the housing market has seen high levels of inventory combined with a reduction in buyers. Effects production homebuilders the most. Baby Boomer Trend – The Baby Boomers are beginning to retire and are looking for ways to spend their disposable income. This has been beneficial to custom home builders as people have more money to spend on quality and customization. Pueblo Market Trends Pueblo job growth is expected to be twice the national average over the next few years. The Pueblo area has received praise from publications such as Forbes, Money Magazine, and US News indicating it is one of the top metro areas in the nation in terms of income growth, educational attainment, crime rate, net migration, cost of doing business, and overall quality of life. Market Analysis - Conclusion Positives We feel that long-term home construction prospects are very attractive for the Pueblo metro area. The city boasts some of the most attractive economic statistics in the nation: job growth, income growth, net migration, etc. Additionally, the people moving to Pueblo tend to have a higher education and higher disposable income. These demographics traditionally point to a higher consumer acceptance of green home features. Pueblo’s green home construction segment should experience significant growth from less than $10M in 2005 to approximately $160M by 2010. Green building is a national trend that has gained significant momentum in the past few years. Industry experts across the board are stating that the switch is for real and is not a fad. It is shaping up to be the future of the industry yet it is only just entering its growth phase. Negatives In the short term, this market is unattractive because home sales are predicted to decline substantially over the next year or two. Even when the market picks up, there will be a period where the market remains unfriendly to new companies as existing companies get back to the sales levels they have grown accustomed to. We expect things to look better around the 20082009 timeframe. Competitive Analysis Market Domination and Rivalry Production home builders This industry segment is dominated by a small number of larger companies that control a significant share of the market. Rivalry is fierce, especially in times of economic hardship. Some smaller companies compete but do not have any sustainable advantages. Custom Home Builders Made up mostly of medium and small companies. The degree of rivalry is significant due to the sheer number of competitors. No single company or group of companies has established market domination. Green Builders Few companies are competing in this segment so rivalry between green builders is low. In fact, many of these companies tend to work together to help promote segment growth. However, there will be times when the customer is impartial to having a green home. In these cases, the green builder will have to compete with other custom builders, which increases the level of competition substantially. Currently, the primary focus is on determining which product features to offer and how to generate sales. Competitor Matrix On-Point Green Rem Energy-Built PeterWolf Product Breadth Narrow – consulting only Narrow – only do remodels Moderate – Energy efficient homes Diverse – Provide a variety of green solutions Product Features Consulting only Green / Energy Efficiency (remodel only) Energy Efficiency Green / Energy Efficiency / Renewable Energy / Smart Homes Need they Satisfy Green consulting services Green remodeling solutions Ground Up Construction – Energy Efficiency only Ground Up – Green Solutions Expertise Good expertise in green solutions Good expertise in green solutions Good expertise in construction. Low expertise in green solutions Moderate expertise in green solutions and construction. Price N/A – don’t build homes N/A – don’t build homes Average – vary the level of green to meet the customer’s budget Slightly more than average – green features will come standard Size Very small – just getting started Very small – two man show that is just getting started Small – Build less than 10 homes per year in the Pueblo area. Father and son operation Conceptual only – goal is to be building 25 homes per year by fifth year of operation. Strategic Alliances With Green Rem With On-Point None None…yet. Competitive Analysis – Conclusion Positives No companies in Pueblo are building fully green homes. Given that Pueblo demographics suggest this type of product would be accepted, we feel this is an underserved segment of the market. Negatives There are few barriers to prohibit existing companies from making the switch to green construction. As the market gets bigger, we expect more and more companies to enter this segment of construction. More than likely, there are several companies currently trying to make the switch. We expect a dramatically different