grant

advertisement

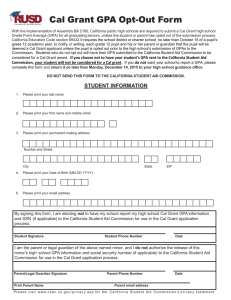

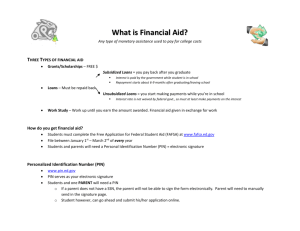

Financial Aid Overview Three Basic Questions O What is Financial Need? O What Types of Aid Are Available? O How do I Apply? What is Financial Need? Cost of Attendance – Expected Family Contribution = Financial Need Cost of Attendance Estimated Total Cost of Attendance Living On Campus Fees/Tuition Books and supplies Room and board California State University (CSU) University of California (UC) California Independent College CSULB UCLA USC $6,738 $12,685 $43,722 $1,666 $1,521 $1,500 $11,300 $14,208 $12,440 Other $4,072 $3,585 $2,171 TOTAL $23,776 $31,999 $59,883 What is Financial Need? Cost of Attendance – Expected Family Contribution = Financial Need EFC O Amount family can reasonably be expected to contribute O Two components O Parent contribution O Student contribution O Calculated using data from the FAFSA O Stays the same regardless of college Estimated Total Cost of Attendance Living On Campus Cost of Attendance EFC Financial Need California State University (CSU) University of California (UC) California Independent College CSULB UCLA USC $23,776 $31,999 $59,883 $500 $500 $500 $23,276 $31,499 $59,383 What are the different types of financial aid? Types of Financial Aid O Scholarships O Grants O Employment (Work Study) O Loans Scholarships O Money that does not have to be paid back O Usually funded by private companies or foundations O Awarded on the basis of merit, skill, or unique characteristic O May or may not have income and/or GPA requirements Grants O Money that does not have to be paid back O Usually awarded through federal or state government O Usually do have income and GPA requirements Employment / Work Study O Allows students to earn money to help pay educational costs O Usually has income requirement O Benefits vs. Part Time Job Off Campus O Higher pay O Flexible schedule O On campus Loans O Money students and parents borrow to help pay college expenses O Repayment usually begins after education is finished O No income or GPA requirements What are some of the financial aid offers students are likely to receive? Pell Grant O Awards up to $5,550 O For low income undergraduate students O Can be used at many schools throughout the USA O Awarded based on financial need O Apply using the FAFSA Cal Grant O Cal Grant A O Pays state fees at UC & CSU O Awards up to $TBD for California Private Colleges O Cal Grant B O Pays state fees at UC & CSU O Awards up to $TBDfor California Private Colleges O Also awards additional living stipend($1,500) O Both have income and GPA requirements O Apply using the FAFSA and GPA Verification Form by March 2nd Cal Grant in reserve O Students can apply for a Cal Grant to be held in reserve while they attend a California community college O Grant is held for three years The California Middle Class Scholarship The California Middle Class Scholarship Starts in 2014-2015 for undergraduate students who are: O Attending a CSU or UC campus O From families with income up to $150k O U.S. citizens, permanent residents or AB 540 eligible O California residents MCS – How it fits in… ANNUAL FAMILY INCOME $150,000 $120,000 $90,000 $60,000 $30,000 Up to 40% fee reduction* Cal GRANT A and C Covers up to 100% of tuition/fees** Cal GRANT B $0 May cover up to 100% tuition/fees and some living expenses** * When fully funded. ** Based on 2013-2014 income levels, family of four. The California Middle Class Scholarship How much can students get? O Up to 40% of mandatory system-wide fees for students whose annual family income is up to $100,000 O No less than 10% of mandatory system-wide fees for students whose annual family income is between $100,001 and $150,000 Student Loans O Subsidized = government pays interest while you are in school O Unsubsidized = interest accrues O Both loans begin payback after graduation O Low interest rates & very flexible payback plans. O Beware of PRIVATE PERSONAL LOANS! Parent Loans O Must pass credit check O May borrow up to total cost of attendance O Unsubsidized = interest accrues O Payback begins immediately O Low interest rates & very flexible payback plans. O Beware of PRIVATE PERSONAL LOANS! Free Application for Federal Student Aid (FAFSA) O A standard form that collects demographic and financial information about the student and family O May be filed as early as January 1st of senior year Official FAFSA Website O http://www.fafsa.ed.gov O FAFSA-4Caster O FAFSA on the Web Worksheet: O Used as “pre-application” worksheet Dependent or Independent? You must answer Yes to at least one question to be considered an Independent student. Who is considered a parent? O Biological or adoptive parent(s) O In case of divorce or separation, provide information about the parent and/or stepparent the student lived with more in the last 12 months O Stepparent (regardless of any prenuptial agreements) California Dream Act O Must be AB540 Eligible O Allows for students to apply for state funded aid including: O Cal Grant O Board of Governors Fee Waiver Grant O State University Grant (CSU) O Other Public Institution Awards California Dream Application O DO NOT FILE A FAFSA O Complete California Dream Application at http://www.csac.ca.gov/dream_act.asp O Same deadlines and filing rules apply O March 2nd Cal Grant Deadline O Determine if Dependent or Independent Student O Deferred Action / DACA applicants should also file Dream Application Scholarships National Search Sites University Websites Local Scholarships Questions?