presentation - Long Beach Cal SOAP

advertisement

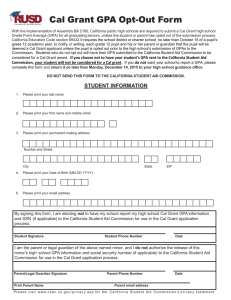

Financial Aid Information Night What is Financial Need? Cost of Attendance – Expected Family Contribution = Financial Need Estimated Cost of Attendance Living On Campus California State University (CSU) California University of Independent California (UC) College CSULB UCLA USC $6,452 $13,251 $50,277 $1,860 $1,383 $1,500 $11,880 $14,904 $13,855 Other $2,772 $4,360 $1,580 TOTAL $22,964 $33,898 $67,212 Fees/Tuition Books and Supplies Room and Board EFC • Amount a family can reasonably be expected to contribute • Considers both student and parent income • Calculated using data from the FAFSA • Student gets $ info immediately after submitting FAFSA • Stays the same regardless of college EFC California California State University of Independent University (CSU) California (UC) College CSULB Cost of Attendance EFC Financial Need UCLA USC 22,964 33,898 67,212 500 500 500 22,464 33,395 66,712 WHAT ARE THE DIFFERENT TYPES OF FINANCIAL AID? Types of Financial Aid • Scholarships • Grants • Employment (Work Study) • Loans WHAT ARE SOME OF THE FINANCIAL AID OFFERS STUDENTS ARE LIKELY TO RECEIVE? CALIFORNIA AID PROGRAMS California State Aid Up to 40% fee reduction* Cal GRANT A Covers up to 100% of tuition/fees Cal GRANT B Covers up to 100% tuition/fees and some living expenses Cal Grant Cal Grant A – – Pays state fees at UC & CSU Awards up to $TBD for California Private Colleges Cal Grant B – Pays state fees at UC & CSU – Awards up to $TBD for California Private Colleges – Also awards additional living stipend($1,648) Both have income and GPA requirements • (see handout) Available to AB540 students Apply by March 2nd w/FAFSA/DreamApp & GPA Verification GPA Verification – mandated electronic upload Additional Cal Grant Info • Colleges must be eligible to receive – List of non-eligible colleges available on CSAC website • Students must update WebGrants account to confirm high school graduation The California Middle Class Scholarship Middle Class Scholarship New program began in 2014-2015 for undergraduate students who are: – Attending a CSU or UC campus – From families with income up to $150k – U.S. citizens, permanent residents and AB 540 – California residents Intended to be up to a 40% discount on state fees for middle income families. ANNUAL FAMILY INCOME MCS – How it fits $150,000 $120,000 Up to 40% fee reduction* $90,000 $60,000 $30,000 $0 Cal GRANT A and C Cal GRANT B MCS • • • • • • • Based on income only, no GPA component Apply using FAFSA / Dream App March 2nd Deadline Awarded on sliding scale based on income LIMITED pool of funds Awards not determined until July Student will NOT see MCS on college financial aid award letters • May receive communication from CSAC that they are eligible for MCS MCS Rollout Plan CSU % of 40% Maximum Award 2014-2015 35% $ 766.08 2015-2016 50% $ 1,094.40 2016-2017 75% $ 1,641.60 2017-2018 100% $ 2,188.80 UC % of 40% Maximum Award 2014-2015 35% $ 1,848 2015-2016 50% $ 2,640 2016-2017 75% $ 3,960 2017-2018 100% $ 5,280 Federal Aid Programs Pell Grant • Awards up to $5,550 • For low income undergraduate students • Can be used at many schools throughout the USA • Awarded based on financial need • Apply using the FAFSA Student Loans • • • • Subsidized = government pays interest while you are in school Unsubsidized = interest accrues Both loans begin payback after graduation Low interest rates & very flexible payback plans. Parent Loans • Must pass credit check • May borrow up to total cost of attendance • Unsubsidized = interest accrues • Payback begins immediately • Low interest rates & very flexible payback plans. •AB 540 (2001) •AB 131 (2011) •AB 2000 (2014) •SB 1210 (2014) California Dream Act AB 540 • Allows for students to pay in state tuition AB 131 •Allows for students to apply for state funded aid including: – Cal Grant – BOG Fee Waiver – State University Grant (CSU) – Other Public Institution Awards DACA & Dream Act • Federal • Immigration Legislation • State • Education Legislation Which Application? Based on Student Status (parent status not relevant) • FAFSA • Dream Application – US Citizen or Eligible Non Citizen – AB540 Eligible – No Social Security Number DO NOT COMPLETE BOTH APPLICATIONS Official FAFSA Website • http://www.fafsa.ed.gov Official Dream Act Website • https://dream.csac.ca.gov/ Two Common Issues • Dependency Status? • Who are considered the parents? Dependent or Independent? • • • • • • • • • • • • • Were you born before January 1, 1993? As of today are you married? At the beginning of the 2015-2016 school year, will you be working on a master’s or doctorate program (such as an MA, MBA, MD, JD, PhD, EdD, or graduate certificate, etc.)? Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training? Are you a veteran of the U.S. Armed Forces? Do you now have or will you have children who will receive more than half of their support from you between July 1, 2015 and June 30, 2016? Do you have dependents (other than your children or spouse) who live with you and who receive more than half of their support from you, now and through June 30, 2016? At any time since you turned age 13, were both your parents deceased, were you in foster care or were you a dependent or ward of the court? As determined by a court in your state of legal residence, are you or were you an emancipated minor? As determined by a court in your state of legal residence, are you or were you in legal guardianship? At any time on or after July 1, 2015, did your high school or school district homeless liaison determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? At any time on or after July 1, 2015, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? At any time on or after July 1, 2015, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? You must answer Yes to at least one question to be considered an Independent student. Who is the Parent? Biological or Adoptive Parent Not Grandma Not Sister Not Uncle No No No What if student lives with… • grandparents because parents are in Mexico? • friends of the family? “But my uncle claims me as a dependent on his tax return.” Biological or Adoptive Parent It doesn’t matter who claims the student on tax return! It doesn’t matter who claims the student on tax return! Divorce or Legal Separation Filing the FAFSA w/out Parent Information • Student can knowingly file w/out parent information • Approved Special Circumstance – Parents incarcerated – Abusive Situation – Unable to locate parents • Unapproved Special Circumstance – Parent refuses to participate • Student will be informed that they will be approved for Student Loans only • Will need to follow up with college financial aid office Preparing to Complete the FAFSA / Dream App • Documents Needed Handout • FAFSA / Dream App Worksheet • FAFSA 4Caster FSA ID instead of a PIN • Created as an increased security measure • Same purpose and use • When creating FSA ID old PIN can be used to link previous accounts (good for parents with students already in college) QUESTIONS?