competitive landscape two years from now. Factors for Success Having a strong network is key to competing effectively. This includes subcontractors, financiers, and suppliers alike. Success is directly proportional to company reputation Growing a residential construction business means having enough financial capital to buy the best locations and being able to ride out inventory surpluses. Venture Analysis Needs of the Home Buyer Purchasing a home is one of the most important decisions a person will make in their lifetime. Because of the size of the transaction and the role their home plays in their daily lives, home buyers tend to choose carefully and expect their home to satisfy a variety of needs. Needs that all homes fulfill: Shelter – The basic function of a home is to keep its residents sheltered from the outside environment; it is the place where they sleep at night. Comfort – Home owners expect their home to maintain a comfortable living space. The lay out should make daily routines easy and convenient. Prestige – In American culture, a person’s home is one of the best indicators of his or her social status. People often use their home to advertise their success. Financial – Often, a home is purchased as an investment strategy. The expectation is that housing prices will appreciate in the future, providing the buyer with an adequate return on his or her money. Unique benefits that a green home will provide: Health – Green homes typically make better use of natural lighting than conventional homes which leads to improved health and comfort. Their indoor air quality is usually better too since they don’t use toxic paints or resins. Prestige – Green homes offer consumers an alternate way of differentiating themselves from their peers. Being the first on the block to own a green home is one of the biggest consumer draws (as per Tom Hoyt, cofounder of McStain Neighborhoods) Social – Green homes are the best consumer option available for those who want to actively participate in bringing about a sustainable future. It is a way for them to set a positive example for the rest of society. Economic – Energy efficiency can result in a reduced monthly housing expense (mortgage and utilities). Tax incentives are available in Pueblo for certain home features (Photovoltaics, Geo-thermal heat pumps) Moral – From an ethical perspective, owning a green home is better than owning a conventional home. Product Description Physical • Quality and appearance are essential to compete in the industry. Architectural features will be applied to all sides of the home and will be selected to complement the home’s natural surroundings. • Energy efficient features, such as radiant barriers and double glazed windows will minimize the home’s electrical loading. Water conservation features, such as low flow devices and native plant landscaping, will reduce the home’s water demand. Both groups of features will be included in every home. • More expensive features that further reduce the home’s environmental impact will be available as green options for customers willing to spend the extra money on a more environmentally friendly home. Examples include straw bale exteriors, photovoltaic power generation, and geothermal heat pumps. Cost • Prices are dependent on the size and location of the home but a standard green package will cost approximately 5% more than a conventional home. An average size home will save approximately $700 dollars per year compared to an equivalent non-green home. • Homes with additional green options will have a larger cost premium but it would rarely exceed 15%. Energy savings for these homes will vary depending on options but will likely be over $1,000 per year. Service • All homes will come with a one-year construction warranty which will be serviced by certified technicians. This is the industry standard. Extending the warranty may be a future source of competitive advantage once the company is established enough to handle the extra liability. Target Market Demographics Psychographics • 30-50 years old • Strong environmental consciousness • Combined household income > $100k • Educated – BS or higher • Enjoy all types of outdoor activities, particularly hiking, backpacking, and fly fishing • Differences in gender, race, or occupation do not vary significantly • Donate time and/or money to organizations dedicated to protecting the environment Product Acceptance and the Purchasing Decision • Consumers fall within a wide spectrum in relation to how much they are willing to pay for a green home but can be segmented into three general categories (according to our survey results – sample size of 17). 1) Not willing to pay extra for a green home. Accounts for approximately 5.9% of home buyers. 2) Willing to pay up to 5% more for a green home. Approximately 58.8% of home buyers. 3) Willing to pay up to 10% or more for a green home. Approximately 35.3% of home buyers. • A consumer’s willingness to pay extra for a green home is positively correlated to their awareness of the benefits of green building, their income level, and their propensity to purchase other green products. • No matter how aware consumers are of green building, the majority are unsure as to which features should be included in a green home. They are reliant on the builder’s professional knowledge. • Purchasing decisions are made as a family but the male typically negotiates the terms of the purchase. Their first point of contact when searching for a home to buy is usually either a banker or a realtor. It is imperative that a builder develop a positive relationship in these professions. Competitive Advantage Knowledge Base Wolf (co-founder) – MBA with an emphasis in Entrepreneurship and Real Estate Development; BS in Civil Engineering; licensed professional engineer (PE) who can perform many of the engineering responsibilities, saving on consulting expenses. It is uncommon and usually too expensive for smaller custom builders (majority of the Pueblo industry) to have a PE on staff. Special knowledge of green building technologies. Pearson (co-founder) – BS in Business Management with an emphasis in Information Technologies. Specialty in website development, an area our competitors are deficient and an effective way to differentiate our product. Jones (future partner) – 20+ years experience with residential construction development. Highly qualified to run the company’s construction operations. Will come into the business around year 3 and work at reduced salary in return for equity. Ties to Industry Strong family ties to Pueblo’s premier construction/real estate law firm Strong family ties to a local bank that specializes in agriculture and home mortgages Strong family ties to a wood supplier, concrete supplier/subcontractor, and excavation subcontractor Values Vision of both co-founders is to establish a company dedicated to the principles of sustainability, an approach to homebuilding that is unique to the Pueblo market. Our target market will better relate with our mission and values than those of our competitors giving us an advantage in establishing brand recognition and customer loyalty. Making our Advantage Sustainable – There is not much proprietary information in the home building industry so any advantage gained through product design, techniques, and processes is theoretically unsustainable. Instead, our sustainable advantage will come from our company values: a dedication to sustainability, operational excellence, and community involvement. Both co-founders plan to actively insert themselves into the Pueblo community as experts on the subject of sustainability. In addition, part of our strategic plan is to establish community programs that will allow Pueblo residents to actively participate in a sustainable future. All of these factors will play into our brand image, making Peter Wolf Construction the best and most recognizable green construction company in southern Colorado. Risks Target Market – Our research indicates that the green building trend is gaining momentum and will continue to grow as a segment of the home building market but this is not guaranteed. Furthermore, there is evidence that the Pueblo green home building market is lagging the national trend. From talking with Pueblo home builders it appears this is an industry problem rather than a market problem but a more comprehensive customer analysis is needed to validate. Technology – Green building technologies have been fairly well developed but it will be difficult to find subcontractors that are familiar with them. Additional refinement of some technologies will be needed to make them more convenient for home owners. Financial – The home building market in general is cyclical and goes through extended downturns. The market is very interest rate sensitive and becomes more competitive as interest rates increase. Insurance – Denver has recently undergone a phenomenon where law firms actively seek out legal suits for homes that have minor defects making it difficult and expensive for builders to obtain insurance on their work. These law firms can be described as the “ambulance chasers” of the home building industry. While this phenomenon has not reached Pueblo, the possibility exists that the trend will catch on there in the future. Competitive – Switching from traditional homebuilding to green home building is relatively easy for established builders. As the green market grows, competition will increase. Strategic Relationships – The most important factors for success is a builder’s reputation and ability to form relationships with subcontractors, lawyers, bankers, and realtors. An inability to meet and grow with the right group of stakeholders will make it difficult to establish credibility. Financial Analysis – Pro forma Market penetration 1st Year (2008) 2nd Year (2009) 3rd Year (2010) Unit Sales (homes) 1 5 15 Projected market size (homes) 200 275 375 Market penetration 0.50% 1.82% 4.00% Operating Income 1st Year (2008) 2nd Year (2009) 3rd Year (2010) Revenue $300,000 $1,500,000 $4,500,000 Cost of Goods Sold 270,000 1,350,000 4,050,000 Gross Profit 30,000 150,000 450,000 Gross Profit % 0 0 0 Operating Expenses Sales & Marketing 30,000 56,000 52,000 Website 5,000 20,000 5,000 Flyers 10,000 15,000 20,000 Advertisements 10,000 15,000 20,000 Misc. OE 5,000 6,000 7,000 General & Administrative 72,000 77,000 182,000 Salary 25,000 25,000 125,000 Office Supplies 2,000 2,000 2,000 Legal 15,000 10,000 10,000 Insurance 20,000 30,000 35,000 Misc. G&A 10,000 10,000 10,000 Total 102,000 133,000 234,000 Operating Income ($72,000) $17,000 $216,000 Break-Even Revenue Investment Required Capital Expenditures Working Capital Other Major Expenses Non-recurring Total $1,020,000 $1,330,000 $2,340,000 $0 102,000 15,000 50,000 $167,000 $10,000 133,000 15,000 0 $158,000 $30,000 234,000 15,000 0 $279,000 Major Takeaways • A significant cash infusion is needed the first year to establish the company ($102,000). An additional infusion ($40,000) will be needed in the second year to cover working capital expenditures. • After the 2nd year, the company becomes self-supporting. • A $1 change in G&A results in about a $4 decrease in breakeven revenue. Controlling these expenses will be critical to our success. • Since we are starting out by building custom homes, the money for construction is put up by the customer’s bank reducing the need for capital expenditures. To grow the company will require us to start building homes on speculation, requiring much more in the way of capital expenditures to purchase lots. Financial Analysis - Assumptions Revenue Due to the operational challenges of getting established and finding good subcontractors, we do not want to grow the company too fast. An appropriate growth schedule for the first three years would be as follows Year 1 – one house Year 2 – five houses Year 3 – fifteen houses We will reach critical mass somewhere around 7-8 houses. Cost of Revenues Typically cost of revenues is carried by the cost of building the house. Having interviewed several contractors, the typical cost of revenues ranges from 80-85% of revenues. To maintain a conservative approach, we used a factor of 90% to compute cost of revenues. It is not practical to break the cost of revenues down further because it is very project-dependent. Some homes will have large landscaping costs but little pavement costs. Others will have large electrical wiring costs, others will not. Subcontractors will perform all site work. Since there is no capital assets in our business model, Peter Wolf Construction would not realize a significant depreciation expense worth noting. Operating Expenses - Sales & Marketing Sales & marketing are broken down into 3 main channels and a 4th miscellaneous channel. Website expense will incur the most cost in the second year because of development and implementation of the site. The first year’s website will be designed using boot strap tactics. Flyers and Advertising expenses will mostly be directed towards direct mailings and building industry relationship. Operating Expenses - General & Administrative A base salary of $25,000 is established for Tyler. This expense will grow to $125,000 in year 3 as two more partners come onboard full time. Legal costs are assumed to cost the most in the first year as certain non recurring expenses will take place such as filing company papers and establishing the partnership agreements. Insurance costs will grow as the business grows. The insurance cost is to protect the homebuyer in case the company goes into default. Health and other forms of insurance will not initially be provided by the company. Miscellaneous G&A is not only a slush fund but also a resource to use in case of emergency cash crunches. Conclusion and Recommendations Conclusion We see a valuable opportunity for success. It will be important to initially utilize our professional network to get the company started on the right foot. From there, we must anticipate change in the economy as well as trends in the housing markets. Our analysis of both the industry/market segment as well as the potential consumers indicates that our product will be well received at the time of its launch. We are confident that with some refinement in processes and product offerings as well as continued consumer preference analysis, Peter Wolf construction will be able to enter the Pueblo custom home building market successfully and will remain successful in the long term. Recommendations Take this opportunity on to the next stage and develop a business plan We need better customer information. Sample size is too small and might not be representative of the Pueblo Market. Delve deeper into the financials. We made some assumptions in our projections and need to work to validate those assumptions. This will eliminate some risk and will improve the accuracy of our projections. References Anatomy of a Housing Recovery, by Frank Nothaft, Amy Crews Cutts, Calvin Schnure, Nela Richardson- December 8, 2006; http://www.freddiemac.com/news/finance/outlooks/Dec_06_frecom_outlook.html Construction Industry Intelligence Report - 2006, McGraw Hill Construction; http://www.construction.com/Analytics/CIIR_G/2006/Fall_FullArticles.asp Florida has 5 of the 10 Best Job Markets, Vegas and Phoenix runners-up, by G. Scott Thomas. http://www.preconstructionprograms.com/real_estate/florida/florida_job_growth.php Going your Own Way, by Megan Barnett, US News; http://www.usnews.com/usnews/biztech/articles/050321/21Colorado.htm Green Building Guidelines to Become a Standard, by Calli Schmidt, Nation’s Building News; http://www.nbnnews.com/NBN/issues/2006-05-29/Codes+and+Standards/index.html Colorado Outlook: News of Colorado’s Economy and Budget, State of Colorado – Division of Financial Management; March 2006 XXVIII No.9 http://dfm.Colorado.gov/Publications/EAB/Outlook/IO2006/outlookmarch2006.pdf It’s All Linked: Mortgage Troubles can Roil Economy, by Steve Jordon, Builder Online, http://www.builderonline.com/industry-news.asp?sectionID=30&articleID=451037 While Housing Withers, ‘Green’ Materials Bloom, by Jim Carlton, The Wall Street Journal Online, http://www.realestatejournal.com/buildimprove/20070222-carlton.html?refresh=on References – continued BUILDER Online: Home Building News, Home Plans, Home Design Ideas and Building Products for Home Builders. http://www.builderonline.com/content/resources/business-market-data-researchstats.asp?channelID=74&sectionID=124 (accessed March 14, 2007). Comfort Zone: Creating a Middle Ground for Green Building and Great Profits. http://www.builderonline.com/industry-news.asp?sectionID=718&articleID=2868 (accessed March 14, 2007). Market structure - Wikipedia, the free encyclopedia. http://en.wikipedia.org/wiki/Market_form (accessed March 14, 2007). Population Projections. http://www.valleycountyeconomicdevelopment.com/pages/PopulationProjections.htm (accessed March 14, 2007). ReferenceUSA. http://reference.infousa.com/bd/matrix_list.asp (accessed March 14, 2007). Seeing Green. http://www.builderonline.com/industry-news.asp?sectionID=13&articleID=322693 (accessed March 14, 2007). USATODAY.com - Building 'green' reaches a new level. http://www.usatoday.com/news/nation/2006-07-26green-construction_x.htm (accessed March 14, 2007). The New Ecological Home: A Complete Guide to Green Building Options, Daniel Chiras, Chelsea Green Publishing Company, White River Junction, VT, 2004 The Solar House: Passive Heating and Cooling, Daniel Chiras, Chelsea Green Publishing Company, White River Junction, VT, 2002 Photovoltaics: Design and Installation Manual, Solar Energy International, New Society Publishers, Gabriola Island, British Columbia, 2004 Solar Living Source Book, John Schaeffer, New Society Publishers, Gabriola Island, British Columbia, 2004 Green Building Products, Alex Wilson and Mark Piepkorn, New Society Publishers, Gabriola Island, British Columbia, 2005 Professional Contacts Merten Homes: McStain Neighborhoods: Based in Boulder, Colorado, Merten Homes is a Green Builder specializing in the architectural design and construction of ultra energy-efficient homes. Donna Merten – Bob Hughes Construction: Based in Boulder, Colorado, Bob Hughes Construction builds high end custom homes greater than $1M Bob Hughes: Owner / President Based in Pueblo, Colorado, Fireside Homes builds approximately 15 custom homes per year. Joe Collins: McStain Founders Fireside Homes: Tom & Caroline Hoyt President & CEO Building a Better World: “We believe that the only truly sustainable human community is one built in balance with the natural environment.” Owner / President SKS Ventures: Real estate investment company. Chuck Berling Use to own a high-end, custom home building company based in Evergreen, Colorado Professional Contacts - continued McStain Neighborhoods: Peak Properties: Develop green residential apartment buildings in Boulder, Colorado Avery Host: President & CEO Suncor: Large scale commercial and residential developer. Operate Pueblo’s larges planned community development Bob Taunton: Custom Home builder in Denver, Colorado Randy Thall: Project Manager S & C Company: Colleen Rozier Building a Better World: “We believe that the only truly sustainable human community is one built in balance with the natural environment.” President of Avimor Development Vice President of Operations Pueblo Springs: Pueblo’s first large scale residential development. Frank Martin Hidden Springs President